What robo-advice providers do?

Robo-advice is currently one of the hottest trends in the very trendy financial services technology (or Fintech) sector. As the name might suggest, the term robo-advice refers to online wealth management services that provide automated, algorithm-based investment portfolio advice. This advice is provided without the use of human financial planners.

In theory, it’s a very good idea. It makes personalised advice affordable for the very large part of the community that can’t afford a human financial advisor. But there’s a problem.

The big mistake of robo-advice providers

All robo-advice plastforms we’ve looked at (including Betterment and Wealthfront in the US as well as Acorns, Stockspot and Six Park in Australia) are making one, very basic mistake. They’re getting caught in the low-fee mindset and choosing to invest only through exchange traded funds (ETFs).

We’re not against using ETF’s, even though at Affluence we’re focused on investing solely through active funds. We recognise that an allocation to ETFs can be a valid portfolio strategy. The problem with robo-advisors constructing a portfolio based only on ETFs is that it introduces several limitations on an investment portfolio.

ETF only portfolios are flawed

It is true that most active managed funds do not beat their performance index after fees. But there are still many, many active funds out there who can consistently outperform the market. Robo-advisors are ignoring the opportunity that this presents. They are limiting themselves to delivering their investors only what the market delivers, less costs. In other words, they are guaranteeing below market returns. In some sectors of the market (for example small-company investing), both average returns and the percentage of active funds that can beat the market are quite high. Strategies such as small-cap investing are difficult to access through ETFs.

Robo-advisors mostly use allocations to investment-grade bonds to provide diversification in portfolios. This repeats one of the classic mistakes we see from many institutional investors – accepting the almost guaranteed poor returns from bonds over the next few years in the name of diversification. There are better ways to do it. For example, there are also many different investment styles that only active managers can deliver, such as market neutral and long/short strategies. These are not available through ETFs. Such investment styles can deliver impressive returns. More importantly they can act as very good diversifiers in a portfolio. This is because they tend to deliver some of their best returns during times of market corrections – just when you need them. This can assist to reduce volatility of returns significantly.

In addition, many alternative asset classes are not available through ETFs, or have very limited investment options. These include assets such as distressed debt investing, direct property, private equity, commodities and infrastructure. This also extends to geographies such as emerging markets, where again there are very limited options to invest through ETFs.

Finally, there are risks inherent in the ETF structure that are not always obvious. They can include such factors as counterparty risk, where assets are not held directly or hedging is in place. Limiting investments to one type of structure can be costly if that structure is found to be inefficient or imperfect in some way. While a small risk, it could have catastrophic consequences.

Chasing low fees can deliver poor returns

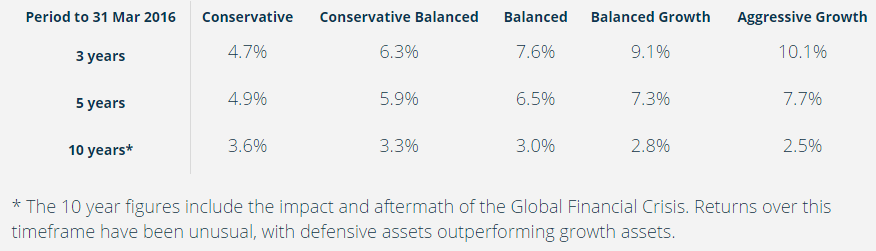

Below is a table of “inferred” returns over a 10-year period for one robo-advisor.

If you had used their strategies over the 10-year period to March 2016, you would have received returns of between 2.5%pa and 3.6%pa. That’s poor. So poor, that just keeping your cash in the bank over the last 10 years would have beaten every single one of these strategies.

While the robo-advisors behind these numbers are at pains to point out the 10-year returns included the global financial crisis, they’ve missed the point. That was only one year out of 10. They’ve had 9 other years to make that up. We believe any investment strategy which delivers a return less than cash over a 10-year period is not a good one.

Robo-advisor business model flawed

So, limiting their investment universe to ETFs is the biggest mistake robo-advisors are making for their clients. But this also means they’ve got a fundamentally flawed business model that would make us wary of ever investing in the robo-advisors themselves. A potential client can simply look at the composition of the portfolio recommended for them by the robo-advisor and replicate it without any help. So the robo-advisor either gets no fee at all if the investor takes their advice and just does it themselves. Or a very low fee for implementing the investment strategy. Either way, the robo-advisor must have a very large pot of money under management before they make a respectable return on capital.

At the end of the day, unless you can demonstrably add value by delivering above market returns, not too many investors are going to be willing to pay much for it. The average investor may simply do it themselves, or will eventually be enticed away to a human advisor who can provide them with a greater range of options.

Fortunately for robo-advice providers, the fix is simple. Stop the unhealthy obsession with just lowering fees and offer some portfolio options which include active managers, alternative strategies and alternative asset classes. Portfolios that have potential to outperform and lower volatility of returns.

We hope that was helpful. If so, here’s some other things you might like.

See more of our articles.

Find out all about us.

Subscribe to our free monthly Affluence newsletter.

Find out about our Affluence Investment Fund.

Or become an Affluence Member and get access to exclusive investment ideas, profiles of some of Australia’s best fund managers and full details of our Affluence investment portfolios.

Invest Differently!