Hi,

Global share markets were down more than 4% in September, continuing their slide from August. Once again it was increasing long term bond yields that rattled equity markets, with the US 10 year bond yield reaching 4.8% before retreating back. Bond and equity markets appear to finally be pricing in the “higher for longer” message. Against this tough backdrop, the Affluence LIC Fund bucked the trend to be up 1.2% in September. The Affluence Investment Fund and Affluence Small Company Fund recorded very small negative returns for the month, showing the benefits of our conservative positioning in this challenging market. You can access the latest Fund reports from the links below.

Commercial property, and in particular listed REITs have borne a lot of pain over the past 18 months. The main cause has been the substantial increase in interest rates. The impact on listed REITs, both in Australia and globally, has been quite brutal. Most are trading at discounts of at least 20% to their most recent net asset value, and discounts of 40% plus are common. We’ve largely avoided the sector for the past two years, but over the last three months, we’ve been looking very closely at the whole sector and we’ve recently started buying again. In this article, Greg explains what’s happened, what the sector looks like right now, and provides an example of what we’re looking for. We are by no means overweight REIT’s, but we’ve started nibbling on a few that look very attractive. It’s an area we’ll continue to watch closely, with some further good buying opportunities likely in the next 12 months.

Should you wish to invest this month, applications for the Affluence Investment Fund and Affluence Small Company Fund close on Wednesday 25 October. Applications for the Affluence LIC Fund close Tuesday 31 October. Go to our website and click “Invest Now” to apply online or access application and other forms for any of our funds.

If you have any questions or feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund returned -0.2% in September. Since commencing over eight years ago in November 2014, the Fund has returned 7.7% per annum, including monthly distributions of 6.4% per annum.

The cut-off for monthly applications and withdrawals is Wednesday 25 October.

Affluence LIC Fund

The Affluence LIC Fund returned 1.2% in September, outperforming the ASX 200 Index which decreased by 2.8%. Since the Fund commenced, returns have averaged 11.0% per annum, including quarterly distributions of 7.9% per annum.

The cut-off for monthly applications and withdrawals is Tuesday 31 October.

Affluence Small Company Fund

The Affluence Small Company Fund decreased 0.3% in September, outperforming the ASX Small Ords Index which fell 4.0%. Since commencing, returns have averaged 8.7% per annum including quarterly distributions of 6.9% per annum. Available to wholesale investors only.

The cut-off for monthly applications and withdrawals is Wednesday 25 October.

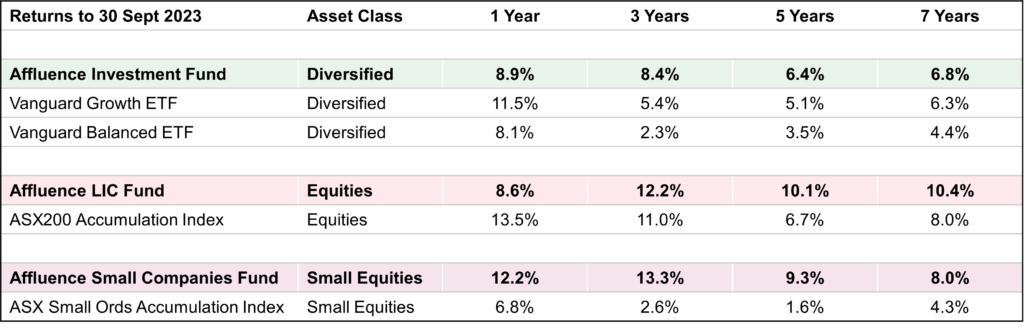

Our Performance

All of our Funds have substantially outperformed their index or passive equivalents over the suggested investment periods of 3 years and longer, with substantially less volatility.

We continue to be excited by the value apparent in all of our fund portfolios. If you would like to know more, you can access our latest quarterly presentation below.

Performance data is calculated assuming the reinvestment of distributions and is expressed net of fees and costs, excluding the buy-sell spread. Performance includes distributions and changes in unit prices, but not franking or other tax credits. Returns for periods over 1 year are annualised. Past performance is not indicative of future performance. Current performance data is available at https://affluencefunds.com.au.

Things we found interesting

The biggest free lunch in financial markets today’Five years ago, an investor went to the bank for a loan, and the banker said, “We’ll give you $800 million at 5%.” Now the loan has to be refinanced, and the banker says, “We’ll give you $500 million at 8%.” That means the investor’s cost of capital is up, his net return on the investment is down (or negative), and he has a $300 million hole to fill.’

and

‘Expected pre-tax yields from non-investment grade debt investments now approach or exceed the historical returns from equity.’

These quotes come from Oaktree Capital co-founder Howard Marks latest memo, titled “Further thoughts on sea change”. The bottom line is that credit investors can access returns from a portfolio of loans and bonds today that are highly competitive versus the historical returns on equities and are much more certain than equity returns. It’s an area we’ve been working on all year. It’s now possible to construct a very diversified portfolio of income producing bond and loan funds yielding 7-8%. Within the Affluence Investment Fund, we’ve added a number of new investments in this area in recent months, and we’ll have much more to say about this soon.

The full memo from Howard Marks is available here.

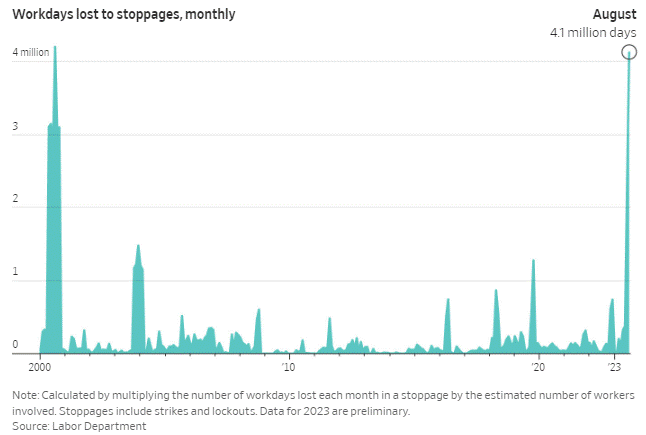

Chart of the month: Employees have the advantage

In August this year, 4.1 million workdays were lost in the US to worker strikes. This seems like a trend that will continue, though perhaps not at those extremes. Workers are seeing their cost of living increase substantially, and there are still plenty of jobs about.

If this trend continues, it will result in higher wage costs (obviously) coupled with lower productivity gains. This has two flow-on effects. It hurts company profits, if prices can’t be increased to match higher costs. And it keeps inflation higher for longer, meaning employees look for large pay rises again the following year. It’s the type of negative loop that central banks don’t want to take hold. But it feels like it just might be getting underway.

This month in financial history.

A couple of months ago, we told you about creation of the Guinness Book of Records. This month we’re going to go back even further into Guinness history. In October 1886, the Guinness Brewery went public on the London Stock Exchange.

Guinness was founded in 1759 as St James’s Gate Brewery by Arthur Guinness in Dublin, Ireland. By 1838, the company had become the largest brewery in Ireland, and by 1886 it was the largest brewery in the world. At the time, the company was producing about 1.2 million barrels of beer per year. Arthur Guinness’ grandson Sir Edward Guinness announced he was selling his 65% stake in the company in an initial public offering for 6 million pounds, which was a heck of a lot of money in 1886. Sir Ed enlisted Barings Bank to underwrite a public offering of his company’s shares.

When the prospectus for Guinness’ IPO was distributed to investors, those who bothered to review the financial statements were not overly impressed. It shouldn’t have taken long to read. The whole prospectus was only 5 pages long, which included the application form and the company constitution.

But despite the seemingly expensive price, speculators took a shine to the company. When the 36 hour application period opened on a Saturday morning, chaos erupted at Baring’s Bank as investors lined up to submit their subscriptions. The demand was overwhelming, and the bank had to shut its doors in 3 hours. The crowd became so out of control that a special police unit was called to guard the bank’s entrance. Speculators resorted to tying their subscription forms to rocks, and hurling them through the Baring’s Bank windows in a desperate attempt to purchase shares. Some sources estimated that Guinness’ shares were 30x oversubscribed and Guinness stock soared 60% on its first day of trading.

Guinness remained listed until 1997, when it merged with Grand Metropolitan to form Diageo, now one of the largest drinks companies in the world. Guinness Draught is still produced at the St James’ Gate Brewery in Ireland to this day.

Vaguely interesting facts.

There’s a segment of the Berlin wall in the men’s bathroom of a Las Vegas casino.

One of Walt Disney’s first art jobs was drawing cartoons for a local barber in exchange for haircuts.

Danish Nobel Prize winner Niels Bohr was gifted a perpetual supply of beer by Danish brewer Carlsberg.

Alnwick Castle in England has a Poison Garden, where many of the plants are so deadly they’re grown in cages.

Many people have araskavedekatriaphobia (also known as friggatriskaidekaphobia), or fear of Friday the 13th.*

Source: mentalfloss.com, wikipedia.com.

* More facts about Friday the 13th:

Symptoms of the phobia range from anxiety to all-out panic attacks.

All years will have at least one and as many as three Friday the 13ths.

It’s not clear where the superstition originates, but it probably has religious origins.

According to National Geographic, more than 80 percent of high rise buildings avoid having a 13th floor.

Director Alfred Hitchcock was born on Friday the 13th. Perhaps that explains his obsession with psychological thrillers?

Finland dedicates one Friday the 13th each year to observe National Accident Day. The day aims to raise awareness about safety.

Many studies have shown that Friday the 13th has little or no effect on events like accidents, hospital visits, and natural disasters.

Dr. Donald Dossey, a folklore historian, estimates that 17 to 21 million people suffer from triskaidekaphobia or a fear of the number 13.

Friday the 13th is not universally seen as a day of misery. In Italy, Friday the 17th is a bad luck day and 13 is thought to be a lucky number.

It’s been estimated that hundreds of millions in business turnover is lost on this day because people will not fly or do business they normally would do.

And finally…

A wife asks her husband, “Could you please go shopping for me and buy one carton of milk and if they have avocados, get 6.”A short time later the husband comes back with 6 cartons of milk.The wife asks “Why did you buy 6 cartons of milk?””Because,” he said, “they had avocados.”

Thanks for reading. If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.