Markets were buoyed in September by the US Federal Reserve cutting rates and China announcing a raft of measures to support the economy. While the US Fed cuts were widely expected, the China stimulus measures weren’t. Chinese and Hong Kong stock markets soared as investors rushed into these extremely unloved markets. This also flowed onto commodity and resource markets which rallied on the news. Some of this China excitement has worn off in October, however it does show what happens when extremely oversold markets receive even a hint of good news.

Our funds performed well for the month, with all generating positive returns. Below, you can access monthly fund reports.

We also take a look at our first unlisted property investment in years and provide you with access to our updated Guide to Managed Funds.

The cut-off for applications this month is Thursday 31 October for the Affluence LIC Fund and Friday 25 October for all other Affluence funds. Go to our website and click “Invest Now” to apply online and access printable paper forms. Applications received by the cut-off dates will be effective from 1 November.

Thanks for your continued support. If you have any questions or feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Income Trust

The Affluence Income Trust returned 0.6% in September and has delivered 8.0%per annum since commencing. The Fund pays monthly distributions, and the current distribution rate is 7.5% per annum.

The cut-off for monthly applications and withdrawals is Friday 25 October.

Affluence Investment Fund

The Affluence Investment Fund returned 1.9% in September. Since commencing, the Fund has returned 7.8% per annum, including monthly distributions of 6.4% per annum.

The cut-off for monthly applications and withdrawals is Friday 25 October.

Affluence LIC Fund

The Affluence LIC Fund returned 4.0% in September and has delivered 11.4% per annum since commencement. At the end of the month, the average portfolio NTA discount remained high at 23%.

The cut-off for monthly applications and withdrawals is Thursday 31 October.

Affluence Small Company Fund

The Affluence Small Company Fund returned 3.3% in September. The largest positive contributors were ASX listed Powerhouse Ventures (PVL) and US Masters Residential Property Fund (URF).

The cut-off for monthly applications and withdrawals is Friday 25 October.

Investment Profile

Each month we profile an underlying investment of one of our funds.

This month, we’ve taken a look at the first unlisted property fund we’ve invested in for some time, the Tea Tree Opportunity Trust. We explain what attracted us to this particular opportunity for the Affluence Investment Trust.

Our Guide to Managed Funds

We’ve updated and refreshed our Guide to Managed Funds. Click below to download the Guide and learn more about how managed funds work and what we look for when we invest in them. In this updated guide, we cover:

- Why you might want to hold some managed funds in your portfolio

- Different types of managed funds

- How managed funds work and how they generate returns

- Key differences between managed funds and other types of investments

- How to use managed funds to diversify your portfolio

- Measuring managed fund performance

- The key criteria we use to find the best managed funds

- Why fund size and liquidity matter

- Some risks you might want to consider

- The right time to buy

- This guide summarises the results of hundreds of hours of our work for you, in less than 25 pages.

Things we found interesting

Chart of the month.

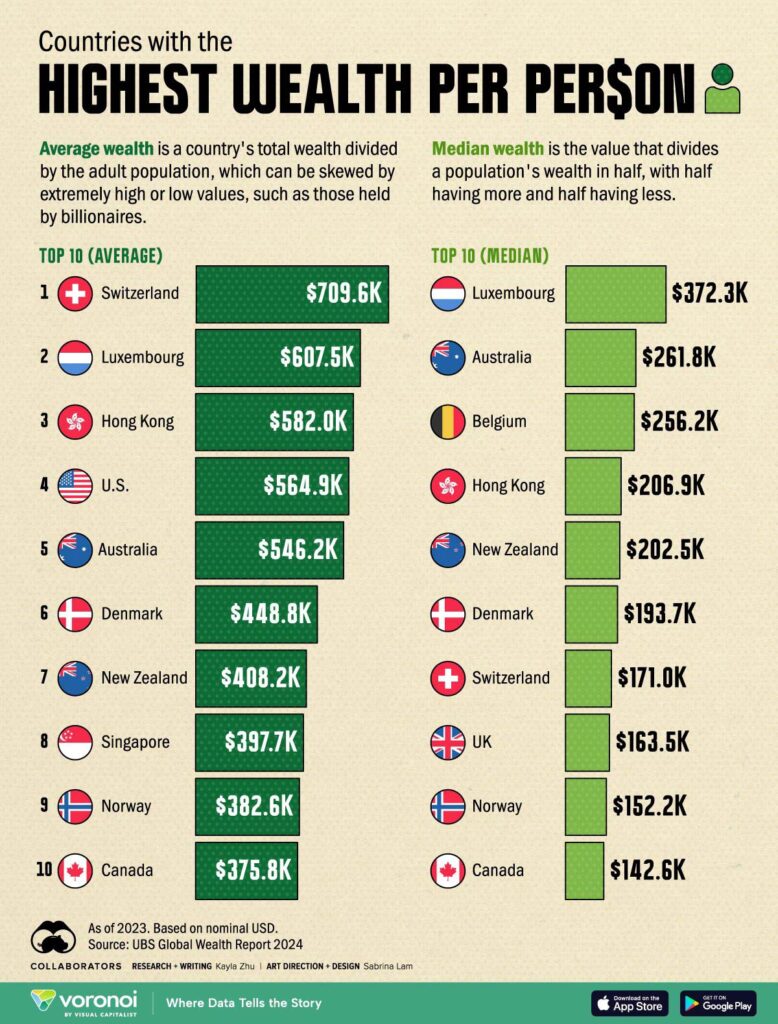

Next time someone tries to tell you that Australia is no longer the lucky country, show them this. According to the 2024 UBS Global Wealth Report, Australia has the 5th highest average wealth in the world. More importantly, we have the second highest median wealth.

Financial word of the month.

Tranche

A layer of debt with a distinctive feature or specific date of issuance, from the French for “slice” or “carve up.” Some tranches may be payable sooner, some later; some may offer a stronger or weaker claim on the issuer’s assets; some may pay interest in cash or in other form. Unlike the slices of a cake, however, which almost always taste good, the least-secure tranches of debt will leave a terrible taste in an investor’s mouth if the issuer runs into financial trouble, as so many did in 2008 and 2009.

Source: “The Devil’s Financial Dictionary” by Jason Zweig.

Strange jobs that no longer exist.

AI is apparently going to make all of us redundant. In recognition of this trend, each month we’re profiling a strange job that no longer exists. This month…

Lamplighter

Public street lighting was developed in the 16th century. It was the duty of a lamplighter to light the streets at night, just as it is with today’s electric streetlights. Lamplighters used a long pole with a wick on one end to light the oil or candles in streetlamps, then returned to snuff them in the morning. Lamp lighting started to decline with the invention of gas lamps in 1814. Early gaslights required lamplighters, but by the late 19th century, systems were developed that allowed the lights to operate automatically. Once the incandescent light bulb was invented by Thomas Edison in 1879, the profession was obsolete and all but extinct by the early 1900s. London still has five remaining lamplighters on the payroll, who maintain London’s last remaining Victorian gas lamps

Source: historydefined.net, Wikipedia, BBC

Vaguely interesting facts.

Astound your friends with these morsels of knowledge:

- In 1991, Wayne Allwine married Russi Taylor. Never heard of them? Well, at the time, Russi was the voice of Minnie Mouse and Wayne the voice of Mickey.

- Jenga blocks have subtle differences in dimensions to make their construction less stable. Each brick is a slightly different size and weight.

- The “Jolene” character in Dolly Parton’s hit country song is based on a real person: a bank teller who flirted with Dolly’s husband.

- The name of the famous Crayola crayons came from words for “oily” and “chalk.”

- Snickers candy bars were named after a beloved horse. *

* The Snickers Bar was invented by candy maker Mars. The chocolate bar was named after the Mars family’s favourite racehorse who was (this is true) born and raised on Frank and Ethel Mars’ Milky Way Farm. Sadly, Snickers the horse passed away just before Snickers the candy bar was released, so he never got to taste that delicious caramel nutty goodness.

Sources: mentalfloss, wikipedia.

Thanks for reading. If you enjoyed this newsletter, forward it to a friend.If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.