We are by no means gold bugs. We don’t usually like investment opportunities that deliver no yield. And we don’t subscribe to some of the doomsday scenarios that many hardcore long-term gold supporters do – usually revolving around the end of the financial world as we know it and Armageddon for the currencies of many developed nations.

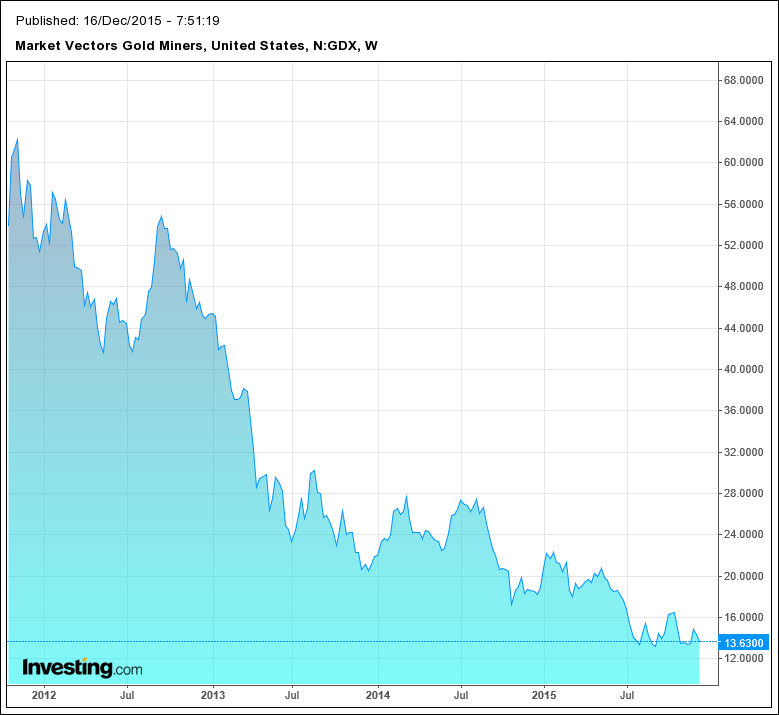

But gold miners are another story. Their share prices have been slammed even more than physical gold, to the point where early this year they were dirt cheap. Then an interesting thing happened. While gold prices languished between USD$1,000 and USD$1,200 an ounce, the prices of Gold miners started to rise. This led us to start paying attention and we have continued to watch the gold market with interest all year.

Finally, last month, we saw something which increased our interest level considerably. Sentiment towards gold, from both traders and investors, reached levels of pessimism not seen since the early 2000’s. Plus, people now laugh at me (or at least look at me funny) when I mention gold stocks. For us, these are triggers to think about buying.

The negatives have been well documented and constantly reinforced by markets. Gold is down around 45% in US dollars from a peak of almost $1,900/oz. to around $1,050/oz. last week. Many miners are making no money, or have no capital to expand. Lower interest rates may keep Gold prices low. And many more.

We now think the negatives are more than priced into gold miners. No-one expects any good news from the sector. But there are now a bunch of factors which could, in our view, lead to upside surprises in the future. Consider the following:

- Many mid and smaller tier miners are now trading at extremely low valuations. Just as earnings are probably close to cyclical lows, so are PE ratios, a double opportunity for upside.

- The cost of operating mines – particularly in Australia, is getting much lower. Factors such as reduced oil prices, reduced wage expectations, greater staff productivity and improved plant efficiency are all combining to drive down operating costs. With plenty of spare capacity and no work, expertise in this area is cheaper than it has been for years.

- There will be limited new development in the short term, and when it does occur it will take some time to come on-stream. Meanwhile demand is unlikely to fall much, if at all.

- The gold market is significantly influenced by traders and speculators, as opposed to long term buyers. Because sentiment by these parties is at record low levels, there is a much greater likelihood the market will soon commence mean reversion. Even a washout of all the short sellers could lead to a swift upwards price movement in both gold or gold miners, or both.

- The lower Aussie dollar has cushioned Australian producers against gold price falls – whereas producers in developed nations with stronger currencies are getting impacted to a much greater degree. This means Australian producers should have a cost advantage against many of the world’s marginal producers.

- Stronger players with minimal debt and a cost advantage are well placed to pick up struggling smaller players at big discounts to long-term valuations. This can add tremendous value over time.

- In recent times, gold stocks have outperformed gold itself. This is a good sign that some of the factors mentioned above are starting to be appreciated.

- The US is widely expected to raise rates in December. Commodity prices, including Gold, have tended to rise during the one-year period after the first rate rise.

Options for investing in Gold stocks are limited if you don’t want to wade through every stock and every research report. We prefer to find the best expert out there and invest with them. Given our preference to invest through active fund managers who have a proven ability to outperform, we have settled on the Baker Steel Gold Fund – an Australia Fund operated out of London. We believe an active manager is much more important in times like these, where there is a big disparity between the best and worst value opportunities, and the mid-small cap stocks may well outperform the bigger end of town.

A word of warning – while we are quite confident of our chances of exceptional returns over a 5-year timeframe – it is likely to be a rocky ride and there are no guarantees. We are unlikely to have picked the bottom of the market. That’s why we’ve initiated with just a 2.5% allocation in the Fund, which we can increase over time if we gain more confidence in the outlook for Gold stocks.

Want more of our insights and investment ideas? Go here to register for our monthly newsletter and gain access to our premium content for Affluence Members only. Take charge of your financial future.