To view the full Affluence Investment Fund Update – July 2016 in pdf format, click here.

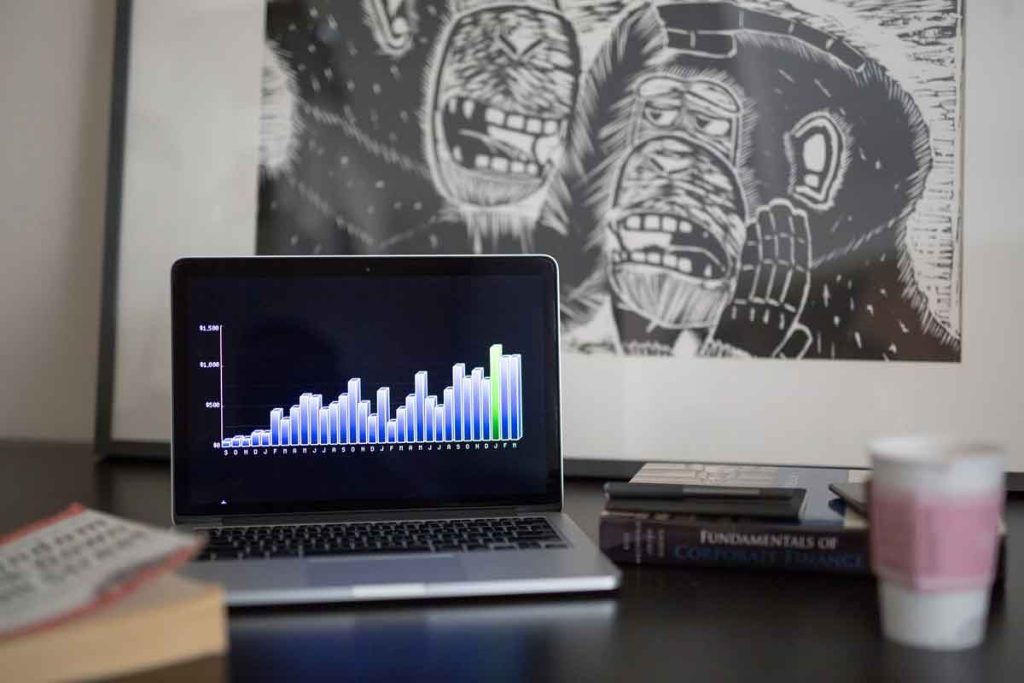

July was our best ever month. The Affluence Fund delivered total returns of 3.0%, helped enormously by the ASX 200 Accumulation Index, which was up 6.3% for the month. Amongst our 22 unlisted Fund investments, 21 delivered a positive return this month. In addition, our ASX-listed LIC investments returned over 6% in July.

Our best returns came from our investments in long/short funds and the Baker Steel Gold Fund. With sentiment for gold stocks sky-high and record long gold positions from traders and other speculators, we took some pro ts on half our Baker Steel investment this month.

We made additional investments into two of our existing holdings in July. We also added two new investments to the Fund portfolio, Bronte Capital and Lanyon.

Bronte Capital is a long/short fund. The majority of their investments are in a concentrated portfolio of global shares with a value style. But they are much better known in the industry for nding and exploiting shorting opportunities. A quality team we have been monitoring for a while and a distinctly different strategy make this one of the more interesting investments in the Fund’s portfolio.

The Lanyon Australian Value Fund had previously been closed to new investors, but reopened brie y in July and were overwhelmed with over $30 million applications in just a few days. We were lucky enough to secure a small allocation into this fund that has returned around 14%pa over the past few years while holding on average 50% cash. A rather exceptional result we think.

We plan to write more about both these funds in coming months. Among our listed investments, the best contributions for the month came from the recently listed WAM Leaders Fund and our small investment in Seven Group preference shares.

At the end of July, the Affluence Fund held investments in 22 unlisted funds, which represented 58%

of the total portfolio. It also held investments in 17 listed investment companies and other securities, representing 16% of the portfolio. The balance of 26% was held in cash.

If you’d like further details of the Affluence Fund portfolio at any time, just email us and we’ll provide it to you.

If you would like to invest with us and get access to over 30 of Australia’s best fund managers, we encourage you to utilise our online application facility. Just follow the link on our website. If you’d like to add to your existing investment, you can either complete the one-page form available on our website, or use the online facility. A reminder, the cut-off for this month’s investment intake is August 25th.

If you know anyone that may be interested in the Fund, feel free to let them know.