Investment performance

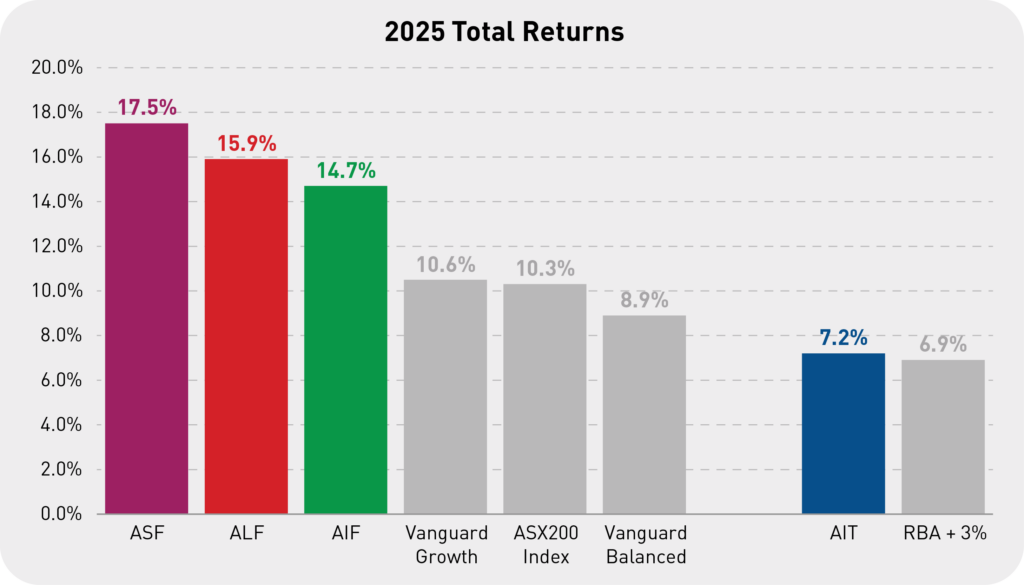

Our Fund returns for 2025 were pleasing:

A few themes that we have held for a while performed strongly in 2025, including:

- Small cap equities.

- Value investments.

- Resources and miners.

- Private credit.

- REITs.

There is no doubt that value investing outperformed growth in 2025. In the 11 years that Affluence has been in existence, this is the first time we have been able to say that with confidence. We believe that all of these themes continue to look attractive, and we continue to be optimistic about the potential in all our fund portfolios over the years ahead. There is a chance that the value renaissance is only just getting started.

Market Highlights

Interest Rates and inflation

The forecast direction of interest rates between Australia and the USA diverged in the second half of 2025. The RBA cut rates three times, from this cycles high of 4.35%, down to 3.60%. The US Federal Reserve has cut rates six times, from a high of 4.75%-5.00% down to 3.50%-3.75%.

Forecasters are now expecting the RBA to increase interest rates in 2026 in response to sticky inflation and continuing strong employment data. In the US, more rate cuts are expected. President Trump will soon announce his new Governor of the Federal Reserve, and he has made it clear that he will only appoint someone who will continue to cut rates, regardless of whether the decision is justified or not.

Interest rates are arguably the most important factor in the future direction of investment markets. As rates are reduced, the risk-free rate (government bond yields) reduces, which supports assets prices. The big question for 2026 is whether inflation will make a comeback in the US. Higher inflation will collide with the Trump administration desire for lower interest rates.

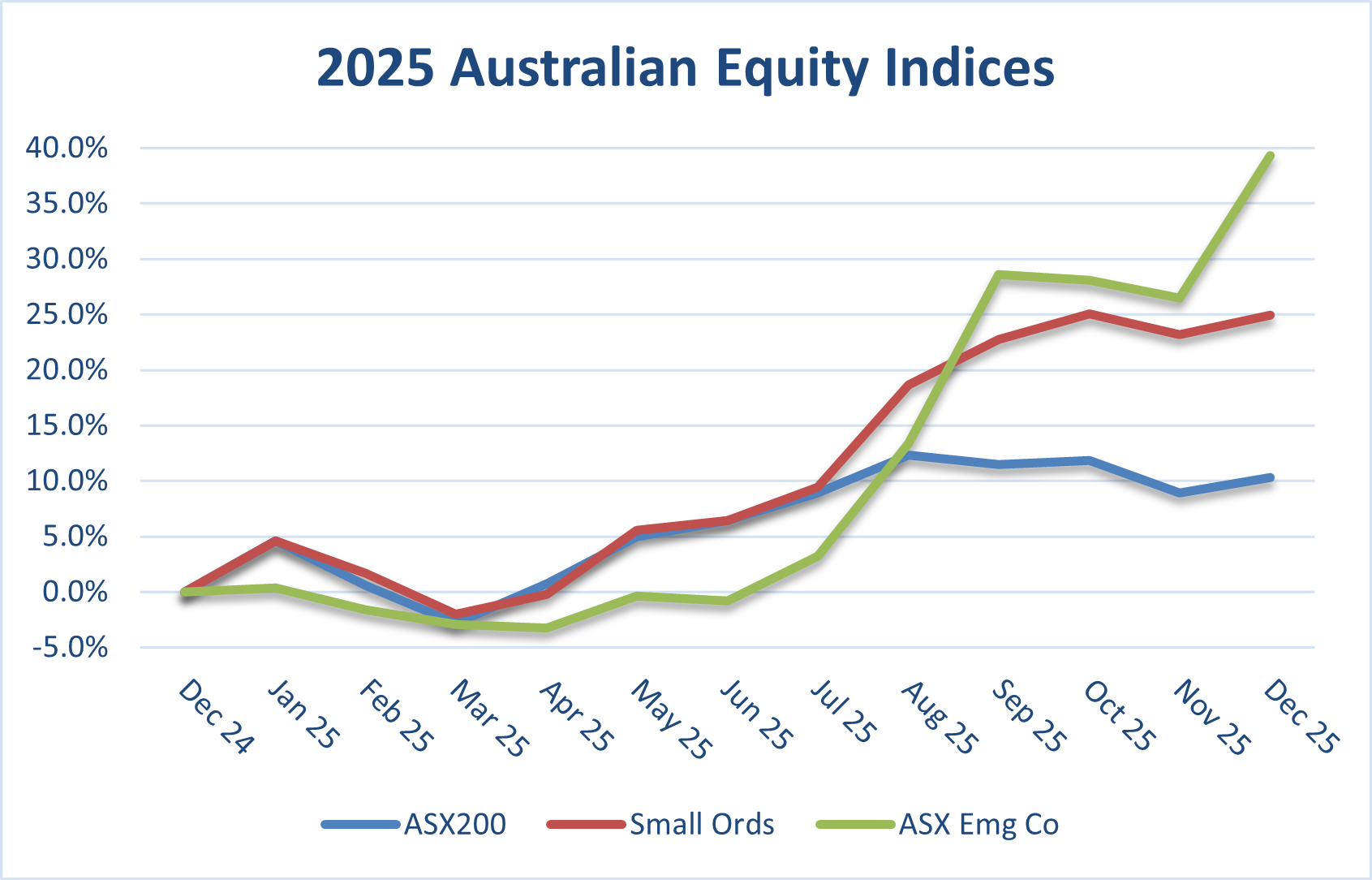

Small cap outperformance

For the last few years, we have lamented how cheap small cap stocks were, compared to their large cap cousins. However, they continued to underperform. This changed in 2025, with small cap equities significantly outperforming the ASX200 Index.

For the ASX200 Index, the Health Care and IT sectors were significant negatives for the year, while Consumer Staples and Energy were also laggards. The largest positive contributor was Materials (mostly mining), which was also a dominant theme throughout the smaller market cap indices. Gold stocks now account for approximately 25% of the ASX Small Ords Index.

Even after a year of such strong outperformance, we continue to believe that the smaller end of the market offers significantly better value and return prospects than the larger end.

Gold

The gold price rallied hard in 2025, continually hitting new all time highs. Prices have increased due to strong “safe haven” demand amid global economic uncertainty, geopolitical tensions (like trade wars and conflicts), high inflation, and significant buying by central banks diversifying away from the US dollar. This has created ideal conditions for its traditional role as a store of value, with lower interest rates making non-yielding gold more attractive. The increase in the gold price has translated into phenomenal gains for some gold miners.

AI Fever

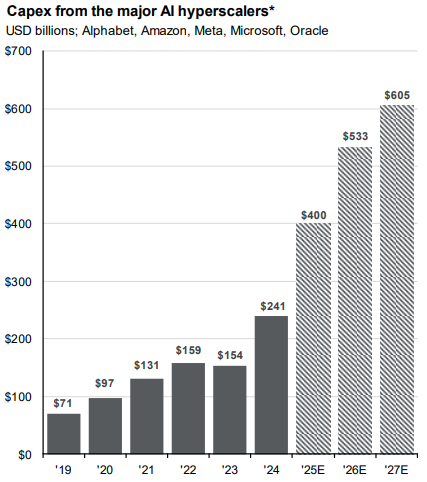

One of the most contentious issues in equity markets has been the continued and accelerating spending on AI related capex.

These numbers are truly staggering. What investors are trying to determine is whether these hyperscalers will earn commensurate revenue and profits from this enormous capex spend. In order for reasonable profits to be made, revenue from AI products would need to be well above any IT product ever produced. There are many sceptics that believe the scale of this AI build out is far in excess of what is justified, and that todays equity market is rhyming with the dot com era of the early 2000’s. Time will tell, but equity markets are pricing in a near perfect execution for these capex programs, which appears to us to be a very aggressive assumption.

Rather than own the companies spending all the money, where profits are likely to be sacrificed in a hugely competitive race to be first in an uncertain new world, we prefer to have exposure to this theme via the materials they will need to build them, and the energy they will need to run them (i.e., resources).

Affluence LIC Fund

Performance

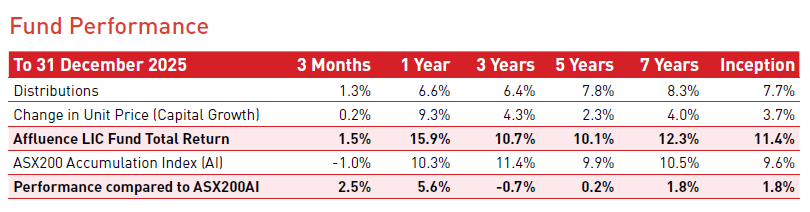

In 2025 the Affluence LIC Fund returned 15.9%, significantly outperforming the ASX200 Index of 10.3%. It’s a pleasing result, given the portfolio discount to NTA at 31 December 2025 remained high at 27%.

The largest positive contributors to the 2025 returns were:

- Ryder Capital (RYD).

- Lion Selection Group (LSX).

- Lowell Resources Fund (LRT)

- Tribeca Global Natural Resources (TGF).

- Cromwell Property Group (CMW).

It was pleasing that our top performers delivered for a number of different reasons. The three resource focused LICs (LSX, LRT and TGF) benefited from the soaring gold price, and to a lesser extent the strong copper price. For the 12 months, these LICs returned 87%, 107% and 73% respectively. We have held all of three for a number of years as we believed this part of the market was particularly cheap. It’s a salient lesson in being patient. We progressively trimmed these three holdings later in 2025 as prices continued to increase. We still hold a combined 7% because we believe there is potential for significant further upside.

Ryder Capital (RYD) is a long term core holding of the Fund. We hold the manager in high regard, and purchased the majority of our position in 2023/2024 after they had a tough period of underperformance. This is one of our favourite purchasing situations, when a great manager goes through a tough period. Ryder has returned 55% over the past 12 months, and while we have trimmed the position, it is still our third largest holding at 5.9% of the portfolio. As with the three holdings above, we believe the underlying Ryder Capital portfolio remains attractively priced, despite the gains so far.

Cromwell Property Group (CMW) is a REIT that we purchased cheaply when one of the major shareholders abruptly sold down their position at a significant discount to NTA, and below where it had been trading. We purchased the majority of the position between April and June 2025 for an average around $0.36 per share. Once the impact of the fire sale had subdued, we sold the position between July and November for a 33% gain.

The largest negative contributor in 2025 was our market hedges, which reduced returns by about 0.7%. In our view, the ASX200 was richly valued for much of the last 12 months, and the US equity market extremely overvalued. The fact that both ended the year even more expensive does not change our process. There will come a time when investors are rewarded for managing risk, but this has certainly not been the case recently.

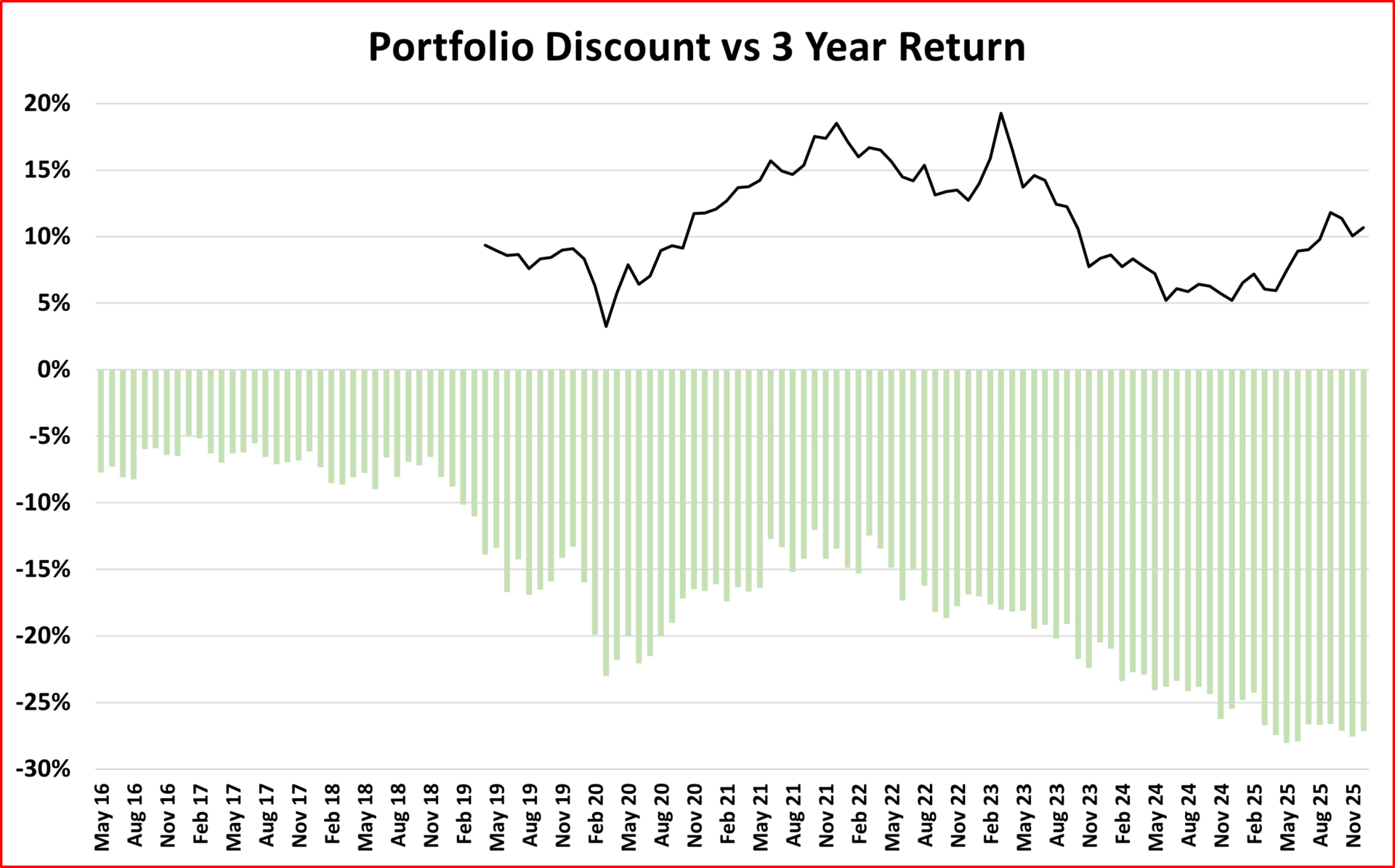

Over the last 3 years, performance for the Affluence LIC Fund has averaged 10.7% per annum, ahead of longer term equity returns but slightly below the ASX200 Index. The key reason the Fund has not gone even better, is all to do with LIC discounts. The increase in the portfolio NTA discount over three years has been stark, increasing from 17% to 27%. That’s been a key headwind for 3 year returns, but it’s good news if we look forward. The following graph explains why. It shows the rolling 3 year return for the Affluence LIC Fund versus the weighted average portfolio discount.

Discounts to NTA increased between 2022 early 2025 and remain at very elevated levels. There is a strong correlation between changes in discounts to NTA and Fund returns. As discounts expand, Fund returns have been lower than they would have been, had discounts stayed the same. We don’t believe that discounts to NTA can increase forever. When discounts start to revert to more traditional levels, this can provide a significant boost to Fund returns, as it has in the past. Quite often, the catalyst for reducing the discounts is a period of above average returns from the LICs themselves, which we’ve seen in many cases over the last 6 months of 2025.

Affluence LIC Fund positioning

Given the sheer number of LIC opportunities now available, the Fund is currently very diversified.

We hold a wide range of attractively priced investments, with a strong weighting toward mid to smaller sized LICs. This area of the LIC market provides more opportunity to profit from mispricing and better value in underlying portfolios. Significant portfolio weightings include:

- Small caps: Our equity LIC investments have a mid/small/micro cap bias. Small caps have outperformed this year, and we believe they will continue to do so.

- Private equity: We hold a range of private equity LICs. Discounts to NTA are very elevated. A number of holdings have specific catalysts underway to reduce discounts. For example we hold Pengana Private Equity (PE1) whose largest holding is Space X. There is the potential for significant upside if Space X undertakes an IPO this year at the values that have been suggested.

- Gold and other resources: The portfolio has exposure to gold miners and other resource investments through several specialist resource LICs. In addition, a number of other LIC holdings have some portfolio exposure to these areas.

We believe the combination of our specialist LIC knowledge, cyclically high discounts and strong underlying value continues to provide an attractive entry point.

Affluence Income Trust

Performance

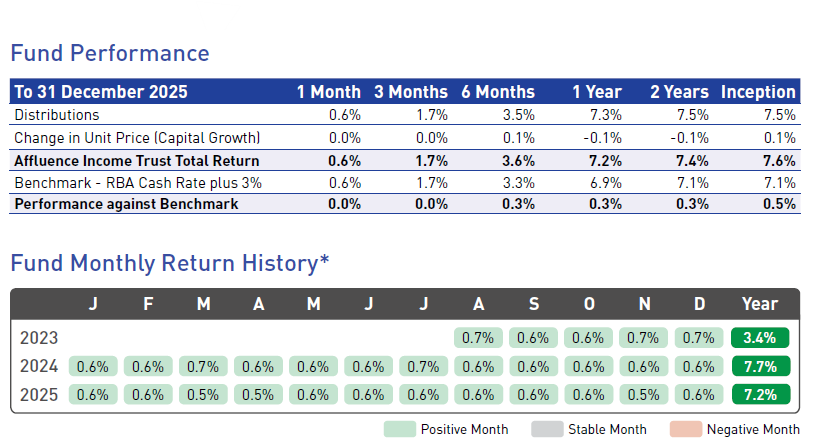

The Affluence Income Trust has continued to perform well, providing investors consistent distributions paid monthly. For 2025, the Fund delivered returns of 7.2% compared to the benchmark of 6.9%.

The Reserve Bank of Australia (RBA) reduced the official cash rate three times in 2025, from 4.35% to 3.60%. The Affluence Income Trust targets a floating rate return 3% above the RBA cash rate. As the official target rate increases or decreases, our target return changes with it. The Fund has outperformed this target in 2025 and since inception.

As you can see from the monthly returns above, the Fund has delivered consistently. The Affluence Income Trust was designed with a very specific purpose in mind – to achieve a premium above what investors can earn from cash and term deposits, while not taking excessive risk. Thus, in both risk and returns, it sits somewhere between cash and equities.

Affluence Income Trust Positioning

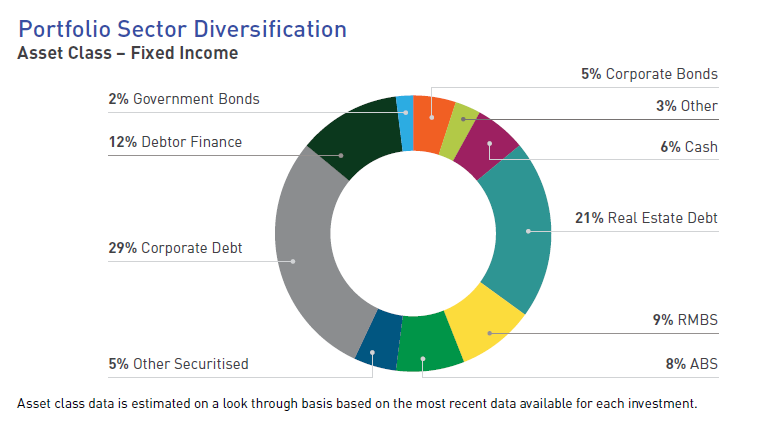

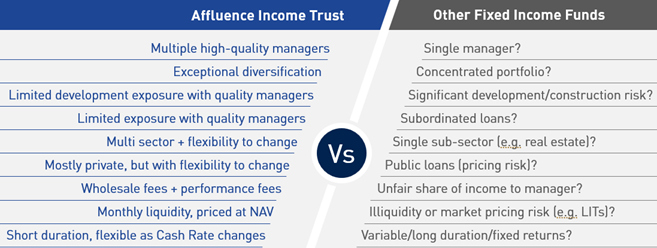

The most important feature of the Fund is that it has a very flexible investment mandate within the fixed income asset class. This allows us to take advantage of what we believe to be the best risk adjusted investment opportunities within this asset class at any given time. This is exceedingly rare in the fixed income sector, with most funds constrained to investing in a single sub sector.

The Fund invests mostly in a range of unlisted funds chosen by us and managed by some exceptional fixed income specialists. Many can only be directly accessed by wholesale and institutional clients. For most individual investors, it would be very difficult to build such a diversified portfolio of fixed income assets.

At 31 December, the Fund had exposure to 20 different investments across a wide range of sub-sectors and investment managers. The look through diversification of the portfolio was substantial.

The combination of diversification and our manager selection process allows us to build a portfolio which looks very different to other fixed income funds. We can think of no other fixed income fund that demonstrates all of the following features, and managed risk the way we do.

If you’re looking for regular income from an extremely diverse portfolio, our Affluence Income Trust may well fit the bill.

Affluence Investment Fund

Performance

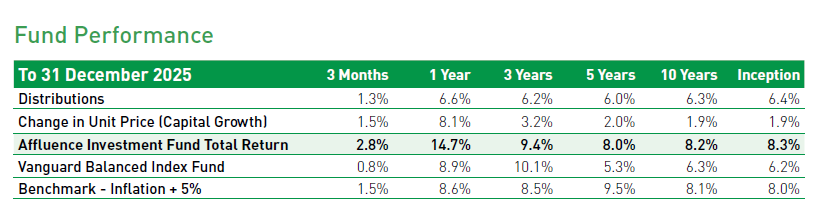

The Affluence Investment Fund had its strongest ever calendar year in 2025, returning 14.7% and comfortably exceeding our target return of inflation plus 5%.

The following summarises the performance of the key sub-portfolios within the Fund:

- The Affluence LIC Fund returned 15.9%.

- The Australian equity investments (including the allocation to the Affluence Small Company fund) returned 19.7%. This was largely due to our small cap and value bias.

- The Global equity investments delivered 22.5%. This was due to the value bias and exposure to emerging markets.

- The fixed income portfolio (including the allocation to the Affluence Income Trust) delivered a strong and consistent 8.8%.

- The alternatives/market neutral part of the portfolio was disappointing, returning 2.8%. This group of investments is uncorrelated with equity markets and has traditionally been an excellent contributor in falling markets.

- The property portfolio performance was well lower than normal, at 5.7%. There were some losses on two small agricultural positions we hold, plus an older property syndicate that is in wind down.

- Resources and gold returned over 90%. We hold two specialist resource managers (Baker Steel Gold Fund and the Terra Capital Natural Resources Fund), who both performed exceptionally well.

- Hedging costs reduced returns by around 0.4%.

Affluence Investment Fund Positioning

It is impossible to build a portfolio that can navigate market downturns and then keep up with aggressive market rallies. Investing is always a balance between offence and defence. We aim to strike the right balance to achieve our return target over the medium to long term. In doing this, we seek to limit the downside relative to the major asset markets and then recover those losses more quickly.

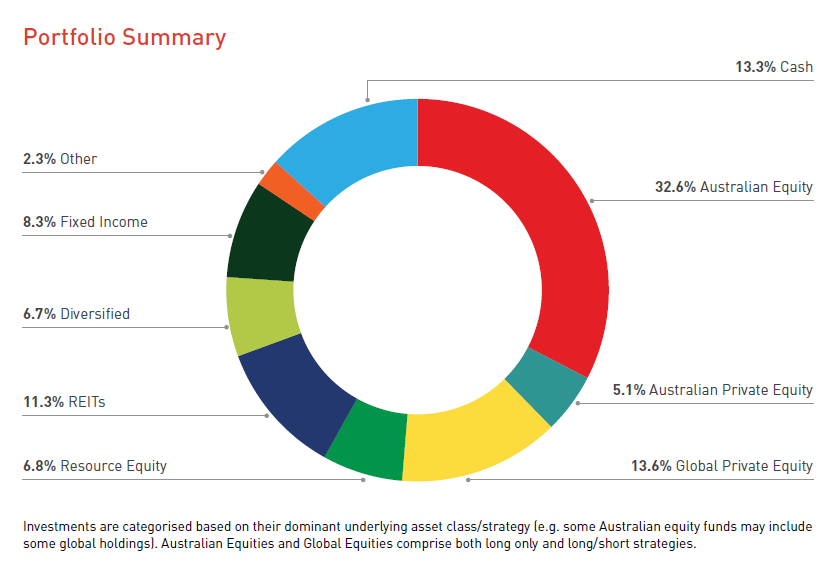

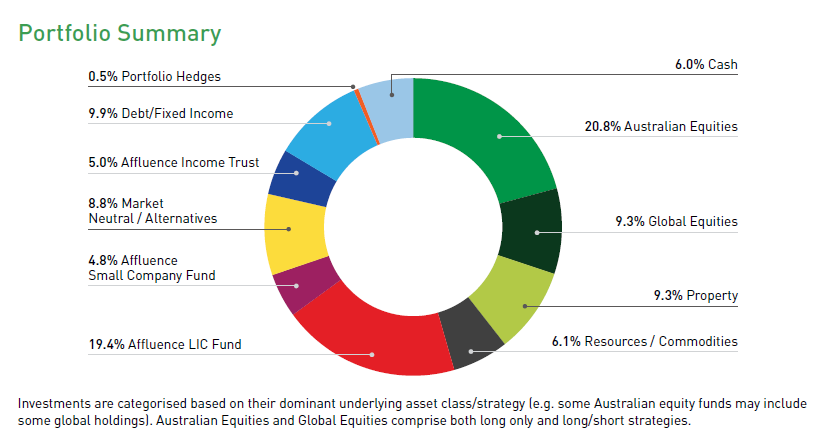

At 31 December 2025, the Fund portfolio looked like this.

We have very little exposure to the expensive stocks that have powered global markets higher. Examples include the Magnificent Seven in the S&P500, CBA in the ASX200, and smaller companies like Life360. We don’t doubt that these are excellent companies. But paying higher and higher multiples does not seem like a long term winning strategy to us.

Our aim with this Fund is to offer you a portfolio that is differentiated, in a good way. We target undervalued and underappreciated areas of the market, and investment strategies where the underlying manager can demonstrate skill and some form of advantage over the market.

In this way, we’re bringing all our best ideas together in a single fund that targets above average long term returns and regular income, while limiting the damage from any market downturns.

More reading

If you would like to know more about any of our funds, you can access a range of information on our website for each Fund, including the latest Fund reports, presentations, portfolio details, performance history and more. Links to each Fund page are below:

Affluence Small Company Fund (Eligible Investors only).

Thank you to all of you who trusted us with your hard earned capital during the year. It is a responsibility that we never take for granted. We look forward to continuing our search for exciting investment opportunities in the coming years.

If you found that helpful, here are some other things you might like.

See more of our articles.

Visit the Affluence Members page to see Fund portfolios and download our guides.

Find out about our Funds.