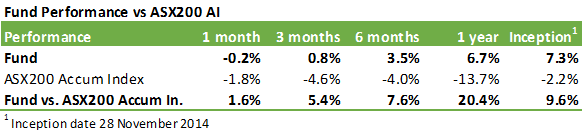

The Affluence Investment Fund returned -0.2% in February. The Australian stock market returned -1.8% over the same period. February was in many ways a carbon copy of January – a tough month with values falling substantially in the first half followed by a partial recovery later in the month.

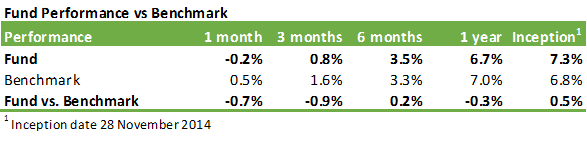

Over the past 12 months, the Affluence Fund is up 6.7% with the Australian stock market down 13.7% including dividends. The difference is over 20% and it is pleasing. Nonetheless, our total returns of 6.7% are, in our mind, barely adequate. We expect to be able to improve upon that in a friendlier market environment.

Within the portfolio last month, we saw an unusually wide variation in results from underlying managers. We put this down to two factors. Firstly, February is half-year results month for most listed companies and this always leads to greater than usual volatility among individual stocks, as everyone digests results announcements and adjusts their forecasts accordingly. Secondly, we saw emerging signs of a trend change in the resource and commodities space. It seems confidence is improving and there is an increasing view the worst might be over. Not too many in the space are outright bullish yet, but many of the short sellers got squeezed.

Given this, it is no surprise our best performing investments were in the resources space. Our worst results were from our long-short managers, who for various reasons were negatively affected. Two of our managers had their worst monthly performance ever, a rare event but one that we were able to absorb without too much fuss given the positive contributions from other investments.

At 29 February, the Affluence Fund held investments in 15 unlisted funds, which represented 65% of the total portfolio. It also held 16 investments in listed investment companies and other listed securities, representing 14% of the portfolio. The balance of 21% was held in cash. We remain ready to deploy that cash as opportunities arise.

With the further market correction in February, we are moving well into buying territory now. Please let us know if you would like to invest with us, or add to an existing holding. A reminder the cut-off for monthly investments is the 25th. If you know anyone else that may be interested in the Fund, feel free to forward on this e-mail.

If you have not already done so, you can go here to register for access to premium content for Affluence Members only. Take charge of your financial future!