Introduction

Welcome to our 2020 investor letter.

Another financial year is in the record books, and FY20 will certainly rank as one of the more exciting. Markets were on a tear for the first half of the year, resetting record highs. Then the world got a crash course in global pandemics. The Coronavirus caused one of the fastest market falls in history, followed by the fastest market recovery in history. For the 12 months to the end of June 2020, the ASX 200 Index returned -7.7%, and the MSCI All Country World Index in AUD (global shares) was up 4.1%. Both of these full year returns are pretty incredible, considering at the low point in March the ASX 200 was almost 40% below its February highs.

So after the previous six months rollercoaster, where to from here? There is a wider range of potential outcomes than usual. Many “experts” are making forecasts ranging from the crisis being over and more easy gains ahead, to those who believe the worst is still ahead and we will retest the March lows. We are not positioning Fund portfolios for either extreme scenario. Rather, we try to ensure that our Funds will perform adequately in all market conditions, and focus on achieving our target returns over a 3-5 year period.

Below, we take a look at each of our two main funds. We review performance, portfolio positioning and what we can expect in the current investment environment.

Affluence Investment Fund

A reminder of the Affluence Investment Fund’s objectives. The Fund aims to provide investors with:

- A minimum distribution yield of 5% per annum, paid monthly.

- A total annualised return (distributions plus increase in unit price) of at least inflation plus 5% over rolling 3 year periods.

- Access to a diversified portfolio of underlying investments.

- Volatility of returns which is less than half that of the ASX200 Index, measured over rolling 3 year periods.

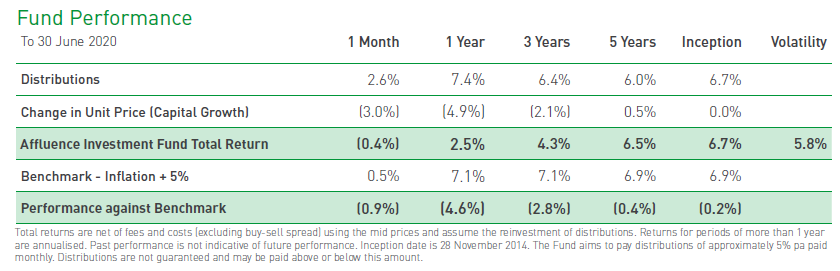

The Fund has certainly been successful in achieving its distribution objective (average distributions of 6.7% per annum since inception, paid monthly), its diversification objective (the Fund is very diversified by asset class, manager and strategy) and its volatility objective (Fund volatility of 5.8% per annum compared to the ASX200 Index of 14.8%). The Fund is currently behind on its return target and is lagging our benchmark over 3 years. We expand on the reasons for that below.

Portfolio Positioning

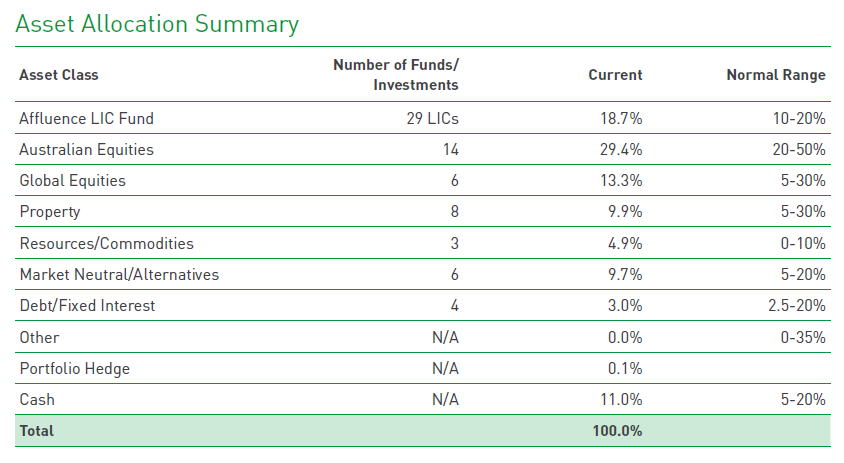

At 30 June 2020 our portfolio was diversified as follows:

The sum of the Affluence LIC Fund, Australian equities, global equities, property and resources exposure is 76%. This is a fairly neutral allocation for the Fund. However, within these allocations, we hold a collection of investments and managers that we believe can produce superior risk adjusted returns compared to the general market indices. We believe in staying reasonably invested in such assets through the cycle. But we do tilt the portfolio to those sectors which we believe offer superior value.

As we write this letter the ASX200 Index is around 6,000 points. Overall, we estimate that this is a little above fair value. But for the 200 individual companies within the index, there are some we consider to offer excellent value and others to be incredibly expensive. It is our job to invest with the managers who can find the individual stocks and sectors offering the best risk adjusted returns.

We are particularly excited about the future prospects of the Affluence LIC Fund (ALF). Considering the sustained headwinds the strategy has faced since 2019 as the LIC sector has traded at an increasing level of discounts to NTA, we are pleased that ALF has been able to deliver higher returns than the ASX 200 Index. The 21% average discount to NTA at 30 June 2020 is well above the 8-10% average during the first three years of the Fund’s history. If discounts revert to more average levels, this has the potential to provide substantial upside to the Affluence Investment Fund. Later in this note, we explain more about the opportunity embedded in the Affluence LIC Fund.

Portfolio Considerations

Given the current investment environment, our strategy for managing the Affluence Investment Fund portfolio is as follows:

- We are targeting average total returns of 6-8% per annum over the next 3-5 years.

- Short and long term interest rates are near zero (the RBA cash rate is 0.25%). Most asset classes that have traditionally been regarded as “low risk” such as cash, term deposits, government bonds and high grade corporate debt are likely to provide very low (or no) returns over this period.

- To achieve the 6-8% per annum return target, the portfolio will need to continue to have relatively high exposure to assets such as equities, property and commodities.

- Investment conditions are more uncertain than usual. The portfolio must be able to protect investors capital from long term impairment. We need to take some risk in order to achieve our target returns. But we are determined to do this in such a way that the portfolio will continue to outperform equity markets during major falls.

Some of our competitor funds, who have similar return targets, have positioned their portfolios extremely conservatively, both over the past three years and currently. Given the uncertain economic conditions, we have considered the merits of this strategy. No doubt the conservative portfolio would hold up better if the market were to have a further major meltdown from here. However, it is likely to substantially underperform in virtually all other scenarios, as these type of portfolios have for the past 3-5 years.

We believe a portfolio of cash, government bonds and high grade corporate debt is guaranteed not to achieve our return target, or indeed any reasonable return target, over the next few years. This is not acceptable to us. Therefore we will continue to hold reasonably high levels of assets with better return prospects, in order to achieve our target returns.

Performance Summary

We are pleased to have protected investors capital through a very volatile period in 2020. The Affluence Investment Fund has outperformed the ASX200 Index (essentially the average return from the 200 largest stocks) by 10.2% over the 2020 financial year. The Fund delivered a net return of 2.5% for the 12 months. That doesn’t sound great but compares well to the -7.7% return for the ASX 200 Index. One of our key internal targets is to ensure that to the extent we outperform markets, we do so when our investors value it most. To have outperformed by 10% in a year when markets fell significantly meets that brief.

The Fund has also outperformed the ASX200 over five years and since inception in 2014. Those returns have also been delivered with significantly lower volatility than the stock market. The results continue to be superior to most similar funds, as demonstrated by the 5-star Morningstar rating.

Despite that performance, we must admit to being a little disappointed with our longer-term returns. Since commencing in December 2014, the Fund has returned 6.7% per annum, compared to our target (inflation plus 5%) of 6.9% per annum. We are also behind our benchmark on a 3 year period.

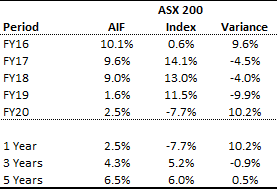

To provide some additional context around our historical returns, the table below shows the Affluence Investment Fund annual return for the last 5 financial years. We have shown compared those returns to Australian shares (the ASX 200 Index).

Focussing on the relative performance by year, the Fund has generally underperformed the ASX 200 Index when equity markets have been strong (FY17 and FY18) and has significantly outperformed when equity markets have been weak (FY16 and FY20). This is in line with our expectations.

Our longer-term returns are held back by a poor FY19 return. In the above table, it stands out as having both a low absolute return of 1.6% and a large underperformance to the ASX 200 of -9.9%. The poor returns in FY19 were largely due to the underperformance that year in the Australian equity portfolio (due to our value strategy bias) and the Affluence LIC Fund (the sector traded at increasing discounts to NTA). Over time, we expect these factors to reverse, and for the Fund to more than recover the slight underperformance to our benchmark. Below, we explain why.

Mean reversion

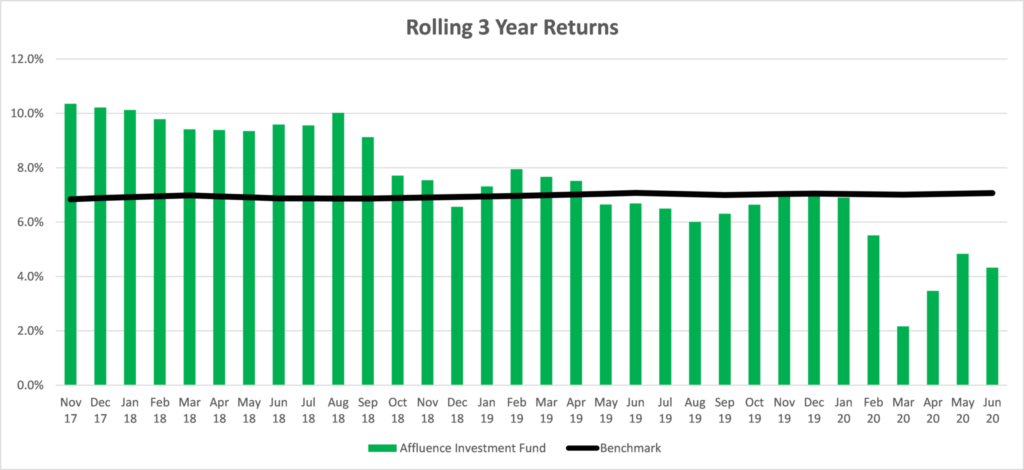

Our formal return target for the Affluence Investment Fund is for total annualised returns of at least inflation plus 5% per annum over rolling three year periods. The following graph compares the Fund’s rolling 3 year return versus that benchmark since inception.

Over the recent past, we have not consistently met the Funds’ benchmark. The simplest explanation for not doing better is that our core investment philosophy, owning more of that which is cheap and less of that which is expensive, has struggled to deliver results for some time.

Many credible studies show that this style of “value” investing has delivered better than average results over the long term. However, in the last five years, and in particular the last three, we have seen the most expensive assets get relentlessly more expensive. At the same time, the cheapest assets have struggled to go far at all. This has led to what is now probably the largest difference in investment styles ever, between high growth investments and more traditional cyclical, or value plays. The only time in history that comes close is the end of the dot com tech boom in 1999.

The reason for this divergence, we believe, is twofold. Firstly, many investors are now prepared to pay almost any price to access growth in a predominantly low growth world. This trend is being amplified by the continuing move to passive investment vehicles such as ETF’s and index funds. Secondly, historically low interest rates mean that most traditional investment classes and many alternative investment strategies are delivering unacceptably low returns. For many investors, there is a perception that growth stocks are the only asset class that can deliver acceptable outcomes. They believe that if you want a decent return, there is no alternative. We believe that paying exceptionally high prices for high growth stocks is becoming an increasingly risky endeavour.

Market divergence

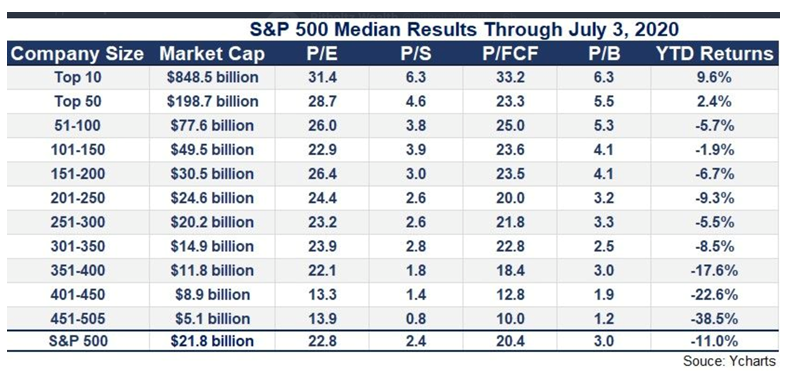

As an illustration of this phenomenon, the following table shows the year to date returns to early July 2020 for the S&P 500 (US Shares), split into market capitalisation bands. What it shows is that the market is being driven by mega-cap stocks, which encompasses largely the big technology companies. The difference in valuations (P/E ratio) and YTD Returns is truly amazing. It appears to us that the current rally/recovery in share markets is being driven by a very narrow group of stocks. This is not sustainable.

Here are two further examples of the current market imbalances.

Firstly, the ASX200 information technology sector is currently trading at a P/E ratio of 64, using next year’s earnings forecasts (which are undoubtedly substantially higher than last years). That seems reasonably expensive to us, to put it mildly. But this number includes Computershare, a good quality company trading on a not unrealistic P/E ratio of 17. If you exclude Computershare from the sector, the balance of companies are trading on a P/E multiple of 101. Dot com level madness.

Secondly, a cursory analysis of what is possibly the best company in the world, Amazon, shows that the current price equates to a P/E ratio of 144, based on the most recent 12 months earnings. So, you are paying USD $3,100 per share for a company that made around USD $21 of earnings last year. If you ignore the loss making global shopping business outside the US, the P/E falls to around 110. In the last year, Amazon grew sales by around 26%. That’s pretty good. But is it worth paying 100+ times today’s earnings for it? We think not.

Future prospects

The good news is that the Affluence Investment Fund, via the wide range of managers we invest with, has very little exposure to the most expensive stocks in the world. Instead, we have quite a lot of exposure to very reasonably, even cheaply priced companies that can still grow earnings. We’re expecting that over the next few years, many of these companies will be recognised as being worth substantially more than today’s prices.

Markets will return to a more balanced valuation scenario in time. While we’re waiting, we plan to continue doing what has worked for 100+ years. To allocate more to those investments which are cheap, and less (or none) to those that are exceedingly expensive.

We believe that the Affluence Investment Fund portfolio represents vastly superior value to the overall market. This means it is positioned well to achieve good returns over a 3-5 year investment period.

Affluence LIC Fund

Performance

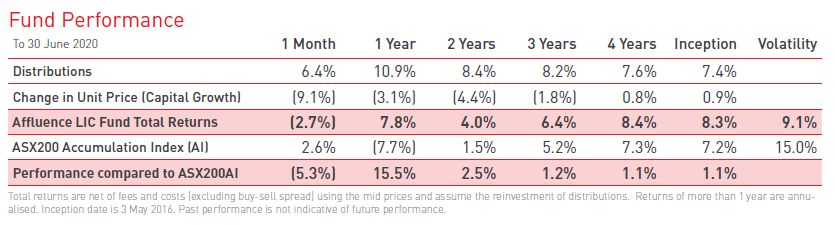

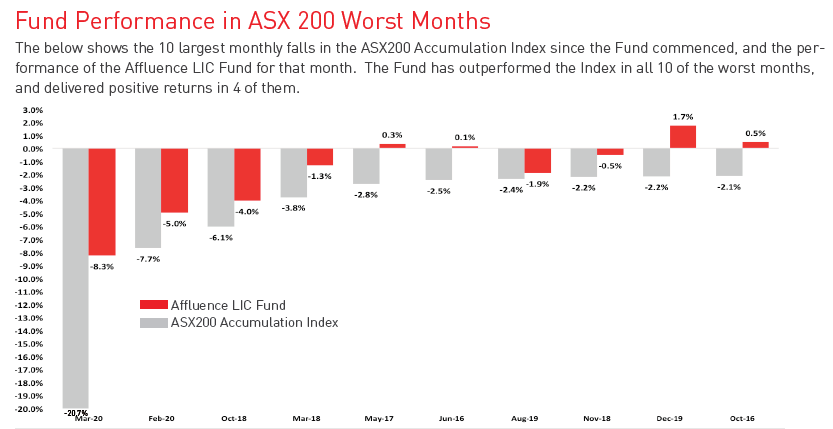

The Affluence LIC Fund outperformed the ASX200 Index by an impressive 15.5% in the 2020 financial year. The Fund returned 7.8% while the ASX200 delivered -7.7%. Returns since inception for the Fund have averaged 8.3% per annum, including quarterly distributions of 7.4% per annum. The Fund has now outperformed the ASX200 Index over 1, 2, 3, 4 years and since inception, with much lower volatility.

The Fund had been lagging the ASX 200 Index until March 2020, due to the sustained headwinds the strategy has faced since 2019 as the LIC sector has traded at an increasing level of discounts to NTA. However, the Fund substantially outperformed in February and March. Over these two months, the ASX 200 Index fell 26.7%. The Affluence LIC Fund fell 12.8%. We were very pleased that we outperformed when investors valued it most, in the face of the extreme market falls.

The LIC opportunity

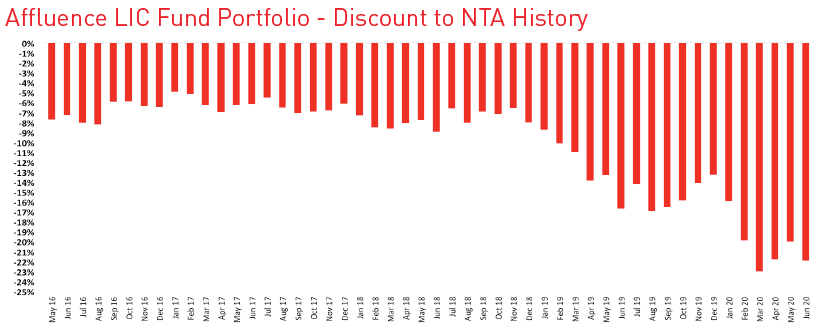

The other story for FY20 was the continued increase in discounts to NTA across the LIC sector. As you can see below, discounts started increasing in January 2019. At the time it appeared the Labor party were a sure thing to win the upcoming May 2019 election. They had promised to stop the refund of franking credits to many investors. The majority of LICs are companies that pay franked dividends, therefore this was a genuine concern for the LIC sector. However, even after the election discounts kept increasing.

The average discount to NTA for the Affluence LIC Fund portfolio from May 2016 to December 2018 was 6.9%. This average is not like for like, as the Fund does not hold a constant portfolio, and different LICs trade within different discount bands. But it is still very illustrative of the dynamics that have been occurring within the sector. At 30 June 2020, the average discount for the portfolio was -21.9%. When discounts revert to more average levels, this has the potential to provide substantial upside to Affluence LIC Fund investors.

LIC activism

No one knows how long it will take for the discounts to NTA to normalise. But this certainly isn’t the first time that discounts have reached this level. On previous occasions, they have always reverted to the mean. There is increased investor interest and activism in the sector. Individual LICs are being targeted through friendly and not so friendly approaches to address the discounts. Over the past couple of years, the following corporate events have occurred:

- Watermark Market Neutral Fund (ASX: WMK) and Watermark Global Leaders Fund (ASX: WGF). After trading at a sustained discount, the manager decided to convert these LICs to unlisted trusts. This allowed investors to exit at NTA. They are under significant pressure to do the same with their one remaining LIC.

- 8IP Emerging Companies (ASX: 8EC). After a period of poor performance trading at a substantial discount, an activist investor forced the manager to implement a sale and wind-up of the LIC. This is now mostly complete.

- Century Australia (ASX: CYA). Was managed by Perennial Value Management and had underperformed and traded at a sustained discount. Wilson Asset Management (WAM) built a significant position and took over management. Later, CYA was merged with the larger WAM Leaders Fund (ASX: WLE).

- Mercantile Investments Limited (ASX: MVT). This LIC was merged with Sandon Capital Limited (SNC), with which it shares some investment staff. The result was a larger and more liquid LIC. This has not helped to narrow the NTA discount.

- URB Investments Limited (ASX: URB). This LIC owned equities and unlisted property. After trading at a sustained discount, 360 Capital built a substantial stake. They subsequently took over and merged the LIC with one of their own listed funds.

Currently, the following corporate events are being undertaken:

- Blue Sky Alternatives Access Fund (ASX: BAF). Has traded at a very large discount since the manager Blue Sky ran into trouble. Activist investors took a substantial stake, and it is expected that Wilson Asset Management will take over the management rights very shortly. This is expected to close the current 30%+ discount to NTA substantially over time.

- Monash Absolute Investment (ASX: MA1). After trading at a sustained discount to NTA, several activist investors took substantial stakes in the LIC. The manager, to their credit, is undertaking a process to convert the LIC into an exchange traded managed fund. This will allow investors who wish to do so, to exit at NTA.

- Ellerston Global Investments (ASX: EGI). After trading at a sustained discount to NTA, the manager is in the process of merging the LIC with one of their unlisted funds. This will allow investors to exit at NTA. With two more LICs also managed by Ellerston, more change is likely.

- Contrarian Value Fund (ASX: CVF). CVF has consistently traded at a sustained discount to NTA. The Board recently announced that in the future they intend to offer the shareholders the option to wind up the LIC.

- Contango Income Generator (ASX: CIE). After a period of poor performance and trading at a sustained discount to NTA, Lanyon Asset Management has built a substantial stake in the LIC and has outlined their plans to take over the management and change the investment strategy.

We are also aware of other LICs where investors are putting substantial pressure on the manager and board to resolve the discounts to NTA. The current level of discounts for the sector is not sustainable. One way or another, activist investors will eliminate discounts. There have been recent changes to the LIC sector which make future LIC IPOs much less likely. This will mean more investor focus on the existing list of LICs.

Future prospects

We are very excited about the prospects for the Affluence LIC Fund. The discounts on offer provide the opportunity to add substantial alpha to the Fund. In addition, in the current market, we expect to see much better investment performance from the underlying managers of LICs. Finally, as markets move up and down, we have the ability to change the market exposure of the Fund. We can do so by changing the mix of LICs the Fund owns, holding cash and using put options.

Targeted average total returns are 8-12% per annum over the next 3-5 years. We believe that is achievable.

If you found that helpful, here are some other things you might like.

See more of our articles.

Visit the Affluence Members page to see more Fund Manager and LIC profiles.

Find out about our Funds.

Disclaimer

This content was prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence 475940 (Affluence) to enable investors in Affluence funds to understand an underlying investment in one or more Affluence funds in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any financial product advice or service.

The content was prepared without considering your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Disclosure documents for Affluence funds are available here. Affluence recommends you consult your professional adviser to determine whether a particular financial product meets your objectives, financial situation or needs before making any decision to invest.