January was another good month for our Funds to start the new year:

- +0.6% for the Affluence Income Trust (+7.2% over 1 year).

- +2.3% for the Affluence Investment Fund (+15.4% over 1 year).

- +4.1% for the Affluence LIC Fund (+18.1% over 1 year).

- +3.3% for the Affluence Small Company Fund (+20.9% over 1 year).

More details are in our monthly fund reports, which you can access below.

In other news this month:

Daryl will be visiting Melbourne from 4-10 March. If you want to arrange a time to meet, please get in touch.

We’ll be recording a webinar in the next week or two, including an update on each of our Funds. If you have any questions or topics you would like us to cover, reply to this email and we’ll try to include them.

As always, thanks for reading and for your continued interest in what we do. If you have any questions or feedback, reply to this email or give us a call.

Regards, Daryl, Greg and the Affluence Team.

Investment Profile

Each month we take a look at an underlying investment in one of our funds. Recently, the Affluence LIC Fund has been buying the Metrics Real Estate Multi-Strategy Fund (ASX: MRE). It’s a fairly typical case of a newish LIT in a post listing slump, trading at a decent discount to underlying value. Click below to read more about it.

Affluence Funds Returns

Affluence Income Trust – Affluence Income Trust January 2026 Report

The Affluence Income Trust returned 0.6% in January and 7.6% per annum since commencing. The current distribution rate is 6.75% per annum paid monthly.

Affluence Investment Fund – Affluence Investment Fund January Report

The Affluence Investment Fund returned 2.3% in January and 8.5% per annum since commencing. This diversified fund brings together our best ideas across all asset classes.

Affluence LIC Fund – Affluence LIC Fund January 2026 Report

The Affluence LIC Fund returned 4.1% in January and 11.8% per annum since commencing almost ten years ago. At the end of the month, the average portfolio NTA discount was around 24%.

Affluence Small Company Fund – Affluence Small Company Fund January 2026 Report

The Affluence Small Company Fund returned 1.5% in December and 10.1% per annum since commencing. There’s still exceptional value in many smaller companies.

Fund In Focus

Are you looking for an investment option that targets consistent, regular income, but without the risk associated with stock maWe’ve been generating alpha from harvesting discounts and other returns from Listed Investment Companies (LICs) for over 10 years, and the Affluence LIC Fund itself has a 9+ year track record. No one knows the sector like we do.

Convincing investors to part with their money for LICs right now is hard. That tells us there is significant value to be had, and our work confirms this. The Affluence LIC Fund has delivered over 11% per annum since inception. Around half that return has come from our discount capture skill – essentially buying individual LICs and other similar investments when they are trading at unnaturally large discounts and selling when they normalise.

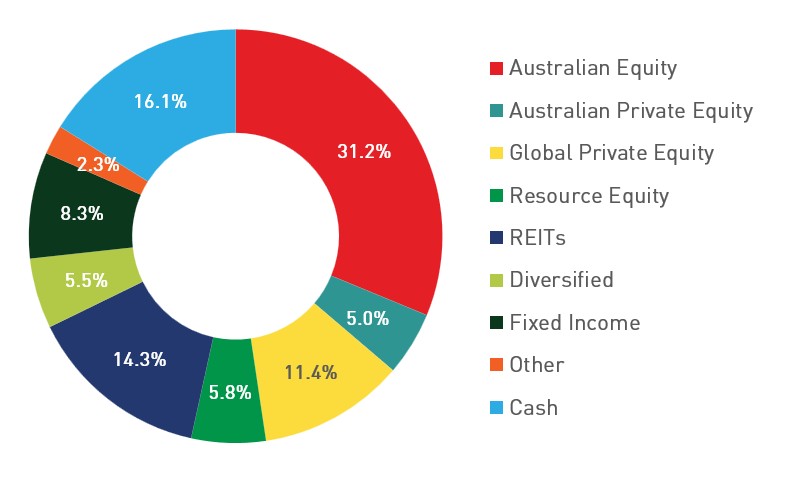

LICs (excluding the fixed income trusts) have been out of favour for a few years, and the discounts show it. Right now, our portfolio of LICs shows an average discount to NTA of around 24%. Currently, via the fund’s portfolio of over 30 LICs, we have significant weightings to small caps, REITs, private equity and resources, areas where value is still particularly evident.

The combination of high discounts and attractive underlying LIC portfolios is one we rarely see. Each time it has happened in the past, we have generated very attractive returns in the following 2-3 years. We have seen interest building and some buying emerging in the last 6 months, which has already delivered some good returns.

The Affluence LIC Fund can be a great satellite allocation to complement core equity portfolios. The Fund has outperformed the ASX200, with around half the volatility. If you’re looking for quarterly income, and equity exposure with extra potential and less volatility, this could be the fund for you.

Things we found interesting

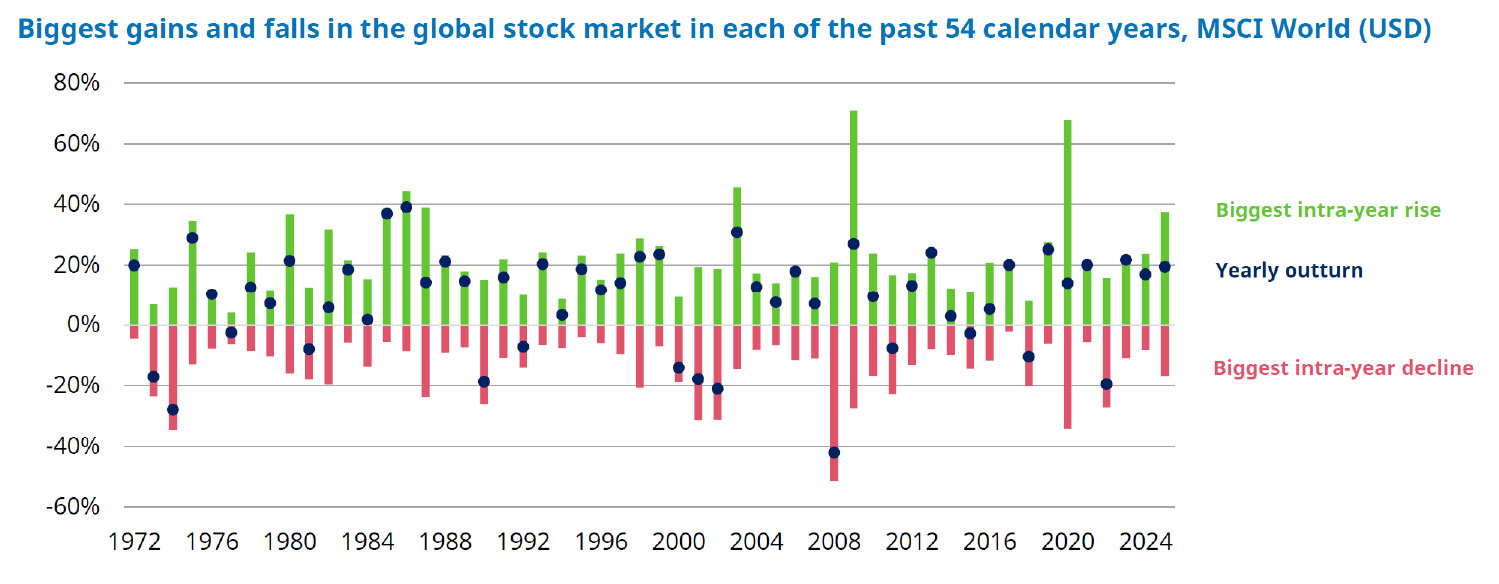

Chart of the month.

On average each year since 1972, the market has risen by 23% at some point, and fallen by 15%:

The green and red bars show the biggest peak-to-trough fall and trough-to-peak rise in the price index (excluding dividends) in each calendar year. The blue dots are the total price return for that year.

The lessons? Markets are volatile. Invest accordingly.

If market falls worry you, and might lead you to sell at an inopportune time, it may be wise to pursue a more balanced or conservative investment portfolio. Related data from Schroders shows that over a 35 year period to the end of 2025, selling out in times of trouble and reinvesting when it feels safer would have reduced your returns from 10.4% per annum to somewhere between 5.8% and 7.5% per annum. That’s huge. Conversely, adding to investments each time markets have fallen by 10% or more would have undoubtedly enhanced returns. So if you’re more comfortable with volatility, it pays to add to investments when it feels hard, not when it feels easy.

Harsh truths about investing

Back in 2012, Morgan Housel penned an article titled “50 unfortunate truths about investing”. We think most of them are pretty important. Here’s five.

- Saying, “I’ll be greedy when others are fearful” is much easier than actually doing it.

- The gulf between a great company and a great investment can be extraordinary.

- Markets go through at least one big pullback every year, and one massive one every decade. Get used to it. It’s just what they do.

- There is virtually no accountability in the financial pundit arena. People who have been wrong about everything for years still draw crowds.

Erik Falkenstein says, “In expert tennis, 80% of the points are won, while in amateur tennis, 80% are lost.” The same is true for investing: Beginners should focus on avoiding mistakes, experts on making great moves.

Vaguely interesting facts.

Astound your friends with these morsels of knowledge:

- Tigers don’t just have striped fur. They also have striped skin.

- A bolt of lightning contains enough energy to toast 100,000 slices of bread.

- The Earth is not perfectly round, it’s 21 km wider across the equator than pole-to-pole.

- A Peppa Pig episode was pulled from Australian TV for teaching children not to fear spiders.

- The microwave inventor got the idea when a chocolate bar melted in his pocket while testing a radar system. *

* In 1945, engineer Percy Spencer worked for Raytheon, developing radar technology using a device called a magnetron. One day, while standing near an active magnetron, Percy noticed the chocolate bar in his pocket had melted. Spencer got curious. He grabbed some popcorn kernels and placed them near the equipment. They popped. Naturally, being a guy, he escalated things. Next experiment…an egg. The result? It exploded.

Spencer eventually figured out that the magnetron’s microwaves were exciting water molecules in the food, causing them to vibrate and generate heat. In other words, cooking from the inside out. Raytheon quickly patented the discovery. The first commercial microwave oven, the Radarange, debuted in 1947. It was nearly 6 feet tall, and weighed over 300 kilograms. Sales were very limited initially, given they cost about $100,000 in today’s money. They were mostly installed in restaurants, hotels, hospitals, railroad dining cars, and ocean liners. It took another 20+ years before microwaves shrank to countertop size and invaded domestic kitchens everywhere.

Thanks for reading. If you enjoyed this newsletter, forward it to a friend. If you are that friend, you can subscribe at the bottom of this page.