Key details

Fund: VGI Partners Global Investments (ASX: VG1) and VGI Partners Asian Investments (ASX: VG8)

Fund Type: Listed Investment Company (LIC)

Invests In: Global Equities

Investment Focus: Long short absolute return strategy for global equities.

Risk profile: Medium to high. The underlying portfolios include a range of global (VG1) and Asian (VG8) stocks, including some short positions. At July 2020, VG1 and VG8 are trading at attractive discounts to NTA, but this can change quickly.

Profile date: July 2020

Affluence Fund Weighting: At July 2020, VG1 and VG8 combined were 8.1% of the Affluence LIC Fund portfolio, making them one of the largest holdings.

Who are VGI Partners?

VGI Partners is a global equities manager, founded in 2008. They currently manage approximately $3 billion of FUM across global and Asian market equities. They have investment staff in Sydney (headquarters), New York and Tokyo. Originally their investment vehicles were unlisted managed funds and private mandates only available to wholesale investors. In 2017 they launched the VGI Partners Global Investments LIC (VG1). In 2019 they launched the VGI Partners Asian Investments LIC (VG8). The unlisted funds and private mandates are now closed. Therefore, the only way for investors to access the strategy is through the two LICs.

The LICs were launched with an extremely investor-friendly structure. The manager (VGI Partners) paid all the upfront listing costs, meaning the initial IPO price equalled the initial NTA. Key staff members are some of the largest shareholders, and they have continued to purchase shares on market post listing. We believe the manager is very well aligned with shareholders.

Robert Luciano leads the 12 person investment team. The Head of Research and co-founder, Douglas Tynan recently stepped down from the manager citing personal reasons. VGI Partners have an outstanding long term investment record, which we would largely attribute to both Robert and Douglas. We are often cautious when an investment team is split up. The decisions made by one member may be different to what was made by both. However, for VGI, given the experience and depth of the team, we are willing to give them the benefit of the doubt.

The VGI Partners investment process

VGI Partners long term objective is to deliver absolute returns of 10-15% per annum through the cycle, and that superior investing must be viewed in terms of risk adjusted returns. Their investment philosophy is based on the following key concepts:

Capital preservation

VGI believe that risk comes from not properly understanding your investments. They place a great deal of importance on assessing downside risk. They attempt to know as much as possible about each investment as they can, as they believe this knowledge guards against permanent capital loss.

Superior long term compound growth

VGI seek to buy and hold what they believe to be some of the best businesses in the world. If the business performs well then the security price should eventually follow. They aim to purchase these businesses with a sufficient margin of safety (below their assessed intrinsic value) to provide attractive long term returns.

Concentration

VGI Partners believe that diversification preserves wealth, while concentration builds wealth. They aim to invest in a relatively small number of high quality businesses and to be concentrated enough in their best ideas not to dilute overall returns but still hold enough long investments to provide an appropriate level of diversification.

Short selling

VGI selectively short what they consider to be weak and overpriced securities for both hedging and alpha opportunities.

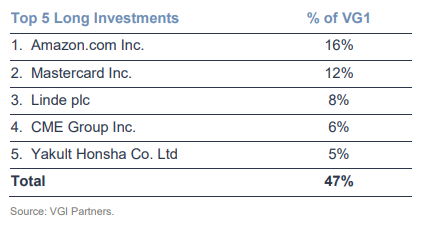

Portfolio example

The long side of the portfolio can be very concentrated, as demonstrated by their top holdings for VG1 from their most recent update:

Performance

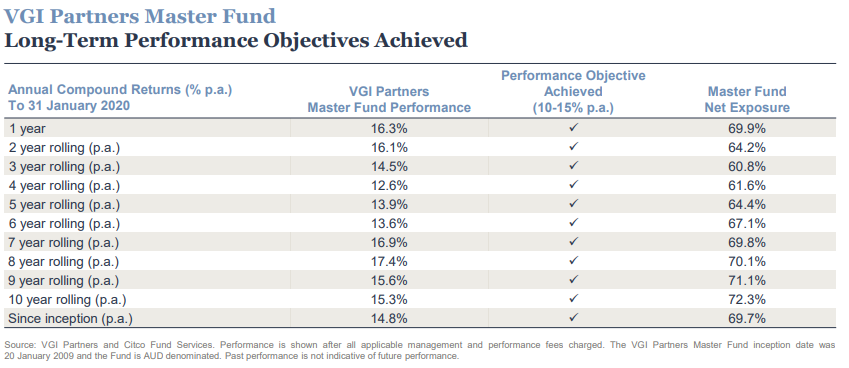

Both VG1 and VG8 have a relatively short track record, so we concentrate on their unlisted funds’ track record as an indication of their performance. They do not publish regular performance updates for their unlisted funds. The most recent published data to the end of January 2020 is as follows:

It is an outstanding track record. It has been achieved with an average net market exposure of 60-70%.

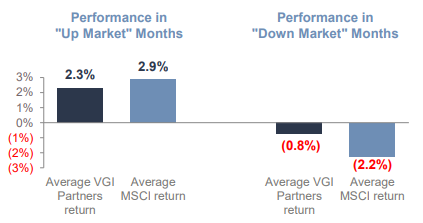

The following graph shows how the strategy has traditionally behaved in up and down markets:

The key to their outperformance is that they capture most of the upside when markets go up, but much less of the downside when they fall.

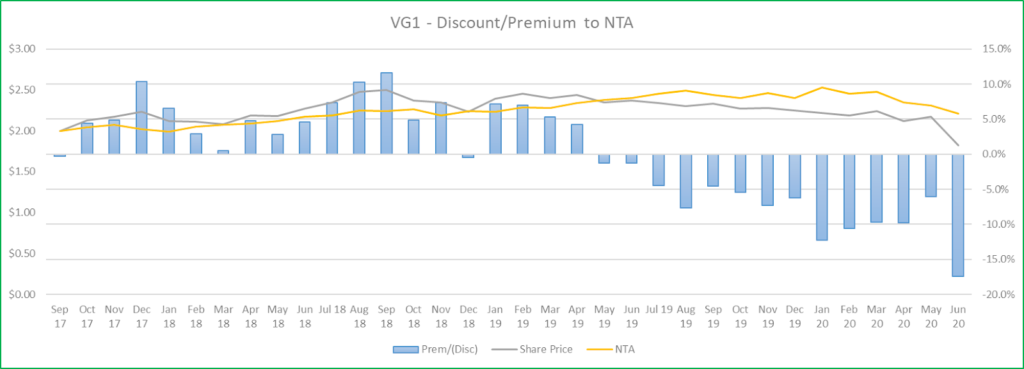

All truly active managers have periods when performance is poor. VGI has underperformed in FY2020, with VG1 returning -4.3% and VG8 returning -0.2% (since inception in November 2019). These numbers are far from a disaster. However, the combination of soft performance and the exit of a key investment staff member has seen the discount to NTA for both LICs increase to over 20%.

The following graphs show the discount to NTA since inception for both LICs:

The opportunity

So now we have one of our favourite opportunities. One of the best investment managers in Australia, with one of the best long term track records, has gone through a short period of underperformance which has led to the shares trading at a considerable discount to NTA. The market likely also has some concerns over the departure of a key investment staff member. However, we believe the reaction is still far too severe.

Over a reasonable period, we would expect the manager to produce alpha over the market, and for the discount to NTA for both LICs to become substantially smaller, if not trade at par. The manager has proven through previous market drawdowns that they often outperform when trouble arises. Given where markets are currently, and the more uncertain than usual investment environment, we believe that VG1 and VG8 give us the best of both worlds. If markets fall again, there is a good chance the manager will outperform on an NTA basis and the discount is unlikely to get too much more significant. If markets rally hard then while the NTA may not capture all the upside, a discount to NTA of above 20% is not sustainable, and there will be increasing pressure to take action to close it.

Potential risks

Here are our top three risks for the VGI Partners LICs.

Investment Staff

As previously mentioned, the Head of Research Doug Tynan recently stepped down from the manager. He had been a core member of the investment staff since VGI commenced. While we believe the 12 person team will be capable under the sole leadership of Robert Luciano, there is a risk that they cannot perform as well.

Persistent discounts

If any LIC trades at a substantial discount for an extended period, it may well come onto the radar of activist investors. They may agitate for either a wind-up or some other type of corporate action to close the discount. VGI Partners themselves have a substantial shareholding. It would likely be tough for a third party to agitate for any effective change. We see this as a low risk, as we believe VGI has the skill and resources to ensure that the discount reduces over time.

VG8 strategy

The long term track record of the master fund is for the global equities strategy. VG8 focuses on Asian equities. While the master fund has had extensive Asian exposure since inception, VGI has never run an Asian exclusive strategy. There is a risk that the Asian strategy cannot repeat the performance of their global strategy, and is seen as the poor cousin of VG1.

Conclusion

VGI Partners have an enviable long term track record. Until their LICs launched, the manager was only available to wholesale investors. Given that both vehicles are currently trading at a record high NTA discount, we believe they are a very compelling investment.

We hope that was helpful. If so, here are some other things you might like.

Learn more about this manager.

See more of our articles.

Visit the Affluence Members page to see more Fund Manager and LIC profiles.

Find out about our Affluence LIC Fund.

View the Affluence LIC Fund Portfolio.

Disclaimer

This content was prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence 475940 (Affluence) to enable investors in Affluence funds to understand an underlying investment in one or more Affluence funds in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any financial product advice or service.

The content was prepared without considering your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Disclosure documents for Affluence funds are available here. Affluence recommends you consult your professional adviser to determine whether a particular financial product meets your objectives, financial situation or needs before making any decision to invest.