There’s an old saying that “it’s time in the market, not timing the market.” The theory is that you should not try to time your investments, just invest regularly and let dollar cost averaging take care of you. While that might work, there is significant value to be added by simply getting your market calls more right than wrong, which is why many investors try to do it.

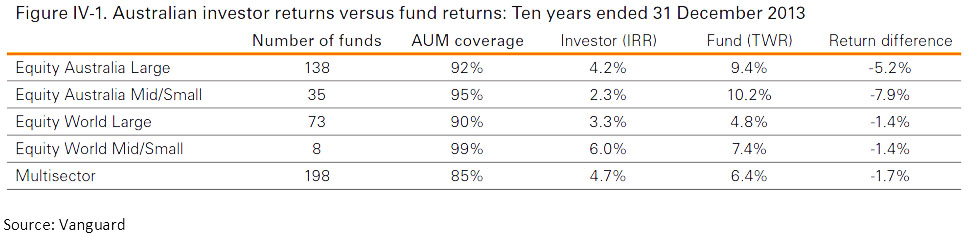

The problem is that most investors are incredibly poor at timing the market. Recent research by Vanguard highlights this. They studied hundreds of managed funds over a 10 year period in 2013 and concluded that while the average investment return of multisector funds 6.4% over this period, the actual return enjoyed by the average investor was significantly worse at just 4.7%.

How can this be? Well it results from our herd mentality, which means we are more likely to invest when markets have been going well and everyone else is also investing in that same market. That means more money flows into assets near the peak valuation periods, and of course the reverse is true when assets fall out of favour and values fall.

And it gets worse the riskier the asset class. For example, the average investor in a large-cap Australian equities fund received a return 5.2% worse than the funds themselves. Small-cap fund investors averaged 7.9% worse, an astounding difference.

I have seen this phenomenon at work first hand. For a number of years at Cromwell, in partnership with Phoenix Portfolios, we ran what was the best returning A-REIT fund in Australia. We delivered total returns of over 300% between 2009 and 2014. But guess what – despite telling all our investors to get on board in 2009, only a handful actually did. We raised less than $2 million for that Fund in 2009 and less than $10 million over its first 3 years of existence, when the majority of the gains were booked. Not only did A-REITs perform very well during this period, but this fund outperformed the A-REIT market by over 7% per annum on top. Believe it or not this level of outperformance for long periods is very rare in the investment management world.

But wouldn’t you know it – in 2013 as valuations increased further for listed property, more investors became interested. As at the end of 2014, the Fund reached maximum capacity and was closed with just over $200 million invested in it. The majority of those investors were late to the party and enjoyed only a fraction of the returns enjoyed by the early, bolder investors.

The moral of the story – it is possible to add value from timing the market, but it requires a contrarian mindset – going against the majority when it really matters. It also requires patience to wait until corrections have played out and signs are improving. That is, a combination of both fundamental and momentum factors must be in place. That is a key part of our investment philosophy at Affluence, but it’s damn hard to get it perfectly right all the time.

If you have trouble being different, or being patient – you should definitely concentrate on investing smaller amounts regularly. The long term odds are stacked against you.