September once again saw the strong start to the financial year continue for all our funds.

- +0.6% for the Affluence Income Trust (+7.3% over 1 year).

- +2.1% for the Affluence Investment Fund (+12.3% over 1 year).

- +3.0% for the Affluence LIC Fund (+12.9% over 1 year).

- +4.5% for the Affluence Small Company Fund (+18.3% over 1 year).

You can access all monthly fund reports below for more details.

In other news this month, we explain our concern with the AI trade, with links to both bullish and bearish viewpoints. We also take a look at why we’re continuing to keep some exposure to gold, despite sentiment being super bullish right now.

As always, thanks for reading and for your continued interest in what we do. If you have any questions or feedback, reply to this email or give us a call.

Regards, Daryl, Greg and the Affluence Team.

Affluence Funds Returns

Affluence Income Trust

The Affluence Income Trust returned 0.6% in September and 7.7% per annum since commencing. The current distribution rate is 6.75% per annum paid monthly.

Affluence Income Trust September 2025 Report

Affluence Investment Fund

The Affluence Investment Fund returned 2.1% in September and 8.2% per annum since commencing. This diversified fund brings together our best ideas across all asset classes.

Affluence Investment Fund September 2025 Report

Affluence LIC Fund

The Affluence LIC Fund returned 3.0% in September and 11.5% per annum since commencing. At the end of the month, the average portfolio NTA discount remained near all-time highs at almost 27%.

Affluence LIC Fund September 2025 Report

Affluence Small Company Fund

The Affluence Small Company Fund returned 4.5% in September and 10.2% per annum since commencing. There’s still exceptional value in many smaller companies.

Affluence Small Company Fund September 2025 Report

Investment Profile

Each month we take a look at an underlying investment in one of our funds.

This month, we profile the Terra Capital Natural Resources Fund, held in our Affluence Investment Fund portfolio. This unlisted fund invests in a portfolio of mostly small and mid-cap mining and energy stocks. It’s a volatile sector, but patience has resulted in strong returns. Click below to read more.

Fund In Focus

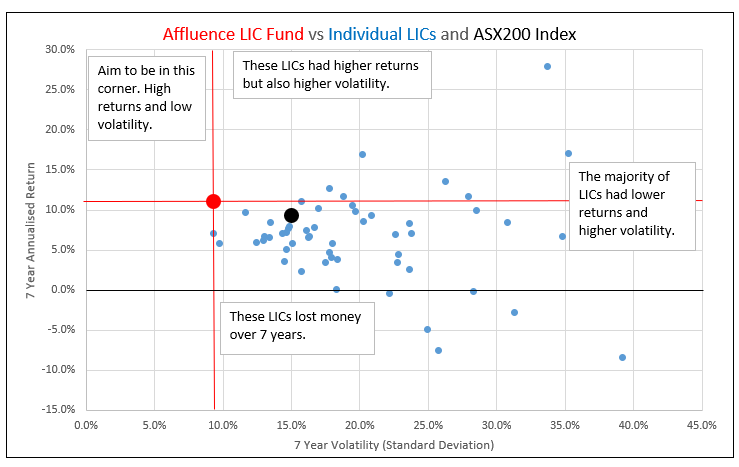

We’ve been generating alpha from harvesting discounts and other returns from Listed Investment Companies/Trusts for over 10 years, and the Affluence LIC Fund itself has a 9.5 year track record. No one knows the LIC sector like we do.

Convincing investors to part with their money for LICs right now is hard. That tells us there is significant value to be had, and our work confirms this. The Affluence LIC Fund has delivered over 11% per annum since inception. Around half that return has come from our discount capture skill – essentially buying individual LICs when they are trading at unnaturally large discounts and selling when they normalise. Because of this, we’ve outperformed the vast majority of individual LICs over the past 7 years, with significantly fewer ups and downs.

- Source: Affluence, ASX. Data for 7 year period to 30 September 2025. Returns are not guaranteed. Past performance is not indicative of future performance.

LICs (excluding the fixed income trusts) have been out of favour for a few years, and the discounts show it. Right now, our portfolio of LICs shows an average discount to NTA of 25%+. To give you an idea of how extreme that is, it’s roughly equal to the discount at the end of March 2020 at the height of the Covid correction.

Currently, via the fund’s portfolio of LICs, we have significant weightings to small caps, REITs and resources, three areas where value is still particularly evident.

The combination of high discounts and attractive underlying LIC portfolios is one we rarely see. Each time it has happened in the past, we have generated very attractive returns in the following 2-3 years. We have seen interest building and some buying emerging in the last 3 months, which bodes well. One or two more interest rate cuts have the potential to be the tipping point that drives retail investors back to LICs for yield.

The Affluence LIC Fund can be a great satellite allocation to complement core equity portfolios. The Fund has outperformed the ASX200, with around half the volatility. If you’re looking for quarterly income, and equity exposure with extra potential and less volatility, this could be the fund for you. Contact us to find out more or click below to view the latest Fund presentation.

Things we found interesting

Chart of the month.

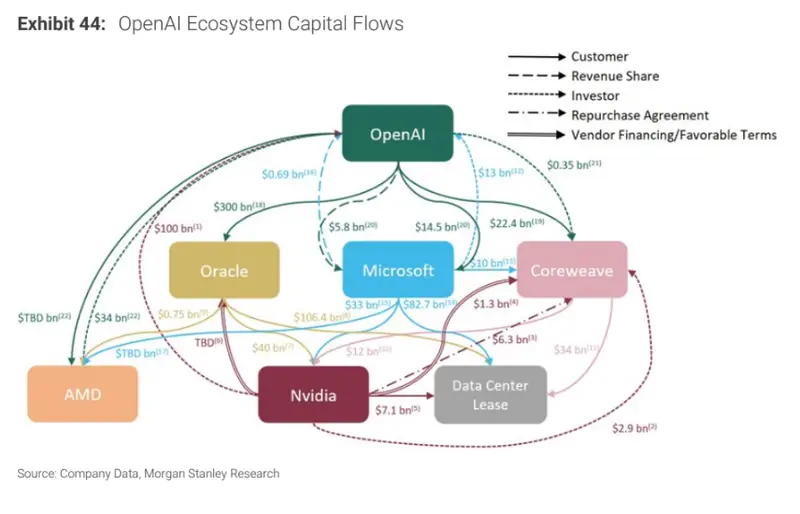

This chart from Morgan Stanley has been circulating widely in the past month. It shows the complicated and interdependent relationships between some of the largest AI stocks.

The AI boom is now leveraged on a tight, circular web of money, technology, and capacity among a handful of companies. Each one is both a supplier and a customer of the others. For example:

- OpenAI and others use billions from Microsoft, Amazon and Google to buy compute and GPUs.

- Those funds go straight to Nvidia, AMD, CoreWeave, and Oracle, whose revenues and stock prices explode.

- In turn, these infrastructure players offer vendor financing and long-term leases, keeping demand high.

- Rising valuations make raising more capital easier for those that need more cash – like OpenAI and Anthropic.

That’s great for short-term growth, but it creates some huge structural fragilities. It’s the opposite of diversification. The assumption is that AI demand will keep growing exponentially. But if revenue growth slows, the entire loop could unwind as everyone’s balance sheet and cash flow shrink at once. If CoreWeave or OpenAI can’t pay, Nvidia and Microsoft are on the hook. If that happens, AI-linked equities could re-rate violently.

It’s reminiscent of the internet boom in 1999. The dot-com bubble didn’t end because the internet failed. It ended because too much capital chased too few profits too quickly. The survivors eventually justified their existence, but only after a brutal multi-year washout that ruined hundreds of players and wiped out trillions in wealth.

We’re watching this space very closely. We suspect sometime in the next year or so, the world will work out we’ve built way too many data centres.

This article, forwarded to us during the month by one of our investors (thanks Bruce) brilliantly explains the problem. If you want a case for why the silliness can continue, Macquarie Bank’s strategist Viktor Shvets believes, “Today is truly different, and our times are truly different. We will never go back to traditional investment thinking.” He made an appearance last month at Livewire Live, and here you can read more about why he believes this time is truly different.

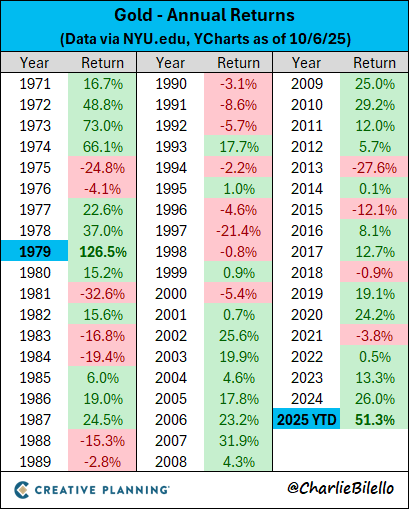

What to do about gold.

Much has been made of the run-up in the gold price in recent months. As value investors with some exposure to the yellow metal, it’s something we’ve been talking a lot about internally. Normally, when we see signs of speculation in an asset, we think it’s time to be out of it, and we sell. But not this time.

While we’ve taken some significant profits, we continue to maintain around a 3-5% portfolio allocation to gold miners in our Investment Fund, LIC Fund and Small Company Fund, for three reasons:

- Our exposure is via a range of specialist resource fund managers such as Terra Capital and Baker Steel. They invest globally and have deep knowledge of the sector.

- Much of what we own are smaller miners (both producers and developers) that have two things going for them. Their share prices do not reflect current gold prices – and so could rise much further if current pricing is maintained. And they will be prime takeover targets for larger miners who want to increase reserves or production quickly.

- Government spending remains out of control. The most likely outcome, particularly in the US, is that inflation makes a comeback, since that’s the least painful way to try to solve the debt problem. This could lead to an environment a bit like the 1970’s, where resources, including gold, did very well.

Don’t believe gold could rise further? Look at the chart below, showing gold’s annual returns since 1971. The 70’s were a period of spectacular returns for the precious metal.

Quote of the month.

“I believe the world is changing in big ways that haven’t happened before in our lifetimes but have many times in history.”

The quote is from Ray Dalio’s book, Principles for Dealing with the Changing World Order.

If you have a spare 45 minutes, this video explainer narrated by Ray, explains what he thinks drives the “Big Cycle” of rise and decline of nations through time, and what it means for the world’s current leading power, the United States. The video is over 3 years old, but it’s brilliantly made, and it seems eerily relevant in the current climate.

Vaguely interesting facts.

Astound your friends with these morsels of knowledge:

- Oxford University is older than the Aztec Empire.

- Sloths can hold their breath longer than dolphins.

- More people own a mobile phone than a toothbrush.

- Roman concrete is more durable than modern concrete.

- The first webcam was invented by scientists to monitor a coffee pot. *

* In 1991, a group of scientists at the University of Cambridge Computer Lab were facing a critical productivity crisis – walking all the way to the coffee room only to find the pot empty! So, a few engineers wired up a camera pointed at the communal coffee pot and wrote code to stream the live feed directly to their desktops. Thus, the first webcam was born. Not to change the world. But to avoid the horror of zero coffee.

Originally, it only displayed grayscale images at one frame per second on internal lab computers. But by 1993, when the internet was becoming a thing, the feed went global. People across the world became fascinated with someone else’s coffee pot. The pot was finally retired in 2001 and now resides in a museum.

Thanks for reading. If you enjoyed this newsletter, forward it to a friend. If you are that friend, you can subscribe at the bottom of this page.