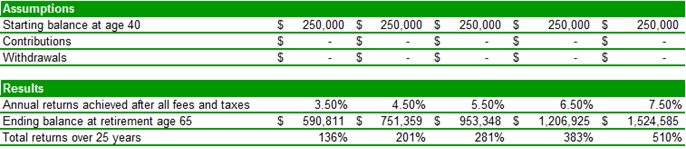

No matter how many times we calculate it, we’re always impressed by the difference a small increase in investment returns can make over a long period. Let’s take the following example of a self-managed super fund. We assumed our investor is 40 years old and has managed to accumulate $250,000 in investments.

We then looked at the results using a range of different returns between 3.5%pa and 7.5%pa. We used 5.5% as the medium return value because that’s the long-term average return from a balanced super fund (you can read more about how disappointing long-term returns have been for most investors here). We modelled returns for our investor over a 25-year period from age 40 until retirement at age 65. We assumed these returns were after all fees, costs and taxes. We also assumed no further contributions or withdrawals to the super fund during this period.

You can see the results below.

The differences over 25 years are huge. Even a 3.5% annual compound return produces a 136% total increase in capital. But if you increase returns to 7.5%pa, your investment value increases by over 500%! Of course that doesn’t take into account inflation, so while these numbers are impressive, bear in mind that if inflation is 2.5% per year, your dollars will buy a lot less in 25 years.

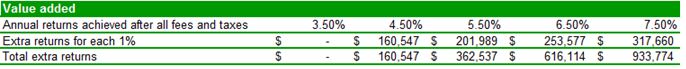

You can see the impact of each additional 1%pa return below. It’s huge.

Improving returns from just 3.5%pa to 4.5%pa over 25 years increases your investment value at the end by over $160,000. Going from 4.5%pa to 5.5%pa improves it by over $200,000. and so on.

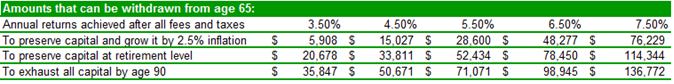

So what does this mean for our hypothetical investor in retirement? Below we look at what pension can be withdrawn from their pot of gold assuming they continue to achieve the same returns. We have looked at 3 different scenarios, depending on whether their goal was to preserve their investment capital (either before or after inflation), or exhaust it all by age 90.

Once again the differences are quite staggering. And they will have a major impact on this hypothetical retirees’ standard of living.

The bottom line? If you can achieve one or two percent better than average returns, after fees and costs, over 25 years, you can improve your quality of life in retirement substantially.

Of course that’s easy to say, and hard to do right? Not necessarily. Here’s the top ways we think all investors can improve their long-term investment performance:

- Be tax aware – super is a good way to reduce tax for most investors, provided you can cope with limited access to your money until retirement. Family trusts can also be very useful tax planning vehicles, provided the benefits outweigh the costs of administration;

- Learn how to assess the performance of your investments, and measure it regularly;

- Maintain a diversified portfolio to help avoid both large drawdowns (negative return periods) and sequencing risk (the risk of a large loss at an inopportune time such as just before or after retirement);

- Educate yourself to continually improve your understanding of markets and how your money is invested;

- Focus on long term market cycles, rather than making rash short-term decisions;

- Review your investments and your portfolio every 3 months, and your progress towards your long term financial goals at least annually; and

- Measure the long-term performance of your investments, fund managers and advisors to make sure you have the best working for you. They should be adding more value than the fees they are charging.

A lot of this is not hard and doesn’t take that long. But it could pay huge dividends (pun intended!) down the track.

If you can’t get there by improving returns, there may be other ways you can potentially boost your retirement earnings or make them go further. For example:

- Starting as early as possible – the benefits of starting just one year earlier are massive;

- Making regular, consistent contributions to take advantage of dollar cost averaging;

- Retiring later, or continuing to work part-time. In many cases continuing to work part-time, particularly for men, has proven to be a better way to adjust to retirement living;

- Getting detailed, professional, personal advice. Strategies such as transition to retirement pensions or withdrawal and re-contribution plans can save thousands, or even tens of thousands in tax.

When all is said and done, the investment decisions you make early on in your investing lifetime, and any increase in investment returns you and your advisors can generate, will have a huge impact on your retirement standard of living. A small amount of effort regularly can make a huge difference in the end.

Want more of our insights and investment ideas? Go here to register for our monthly newsletter and gain access to premium content for Affluence Members only. Take charge of your financial future.