If you watched any news or read a newspaper last month, it would be hard to have missed that there is a Royal Commission going on into banking and wealth management. Much has already been written about it, and I don’t want to add too much more except to make two very important points.

It’s not all bad

Firstly, while we have seen some staggeringly bad stories exposed so far, we must remember that these represent a very small minority of the worst offenders in a very large industry. While the behaviours in the worst cases are inexcusable, my experience over many years has been that the vast majority of financial advisers are good people who do have their clients’ best interests at heart.

But there is one problem. And we must deal with it.

The problem

Any adviser who works for a large wealth management organisation is likely to be hamstrung by one aspect of our financial system that is indefensible and must be stamped out. It’s called vertical integration. To understand what that means, you first need to know that there are three main ways that financial services businesses make money:

1. Provide personal financial advice, tailored to the needs of your clients.

This is what Financial Advisers do. Most advice is now provided under a fee for service model, which means the fee reflects the intensity of the work done, not the value of the investment made, but there are some exceptions.

2. Provide an administration service, through what is known as an investment platform.

Investment Platforms essentially consolidate all the investments a client has in one place. This allows for easier reporting and centralised management of tax positions. Many Platforms charge a fee based on the value of assets an investor has on the Platform. Pleasingly, over time, this is moving more towards a fixed or scaled fee model.

3. Generate the investment returns.

This is what Affluence and other fund managers do. Most fund managers charge a fee based on a percentage of the funds they manage. They may also charge a performance fee as well. In our case, we charge the second, but not the first. That’s currently very rare, but that may also change in the future.

Now, vertical integration means that a single financial services provider can provide two or more of the services noted above. If you were a client of that organisation, you might, therefore, be paying them for more than one of the jobs above.

Why vertical integration is bad

To explain why this is bad, let’s take a fictitious financial services provider. We’ll call them PMA. Now PMA is smart. And very big. They do everything. They have financial advisers who can help you get personal advice. And they have a platform which can administer your money. And they have their own investment products that you can invest into and insurance policies you can buy. As Charlie Munger once said, “Show me the incentive, and I’ll show you the outcome.” The boffins at PMA head office are incentivised to make sure that if you’re a client of a PMA Financial Adviser, your money will be invested through the PMA Platform, into PMA financial products.

Regardless of how honourable the intentions of the PMA Financial Advisors are, they will always to some degree be impacted by the conflict of interest that exists. That is, PMA will earn more money from you if you use their Platform, invest in their investment funds and use their insurance products.

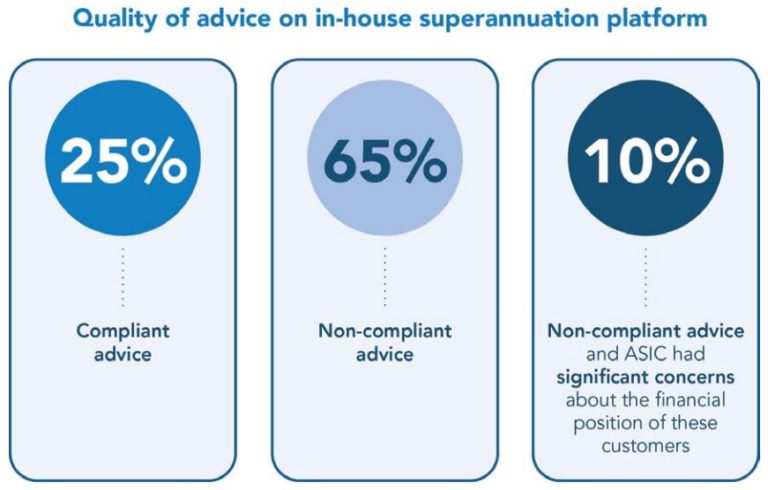

This is backed up by an ASIC report released in January 2018, the results of which are summarised below:

After reviewing five of the largest wealth managers in Australia, ASIC found that:

- Despite 79% of products approved for use being external products, only 32% of client funds went to those external products; and

- Only 25% of advice on in-house super platforms was compliant, with three quarters being non-compliant. In 10% of cases, ASIC had significant concerns.

Those are shocking statistics. What are the chances that our fictitious wealth manager PMA has the best Platform for you out of all the ones available? And also that they have the best Investment and Insurance Products? Pretty slim we’d say. Even having 21% of the products on PMA’s approved product list (the pre-approved list of products Financial Advisers can choose from) being their own is indefensible. There are thousands of products available in Australia. How can even 20% of the best be in-house products?

We invest in managed funds. We spend a lot of time looking for the best. How many funds run by the five biggest vertically integrated wealth managers in Australia do you think are currently in our investment portfolio? None. Zilch. Zero! Not one of over 30 managed funds currently in our Affluence Investment Fund portfolio is managed one of the top 5 wealth managers. Why? Because based on our independent and objective criteria, and our detailed research, they don’t make the grade.

The solution for the Royal Commission

The easiest way for the Royal Commission to have the biggest positive impact on the investment outcomes of millions of Australians is breathtakingly simple. Ban vertical integration completely. That is, forbid any organisation to own more than one of the three pillars of wealth management – People (Advisers), Platforms and Products. This would very quickly create large, independent wealth advisory groups, most likely staffed with very capable research teams. They will be spreading their clients’ money across the best platforms and the best investment products for that client.

This will take some time. It will require a reasonably long transition period to enable integrated firms to divest one or more businesses. The big firms will lobby against it for all they’re worth. They will come up with a myriad of reasons why it’s impossible to do. They’ll spout on about economies of scale and keeping costs low for clients and a bunch of other stuff. It’s all rubbish. We should not listen to them. The sooner we start separating People, Product and Platform, the better off we’ll be.

There are also a raft of other potential changes that can make a difference. But they all pale into insignificance next to the banning of vertical integration. Let’s get onto it.

By the way, hot off the press from a very recent submission by ASIC to the Royal Commission:

“ASIC’s present view is that:

- it should be possible for licensees to effectively manage the conflicts of interest associated with providing personal advice to clients and manufacturing financial products; and

- it should not be necessary to enforce the separation of products and advice.”

It’s not often we disagree with ASIC. But on this issue, in our humble opinion, they are wrong.

Take care and all the best with your investing.

We hope that was helpful. If so, here are some other things you might like.

See more of our articles.

Find all about us.

Subscribe to our free monthly Affluence newsletter.

Find out allAffluence Investment Fund.

Or become an Affluence Member and get access to exclusive investment ideas. Plus access profiles of some of Australia’s best fund managers and full details of our Affluence investment portfolios.

Invest Differently!