Hi

Welcome to our monthly update. All three Funds delivered positive returns in April. Links to the monthly fund reports are below.

Among the things we found interesting this month, we review the latest booming asset that’s not real, explain why you should be wary of inflation, and take a look at LIC dividends, Crocs and a Koala.

If you’d like to invest with us, monthly applications for the Affluence Investment Fund and Affluence Small Company Fund close on Tuesday 25 May. Affluence LIC Fund applications must be completed by Monday 31 May. Investments will be effective 1 June, with confirmations emailed about a week after that. As always, go to our website and click the “Invest Now” button to apply online or download application/withdrawal forms.

If you have any questions, or just want to give us some feedback, reply to this email or give us a call.

Regards, and thanks for reading.

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund returned 2.2% in April. Since commencing in 2014, returns have averaged 8.7% per annum, including monthly distributions of 6.7% per annum.

There continued to be evidence of a changing in the guard of market leaders in April. Prices for the speculative and high growth stocks that dominated 2020 continued to drift back, while more value orientated cyclical and resource stocks powered ahead.

Affluence LIC Fund

The Affluence LIC Fund returned 2.3% in April. The Fund achieved its 5 year track record this month. Since commencing in 2016, returns have averaged 13.2% per annum, including quarterly distributions of 7.3% per annum. The Fund will close to new investors on 30 June.

The average discount to NTA for the Fund portfolio at the end of the month was 16%. At the end of April, the Fund held investments in 20 LICs representing 85% of the Fund, 5% in portfolio hedges and 10% in cash.

Affluence Small Company Fund

The Affluence Small Company Fund returned 4.6% in April. Since commencing in 2016, returns have averaged 9.6% per annum, including quarterly distributions of 5.9% per annum. The Fund continues to be strongly positioned in small cap value opportunities.

At the end of April the portfolio included six unlisted funds (56% of the portfolio), five LICs (17%) and seven ASX listed Small Companies (16%). The balance 11% was cash and options. The Fund is open to Wholesale and Sophisticated Investors.

Invest in LICs the easy way

With a unique discount capture strategy, quarterly distributions and access to a wide range of quality LICs, the Affluence LIC Fund may be a useful addition to portfolios.

At 30 April 2021, the Fund had outperformed the ASX200 by 2.9% per annum since commencement, and owned a portfolio of LICs at an average 16% discount to their underlying value.

The Fund will close to new investors in June 2021. From July 2021, only existing Affluence investors will be able to continue to invest in the Fund.

Things we found interesting

Chart of the month.

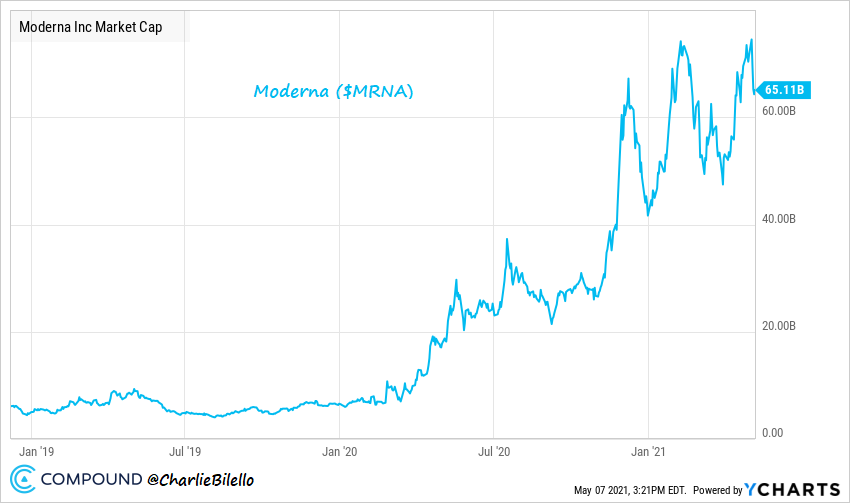

Moderna vs Doge.Moderna created a life-saving vaccine in record time and now has a market cap of $65 billion. This is a 10x increase from where it stood at the start of 2020. Seems fair.

Dogecoin was created as a joke by an Australian who doesn’t even own any of it, became a meme and now has a market cap of $USD87 billion, a 348x increase from the start of 2020.

Only 3 ASX listed companies are bigger.

Chart of the month 2. Why everyone is watching inflation.

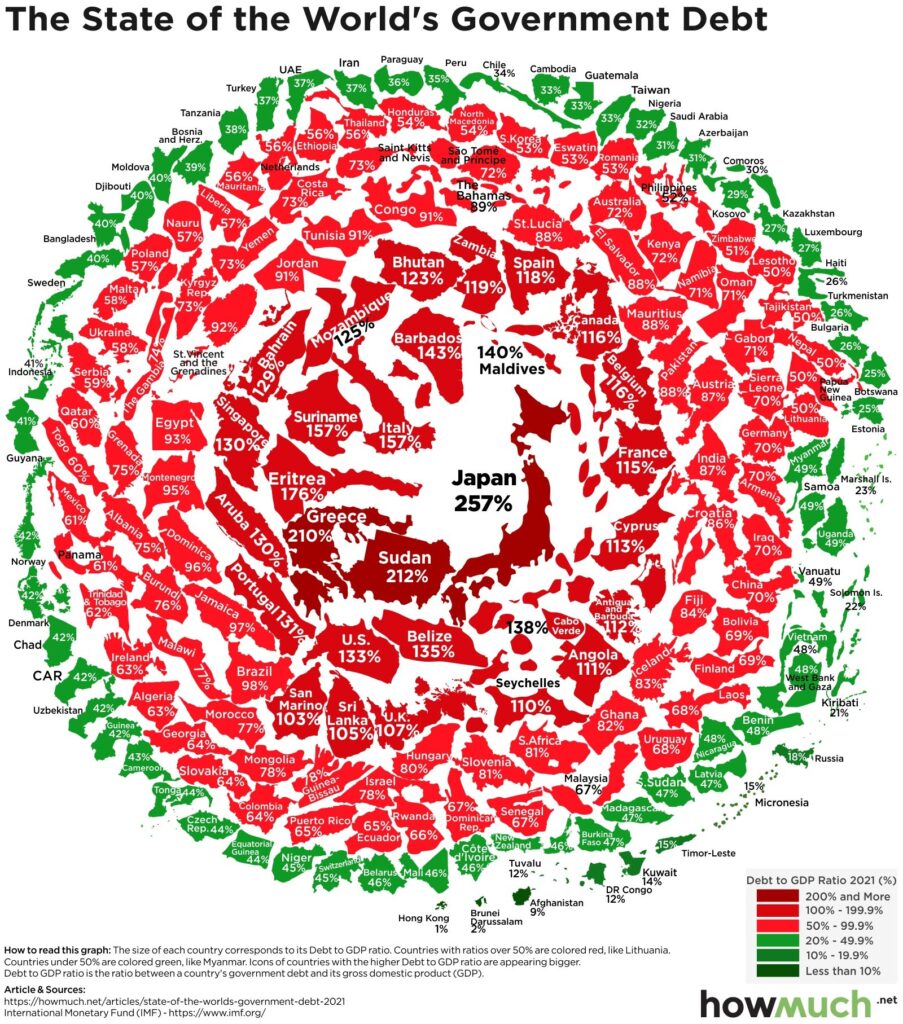

This is Government debt as percentage of GDP for most nations in the world. Think of it as a crude calculation of debt to income for each country.

Can you find Australia? At just over 70%, it’s getting up there. Just a few years ago we were well below half that figure. To be fair, the number for Australia is well overstated, as it ignores offsetting assets such as currency, deposits and loans receivable. Australia’s net debt to GDP position is only about half that shown on the graph. Even based on this week’s budget numbers, net debt to GDP is expected to top out in a few years at below 50%. Nonetheless, it’s clear that a lot of countries in the world now have a debt addiction. And the trend is undeniably up.

Now, here’s where the current focus by financial markets on inflation gets interesting. Let’s assume you’re a Government. And let’s assume you have a debt problem. How do you fix it? Well, there’s basically three ways. First, you can default. No one wants that. Option 2, you can repay it, almost certainly requiring a big increase in taxes. Some Governments used to say they would do that. None of them do anymore. The last option? Inflate it away. If the impact of a sustained period of higher than normal inflation is to grow GDP, suddenly your debt/GDP ratio goes down. Hey presto, you’ve magically reduced your indebtedness without actually doing anything.

A few years of higher than average inflation (say 5%pa) without a big rise in interest rates, could lead to:

- Decent wage increases for most employees.

- Big pressure on companies that are price takers.

- Growth in real asset prices (property, commodities, and any companies that can raise prices in line with inflation).

- A reduction in Government (and private) indebtedness as a percentage of GDP/asset values.

It’s easy to make the case that a lot of people would welcome some form of higher inflation for a while. The problem? It’s very, very hard to deliver above average inflation, without it getting out of hand. And rampant inflation requires much higher interest rates to get it back under control. And that would be bad for almost everybody.

Everywhere we look right now, we see evidence of much higher prices. This week the US saw the largest month on month core inflation increase in nearly 40 years. But central banks continue to believe it is a temporary phenomenon, and will cease to be problem later this year. We disagree.

So, to sum up. A little bit of high inflation is probably good. But sustained high/increasing inflation could be bad. Very bad. And that’s what’s worrying markets right now. Governments (and central banks) are pretending to be oblivious to the danger.

LIC Dividends.

Earlier this month we were interviewed for an article about the outlook for LIC dividends. While we never invest in an LIC just for its dividend yield (it’s one of the greatest mistakes we see from LIC investors), we do think about which LICs have the ability to grow their dividends from current levels. The good news in the LIC sector is that many LICs have performed very well over the past 12 months, and now have significant profit reserves.

In the article, we named ten LICs with a high chance of growing dividends. Seven of them are currently in our LIC Fund portfolio. We also talked about the things we look for in the LIC market, franking credits, and two value focused LICs we think can do well over the next few years.

This month in (financial) history.

This may be the greatest financial comeback in living memory. In 2007, the US listed maker of Crocs (yes, those brightly coloured sandals) was riding a wave of popularity, and traded at over $70 a share. By 2009, the share price hit a low of just 79 cents, and everyone thought that was that.

But you can’t keep a good sandal down. Last year, Crocs started a massive comeback. Last month, the shares hit a new all time high of over $100. Presumably, because lockdown caused a rush of buying from those of us stuck at home and craving comfortable plastic shoes.

Five things to think about.

- Whose bright idea was it to put an ‘S’ in the word ‘lisp’?

- We know the speed of light. What is the speed of darkness?

- Why do we press harder on a remote control when we know the batteries are flat?

- Why do banks charge a fee on ‘insufficient funds’ when they already know there is not enough?

- Why does someone believe you when you say there are four billion stars, but check when you say the paint is wet?

And finally, only in Australia.

In Cooberrie Park Wildlife Sanctuary, in Central Queensland, lives the world’s coolest Koala.

Got a question?

If you would like to learn more about our Funds, or invest with us, the buttons below will take you to the right places.

If you have a question, you can email or call using the details below. Alternatively, click on the ‘contact us’ button, fill out the contact form on our website and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete and it does not take into account your investment objectives, financial situation or needs. Prospective investors in any Affluence Fund should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contain important notices and disclaimers and important information about the relevant offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. The value of your investment will go up and down over time, returns from each fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that there is always the chance that you could lose money on an investment. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM is not a recommendation by Affluence or any of its officers, employees, agents or advisers and potential investors are encouraged to obtain independent expert advice before any investment decision.

The Morningstar Rating™ is an assessment of a fund’s past performance – based on both return and risk – which shows how similar investments compare with their competitors. A high rating alone is insufficient basis for an investment decision. © 2019 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘class service’ have been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. Refer to our Financial Services Guide (FSG) for more information at www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a professional financial adviser.