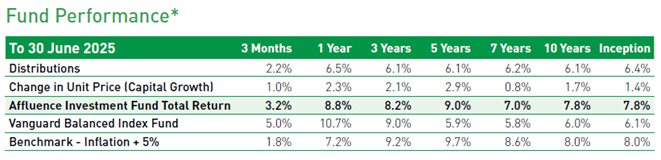

Investment performance

Our fund returns for FY25 were:

- +7.3% for the Affluence Income Trust.

- +8.8% for the Affluence Investment Fund.

- +7.9% for the Affluence LIC Fund.

- +9.9% for the Affluence Small Company Fund.

Below, we take a closer look at market conditions, and review the performance, current positioning and outlook for each of our Funds.

Market Update

Tariffs

The last 3 months have been all about tariffs. While investors knew that this would be part of the Trump presidency, “Liberation Day” on 2 April when he announced his proposed tariffs was met with shock and awe. Markets fell sharply as investors tried to calibrate to a new world order. Equity markets plummeted and bond yields increased sharply to reflect a new source of risk. Trump quickly announced a pause on the tariffs in the face of market turmoil.

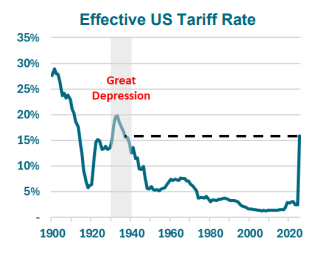

Trump wants to raise tariffs to re-shore manufacturing that has moved out of the US over the past 30 years, to raise duties to help offset the huge fiscal deficit and to assist in trade negotiations. It is dubious whether any of these desired outcomes will ultimately occur. Tariffs bring with them significant risks, including a re-acceleration of inflation, and putting an already stretched US consumer under more pressure. Should announced tariffs actually eventuate, they will result in the highest effective rate since the 1930’s.

Right now, markets have discounted tariff risk completely and have reached new highs. A new investor mantra has emerged – TACO (Trump Always Chickens Out). It appears that markets believe that TACO is the new normal, and if markets do correct on any new policy, Trump will quickly reverse course to sooth them. This does give rise to the question of what happens if he doesn’t reverse course.

Fiscal Stimulus

Since the GFC, most western governments have struggled to rein in their budget deficits. We appear to have reached a point where neither government nor opposition political parties even pretend to have a plan to return budgets to a surplus.

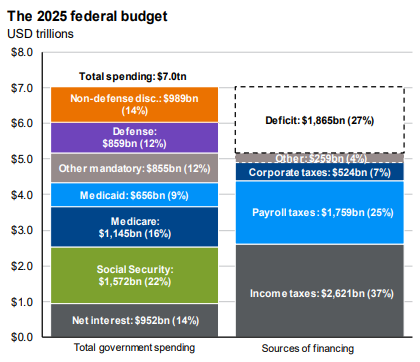

The US Federal budget is the most important and largest in the world. The following graphic from JP Morgan illustrates the extent to which governments are addicted to debt.

Net interest expense now makes up 14% of total US government spending (and will increase as cheaper debt is replaced with debt based on todays bond yields). Even more alarming, in order to meet the USD$7.0 trillion of spending a further USD$1.9 trillion of new debt is required.

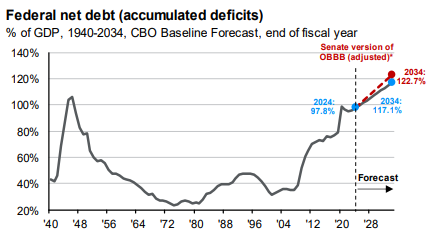

The result is a continuing increase in the level of total debt, to well above 100% of US GDP.

In the short term, the huge fiscal stimulus delivered by excess Government spending is supporting consumer spending and business investment. But it comes at an unknown future cost. One of the more existential risks for capitalism is whether US debt becomes so large that bond investors start to doubt the ability of the US Government to meet their obligations. This would be reflected by ever increasing bond yields, particularly over the medium to longer term. Given most global financial assets are priced off US Bonds, this is no telling what the impact may be. However it remains to be seen if this is a 2 year or 50 year problem. Respected commentators such as Ray Dalio from Bridgewater and historian Niall Ferguson have been warning that this situation bears close monitoring.

Interest Rates

Most central banks around the world have been reducing interest rates from their cyclical highs, as the worst of inflation post the covid pandemic appears to be behind us.

In Australia the RBA has reduced rates twice from 4.35% to 3.85%. While the timing and quantum is uncertain, it is likely that there will be further interest rate cuts in from the RBA in the next 6-12 months.

In the US, the Federal Reserve has reduced rates three times to sit currently at 4.25%-4.50%. It is likely that it would have cut further already, except for the risk of a renewed spike in inflation from tariff impacts. Similar to running fiscal deficits, reducing interest rates is stimulatory in nature. Reducing the cost of borrowing increases investment and consumption. Additionally, as the risk free rate of return reduces, it encourages investors into risker assets to maintain the same yield they had been receiving previously.

Market Returns and Valuations

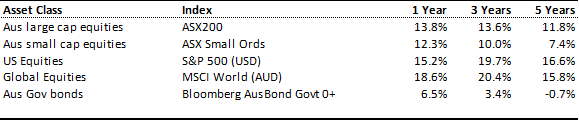

Returns over most time frames up to 5 years are well above average for most equity markets. US and Australian markets, continue to hit new all-time highs.

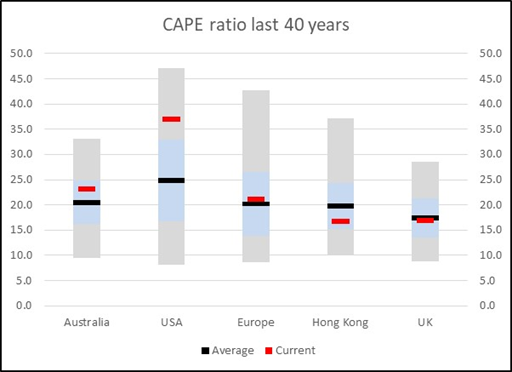

Our preferred valuation metric is the CAPE Shiller PE ratio. Instead of using the past 12 months or future 12 months earnings, the CAPE ratio uses the actual last 10-year earnings adjusted for inflation. This metric attempts to smooth the impact of good and bad years of earnings which can distort a static PE ratio. Here’s how CAPE ratios have varied over the past 40 years in five key markets.

As we have noted in previous investor letters, the chart shows that US equities have been, and continue to be very expensive. Australian markets are above average, though not perilously so. Many global markets offer reasonable value. Major global indices are now 70% weighted to the US, therefore passive global equities we would consider to be expensive.

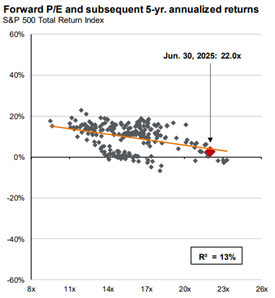

The following graph shows historical 5 year returns from different valuation levels for the S&P500 (represented by forward PE ratios). Clearly, the higher the PE ratio, the lower the future returns. Based on history, investors holding US equities from here shouldn’t have high expectations of future returns.

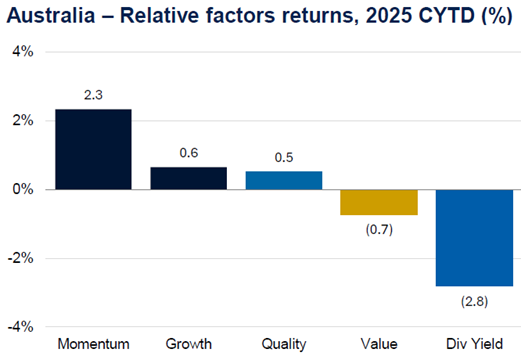

There’s one more key thematic playing out in equity markets:

Since 2024 (and for a large part of the last 10 years), two investment strategies have delivered the bulk of gains. Momentum and growth strategies have been the big winners, helped by the ever larger pot of money invested in passive vehicle. This has created two outcomes. The largest stocks have grown the most, and have the most extreme valuations. The performance of CBA over the past 12 months is perhaps the best example we can find of the impact that momentum investing has had on markets.

Conversely, many smaller stocks with lower (or no) growth, are priced like we’re in a recession.

Investing with us is, in essence, sharing our view that at some point sanity will return, and valuations will normalise. In this environment, we should do well.

Of course, our thesis relies of some form of mean reversion, where markets return to somewhere in the vicinity of norms dictated by the last 100 years or more of history. If we are indeed in some sort of new paradigm, where investors continue to pay ever higher multiples for the same dollar of earnings, then this silliness can continue to prevail for a while longer.

Luckily, as recent results have shown, we can still manage to deliver reasonable returns, while we wait for common sense to return.

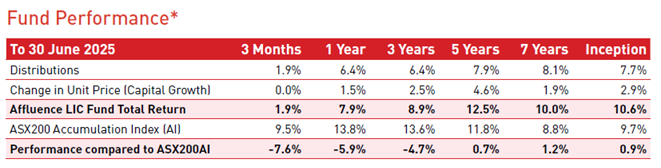

Affluence LIC Fund

Performance

For FY2025 the Affluence LIC Fund returned 7.9% (6.4% distributions and 1.5% capital growth). It’s an OK return, but well below the average of 10.6% since the Fund commenced in 2016. The difference can be explained by the average discount to NTA for the portfolio, which increased from 24% to 28% during the financial year.

The largest positive contributors to the FY2025 returns were:

- Lion Selection Group (LSX).

- Ryder Capital (RYD).

- Salter Brothers (SB2).

- US Masters Residential Fund (URF).

- GDI Property Group (GDI).

The largest negative contributor was our market hedges. In our view, the Australian market was materially overvalued for much of the last 12 months. The fact that it ended the year even more expensive does not change our process. There will come a time when investors are rewarded for managing risk, but this has certainly not been the case recently.

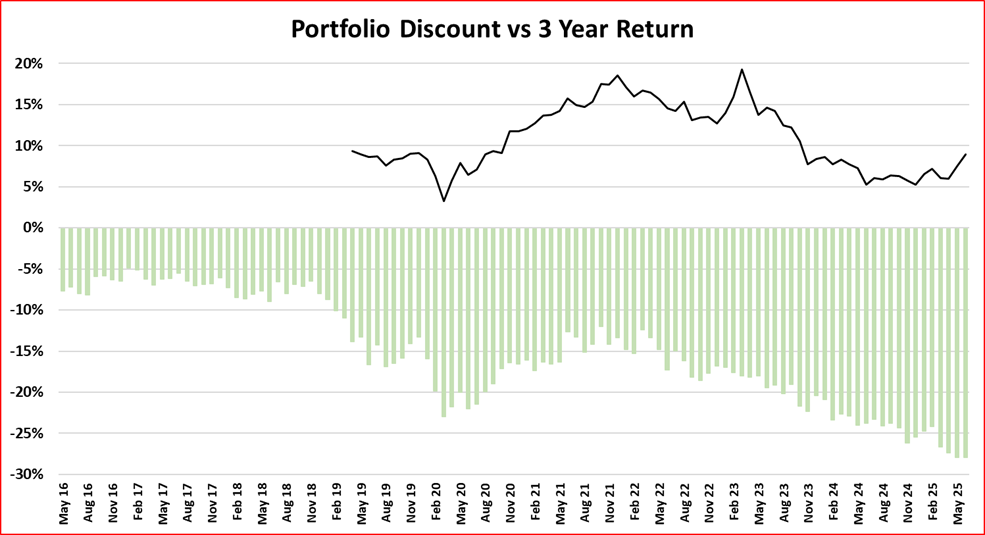

Over the last 3 years, the story has been similar. Performance has averaged 8.9% per annum, on par with longer term equity returns. But the increase in the portfolio discount over three years has been stark, increasing from 17% to 28%. That’s been a headwind for 3 year returns, but it’s good news if we look forward. The following graph explains why. It shows the rolling 3 year return for the Affluence LIC Fund versus the weighted average portfolio discount.

The graph shows clearly:

- Discounts to NTA have been increasing since 2022, and are now at previously unseen levels.

- There is a strong correlation between changes in discounts to NTA and rolling 3 year returns.

As discounts expand, returns have been negatively impacted. Returns have been lower than they would have been, had discounts stayed the same. We don’t believe that discounts to NTA can increase forever. When discounts start to revert to more traditional levels, this can provide a significant boost to Fund returns, as it has in the past.

The interesting thing is that investing at current discounts magnifies investment returns, even if the discount never reduces. For example, assume an LIC manager delivers a 8% per annum return on their investment portfolio and that the NTA for this particular LIC is $1.00 per share ($1.00 x 8% = $0.08 per share per annum returns).

At a 25% discount, the LIC can be purchased for $0.75 per share. If the discount remains at 25%, that $0.08 return on the discounted purchase price of $0.75 is equivalent to a return of 10.7% per annum ($0.08 return on a $0.75 purchase price).

If the discount does narrow, investment returns are further improved.

Affluence LIC Fund positioning

Given the sheer number of LIC opportunities now available, the Fund is currently very diversified.

We currently hold a wide range of attractively priced investments with a strong weighting toward mid to smaller sized LICs. This area of the LIC market provides more opportunity to profit from mispricing and better value in underlying portfolios. Significant portfolio weightings include:

- Small caps: Our equity LIC investments have a mid/small/micro cap bias. Since 2022, large companies have materially outperformed smaller companies. We believe at some point this imbalance will mean revert, and small caps will outperform.

- Private equity: We hold a range of private equity LICs. Discounts to NTA for this part of the portfolio exceed 30%. In addition, valuations are generally lagging, with potential for realisations above NTA. A number of holdings have specific catalysts underway to reduce discounts.

- Real estate investment trusts: We hold a range of small-mid sized ASX listed REITs trading at large discounts to NTA. Most are also paying healthy cash distributions. We believe valuations are bottoming, and many REIT prices can increase over time to be much closer to NTA.

- Gold + other resources: The portfolio has exposure to gold miners and other resource investments through several specialist resource LICs which are showing exceptional value. In addition, a number of other LIC holdings have some portfolio exposure to these areas.

We believe the combination of our specialist LIC knowledge, cyclically high discounts and strong underlying value provides an attractive entry point.

Affluence Income Trust

Performance

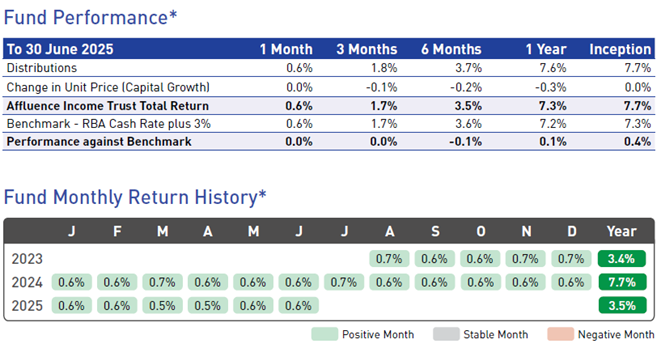

The Affluence Income Trust is one month shy of its two-year track record. Returns are ahead of the benchmark at 7.7% per annum. For Fy2025, the Fund delivered returns of 7.3%.

The Reserve Bank of Australia (RBA) reduced the target cash rate twice in FY2025, reducing the official rate from 4.35% to 3.85%. The Affluence Income Trust targets a floating rate return. As the official target rate increases or decreases, our target return changes with it.

In line with the reduction in the cash rate, the Funds target return has reduced from 7.35% at the start of the financial year to 6.85% at the end. The Fund targets a 3% premium over the official target rate, which it has achieved since inception.

As you can see from the monthly returns above, the Fund has delivered those returns with consistency.

Affluence Income Trust Positioning

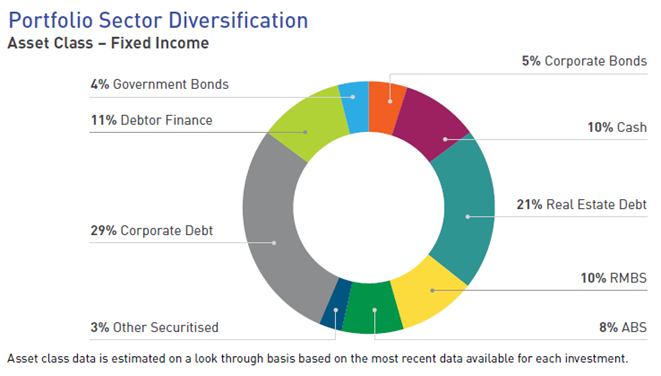

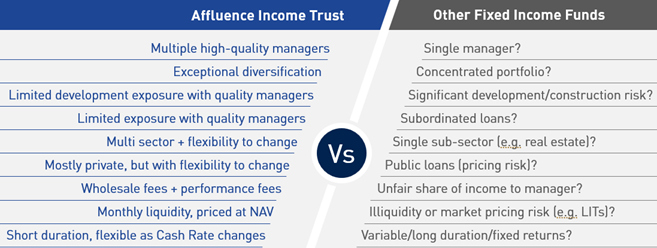

The Fund has a very flexible investment mandate. Importantly, this allows us to take advantage of what we believe to be the best risk adjusted investment opportunities within this asset class at any given time. This is very rare in fixed income, with most funds constrained to investing in a single sub sector.

The Fund portfolio includes a range of investments chosen by us, and managed by some exceptional fixed income specialists. Many can only be directly accessed by wholesale and institutional clients. For most individual investors, it would be very difficult to build such a diversified portfolio of fixed income assets.

At 30 June the Fund had exposure to 18 different investments across a wide range of sub-sectors. The look through diversification of the portfolio was substantial.

The combination of diversification and our manager selection process allows us to build a portfolio which looks very different to other fixed income funds. We can think of no other fixed income fund that demonstrates all of the following features.

When choosing managers, we focus heavily on finding the best risk-adjusted returns. Our return target is set with this in mind. Over time, data published by the Reserve Bank of Australia shows that the average return that investors receive on cash deposits is approximately equal to the RBA cash rate. By targeting a premium of 3% above this amount, we’re seeking to provide investors with a significant premium above the cash rate, without significant risk.

We believe the current portfolio will be very effective in allowing us to meet those aims.

Affluence Investment Fund

Performance

The Affluence Investment Fund had a very solid FY2025, returning 8.8% and comfortably exceeding our target return on inflation + 5%.

A wide range of underlying investments contributed positively to returns in the past 12 months, including REITs, gold/resources, fixed income and a range of equity strategies.

The main headwinds over the past 12 months (and really the past 3 years) have not changed. These include:

- Being risk aware in a bull market has lowered overall returns.

- Mean reversion as a strategy has not worked (yet).

Pleasingly we believe the current portfolio shows significantly more potential than historic returns would suggest, and far superior value than equity and credit markets in general.

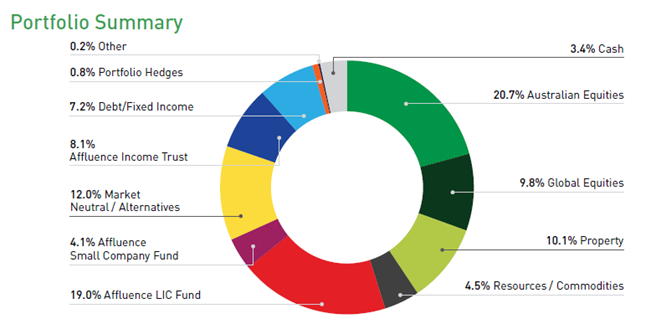

Affluence Investment Fund Positioning

It is impossible to build a portfolio that can navigate market downturns and then keep up with aggressive market rallies. Investing is always a balance between offence and defence. We aim to strike the right balance to achieve our return target over the medium to long term. In doing this, we seek to limit the downside relative to the major asset markets and then recover those losses more quickly.

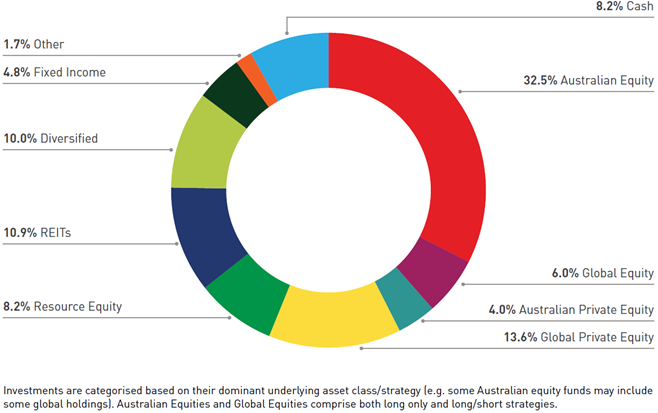

At 30 June 2025, the Fund portfolio looked like this.

We own very little of the expensive stocks that have powered global markets higher (e.g. The Magnificent Seven in the S&P500, CBA in the ASX200, and even smaller companies like Life360 that have had massive share price increases but are still loss making). We don’t doubt that these are excellent companies at the right price. But paying higher and higher multiples does not seem like a long term winning strategy to us.

Our aim with this Fund is to offer you a portfolio that is differentiated, in a good way. We target undervalued and underappreciated areas of the market, and investment strategies that are differentiated, where the underlying manager can demonstrate skill and some form of advantage over the market.

We own investments in many areas that we believe have significant potential. These include:

- Private Credit: Our fixed income investments are providing strong, consistent returns. Our expectation for structurally higher interest rates, and the opportunity in private credit, provide excellent risk adjusted return prospects.

- Affluence LIC Fund – The average discount in the Affluence LIC Fund is 28%. This is getting a little ridiculous and we believe this level of discount is unsustainable. In addition we believe the underlying portfolios show significant superior value.

- Small Caps: Our equity investments have a small/micro cap bias. Since early 2022, large companies have materially outperformed smaller companies. We believe at some point this imbalance will mean revert, and small caps will outperform, as we saw happen in the March quarter.

- Value strategies: A lot of our equity portfolios use a value methodology whereby the underlying manager looks to buy attractively priced stocks. This is the opposite of what has been driving markets higher. We don’t believe this will be the case forever, and we are very comfortable with our current equity holdings.

- Office REITs: These REITs continue to trade at substantial discounts to NTA, even though there are an increasing number of direct transactions confirming the underlying asset values. We own a number of office REITs trading at 30-40% discounts to their underlying value, while getting paid 8%+ to wait for the market to close the valuation gap.

This proven investment strategy allowing you to access to a diversified mix of quality investment managers provides potential for attractive long-term returns.

More reading

If you would like to know more about any of our funds, you can access a range of information on our website for each Fund, including the latest Fund reports, presentations, portfolio details, performance history and more. Links to each Fund page are below:

Affluence Small Company Fund (Eligible Investors only).

Thank you to all of you who trusted us with your hard earned capital during the year. It is a responsibility that we never take for granted. We look forward to continuing our search for exciting investment opportunities in the coming years.

If you found that helpful, here are some other things you might like.

See more of our articles.

Visit the Affluence Members page to see Fund portfolios and download our guides.

Find out about our Funds.