Interest rates & inflation

Legendary debt investor Howard Marks periodically releases memos on how he sees the investing world. In December, he wrote that he is seeing just the third “sea change” in financial markets in his 53 years. For the past 40 years, returns from all asset classes have had the massive tailwind of falling interest rates. At the end of 2021, global interest rates were near 0%, and many investors were expecting this “new normal” to last forever.

Marks uses the imagery of a travellator at an airport. Simply standing on the travellator provides a rest for weary travellers. But if, rather than stand still on it, you walk at your normal pace, you move ahead much more rapidly. Your rate of travel is the sum of the speed at which you’re walking plus the speed at which the walkway is moving. The bonus speed of the travellator is equivalent to the benefit of falling interest rates.

Like Marks, we believe that the next 40 years will not be subject to the same interest rate tailwinds as the last 40. 2022 was the year we saw inflation explode all over the world, and with it the era of zero interest rates and central bank money printing came to an end. During 2022 the RBA increased rates from 0.1% to 3.1%, the US Fed from 0.25% to 4.5%, and the Bank of England from 0.1% to 3.5%. These are staggering increases over such short periods of time.

Around the globe many countries, including Australia, have near or record low unemployment. Central banks are increasing interest rates to reduce demand in the economy, thereby increasing unemployment and reducing wage growth. In this way, they aim to bring inflation back to 2-3% over time. How long this process will take, and how effective it will be, will largely determine what happens in investment markets in 2023.

Investment performance

It’s worth remembering that for all our strategies, our focus is always on three things:

- Delivering better than average returns over three years and longer.

- Limiting the impact of market corrections and thus avoiding significant long term capital losses.

- Providing a decent level of regular income, with the option to reinvest and compound returns.

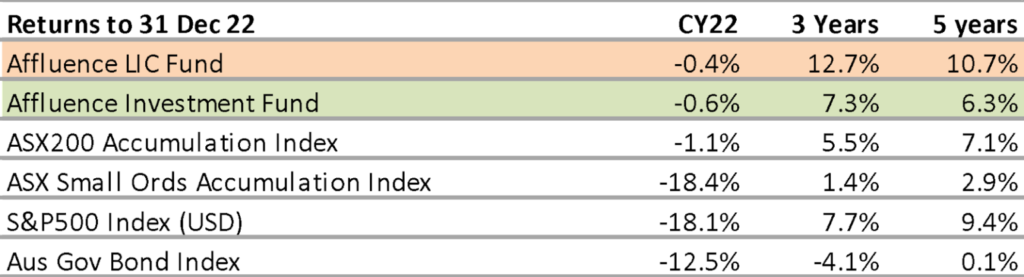

The below table summarises the performance of the major indices and our two Affluence funds.

The ASX200 Index was an outlier in 2022 as it massively outperformed its global peers. This was largely down to the large concentration in energy, utilities and materials stocks, which increased substantially. It also helped that the ASX Index had much more reasonable starting valuations compared to US markets.

The other significant factor in 2022 returns, was that bonds fell as much or more than equity markets. Typically, investors hold bonds in their portfolio to reduce the overall loss when equity markets fall. During 2022, as interest rates increased, bond prices fell, leaving investors with few places to hide.

The Affluence LIC Fund returned -0.4% for 2022 and the Affluence Investment Fund returned -0.6%, ensuring none of our investors suffered material losses. Measuring performance in the midst of a market downturn is never pleasant. Our returns for both funds relative to the major benchmarks are reasonable, and vastly superior to our peer group averages. But it gives us no great pleasure to deliver flat returns, no matter how bad markets have been.

Our 3 year and 5 year performance numbers also compare very well to the Indices. Just as importantly, we are much more excited about the value embedded in our fund portfolios, relative to the markets in general. This provides us with an excellent starting point for the next 2-3 years. If we can substantially outperform asset markets when they suffer their biggest drawdowns, that gives us a great chance of producing better than average returns over the long run.

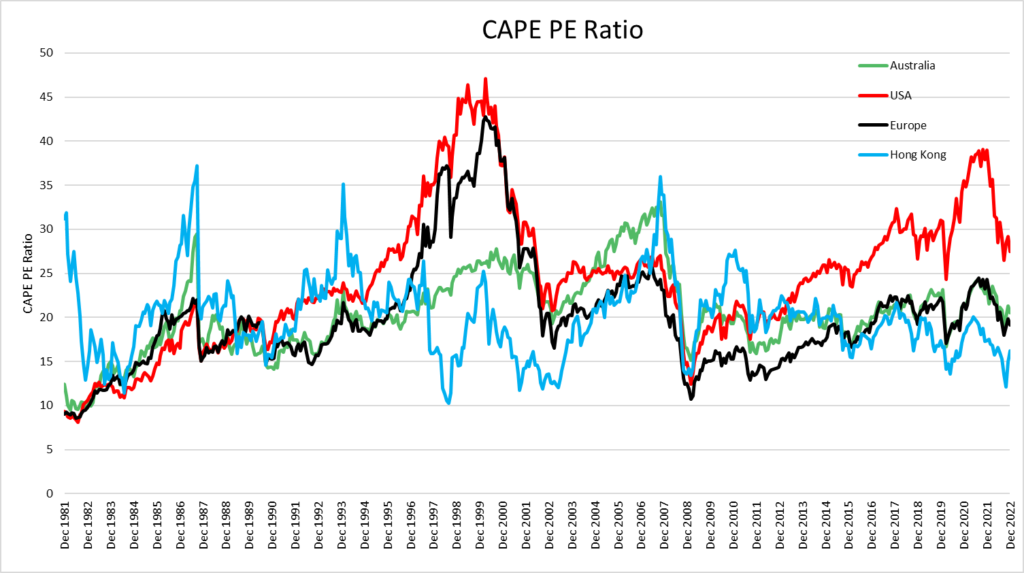

CAPEs & profit margins

US markets started 2022 at extremes. On some metrics, US equity valuations were near or at all time highs. One reasonable guide to market valuations that we pay attention to is the Cape Shiller 10 year PE ratio. This differs from a standard PE ratio, in that it uses the average of the previous 10 years earnings adjusted for inflation. This is intended to normalise for abnormally high or low earnings through market cycles. We believe this is particularly relevant at the moment. US profit margins are near all time highs, and likely not sustainable.

The graph below shows the CAPE PE ratio since 1981 for Australia, the US, Europe and Hong Kong.

The US CAPE PE Ratio has reduced back through the frothiest part of the recent bubble. However it remains well above long term averages. US equity markets continue to assume earnings growth in 2023 and 2024. Economic conditions are about as good as they can get, and the US Fed is actively trying to reduce demand. We believe the risks to earnings are skewed to the downside. Other global markets, including Australia, are subject to the same risks. But they have the benefit of starting from a much less demanding valuation. A few markets, notably Hong Kong, are cheaper than average.

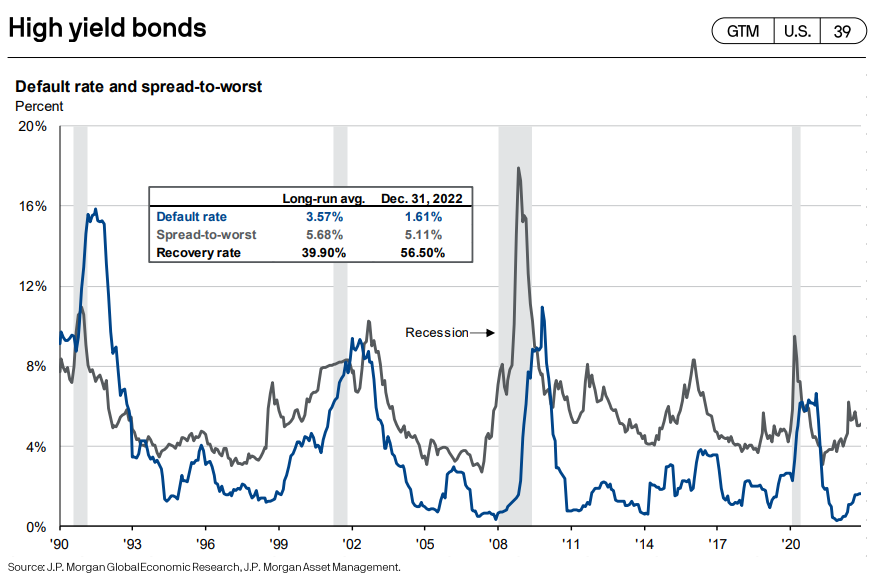

Bond repricing

Credit spreads have also adjusted over 2022 as risk has been repriced. The following graph shows default rates and interest rate spreads for US High Yield Bonds.

Spreads have increased back to around long term averages. While they are not particularly cheap and do not reflect a worsening economic environment, they do provide a much better starting valuation than 2021.

The big benefit from the current investment environment compared to the recent past is that investors can now generate a return from cash. We are currently receiving 3% per annum on fund cash holdings. At the start of 2022, the equivalent rate was very close to zero.

Current Market Valuations

At a high level, we would summarise financial conditions as follows.

- Australian equities are a little expensive, and do not reflect the potential earnings downside that could flow from recent and continuing RBA interest rate increases.

- There are pockets within the Australian market that we believe are very attractive, including some small cap equities, resource sectors and REITs. Not all stocks in these sectors are attractively priced, but there are enough to get us mildly excited.

- US equities are still well above fair value. We also expect the US economy to be more harshly impacted than Australia, which will impact US market returns.

- Most other global markets are somewhere between somewhat attractive and fair value. A few look cheap, though certainly not without risk. Examples include the UK, Hong Kong and some Asian emerging markets.

- Residential property prices in Australia are falling. The extent of falls will be dependent on future interest rate rises, and how long rates stay elevated, which in turn is dependent on how quickly inflation gets under control.

- Transaction volumes for commercial property (office buildings, shopping centres and industrial sheds) have reduced dramatically. This is often the first stage before prices fall. Sellers don’t want to be the first to sell at lower prices and buyers get cold feet and decide to wait a bit longer before jumping in.

- Bank term deposit rates have increased dramatically. It is now possible to achieve five year term deposit rates above 4% per annum.

We have no special insight into what happens from here. However, we are taking a cautious approach. Our concern is that rising home loan rates, coupled with the increased cost of living has not yet hit consumer spending. To date, fixed home loan rates for many borrowers and COVID savings have acted as buffers against higher costs. Those buffers are eroding fast.

Portfolio Positioning

Given our cautious outlook we have positioned the portfolios quite conservatively heading in 2023:

- Higher than average cash levels.

- Some hedging to soften any market falls.

- Very limited US equity exposure.

- A strong value style bias with limited growth style investments.

If further downside occurs, we believe we are reasonably positioned to ride out the turmoil. In this scenario our funds may still fall, however we would hope to perform substantially better than equity markets.

If markets have already bottomed, we would expect to be well positioned to deliver decent returns over the next 3-5 years.

Return targets for Affluence funds

We are often asked by new investors which of our funds they should invest in. We’re not allowed to give personal investment advice, so it’s a question we can’t answer directly. Instead, we prefer to highlight the return target and expected risk profile for each of our funds. It’s then up to you to decide (along with your advisor if you have one) where you allocate your investment capital. This is likely to be heavily influenced by your return expectations and your risk tolerance.

The Affluence Investment Fund targets a return of inflation plus 5% from a very diversified mix of investments. In addition, this Fund aims to pay monthly distributions and perform much better than stock markets, particularly the ASX200 Index, when markets fall. In both risk and returns, this Fund sits somewhere well above cash and bonds but below equity markets.

The Affluence LIC Fund targets equity-like returns. We aim to beat the ASX200 Index returns with less volatility. You should assess the LIC Fund as having a similar risk/reward profile to an equity fund.

The Affluence Small Company Fund targets the potentially higher returns available from smaller companies. It has the highest potential returns, and the highest risk of all our funds. Currently, this fund is only available to wholesale and sophisticated investors, though we hope to be able to change that in time. If you’d like to learn more about this fund, or to register your interest should it be available to all investors in the future, let us know.

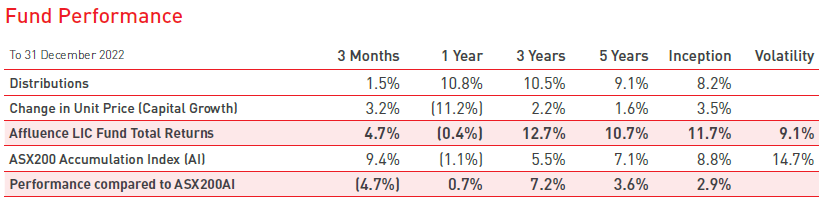

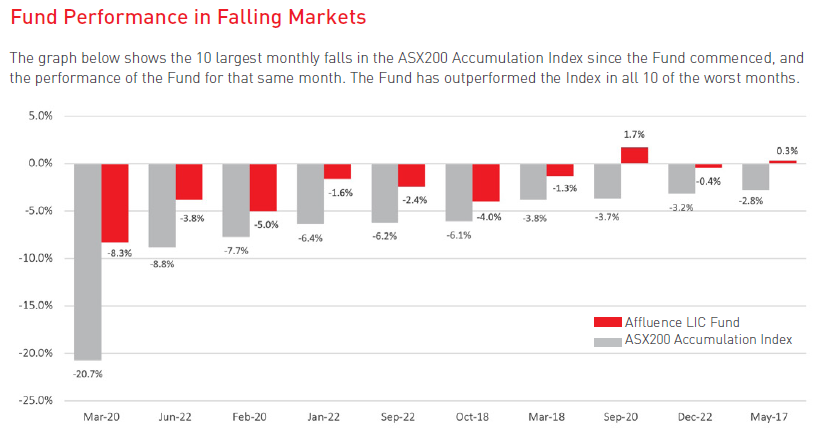

Affluence LIC Fund Performance

The Affluence LIC Fund has continued to outperform its benchmark (ASX200 Index) over most time periods, with significantly lower volatility.

During the past twelve months there were three months that were some of the biggest falls for the benchmark since the Fund began. Pleasingly, we managed to limit the falls during these months.

Our conservative positioning paid off in 2022, with our higher than average cash levels and index hedges cushioning the market falls. Our index hedges alone added almost 4% to the overall result. We also made some additional profits from our discount capture strategy on shorter term opportunities. The largest detractors came from some of our Australian small cap LICs and global LICs, which suffered from both falling NTAs and an expansion in their discounts.

The overall discount to NTA for the portfolio increased from 13.4% at 31 December 2021 to 17.3% at 31 December 2022. In this respect, its pleasing that we have been able to increase the overall discount to NTA of the portfolio while the overall result was flat.

Affluence LIC Fund Positioning

We enter 2023 with approximately 25% in cash and some index hedges to help protect against any further market falls.

The portfolio has changed quite significantly since 31 December 2021:

- Debt LITs and convertible notes – The portfolio has an 18% allocation to this sector, which is a substantial increase over the past 12 months.

- Australian LICs – Approximately 26% of the portfolio is in Australian equity LICs. The average discount to NTA is over 20%.

- Global LICs – Approximately 28% of the portfolio is in global LICs. It includes quite an eclectic mix of strategies, and the average discount to NTA is just under 20%.

We continue to see corporate activity in the sector, both voluntary and forced by activist investors. Those LICs that have continued to trade at discounts to NTA for extended periods are most under pressure. We expect to continue to profit from these events.

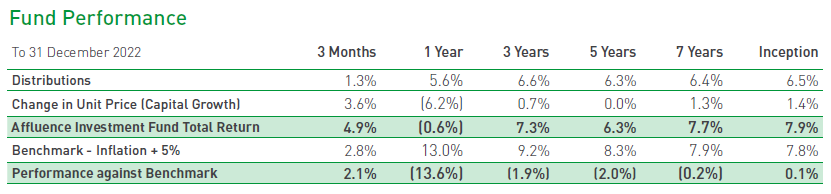

Affluence Investment Fund Performance

The Affluence Investment Fund has achieved similar returns to the ASX200 over time, with much lower volatility. Nonetheless, the Fund did underperform its return target (inflation plus 5% per annum) in 2022 and is also behind over 3 and 5 years. As inflation has continued to increase, our return target has continued to increase with it!

Our long term return of 7.9% remains adequate, however it has obviously been largely affected by the last 12 months market ructions.

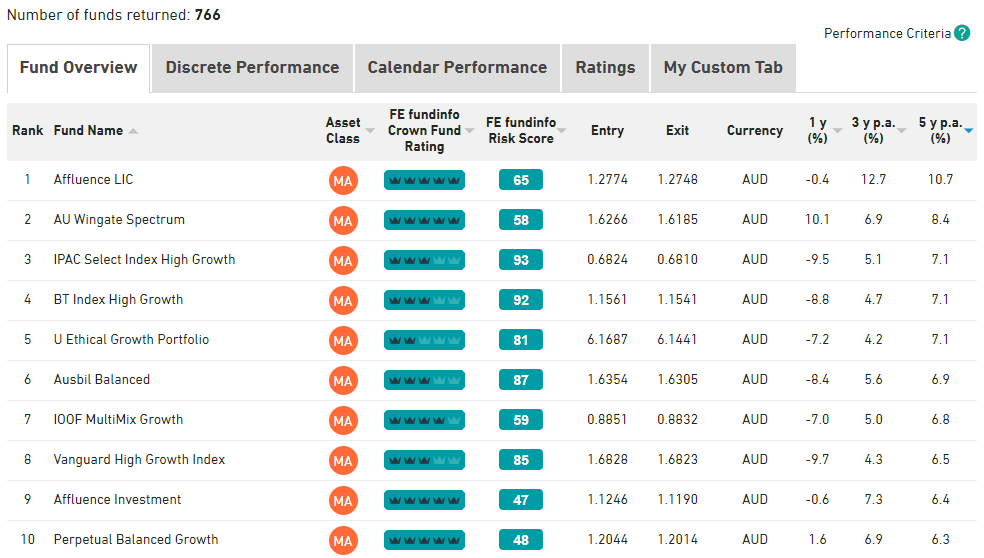

To give you an idea of how tough the market has been out there, here’s a list of the top 10 best performing Australian multi asset funds over the last 5 years, from the FE database.

Our two funds rank in the top 10 of 766 funds. Importantly our one and three year returns also compare well against that top 10.

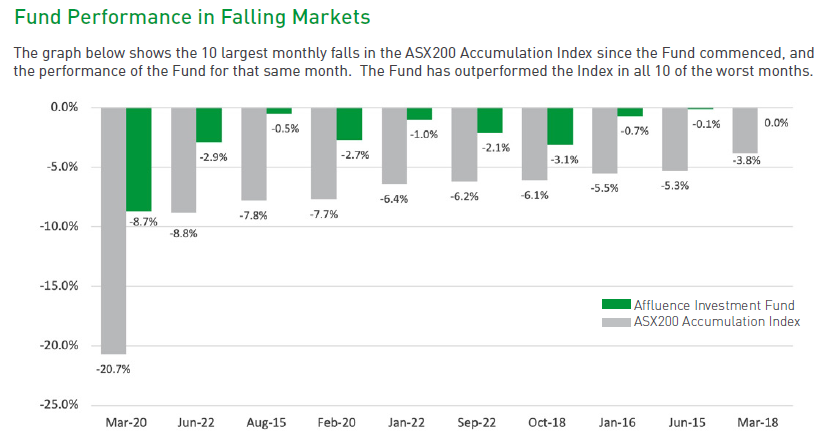

The other factor we consider alongside our long term returns is the risk realised in achieving those returns. More particularly, how the Fund has performed at times when the ASX has fallen. We can see that a lot of the outperformance has come in times of market turmoil.

We believe that if we can substantially outperform asset markets when they suffer their biggest drawdowns, that gives us a great chance of producing better returns over the long run.

Affluence Investment Fund Positioning

It is impossible to build a portfolio that can consistently achieve our benchmark returns and completely eliminate periods of negative performance. Investing is always a balance between offence and defence. Our job is to ensure we strike the right balance to achieve our return target over the medium to long term. In doing this, we seek to limit the downside relative to the major asset markets and then recover those losses more quickly.

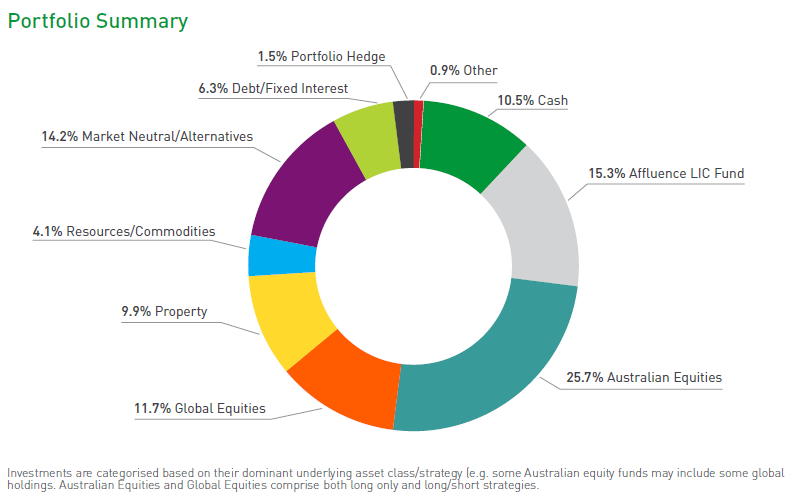

At 31 December 2022, the Fund portfolio looked like this.

In addition to the 30 different underlying managers in the portfolio, we continue to identify new managers that excite us. While the level of turnover in underlying funds is not high, you should expect us to continue to gradually tweak the investments as markets change and opportunities come and go.

No one knows where markets go from here. But we are comfortable we’ve put together a portfolio that allows us to feel very optimistic about future return prospects in the medium to longer term. It also gives us the comfort of knowing your (and our) investment capital is in the hands of nearly 30 different investment teams. We trust them not only to deliver good long term results but also to do the right thing by their investors. After all, almost all of them, like us, are long term investors in the funds they manage.

Thank you to all of you who trusted us with your hard earned capital during the year. It is a responsibility that we never take for granted. We look forward to continuing our search for exciting investment opportunities in the coming years.

If you found that helpful, here are some other things you might like.

See more of our articles.

Visit the Affluence Members page to see more Fund Manager and LIC profiles.

Find out about our Funds.