Hi,

Welcome to our monthly update.

September was another rough month for equity markets. In Australia, the ASX200 Index fell 6.2%, and the ASX Small Ords Index was down 11.2%. Globally, the US S&P500 Index was down 9.2% and global shares 9.6%. By the end of September most equity markets were at or near their 2022 lows. Markets are becoming increasingly nervous about the potential for an economic recession caused by the rapid increase in interest rates, war in Ukraine and surging energy prices. All three Affluence funds delivered negative returns in September, but nowhere as bad as equity markets. Over the September quarter, all three funds delivered positive returns.

In August and early September as markets recovered, we sold down some investments in Fund portfolios, in many cases booking profits on holdings acquired in May and June this year. Following the market falls in September, we have been gradually and selectively buying again. In the Affluence Investment Fund, we’ve been adding to our all-weather managers (those who have proven they can still make money, even in a falling market). Other investments we’ve been selectively adding to in Affluence fund portfolios include:

- Some Australian REITs at 30+% discounts to their latest valuations, which we believe is a significant margin of safety.

- Debt-focused listed investment trusts at yields of 5-7% and discounts to NAV of 15%+.

- Small cap value stocks, which are down around 25% this year.

We’re excited by many of the investments in each of our funds. But we continue to be cautious about markets in general, and to hold more cash than usual.

Monthly applications for the Affluence Investment Fund and Affluence Small Company Fund close on Tuesday 25 October. Applications for the Affluence LIC Fund close Monday 31 October. If you want to apply online or download application or withdrawal forms for any of our funds, go to our website and click “Invest Now”.

If you have any questions or want to give us some feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund decreased 2.1% in September outperforming the ASX200 Index which fell 6.2%. Since commencing in 2014, returns have averaged 7.5% per annum, including monthly distributions of 6.5% per annum.

At month end, 58% of the portfolio was invested in unlisted funds, 15% in the Affluence LIC Fund, 14% in listed investments, 2% in portfolio hedges and 11% in cash.

The cut-off for monthly applications and withdrawals is Tuesday, 25 October.

Affluence LIC Fund

The Affluence LIC Fund decreased 2.4% in September outperforming the ASX200 Index which fell 6.2%. Since commencing in 2016, returns have averaged 11.4% per annum, including quarterly distributions of 8.3% per annum.

The average discount to NTA for the portfolio at the end of the month was 17.5%. The Fund held investments in 29 LICs (76% of the Fund), 5% in portfolio hedges and 19% in cash.

The cut-off for monthly applications and withdrawals is Monday 31 October.

Affluence Small Company Fund

The Affluence Small Company Fund decreased by 5% in September outperforming the ASX Small Ordinary Index which fell 11.2%. The Fund holds a range of value investments focused on smaller companies. Since commencing in 2016, returns have averaged 8.2% per annum.

The Fund held 8 unlisted funds (56% of the portfolio), 8 LICs (16%) and 8 ASX listed Small Companies (22%). The balance 5% was cash and hedges.

Available to wholesale investors only. The cut-off for monthly applications and withdrawals is Tuesday, 25 October.

Updated Product Disclosure Statements

During September, we refreshed the Product Disclosure Statements for the Affluence Investment Fund and the Affluence LIC Fund. There are no changes to the investment strategy or other key terms of either Fund. You can access these new documents, along with updated application and withdrawal forms, from our website.

Affluence LIC Fund

A unique strategy with an exceptional track record

The Affluence LIC Fund Fund seeks to invest with some of the best LIC managers, while simultaneously taking advantage of unusually large discounts and short term trading opportunities via our unique discount capture strategy.

The Fund has outperformed the ASX200 by 3%+ per annum since inception. We’ve recently reopened the fund to new investors. At the end of September, the Fund held 29 LICs, plus significant cash to take advantage of opportunities. The average NTA discount for the LIC portfolio at the end of the month was approximately 17.5%.

With quarterly distributions and a performance based fee structure, the Affluence LIC Fund may be a useful diversifier for your investment portfolio.

Things we found interesting

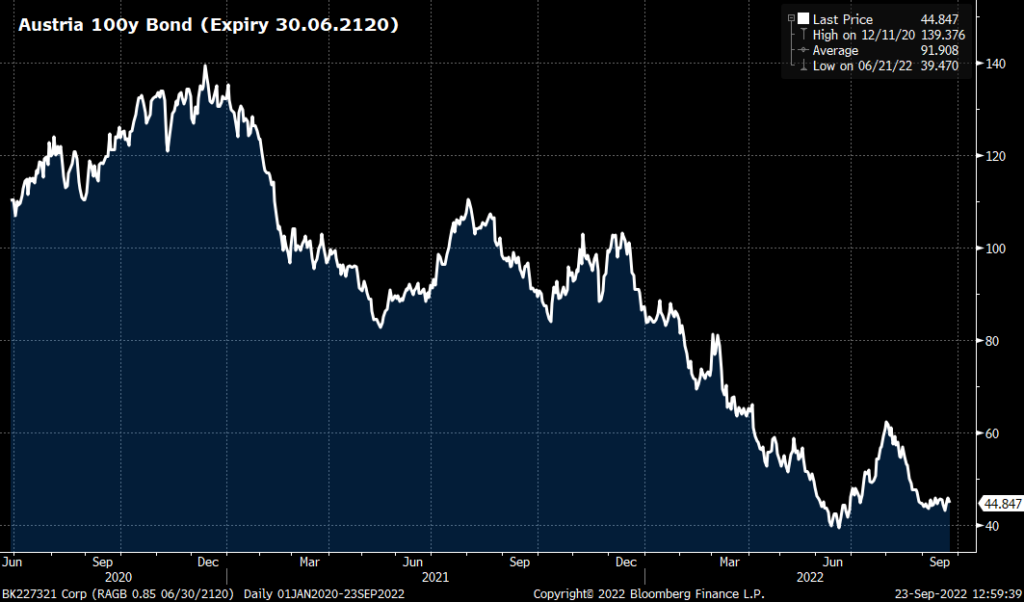

Chart of the month.

The Austrian government may have made the trade of the century in 2020, when they issued a 100-year bond. Buyers lined up to own it, with a fixed yield of just 0.85% per annum. For 100 years.

Unbelievably, buyers of the bonds initially made a lot of money. As interest rates reduced even further, that 0.85% annual yield started to look pretty tasty. At one point, the value got as high as $140. Eventually, reality and higher interest rates set in. Vienna’s gain means plenty of pain for those who still hold these bonds. Thanks to higher rates, they now trade at less than half their original value, as that 0.85% yield looks anaemic compared to current rates. Austria doesn’t care. No matter what happens, they’re paying less than 1% per annum interest for another 98 years.

Incidentally, Ireland and Belgium also sold 100-year bonds around the same time, giving new meaning to the term, “long-term debt.”

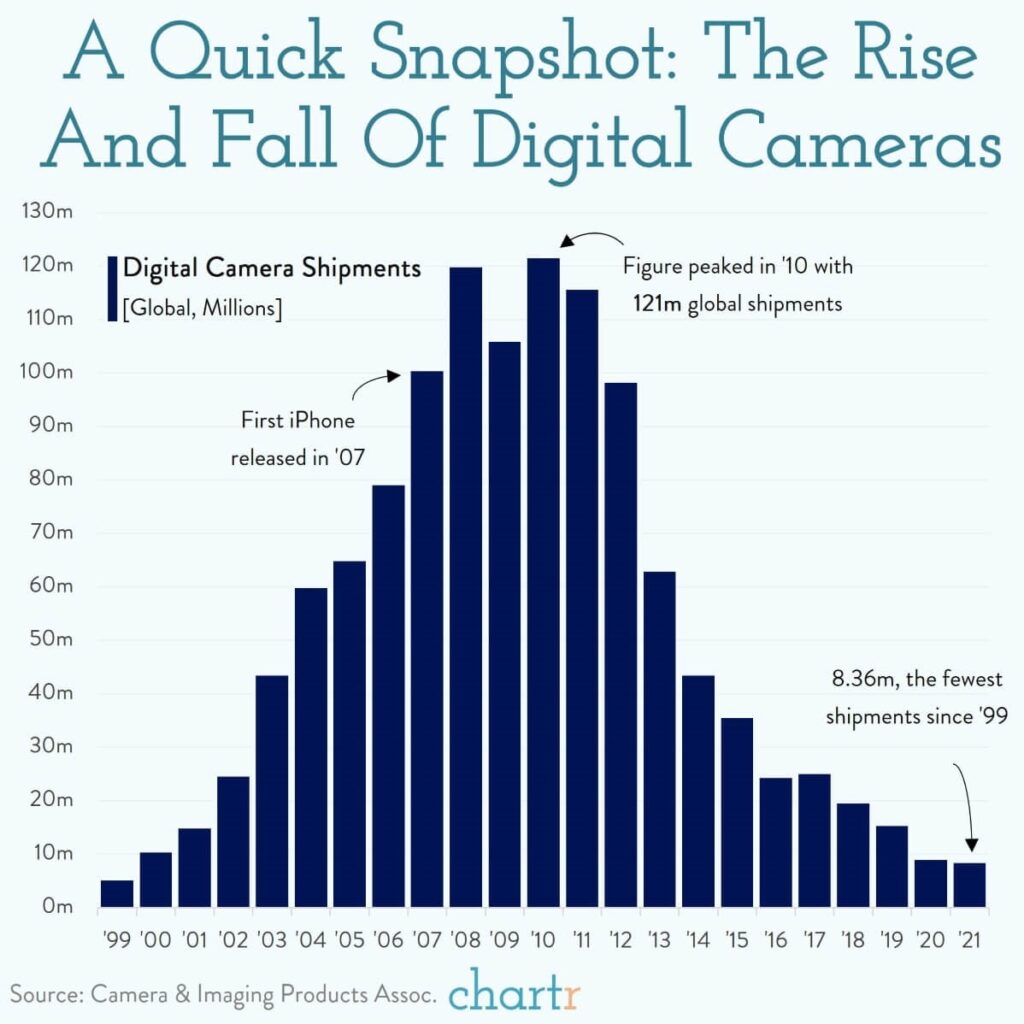

Chart of the month 2.

In the year 2000, digital cameras were the next big thing, quickly displacing film cameras and photo developers. For the next 8 years, sales skyrocketed. But in June 2007, something momentous happened that would abruptly change the future of digital cameras. Apple released the first iPhone.

Within a year, digital camera sales had stalled. And by 2012, they went into freefall, as phone camera technology became exponentially better. By 2021, digital camera sales were back to levels at the turn of the century.

Ironically, in the last few years, analog (film) cameras have made a big comeback. In the last 18 months, camera giant Kodak has reportedly hired 300 people in their film and chemicals department. Just like vinyl records, all that was old is new again. Reportedly, prices of some popular SLR film cameras have risen 80%+ in recent years.

Quote of the month.

“I have more humility than I’ve ever had in terms of a forecast. In fact, my positions reflect that. They’re very light. Not because I’m scared, just because I can’t see a fat pitch, I can’t figure it out.”

AND

“We’ve never seen the gap we have now between monetary policy and inflation. A lot of my gig is to go back and find historical analogues and see how they worked out and learn from them. This is the most unprecedented cocktail I’ve ever been served up.”

Famed investor Stanley Druckenmiller, September 2022. If Stanley can’t figure it out, then what chance have the rest of us got? It seems like a very good time to carry some extra cash, be diversified in a portfolio that is cheaper than average, and be patient.

This month in (financial) history.

In October 2008, Warren Buffett announced Berkshire Hathaway would invest $3 billion in General Electric. GE had got itself into trouble, as loans within its GE Capital arm began to default. Buffett bailed them out, but on his terms. The $3 billion was issued in preferred shares of GE. They yielded 10%. They also came with an option to buy 135 million GE shares at any time in the next five years for $22.25 each — close to its stock price at the time.

Like his $5 billion investment in US bank Goldman Sachs a week earlier, Buffett’s timing would prove early. Shares in GE would fall to $7 by March 2009. However, Buffett was patient, and the deal would ultimately net Berkshire roughly $1.7 billion in profits. Berkshire received $3.3 billion when GE redeemed its preferred stock in October 2011, as well as $900 million in income in the intervening three years. Buffett negotiated to vary the share option in 2013, to allow Berkshire to exercise them without spending any cash. It received 10.7 million shares as a result. Berkshire finally sold their GE shares in August 2017. Between the preference share premium, the income, and the proceeds from the share sales, Berkshire achieved about a 50% return.

At Berkshire’s annual meeting in 2018, Buffett revealed that he could have driven a harder bargain.

“They were going to take the terms we offered.” he said, “But we actually didn’t push it to the limit because there really wasn’t anybody else around.”

Vaguely interesting facts.

Elvis Presley’s manager sold “I Hate Elvis” badges as a way to make money off people who weren’t buying his merchandise.

According to a study, most dogs reach peak cuteness between six and eight weeks old. Who pays for these studies?

After passing a kidney stone in 2006, William Shatner sold it for $25,000. Shatner donated the money to a charity.

The medical term for ice cream headaches is sphenopalatine ganglioneuralgia.

Earmuffs were invented in 1873. By a 15-year-old. *

Source: mentalfloss.com, wikipedia.com

* Chester Greenwood was the 15 year old inventor of the earmuffs. He came up with the idea after his ears became frostbitten while ice skating. At first, Chester’s friends made fun of his strange ear protectors. But they soon realized that they worked, and it wasn’t long before almost everybody was wearing them.

Chester continued to improve the design. Within 10 years, he had built a small factory near his home town of Farmington, which employed 11 workers. In 1883, they produced 50,000 pairs. After World War I broke out, Chester’s factory provided earmuffs to thousands of overseas troops. When he died in 1937, the plant was producing 400,000 pairs of earmuffs per year.

In the US state of Maine, the first day of winter is known as Chester Greenwood Day, in honour of the earmuff boy. In Chester’s home town of Farmington, they hold an annual “Earmuff Parade” in his honor.

And finally…

Investing is not for everybody.

If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.