August saw the strong start to the financial year continue for all our funds.

- +0.6% for the Affluence Income Trust (+7.3% over 1 year).

- +2.1% for the Affluence Investment Fund (+12.1% over 1 year).

- +3.3% for the Affluence LIC Fund (+14.0% over 1 year).

- +4.0% for the Affluence Small Company Fund (+17.0% over 1 year).

It seems the value in our portfolios is finally starting to be realised by the markets. Below, you can access all monthly fund reports for more details.

As we write this, we’re halfway through a week of catching up with fund managers in Sydney. Below, we’ve outlined a few things we’ve been learning and talking about with some of the best investment minds in Australia. Also below, we’ve included our usual investment profile, and a link to an insightful piece from fund manager GQG on big tech and why it might be more overvalued than the year 2000.

As always, thanks for reading and for your continued interest in what we do. If you have any questions or feedback, reply to this email or give us a call.

Regards, Daryl, Greg and the Affluence Team.

Affluence Funds Returns

Affluence Income Trust

The Affluence Income Trust returned 0.6% in August and 7.7% per annum since commencing. The current distribution rate is 6.75% per annum paid monthly.

Affluence Income Trust August 2025 Report

Affluence Investment Fund

The Affluence Investment Fund returned 2.1% in August and 8.1% per annum since commencing. This diversified fund brings together our best ideas across all asset classes.

Affluence Investment Fund August 2025 Report

Affluence LIC Fund

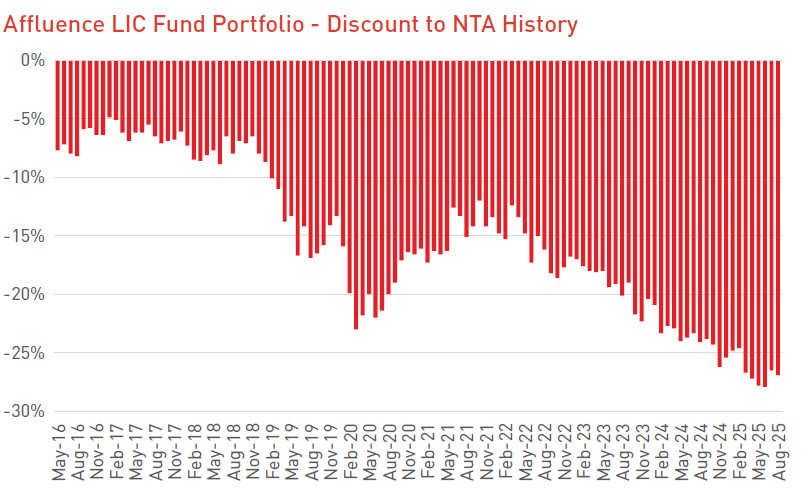

The Affluence LIC Fund returned 3.3% in August and 11.3% per annum since commencing. At the end of the month, the average portfolio NTA discount remained near all-time highs at almost 27%.

Affluence LIC Fund August 2025 Report

Affluence Small Company Fund

The Affluence Small Company Fund returned 4.0% in August and 9.8% per annum since commencing. There’s still exceptional value in many smaller companies.

Affluence Small Company Fund August 2025 Report

Investment Profile

Each month we take a look at an underlying investment in one of our funds.

This month, we profile the Regal Partners Private Fund, held in our Affluence Investment Fund portfolio. This unlisted fund brings together a variety of funds from Regal and its associated managers to produce a unique blend of alternative investment strategies. Despite a hiccup earlier this year, we believe this fund will be a long term holding for our Affluence Investment Fund. Click below to find out why we like it.

Fund In Focus

We’ve been generating alpha from harvesting discounts and other returns from Listed Investment Companies/Trusts for over 10 years, and the Affluence LIC Fund itself has a 9.5 year track record. No one knows the LIC sector like we do.

Convincing investors to part with their money for LICs right now is hard. That tells us there is significant value to be had, and our work confirms this. The Fund has delivered 14% returns in the past year and 11%+ per annum since inception. Around half that return has come from our discount capture skill – essentially buying individual LICs when they are priced at unnaturally large discounts and selling when they normalise. LICs (excluding the fixed income trusts) have been out of favour for a few years, and the discounts show it. Right now, the ALF portfolio of LICs and REITs shows an average discount to NTA of 25%+. To give you an idea of how extreme that is, it’s roughly equal to the discount at the end of March 2020 at the height of the covid correction.

* Returns are not guaranteed. Past performance is not indicative of future performance.

Currently, via the fund’s portfolio of LICs, we have significant weightings to small caps, REITs and resources, three areas where value is still particularly evident.

The combination of high discounts and attractive underlying LIC portfolios is one we rarely see. Each time it has happened in the past, we have generated very attractive returns in the following 2-3 years. We have seen interest building and some buying emerging in the last 2 months, which bodes well for the fund. If we see one or two more interest rate cuts, it is likely to be the tipping point that drives retail investors back to LICs for their yield.

The Affluence LIC Fund can be a great satellite allocation to complement core equity portfolios. The Fund has outperformed the ASX200 Index, with around half the volatility. If you’re looking for quarterly income, and equity exposure with extra potential and less volatility, this could be the fund for you. Contact us to find out more or click below to view the latest Fund presentation.

Things we found interesting

Ideas from Australia’s best fund managers.

As we write this, we’re halfway through a week of catching up with fund managers in Sydney. Here are a few things we’ve been learning and talking about with some of the best investment minds in Australia.

Gold’s exceptional run can continue. The key turning point for gold was the confiscation of Russia’s foreign reserves after the invasion of Ukraine. From that point on, many nations, led by China, started switching their foreign reserves for gold. Initially, the play for investors was to hold the metal itself. Over the past 12-18 months, many have switched to investing in gold miners, where share prices are not yet reflective of gold fundamentals. We have some exposure to gold miners in both our Affluence Investment Fund and Affluence LIC Fund. They have been some of our best performing investments in the past 12 months. While we’ve taken some profits, we continue to maintain an allocation.

Interest rates are falling. That means equity markets can continue to go up. Central banks are coming under pressure to cut rates, and they’re running out of reasons not to. We’re likely to see several cuts in the US. While a lot of that is priced in, market momentum is strong. This will, in time, likely lead to a resurgence of inflation, with a repeat of what happened in the 70’s, though the second wave of inflation is unlikely to be as high as it was back then. This inflation resurgence may well be the thing that finally stops this market advance.

Small resources remain attractive. In an environment where inflation is making a comeback, resources and other hard assets can deliver very good returns. In particular, resource managers are backing companies with projects in attractive sectors, including gold, rare earths and uranium. Projects that are permitted, derisked and bankable will be prime takeover targets for larger resource companies.

Money continues to flow into private credit, despite many investors having reservations about the sector. In our view, there are a lot of very good managers in this space who can and are delivering attractive risk adjusted returns. At the moment, there are two things to remember. Don’t take too much risk (ask yourself whether that extra 2 or 3 percent return is really worth the extra risk you’re taking). And understand the liquidity of the portfolio you’re investing in, because if there’s a mismatch between the fund liquidity terms and the underlying portfolio, you’ll need to be prepared to be patient at some point.

When investing with fund managers, some of the best results can come from backing long only managers, who have significant flexibility to construct reasonably concentrated portfolios, in areas where they have a natural competitive advantage over the rest of the investment community. We invest with a range of managers who meet this criteria, and we’ve seen some very good results from it. Many of them are no longer accepting new clients, as they realise that having too much money to manage will mean lower returns. They would rather deliver great returns with less money.

Shorting is hard right now, to the point where in the US, many short sellers have left the market. Many (though not all) long short strategies are struggling in what is an unfriendly market. Some will bounce back very strongly when conditions improve for them. Some will not. We’re very selective in this space. Market neutral funds are finding it very hard to deliver acceptable returns. We have not had investments in any market neutral funds for some time, and that’s unlikely to change.

Small and microcap stocks have finally received some attention in the past couple of months, after a brutal tax loss selling season in May/June. But there’s a long way to go, and there are still a wide range of very attractive opportunities in this space. Many of the small cap managers we have talked to think it’s only just getting started. This is very positive for our funds. All except the Affluence Income Trust have a decent exposure to small cap managers.

LIC managers are not feeling the love. Many are trading at large discounts, in some cases even though performance over the last year or so has been very good. We really like the setup here. Our LIC Fund has delivered around 14% over the past 12 months, despite our average LIC portfolio discount remaining near all-time highs. In the past, the combination of attractive LIC discounts and attractive underlying LIC portfolios has proven attractive.

The private equity space remains challenging, with many managers globally sitting on aged portfolios they are struggling to realise, and investors who want liquidity. This is slowly clearing, but it’s taking time. The lack of support in the IPO markets, particularly in the small end of the market, isn’t helping. We need to see a significant improvement in the valuations of listed small caps to revitalise this market. In the meantime, rather than buying unlisted private equity with limited or mismatched liquidity, we continue to focus on owning a range of listed private equity funds that we can buy at deep discounts to the most recent valuations. In many cases, these discounts are over 30%.

Quote of the month.

“It may be hard for investors to face the uncomfortable reality that the trade that worked for over a decade may be over. After all, most money managers today do not carry the scars of the dotcom era. Of the approximately 1,700 active large-cap US portfolio managers, just 4% invested through that period. There is a difference between living through a downturn and merely reading about it.”

The quote is from a recent article by global fund manager GQG. They have delivered very good long-term returns, but not in the past 12 months, due to their conviction that large tech is no longer a good investment. In the article, they make an exceptional case as to why this is true, even suggesting that the current market pricing is worse than the dotcom boom.

Financial word of the month.

Oversight: A word with two opposite meanings: “supervision”’ as by a regulator or risk manager, and “omission or negligence.” The directly contradictory meanings should serve as a warning to investors. Oversight can result in either outcome

Source: “The Devil’s Financial Dictionary” by Jason Zweig.

Vaguely interesting facts.

Astound your friends with these morsels of knowledge:

- Peanuts aren’t nuts. They’re legumes.

- There’s no word in English that rhymes with “month.” It is one of a handful of words that are considered rhymeless, along with “orange,” “silver,” and “purple.”

- Your nose can remember around 50,000 different scents – at least that’s the best estimate we have. It’s capable of detecting over 1 trillion distinct smells. You just can’t remember them all.

- Some snails can hibernate for up to three years to survive in extreme environmental conditions. But in normal conditions, snails have a regular sleep cycle of 13–15 hours of sleep followed by 30+ hours of activity.

- Bluetooth is named after a 10th-century Danish king, Harald “Bluetooth” Gormsson. King Harald was known for uniting parts of Denmark and Norway. The tech’s creators – Swedish company Ericsson – named it in homage to this spirit of unification. The Bluetooth logo combines the runes for H and B (Harald Bluetooth).

And finally.

The best thing on LinkedIn this year…

Thanks for reading. If you enjoyed this newsletter, forward it to a friend. If you are that friend, you can subscribe at the bottom of this page.