The latest SPIVA results from Standard and Poors are in. They provide some important investment lessons on where to look if you’d like to find long-term outperforming managed funds, although that’s not the impression you’d get from reading the report.

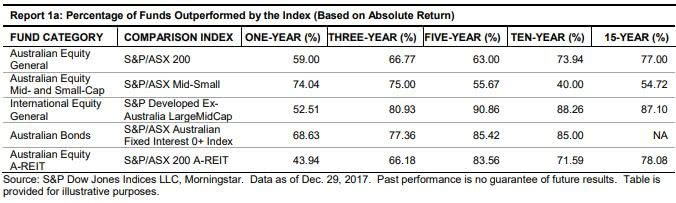

In their latest scorecard, S&P evaluated returns of more than 786 Australian equity funds (large, mid, and small cap, as well as A-REIT), 378 international equity funds, and 109 Australian bond funds. For the first time in Australia, S&P was able to provide data for a 15-year period. The results are summarised below:

The SPIVA study has consistently observed that the majority of Australian managed funds fail to beat comparable benchmarks over the long-term. For example, over the 15-year period ending December 2017, more than 87% of all international equity funds underperformed their benchmark after fees. In all categories, over almost all time periods, a large percentage of managed funds failed to beat a fair benchmark.

But behind the headlines, there are some important lessons to be gleaned. Here are six investment lessons from fifteen years of data.

Funds that invest in smaller companies do better.

The best performing group of funds by far over 5, 10 and 15 years were those that invested in Australian smaller companies. More than 60% outperformed over 10 years and around 45% over 5 and 15 years. While that’s still not great, it’s way better than all other categories, where success rates are generally less than 25%.

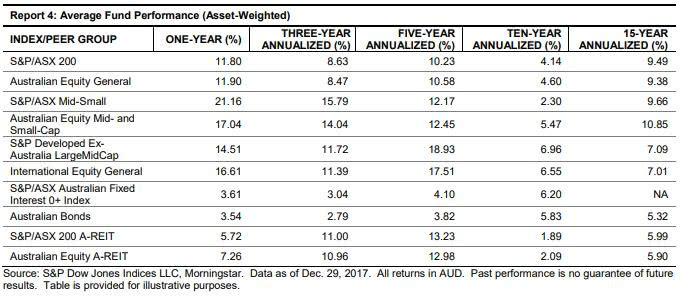

It’s often pointed out (mostly by managers of funds that invest in large companies) that the Australian small caps index is poorly constructed and easy to beat, which makes it a low hurdle. There is some truth in that. But it’s also true that smaller company funds delivered a greater total return compared to larger company funds, as can be seen below:

Over all time periods, mid-small company funds beat their larger company peers.

So, Lesson 1, it’s a good idea to have some exposure to smaller companies in the equities part of your investment portfolio.

Overall returns aren’t as great as most people think

The Table above also shows that the best 15-year returns came from small-mid sized companies at around 10%pa. Funds investing in larger companies delivered 9-10%pa on average, depending on whether you had an active manager or an index fund. That excludes franking credits, which probably would have added up to another 1%pa. So that’s pretty good.

In comparison, (surprisingly to most, but not us), international shares fared worse at around 7% annual returns. This is the case even though global shares have performed much better over the past 5 years. It supports our current positioning in the Affluence Investment Fund Portfolio. We maintain a low allocation to global shares because compared to Australian shares, they’re significantly more overvalued.

Bringing up the rear returns-wise, over 15 years Australian bonds have delivered just over 5%. A-REITs (or listed property trusts) returned around 6%pa.

This means on average, a balanced portfolio of 60% shares/property, 40% bonds/cash might have delivered investors around 7.5%pa. This compares well to the average balanced super fund, which according to Chant West has delivered around 6.8%pa over the past 15 years, after tax.

Lesson 2, recognise that average returns aren’t that great, and make sure your return target is realistic.

But there’s also more to this story. On average investors do far worse than this. That’s because they tend to invest near market highs and sell near lows. Many credible studies show the impact of poor timing is that the average investor will achieve returns 2-3%pa worse than the above markets, mostly because of poor timing decisions.

Lesson 3, unless you’re very comfortable going against the crowd, any strategy that delivers more consistent returns should be preferred. It means you aren’t tempted by wild valuation swings to buy and sell at the wrong times.

Growth vs Value.

Although the Australian study doesn’t look at differences in returns from investment styles, the much bigger US study does. It showed that over 15 years, there was not a large amount of difference between value and growth styles. But within shorter periods, there could be quite a big difference. For example, over the past year, US large-cap growth funds delivered almost 30% returns, compared to value funds at just 15%. There have been other times when the reverse has occurred, although rarely to the same degree.

There is not a lot of difference over the longer term. Over 15 years, large-cap growth outperformed large value slightly. And small-cap value outperformed small-cap growth slightly. These results are perhaps not what you would expect.

Lesson 4, allocations to both growth and value styles are likely to outperform at different times. You might get the same long-term result, but perhaps a smoother overall rise if you have both in your portfolio.

The recent stars are more likely to be the future laggards.

One of the common trends we see is the herd piling into last year’s best performing funds. That’s usually a big mistake. Our experience is that an equity fund delivering above 12%pa over ten years or more is extremely rare. So, if you invest in one that just did 20%pa for the last two years, chances are that a big part of that performance was due to the fact that the assets or market they have invested in is now overvalued. Or their investment style has had a good run. Or they had a low amount of funds to manage but now they have a lot. Maybe all three.

Any or all of these things don’t bode well for the next few years returns from that fund. Last year’s outperformers can be next year’s laggards.

So, Lesson 5, be wary of funds that have delivered high returns in recent years. In many cases, it’s just not repeatable.

The best funds might not actually be in the survey.

The SPIVA survey is limited. They do include over 1,300 funds, which is a lot. But their data set is limited to those funds included in Morningstar’s database and in the categories stated. In our experience, many of the best funds, including a great number available only to wholesale investors, are not on the Morningstar database. Or they pursue an investment strategy not covered in the SPIVA survey.

As an example, around a third of the Funds in our Affluence Investment Fund Portfolio are not on Morningstar. Another third are in categories not covered by the SPIVA study. So two-thirds of the funds in our Affluence Investment Fund Portfolio are not covered by the SPIVA study. Almost all of them have significantly outperformed their benchmarks over time.

So finally, and most importantly, Lesson 6. Despite what this study suggests, great funds and managers who can outperform over the long term are out there. If you know where to look. And what to look for. Much of the answer to that is encompassed in our motto, Invest Differently.

By the way, if you’re interested, the full SPIVA report can be found here.

Take care and all the best with your investing

We hope that was helpful. If so, here are some other things you might like.

See more of our articles.

Find all about us.

Subscribe to our free monthly Affluence newsletter.

Find out allAffluence Investment Fund.

Or become an Affluence Member and get access to exclusive investment ideas. Plus access profiles of some of Australia’s best fund managers and full details of our Affluence investment portfolios.

Invest Differently!