Here at Affluence, we love finding beaten up stuff at prices below long term fair value. That’s why we’re excited by the oil price right now. Oil was the big story for the second half of 2014, as it continued a relentless slump in price to below USD$50 per barrel. Every nation in the world is affected by the oil price. The degree of impact depends on whether you are a net buyer or seller.

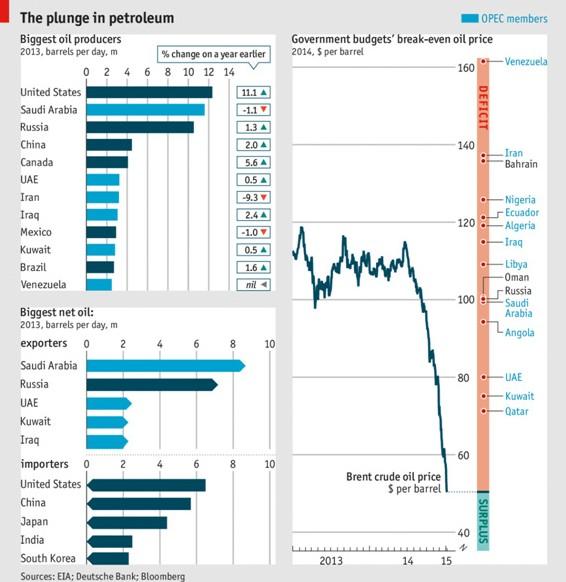

The excellent graphic below (courtesy of the economist) shows the biggest producers and users of oil. The graph on the right explains why we are now actively looking at opportunities to take some exposure to the oil sector. The current oil price is below the break-even price required to balance the budget of every major oil producing nation./im

In the short term, the oil price is driven by speculators and sentiment, and I have no idea where it will go. But over a reasonable time, the price of oil must rise, and rise substantially. Just as high oil prices a few years ago drove new supply, particularly in the US; low oil prices, should they continue for long, will very quickly force a lot of production to stop as the highest cost producers lose substantial money. This will take a little time, as many producers have hedged, or fixed their sales of oil for various periods into the future, which means they have effectively pre-sold some of their future production at yesterday’s, higher prices. But eventually the hedges will run out, and if prices stay low, production will reduce. This should, by definition, increase the price, since supply will be slowing but demand will continue.

It may take a month, a year or 3 years, but the oil price will rise and there is good money to be made when it does. If I was a betting man (which I’m not) I would expect at least some bounce in the oil price in the short term. With every “expert” predicting further doom and gloom, some a price as low as $10 per barrel, it seems well primed for at least a short term reversal in price.

We will be looking for early signs of that rise and will probably seek to place a small amount of the Fund’s capital in oil futures or oil stocks in anticipation, with a view to increasing exposure as we see signs of a change in sentiment and momentum. Given oil and oil stocks deliver no, or very low income, we are unlikely to stake no more than 5% of the Fund’s capital on oil, but it provides a very good example of the sort of investment where you have the chance to buy well and are prepared to be patient.

Personally, I’m happy to wait. I, like most of you, am a net buyer of oil every time I go to fill up the car. I will be waiting very patiently for the oil price to go back up.