When we tell most people what average long-term investment returns have been, they tend to be very surprised. Most of us regularly hear the stories of the good investments and the great returns, but very rarely are people prepared to tell you about their not-so-good investments. This leads to a huge bias in reporting and means it’s perfectly natural for us to believe returns have been higher than they actually have.

So what are average returns? Perhaps 8%pa? 9%? or even 10% or more?

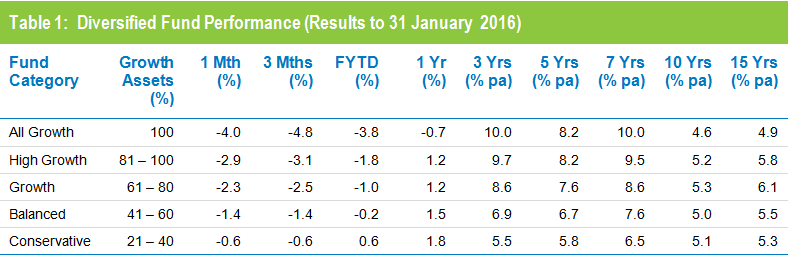

Sadly, no. As shown below, the average Australian balanced super fund returned just 5.5% p.a. net of investment fees and taxes over 15 years to January 2016.

Source: Chant West

Pre-tax returns are estimated (by us) at around 6.1% p.a. over the past 15 years. This allows for tax at around 10%, which is the average long term tax rate for a super fund. And many investment managers are currently warning that future returns are likely to be lower than past returns.

Crucially, these returns are before the impact of any personal advice fees or administration costs, which can easily cost another 1-2% each year. After these personal fees, we estimate the average investor has received returns of less than 5% p.a. over the last 15 years. This is roughly equivalent to leaving your money in the bank!

There are two other important takeaways from these statistics. Firstly, the higher growth options have struggled to keep pace with the balanced option over 15 years. In fact, over this period the all growth option (shares and property) has underperformed both the balanced and conservative strategies.

We are often told the average long term returns from the sharemarket are 8-10% per annum – so how is it that these results are so much lower? We’re not sure, but we put it mostly down to bad timing decisions on behalf of investment managers. That is, they buy more shares when they are overvalued and sell them when they are cheap. It’s the single biggest reason why investors (even professional ones) underperform over long periods. We wrote more about this concept here.

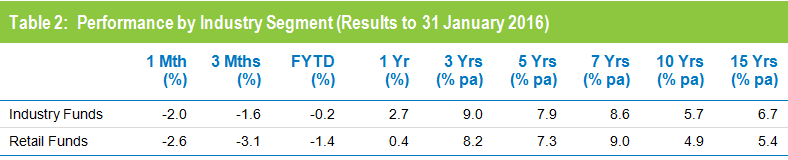

The second key takeaway is that industry super funds have significantly outperformed retail funds over every time period except 7 years, as shown below.

We put this down mostly to lower fees, something the industry funds have trumpeted quite loudly in their ongoing “compare the pair” advertising campaign. We also suspect part of the answer relates to industry funds’ tendency to hold a greater proportion of their investments in unlisted funds and assets. This would make their returns both less volatile and less susceptible to bad timing decisions.

When separated out this way, the results from industry funds aren’t actually all that bad. They have managed returns of 6.7%pa after tax, which we estimate is equivalent to a 7.4% pre-tax return.

However, we believe they could be doing much better. There are still some changes most major super funds could make that might deliver much better results. They include:

- Not being afraid to hire managers with above average fees if they can prove they’re worth it.

- Pursuing better diversification through investing in differentiated strategies.

- Avoiding investments (such as most bonds right now) that have a high chance of delivering below average returns.

- Being happy to carry significant cash at any given time if there aren’t enough exciting opportunities to buy.

- Allocating a reasonable portion of the portfolio to unlisted investments. They are less liquid, but deliver lower volatility and generally better long term returns than listed investments.

- Hiring some smaller managers with skin in the game and a differentiated strategy.

- Being aware of long term cycles and considering timing in investment decisions.

In other words…investing differently.

Interestingly, the Future Fund has adopted many of these principles in their investing methodology. Their returns have comfortably beaten the average super fund over long periods, suggesting it’s working. You can read more about the Future Fund and how they invest here.

With your own investment portfolio, it’s important to understand the level of long term returns being generated by the market. You can take this into account when setting our own investing goals and analysing opportunities. You shouldn’t overestimate what will be achieved by average managers investing in an average way.

Want more of our insights and investment ideas? Go here to register for our monthly newsletter and gain access to premium content for Affluence Members only. Take charge of your financial future!