Altor Credit Partners – Key Details

Profile date: August 2024

Manager: Altor Credit Partners

Fund: AltFi Income Fund

Fund Type: Wholesale Unlisted Fund

Asset Class: Private Lending

Investment Strategy: The Fund currently provides private loans to 9 borrowers across a range of sectors. The loans often include an equity component that can provide additional upside to the Fund.

Affluence Holdings: The Altor AltFi Income Fund is a smaller satellite investment in the Affluence Income Trust.

What does Altor Credit Partners do?

Altor Credit Partners is part of Altor Capital, an alternative asset manager investing in public and private mid-market companies. They offer two strategies in this sector, private equity and private credit. Altor Capital was founded by Harley Dalton and Benjamin Harrison and in February 2024 was acquired by ASX listed Prime Financial Group. The private credit strategy is managed by Ben with this assistance of Tom Cochrane as an associate portfolio manager.

Both strategies are managed in line with their investment philosophy:

- Protect the downside.

- Stick to your knitting and invest in what you know.

- Follow the process.

- Invest with patient capital.

What is the Altor AltFi Income Fund?

The Fund invests in senior secured loans, aiming to protect the downside while offering potential upside through attaching equity instruments where possible. The loans are made to both private and public SME’s across a range of industries.

One of Altor’s key advantages is that they can tailor each loan specifically to what the borrower requires. By being flexible, Altor can secure superior risk adjusted returns while also providing benefits to the borrower.

The Altor AltFi Income Fund aims to pay quarterly distributions of 10% per annum, plus the potential for additional returns from the equity instruments. The manager applies a private equity lens to their investment approach. Over the past 6 six years, the equity instruments have provided additional returns.

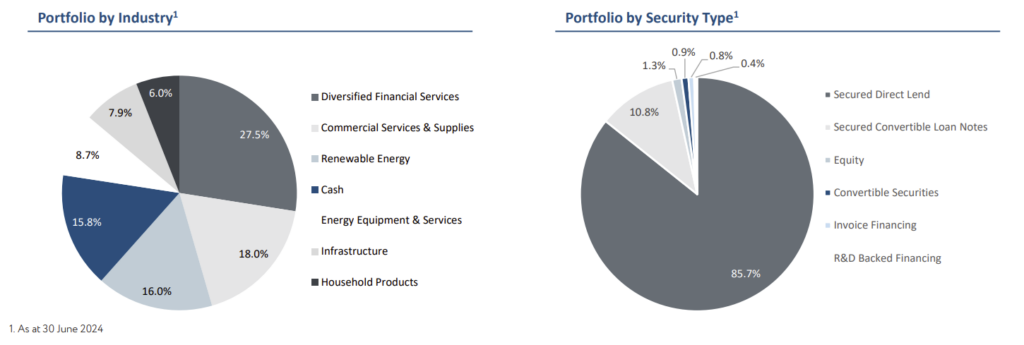

The Fund has been operating since April 2018 and currently holds loans to 9 borrowers. The following graph summarises the portfolio as at 30 June 2024:

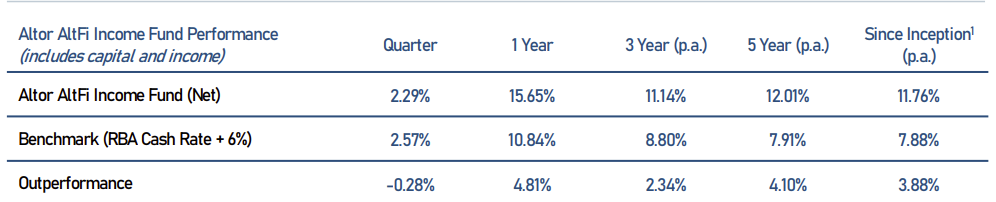

Altor AltFi Income Fund Performance

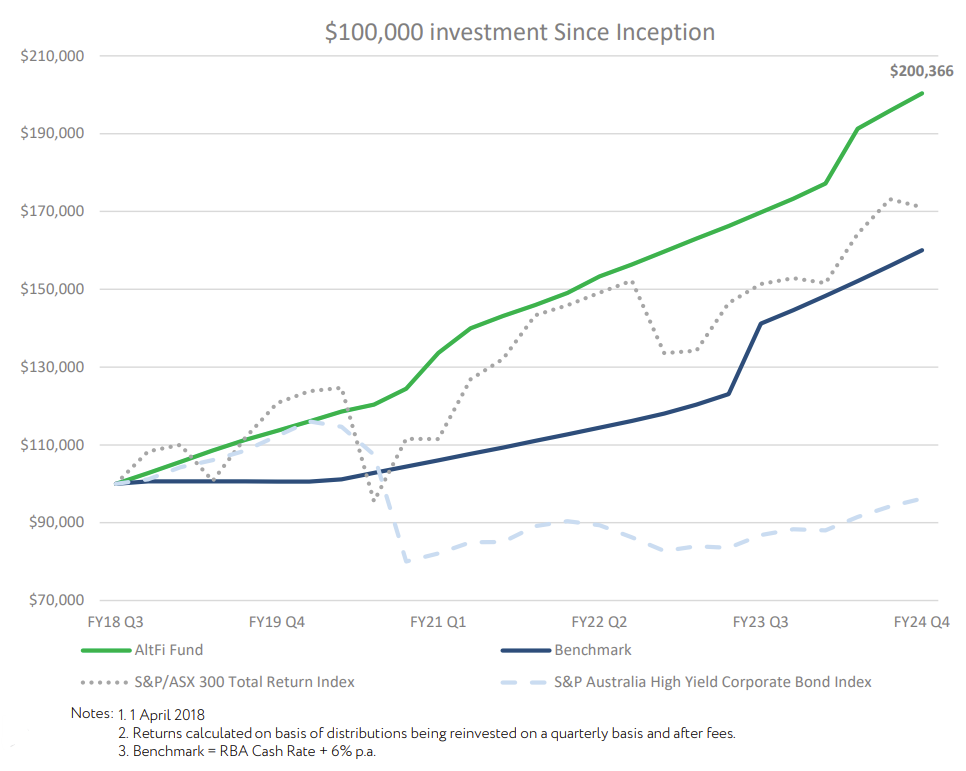

The Fund has produced excellent returns over its 6 year history, through a combination of loan performance and equity upside.

The Fund has outperformed the managers’ internal benchmark of the RBA cash rate plus 6% per annum.

Why we like the Fund

Our portfolio construction philosophy for the Affluence Income Trust is to diversify the portfolio across different credit risks as much as possible. The Altor AltFi Income Fund offers exposure to a portfolio of SME loans selected by a manager with a long history in private equity.

The investment process is thorough, enabling the team to develop a deep understanding of each borrower and their business and to provide a tailored solution that meets the specific needs of the borrower. The Fund provides a very solid running yield, with the potential for additional upside over time from the equity instruments.

Conclusion

The Altor AltFi Income Fund is a 2-3% position in the Affluence Income Trust due mainly to the risk profile and concentrated loan portfolio. We hold several of these smaller positions that can provide higher returns for a reasonable level of risk. The potential for 10% plus returns from a manager with a strong track record meets these criteria.

The ability for the Fund to earn additional returns from the equity instruments is an important differentiator for this Fund.

We hope that was helpful.

To learn more about the Affluence Income Trust you can visit the Fund Page here

If you enjoyed this Fund Manager Profile, you can view our July 2024 profile here

Want to learn more about Fixed Income?

You can download our Guide to Fixed Income

Disclaimer

This Fund Profile was prepared by Affluence Funds Management Limited (Affluence). It was prepared to assist investors in Affluence funds in understanding the investments of the relevant Affluence fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any product advice or service.

This Fund Profile does not consider your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser before making any decision to invest.