Why drawdowns matter

No one likes losing money. However, investors must accept that to try to achieve the higher returns available from equities, negative periods where investments fall in value (known as drawdowns) are inevitable.

Over the long term, superior investment performance can come from either outperforming in falling markets, outperforming in rising markets, or some combination of both. Your investment philosophy determines which is the most appropriate for you. Some investors really do have ice in their veins. They can handle temporary losses far in excess of market movements in return for superior long-term returns. However, most people find it extremely hard to be so emotionless.

There are many reasons why drawdowns can be bad for long term performance:

- Studies have shown that the emotional pain of losing money is much higher than the happiness from making money.

- Losing money often leads to poor investment decisions based on emotion rather than logic and reason. This is why many investors sell when assets have fallen and are cheaper, and buy assets after they have risen and are more expensive.

- For those near or in retirement, who typically sell investments in their portfolio regularly to supply them with an income stream, market falls can hurt. More investments must be sold to provide the same level of income. This is known as sequencing risk.

- After a negative investment period, it takes a bigger subsequent gain to get back to the same starting value.

- Over long periods, the impact of negative returns on investment performance is exaggerated due to compounding.

At Affluence, we try to reduce the impact of the inevitable negative investment periods without materially impacting returns. We have generally been successful in this endeavour, which has been a large part of the reason for our long term outperformance.

Negative Periods

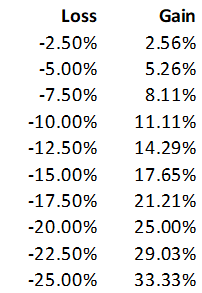

After a negative investment period, it takes a bigger subsequent gain to get back to the same starting value. The following table shows the subsequent gain that is required after different levels of drawdowns.

For smaller losses, the subsequent gain required is not materially different. For larger losses, the difference can be substantial. For example, after a 25% loss, a gain of 33% is required to recover those losses.

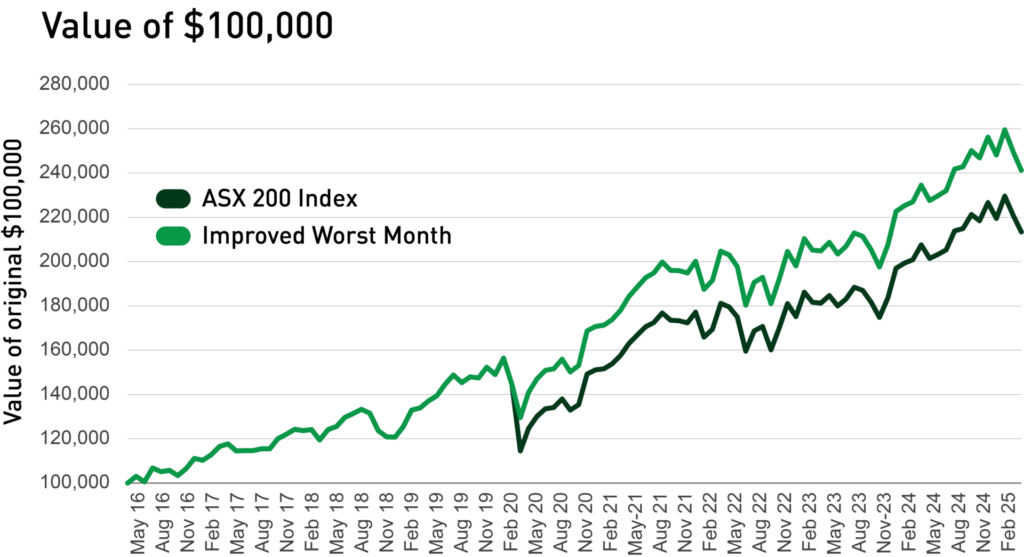

Over time, the impact on long term performance from negative performance periods is magnified. As a simple illustration, we have undertaken a hypothetical analysis. The following graph shows the impact on long term returns from reducing a drawdown. The return for the ASX200 Index in March 2020 was -20.7%. In our analysis, we have looked at the impact of halving this loss to -10.3%.

The scenario starts with a hypothetical investment of $100,000 in 2016. The difference in the value of the hypothetical investment at the end of March 2020 was $114,628 for the ASX200 Index (after a 20.7% fall) and $129,544 for the scenario assuming only half the fall. The difference at this time was a sizeable $14,916.

Assuming both investments perform exactly the same for the next 5 years, the difference gets substantially bigger. At the end of March 2025, the ASX200 Index investment would be $213,435, and the improved worst month investment would be $241,208, a difference of $27,773. Over only 5 years, a $14,916 difference has compounded to almost double.

Reducing Drawdowns in Action

It is easy to mathematically prove the benefits of reducing investment drawdowns. In real life, with the unpredictable nature of markets, this becomes more difficult.

We aim to outperform in the long term by doing better in falling markets. In doing so, we accept that we will probably underperform when markets go up very strongly. This strategy is best illustrated by the Affluence LIC Fund‘s performance, compared to its benchmark of the ASX200 Index.

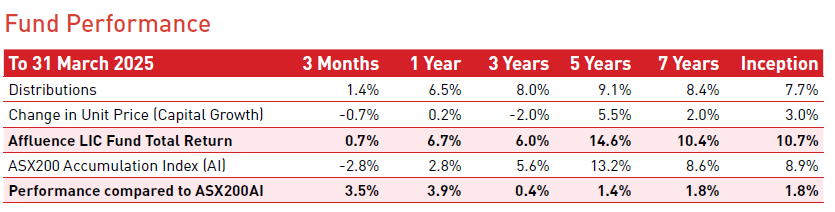

The Fund has outperformed the ASX200 Index over most periods:

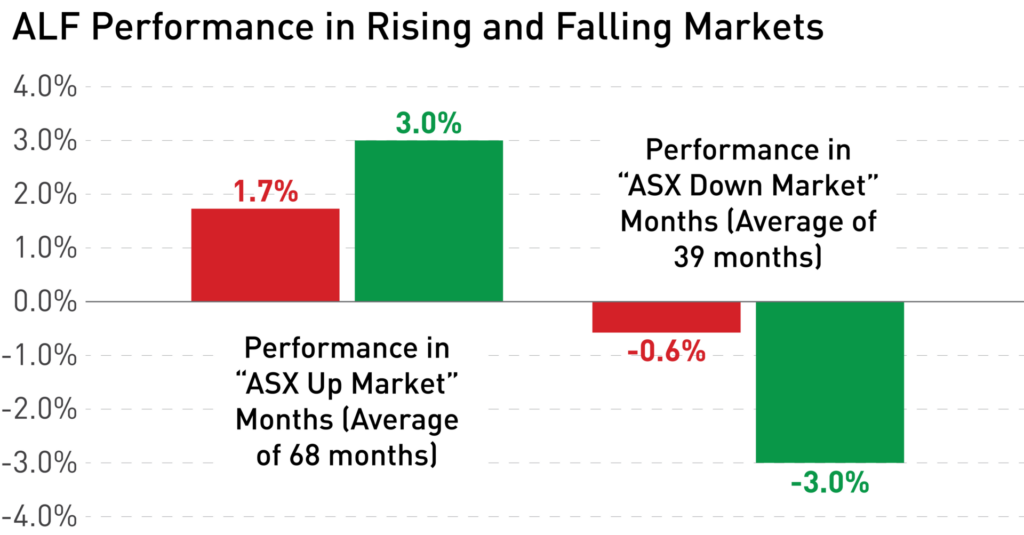

But how have we achieved the outperformance? The following graph compares what the Affluence LIC Fund does on average when the ASX200 Index goes up and when the ASX200 Index goes down.

The Affluence LIC Fund has a performance track record of 107 months:

- There have been 68 months when the ASX200 Index was positive. On average for these months, the ASX200 Index was up 3.0%. In comparison, the Affluence LIC Fund returned 1.7%.

- There have been 39 months when the ASX200 Index was negative. On average for these months, the ASX200 Index was down 3.0%. In comparison, the Affluence LIC Fund down only 0.6%.

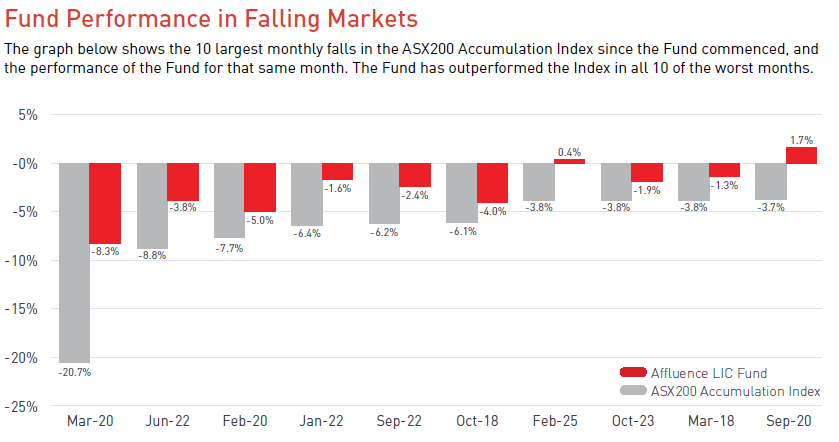

The Fund’s performance in the worst months for the ASX200 Index has generally been far superior:

While on average the Affluence LIC Fund does not increase as much when markets go up, it more than makes up for this by falling substantially less when the ASX200 Index falls. The Fund has captured just 57% of the upside, which seems poor. However, taking only 19% of the downside has translated into superior long term investment performance.

Just as importantly, it’s psychologically easier for investors in the Fund to buy and hold for the long term when the downside is less bad. Because the negative returns in times of trouble are lower, investors are much less likely to sell low or buy high.

More reading

Thank you to all of you who trust us with your hard earned investment capital. It is a responsibility that we never take for granted. We look forward to continuing our search for exciting investment opportunities in the coming years.

If you found that helpful, here are some other things you might like.

See more of our articles.

Visit the Affluence Members page to become an Affluence Member, see Fund portfolios and download our guides.

Find out about our Funds.