In addition to our regular program of manager meetings, around 3-4 times per year we hit the road to catch up with a group of up-and-coming Australian fund managers that show promise. This time around we saw new managers in Sydney and Melbourne. It’s always an interesting exercise and we’re continually impressed by the quality of boutique managers in Australia. It’s also surprising how often we see the same factors at play in managers we like – the reasons why the best fund managers outperform.

Here are the key things that we believe, time and time again, separate the brilliant Australian fund managers from the rest. They don’t guarantee success. But we find that often, managers that are very successful have most, if not all these traits.

A good track record

This is an obvious one. But it’s surprising how often we see money allocated to funds and managers who have a poor track record. Who’ve simply never beaten a fair benchmark by a meaningful amount, over a meaningful period. For us, this must be present before we even start. We would never look at investing with a team who hasn’t delivered the goods in the past. Quite often that track record has been at least partly achieved at one or more different investment firms. So long as the team is the same, and the investment process similar, we can take that historical performance into account.

Co-investment

It goes without saying that we expect all key investment staff to have a meaningful amount of their investment capital in the Funds they manage. The quantum is less relevant than whether it is significant for them. Just as importantly, we prefer to see all key investment staff owning a meaningful stake in the investment management firm as well. Provided the fee structure is fair, there is no better alignment than having investment staff own stakes in the manager and the fund.

Flexibility

Large investment organisations have a habit of throttling investment performance by limiting how their fund managers can invest. They do this as a crude way of managing risk. More than anything else, it is this constraint that stops great investors achieving better results in large investment firms. We prefer our managers to have the flexibility to do what they think is right, within their circle of competence. Great investors will always manage risk appropriately. But they rarely do it by stifling the best opportunities.

An investment edge

One of the best ways to give yourself a shot at long-term greatness is to make sure your investment universe is a place where you’re confident you can do better than 90% of other investors. Almost every great manager has an edge. A part of their process where they can be certain they have an advantage over most other investors. It could be that they specialise in a certain sector, industry or type of company. It could be the use of data. Or a systemic process to take advantage of market inefficiency. Or investing in smaller and less liquid companies, where its easier to find undiscovered treasures. Whatever the edge is, it provides an enduring advantage that gives the investment team a head start on the rest of the market.

Managing less money, not more

This may seem strange to many. But in our experience, it’s the single biggest factor that helps the best fund managers outperform. The optimum amount of funds under management for most types of investment strategy is just enough for the manager to cover costs and make a reasonable living. As the fund grows beyond this, it usually gets progressively harder to outperform. This is particularly the case where the manager targets smaller or less liquid investments, or in a very specific market or sector.

The ideal dollar amount can vary widely depending on the strategy. For a micro-cap fund, it could be less than $20 million. For a systemic fund investing in large liquid assets, it could be hundreds of millions, or billions. Whatever it is, the best managers recognise this limitation. They deal with it by capping the amount of capital they accept. It’s one of the reasons why we’re reasonably tolerant of higher fees from managers in the right circumstances. If a higher fee means the manager can limit their funds to a lower amount, this can ultimately give investors a much better result.

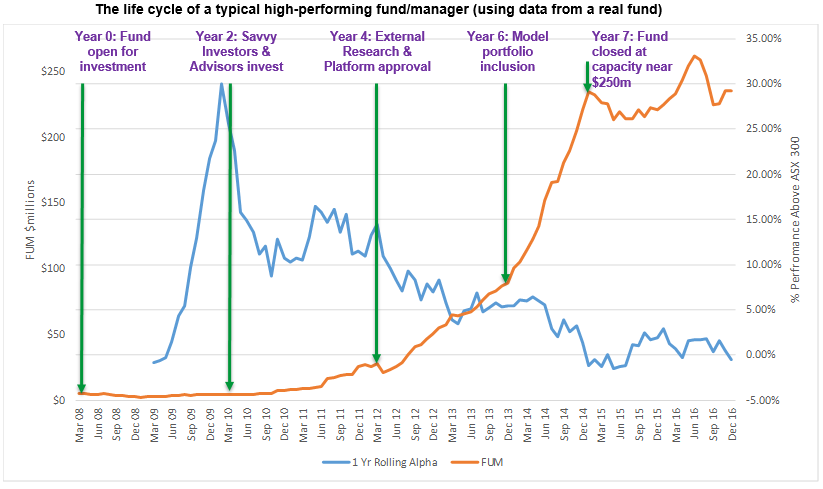

Here’s one example of how increasing funds can reduce excess performance. This is a fund where results have been unbelievably good. But clearly, the outperformance was much more pronounced when the fund was smaller (below $20 million).

The manager did all the right things. They closed their fund at a level which allowed them to continue to outperform a fair benchmark by around 2%-3% per annum. This places them in the top 5% of all managed funds. But it’s still much less than the 5% – 15% per annum excess performance delivered in the first few years when funds under management were much lower.

Summary

There are various studies that have confirmed the ability of boutique investment managers to outperform their larger peers over long periods of time. Most of that outperformance can be attributed to the factors outlined above. For sure, there are other things that matter as well. And managers without these traits can also perform well. But what we consistently see is that fund managers who have most, or all of these traits have a much better than average chance of long-term success.

We have a large and very successful crop of boutique Australian fund managers. And there’s more coming on board all the time. If you’re not investing with some of them, you’re likely to be missing out on some great opportunities.

What other factors do you think impact the ability of managers to outperform? Leave your comments below.

We hope that was helpful. If so, here’s some other things you might like.

See more of our articles.

Find all about us.

Subscribe to our free monthly Affluence newsletter.

Find out allAffluence Investment Fund.

Or become an Affluence Member and get access to exclusive investment ideas. Plus access profiles of some of Australia’s best fund managers and full details of our Affluence investment portfolios.

Invest Differently!