It was a tough month in equity markets, with the ASX200 Index down 2.9% and global markets down a similar amount. All our Funds pleasingly bucked that trend, delivering positive returns. You can access all our fund reports below.

In other exciting news, our funds have been added to various platforms over the past few months. If you’re a financial advisor or you use a platform to manage your investments, you can now access several Affluence funds on the Netwealth, HUB24 and Mason Stevens platforms. You can see the full list below, or on our website. If you would like to access any of our funds on a particular platform, please let us know, and we’ll do our best to accommodate you.

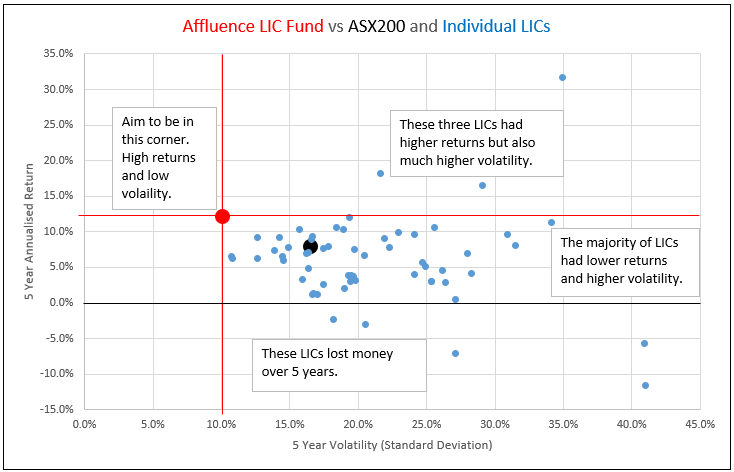

If you invest directly in any Listed Investment Companies, check out the graph below the monthly fund reports. We’ve compared the performance of all the LICs we track, against our own Affluence LIC Fund. Over the last 5 years, our specialised discount capture strategy has outperformed 53 of the 56 LICs we monitor.

A reminder that all our funds offer monthly applications and withdrawals. The cut-off for applications this month is 31 May for the Affluence LIC Fund and 24 May for all other Affluence Funds. Go to our website and click “Invest Now” to apply online or access application and other forms for any of our funds.

Thanks for reading, and for your continued support. If you have any questions or feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

April 2024 Fund Reports

Affluence Income Trust

The Fund returned 0.6% in April. The Fund pays monthly distributions. The current distribution rate is 7.5% per annum.

Affluence Investment Fund

The Fund returned 0.6% in April. Since commencing, the Fund has returned 7.8% per annum, including monthly distributions of 6.4% per annum.

Affluence LIC Fund

The Fund returned 0.7% in April. The average NTA discount for the LIC portfolio at the end of the month remains near record highs at approximately 23%.

Affluence Small Coy Fund

Available to wholesale investors. The Fund returned 1.7% in April. The largest positive contributors were Birddog Technology (BDT) and Midway (MWY).

Platform Availability

Our retails Funds are now available on HUB24, Mason Stevens and Netwealth. You can also view our platform availability on our website here.

If you would like to access any of our funds on a particular platform, please let us know, and we’ll do our best to accommodate you.

Affluence LIC Fund vs Individual LICs

We are specialists in the LIC sector, having run a dedicated fund for over 8 years. Over this period, the Affluence LIC Fund has delivered total returns of 11.1% per annum, outperforming the ASX200 Accumulation Index by 2% per annum. We have also outperformed the vast majority of individual LICs due to our ability to identify mispricing in the sector and profit from it.

In our opinion, there are very few LICs where a buy and hold strategy is effective. Discounts stretch and contract over time. Our strategy aims to take advantage of this, adding extra value over and above the investment returns generated by the LIC investment manager.

The following graph plots the performance and volatility of the LICs that we track, which have a performance history of at least 5 years. We have also included the Affluence LIC Fund (in red) and the ASX200 Accumulation Index (black).

In addition to beating the ASX200, the Affluence LIC Fund has also delivered better returns than 53 of the 56 LICs we track with a 5 year performance history. All three outperformers have done so with significantly higher volatility, meaning it was a much rougher ride, with more ups and downs along the way.

If you invest in LICs directly, please consider the benefits of making an allocation to our Affluence LIC Fund. If you would like to learn more, a link to the Fund Page is below. Here, you can access all the important information about the Fund, including the PDS, TMD and the latest fund reports.

New Fund Manager Profile

Each month we profile an underlying investment of one of our funds. The Oceana Australian Fixed Income Trust focuses on trade and debtor finance, and also includes smaller business lending and private credit portfolios. It’s a core holding in our Affluence Income Trust. Click below to find out why we like it.

Things we found interesting

Financial word(s) of the month:

Yield Curve.

A measure of interest rates on bonds at various maturities. In a “normal” yield curve, long-term bonds pay interest at higher rates because investors are putting their money at risk for longer periods. Yield curves can also be:

- “flat,” with interest rates relatively constant across short-term and long-term bonds

- “steep,” with long term bonds having much higher yields, or

- “inverted,” with short-term debt paying higher rates than longer-term bonds.

Predicting where the yield curve is headed is about as easy as forecasting exactly where a fistful of feathers will land in a hurricane. The difficulty of prediction doesn’t deter many professional bond managers from investing primarily on the basis of where they think the yield curve will be one year or more in the future. It should, however, deter you from taking them seriously

Source: “The Devil’s Financial Dictionary” by Jason Zweig.

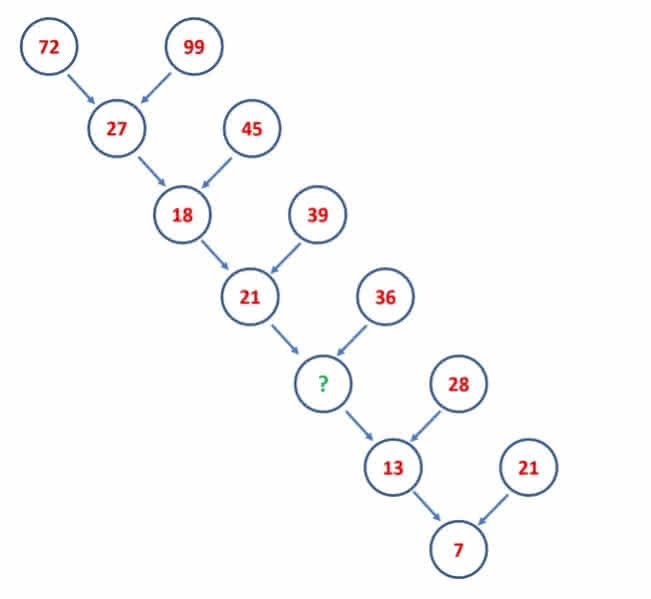

Brain Teaser.

Below is Nob’s Number Puzzle. Nob was the nickname for Nobuyuki Yoshigahara (1936–2004) a well-known puzzle creator. Nob graduated from the Tokyo Institute of Technology in applied chemistry. After becoming disenchanted with his career in high-polymer engineering, Nob turned to high school teaching as an educator of chemistry and mathematics.

This is one of his better known puzzles. The idea is to find the missing number:

The first solution you think you’ve found might not be the right one. Scroll to the bottom of this enews for the answer.

Vaguely interesting facts.

- Humans are the only animals with chins.

- Sorry, Scotland. Persians invented bagpipes.

- Cleopatra had a special lipstick made for her, consisting of a crushed mixture of ants and deep red carmine beetles.

- According to a 2015 study, adding 10 trees to your street can make you feel as healthy as someone who’s seven years younger.

- Since 1800, there have been 52 countries that saw their Debt to GDP expand above 130%. Of those countries, 51 eventually defaulted on their debt. *

Sources: mentalfloss, wikipedia, kobeissi letter.

* The US debt to GDP ratio is currently 124%. It has risen by over 20% since 2020. Based on the expected trajectory, the US will be above the 130% threshold by 2033. We think it will happen sooner. The only country with debt to GDP above 130% that has not defaulted is Japan.

Quotes of the month.

“The early bird may get the worm, but the second mouse gets the cheese.”

“When everything is coming your way, you’re in the wrong lane.”

“If you want the rainbow, you got to put up with the rain.”

“82.7% of all statistics are made up on the spot.”

“I intend to live forever … So far, so good.”

These quotes have all been attributed to Comedian Steven Wright. But in many cases, the original author was likely someone else.

Brain Teaser answer.

The first ‘solution’ that many people consider is tackling the numbers in groups of three and subtracting the number on the upper left from the number on the upper right to get the number on the lower centre. For example, 99 – 72 = 27. This works all the way down until you get to the last group. But 21 – 13 does not equal 7. So that’s not the answer.

The correct answer is that the number in each circle the arrows point to is the sum of the individual digits in the two “source” circles. So for the first group, 9 + 9 + 7 + 2 = 27. For the second group 4 + 5 + 2 + 7 = 18, and so on. Thus, the missing number can be found by summing the digits of the two circles above it. So 3 + 6 + 2 + 1 = 12.

Thanks for reading. If you enjoyed this newsletter, forward it to a friend. If you are that friend, you can subscribe and see previous newsletters here .

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.