What is Volatility?

The performance of an investment is ultimately the most important thing. But when assessing a potential investment, it is also vitally important to understand volatility. In essence, this term refers to the range of investment returns, or how much performance varies over time. Returns from volatile investments are more erratic and less consistent. It is also referred to as standard deviation and is usually measured as a percentage, based on a statistical formula.

If the price of a stock or other investment moves up and down rapidly over short time periods, it has high volatility. This means the potential range of future returns is much wider. But with higher potential returns, comes higher potential risk. If the price almost never changes, it has low volatility.

Why It Matters

The holy grail for an investor is the delivery of their targeted returns with very low volatility.

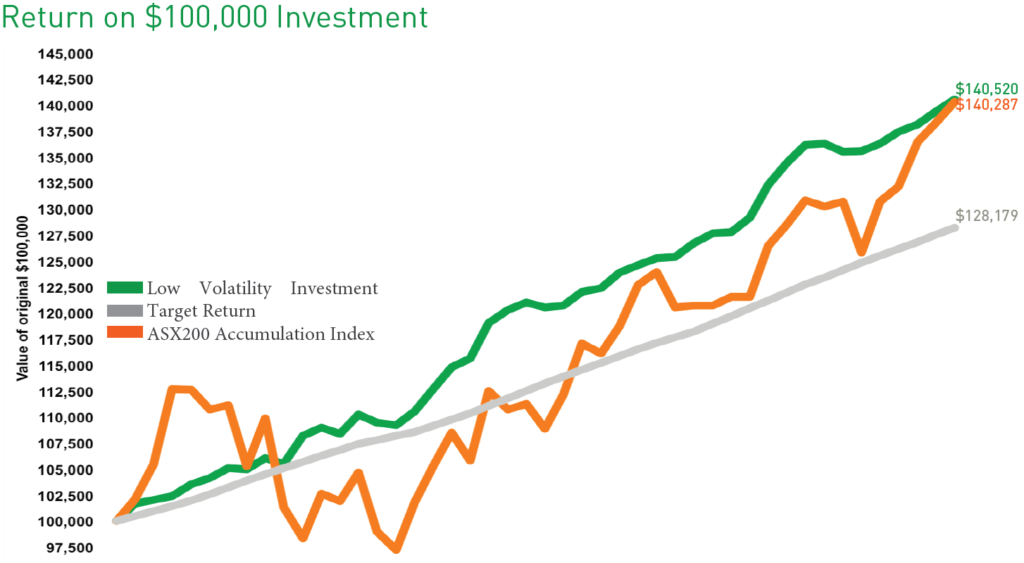

In the example below, both the low volatility (green) investment and the ASX200 (orange) have delivered the same returns of around 9% per annum. But the green investment has volatility of just 4%. The orange investment has volatility of around 12%. For most people, the green investment outcome is more desirable.

We prefer to think of it as getting rich slowly.

For long term investors, high volatility investments are inherently riskier because they can prompt a much wider range of decisions from investors. Or put another way, these types of investments can cause you to deviate from your investment plan and do dumb things.

If you held the investment represented by the orange line, it may cause significant angst as values fall and lead you to a decision to sell at an inopportune time. Contrast that with the green line, which very rarely causes any concern, with minimal negative return periods.

While all of our Funds target above average returns through the investment cycle, we also try to make sure they do so with lower than average volatility.

Variations Between Investment Types

Different types of investments tend to display differing volatility characteristics. For example:

- Listed investments tend to be more volatile (but obviously more liquid) than unlisted investments.

- Smaller listed stocks tend to be more volatile than larger listed stocks. This is because smaller stocks can have smaller trading volumes, wider bid/ask spreads and more concentrated share registers. This means individuals or small groups of investors can have a larger impact on trading prices, particularly in times of market distress.

- A single stock is usually more volatile than a basket of similar stocks.

- Sectors such as resources, IT and biotech tend to be more volatile than sectors such as health, telecommunications and industrials. The first group of industries may include a higher proportion of early-stage businesses which may not be profitable or consistently so, whereas the second group are more likely to contain established businesses.

- Sectors such as bonds and property (when held directly) tend to have much lower volatility than shares.

- A properly diversified portfolio can help to significantly lower volatility.

- Cash, theoretically, has no, or very low volatility.

Measuring Volatility

Volatility can be measured in a number of ways but is generally not well understood by most investors. It is complicated, backward-looking and it can be difficult to obtain sufficient data to calculate it properly over time. However, there are some things you can do to assess the volatility of an investment.

Start by looking at a chart of the investment performance against a relevant index or benchmark. For example, if you are assessing an ASX-listed stock or a managed fund that invests in Australian shares, you may wish to look at performance against the ASX200 index. Most online brokers will make this information readily available. Study the chart, particularly during a time when the market has corrected. Did the investment move down more, less or about the same as the market? Greater movements relative to an index mean greater volatility.

Some managers of funds and LICs publish limited volatility data. Measures such as standard deviation, up vs. down months and ratios such as the Sharp and Sortino Ratios can be useful tools to assess this. But this data is generally only useful if it can be obtained for long periods of time. It should also preferably contain at least one period where a significant market correction occurred.

Of course, volatility is not always bad. Many traders like investments with this feature, because they can provide greater opportunity to enter and exit trades and can also generate profits relatively more quickly. Higher volatility investments can also generate much larger gains for long-term investors and provide better entry points, but this also comes with higher risk, so it’s a balancing act.

How We Think About Volatility

Here’s how we take volatility into account when constructing our investment portfolios for the Affluence Investment Fund:

- We measure the historical volatility of each investment we hold and any new investments we consider. In particular, we focus on how the investment has performed in negative market periods.

- We think about whether this past track record might also be reflected in the future. Sometimes, certain unusual factors in historical periods might mean future results could be different.

- We compare our expected returns to expected volatility. We target returns of at least inflation plus 5%, and we like returns to be at least as high as volatility. So if two different investments both had an expected return of 10%pa, but one had an expected volatility of 7%pa and the other 15%pa, we would in all likelihood prefer the one with the lower number.

- We are more likely to allocate a higher portion of our portfolio to a lower volatility investment, so long as it meets our return criteria.

- We measure the volatility of our portfolio over time. Our return target is always the priority. But we also have a volatility target of less than half that of the ASX200 stock market index.

- We work hard to keep it as low as possible. We do this mostly by trying to ensure our portfolio is well diversified with many different strategies that behave differently in all market conditions.

- Finally, we never compromise our return targets just to reduce volatility. Many investment managers hold assets such as bonds in order to do this, but they fail to recognise that by doing so they are severely compromising potential investment returns.

Want to know more?

See more of our articles.

Find out all about us.

Learn about the Funds we offer.

Subscribe to our free monthly Affluence newsletter or become an Affluence Member and get access to exclusive investment ideas, profiles of some of Australia’s best fund managers and full details of our Affluence investment portfolios.

If you have any questions, please send us an message or give us a call.

Take care and all the best with your investing.