Key Details

Profile date: May 2016

Manager: Wentworth Williamson

Fund: Wentworth Williamson Fund

Fund Type: Wholesale Unlisted Fund

Invests In: ASX listed stocks

Key People: James Williamson, Geoff Levy

Investment Focus: Deep value bias with a focus on research and analysis to fully determine the intrinsic value of a business. Concentrated portfolio usually with a high cash balance.

Risk profile: Medium. A concentrated portfolio of medium sized companies can be quite volatile. However, with a typical cash balance of 20-30% historical returns have been almost half the volatility of the ASX200.

Affluence Fund Weighting: As at April 2016, the Wentworth Williamson Fund makes up around 6% of the Affluence Fund’s portfolio.

Why we like it

The combination of significant outperformance and much lower volatility is a rare gem; however, this is exactly what this fund has delivered since inception. Because of these qualities the fund also has a relatively low correlation with the stock market, and has performed very well in some months where the index has had large losses. We have great admiration for the principal James Williamson and the process he applies to the fund.

James also maintains a significant personal investment in both the Fund and the management company, along with Geoff Levy, who chairs the investment committee. This helps to ensure both long-term alignment of interests with investors, and that James is incentivised to remain with the Fund over the long term.

What the Manager does

Wentworth Williamson is a Sydney based fund manager. They currently manage this Fund and several individual mandates using a similar strategy. The underlying investment approach of the manager is that the price of shares tends to vary far more than the value of the underlying businesses, due to factors such as:

- Economic sentiment;

- General market sentiment towards equity investments as a category;

- Management changes;

- Country-specific issues;

- The market’s view that the business model is broken (at least in the short term) or conversely over optimistic expectations; and

- Lack of sell-side research due to size or free float in the shares of the company or conversely the ‘follow the pack’ mentality often driven by mainstream, widely read analysis and research.

The differentiating features of this fund are:

- Contrarian – They don’t believe that investment success can be achieved by ‘following the pack’ and actively look for new investments in unpopular sectors and unloved companies;

- Concentrated portfolio and long term focus – They look to build a portfolio of 20-25 well understood investments trading below their intrinsic value. This level of concentration allows each investment to have a meaningful impact on the Fund’s performance;

- Investment flexibility – The Fund is able to pursue any investment idea regardless of sector or market capitalisation. By maximising the investment opportunity set they can select the best prospects for the portfolio.

- Portfolio is benchmark unaware – They believe that while indexes are useful for comparing investment returns, they are not a tool for active portfolio construction.

The key manager is James Williamson who has significant experience in financial analysis and investing over many years. He is supported by analyst Adam Congiusta.

Performance History

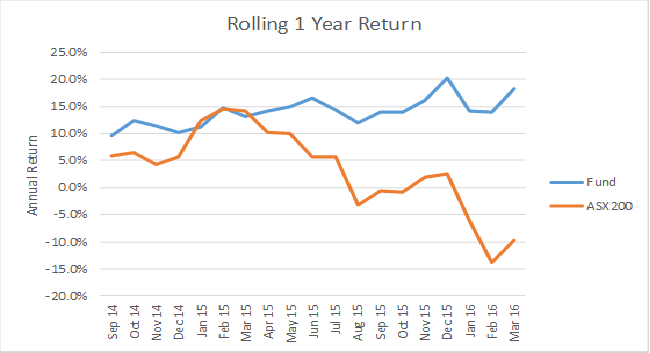

Since inception in September 2013 to March 2016 the fund has delivered an average annual compound return of 12.8%. Over the same period the ASX 200 Accumulation Index has returned 3.5%, resulting in outperformance of 9.4% per annum. To better demonstrate this level of outperformance, $100,000 invested in the fund in September 2013 would now be worth $135,000, versus $109,000 if it had been invested in the index. This represents a 24% difference over the funds 30-month history.

Other important considerations:

- Volatility (or variability of returns) has been 7.2%, almost half that of the ASX 200 index;

- The Fund usually holds a significant amount of cash – usually 20-30% of the total portfolio. This reduces volatility and enables additional stocks to be bought on market corrections;

- The correlation (how similar the returns are) between the Fund and the index is 0.64, which is relatively good for an equities fund;

- When the index has had its biggest losses the Fund has usually significantly outperformed the index;

- The Fund’s worst monthly return of -3.7% occurred when the index lost -5.5%.

Potential risks

We spend a significant amount of time thinking about what could go wrong for each investment we make. Outside of normal equity market risks, here are our top risks for this Fund:

1. Concentrated Portfolio

The Fund holds a small number of stocks with individual shares currently representing up to 8% of the total portfolio. This can lead to significant volatility in returns, both positive and negative.

2. Style Risk

Wentworth Williamson are generally value investors who look to purchase share in a company below its intrinsic value. There are periods when this style of investing underperforms other styles such as growth investing.

3. Key man risk

James is the key investment manager and a significant reason for the exceptional performance. Should it be required, investments could mostly be liquidated over a period of time and capital returned.

Conclusion

Wentworth Williamson is one of our most trusted managers and this is reflected in them having one of our highest allocations, currently 6% of the portfolio. They run a very different investment strategy to most fund managers, and the combination of significant outperformance and low volatility gives us confidence that it works.

Disclaimer: This article is prepared by Affluence Funds Management Pty Ltd ABN 68 604 406 297 AFS licence no. 475940 (Affluence) to enable investors in the Affluence Investment Fund to understand the underlying investments of the Fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any financial product advice or service. The content has been prepared without taking into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser to determine whether a particular financial product meets your objectives, financial situation or needs before making any decision to invest.