Being a 26-year-old Generation-Y investment professional, FinTech is a topic that I follow closely and am genuinely excited about. The web platforms and investment apps these financial tech start-ups are creating these days are unbelievable.

Their mission? To make investing seamless and interesting, for anyone, of any age. They want to allow you to plan for a prosperous financial future and better understand how the investment markets work. Over the next few months, I will trial and personally review some of the best up and coming FinTech firms available in Australia and overseas.

For now, let’s review Acorns, the spare-change investment app. Acorns launched in Australia earlier this year and in the first few weeks had over 50,000 Australian signups. The app links with your regular everyday bank account and credit card. Acorns rounds up your purchases to the nearest dollar and automatically invests ‘the rounded-up change’ into a diversified portfolio of ETFs. Acorns, originally a US founded firm, developed the app to create an easy entry into the stock market for younger, new investors. And they have nailed it. They have removed the arduous entry barriers to owning your slice of the stock-market pie such as lengthy application forms (every Gen-Y’s nightmare), high brokerage rates and minimum investment amounts.

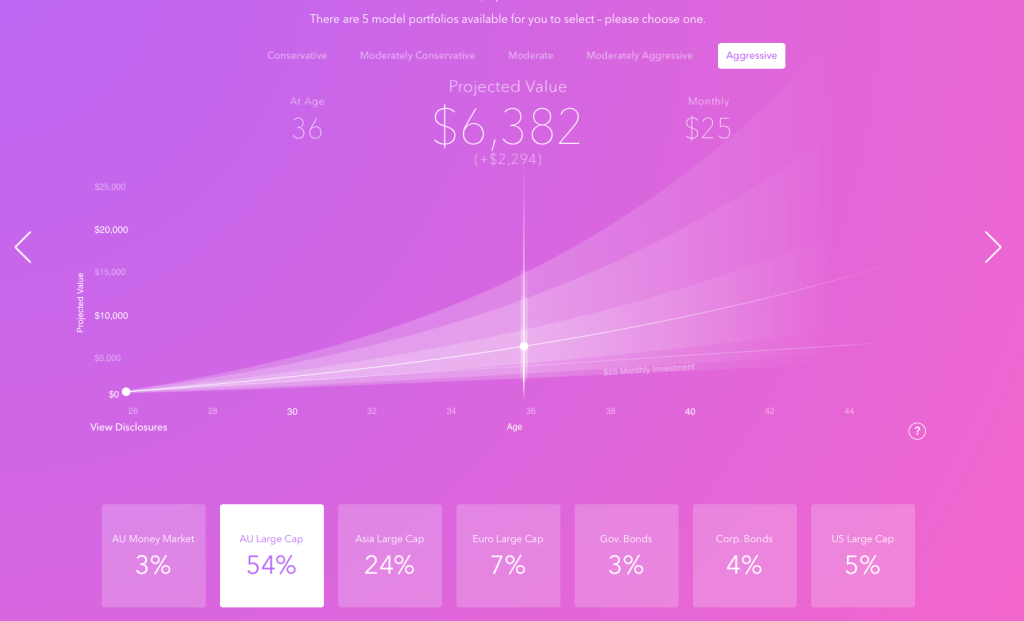

The Acorns App is free to download from the app store and probably has the easiest investment-related signup process I have seen. The app will ask personal details to determine the best investment portfolio for you – Conservative, Moderately Conservative, Moderate, Moderately Aggressive and Aggressive. Depending on your risk appetite and current situation, the app will suggest a portfolio for you. You also have the ability to select your own preference. The conservative option puts most into cash and bonds, while the aggressive has over 80% allocated to equities.

I selected the aggressive portfolio and since signing up, I’ve deposited a total of $1,250.00 just through roundups and an initial $500 deposit to start the account. It’s a pretty small investment compared to what you would usually require on the stockmarket to make sure the fees don’t eat too much into your returns.

Now, fees – one of the most important aspects when considering any investment. For an account balance under $5,000 it will cost you $1.25 per month, or $15 per year to operate. This gets debited from your selected funding account. Based on a $5,000 investment, that’s a yearly fee of 0.3%, significantly less than a traditional broker. For accounts with over $5,000 invested, the annual cost is 0.275%.

I have been using the app since its beta testing stage and highly recommend it. If you’re just starting to dip your toes into the investment market pool, this is a perfect start. In under a month, you will begin to understand how your money is put to work and the affect market changes have on your portfolio.

Other features:

- Set and forget – Set up regular deposits from your bank account into your Acorns investment account

- Automatic roundups – instead of manually selecting which purchases you roundup and invest, you can select ‘automatic roundups’ and have it done for you

- Easy withdrawal – in under 5 clicks, you can withdraw the entire balance of your Acorns investment account and have it credited to your funding bank account

- Change of Portfolio – want to change your portfolio settings? Simple – any user can change which portfolio their funds are invested into (conservative all the way through to aggressive)

- Security – Acorns have worked incredibly hard to offer users of the app bank-level security. Your funds are actually insured against fraudulent and criminal activity

- Available on all devices – you can use the Acorns app on an iPhone, iPad and desktop computer

- Global exposure – in the more aggressive portfolios, a portion of your funds will be invested into international equity focused ETFs

If you have come across an other FinTech websites, apps or services and would like us to review them, please let us know by leaving a comment below and we will do our best to give our opinion.

If you’d like to know more about Affluence and how we find the best fund managers available in Australia, go here.

Want more of our insights and investment ideas? Go here to register for our monthly newsletter and gain access to premium content for Affluence Members only. Take charge of your financial future.