GDI Property Group

Key Details

Profile date: November 2024

Manager: GDI Property Group

Fund: GDI Property Group (ASX: GDI)

Investment Type: Listed Real Estate Investment Trust (A-REIT)

Asset Class: Commercial Office Property

Investment Strategy: GDI Property Group is an ASX listed REIT focused on Australian office property.

Affluence Holdings: At the profile date, the Affluence Investment Fund and Affluence LIC Fund currently hold an investment in GDI Property Group.

Important note: All figures are current as at the stated dates but can change significantly over time, particularly for listed investments.

Who is GDI Property Group?

GDI Property Group is an internally managed commercial property investor. It is structured as a stapled security where the property trust and operating company are traded as a single security.

GDI was established in 1993. It has had a number of different names and corporate structures since then, and has been listed on the ASX since 2013. GDI went through a management change in 2023 when Stephen Burns was appointed CEO. We believe this was an important change and a positive for GDI. The company has achieved strong results since this time.

As at 30 June 2024 GDI had net assets of over $650 million, equating to about $1.19 per share. It is trading on ASX at a substantial discount to that value. At the current share price of around $0.60, the company has a market capitalisation of $320 million.

What does GDI Property Group do?

The GDI business has three main components:

- Directly owned assets. GDI owns approximately $1 billion of office buildings, predominantly in Perth.

- Funds management business. GDI manage a number of unlisted property funds, and co-invest in many of them. This is a smaller component of their business than it was previously, but has the potential to grow strongly again at some point in the future.

- Co-living JV. The group owns 50% of a mining accommodation joint venture. The JV currently owns and operates three assets in Western Australia that provide accommodation to workers in the mining sector.

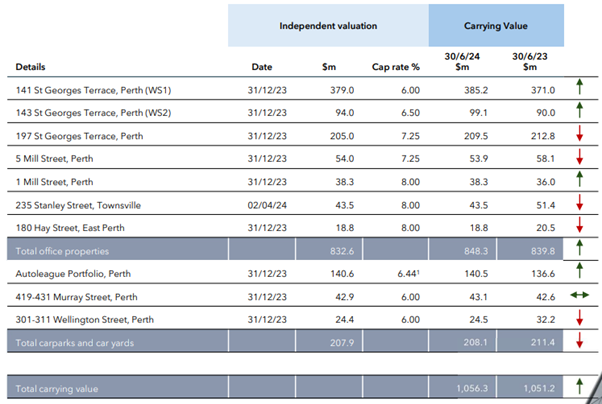

The directly owned assets are by the largest and most important sector of the group. A summary of the portfolio is below.

The three main assets (WS1, WS2 and 197 St Georges Terrace) are A grade office buildings well located in the Perth CBD. WS2 is a brand new building that GDI developed themselves. In the past 18 months, GDI has achieved significant leasing success over these three assets. This has substantially de-risked the portfolio.

While there is still work to be done on the leasing-up front, the income generated from these assets underwrite revenues for the GDI business for the next several years.

GDI have also developed plans for further new office developments on other assets they own. While these new developments would only occur if substantially pre-leased, we believe the optionality does increase the value of the portfolio.

As at 30 June 2024 the group had a loan to value ratio (total debt divided by property value) of 40%. Overall gearing (which includes cash and other assets) was 33%. Given the substantial leasing progress and valuation metrics, we are comfortable with this level of gearing.

Why we like GDI Property Group

As noted above, at 30 June 2024 GDI Group had an NTA of $1.19 per security versus a current share price of around $0.60. This is a 50% discount to NTA which we believe is far too excessive. This discount to NTA is one of the biggest in the REIT sector. We believe the market is being far too pessimistic in three areas.

Office sector exposure

Much has been written about the death of offices, in a world of working from home. While the sector has obviously been impacted, we do not believe that offices are now obsolete. There has been an avalanche recently of large corporate and government sectors demanding employees return back to the office for at least part of the working week. While there has been resistance to this from workers, we believe that as the unemployment rate rises and normalises, office occupancy will continue to trend upwards.

We do agree that poorer located and older lower quality assets will struggle. The majority of GDI’s exposure is to good quality assets.

Perth location

For many years the Perth office market was seen as a poor cousin to the major east coast markets of Sydney, Melbourne and even Brisbane. This was partly due to the boom and bust nature of the resource sector, which was reflected in the Perth office market.

However, this time around is a little different. During Covid, the Perth CBD was one of the least effected office markets in the country. Unlike other markets such as Melbourne, actual worker occupancy remained much higher in Perth. This has been a major advantage, as the task of getting workers back into the office has not been as dramatic. We are much more enthusiastic about the Perth CBD office market than many other institutional investors, and believe the pricing difference is excessive.

Smaller REITs are being ignored

With a market capitalisation of around $300 million, GDI is smaller than the vast majority of ASX listed REITs, including the other office sector REITs. We have seen across all listed companies both in Australia and globally that larger stocks have substantially outperformed smaller stocks. This trend is evident in the REIT market, and like our bias towards small cap stocks in other sectors of our portfolio, we believe there is more upside in these smaller companies.

Over time, as the larger REITs re-rate and trade closer to net asset values, investors (including specialist property investors) tend to move down to the smaller REITs, which then boost share prices.

There is significant value on offer right now.

As the current share price of $0.60 per security an investment in GDI delivers the following benefits:

- A 50% discount to net asset value and a 35% discount at the property asset level. The current capitalisation rate for the portfolio based on the most recent valuations is 6.6%. Based on the current share price, investors are effectively buying the portfolio at almost a 10% yield, without paying stamp duty. We believe this is exceptionally cheap.

- An annual distribution rate of 5 cents per stapled security. This is an 8.3% distribution yield on the current share price.

- We believe this distribution is maintainable, and may even grow. We expect earnings for FY25 to be above the 5.5 cents per share achieved in FY24, due to the additional leasing success achieved.

- Investors are getting the funds management business and co-living JV business for free.

While we do not know what the catalyst will be for GDI to re-rate, we are confident in the underlying value. Even better, while we wait for this to occur, we are getting paid an 8%+ distribution yield. This distribution yield is supported by the high level of contracted lease income over the property portfolio, with minimal lease expiries over the next few years.

Conclusion

We like contrarian investments. We find GDI very attractive at the current share price. Other investors are chasing shiny new asset classes such as data centres and paying above net asset value to buy them at lower yields. We are very happy to get a paid a healthy distribution rate on assets we can buy at a large discount, and wait until the market wakes up to the inherent value.

We hope that was helpful.

Learn more about the Affluence Investment Fund and the Affluence LIC Fund.

If you enjoyed this Fund Manager Profile, you could view our October 2024 Fund Manager profile Tea Tree Opportunity Trust – Affluence Funds Management

Want to learn more about Managed Funds?

You can download our Guide to Managed Funds

Disclaimer

This Investment Profile was prepared by Affluence Funds Management Limited (Affluence) to assist you to understand an investment held by one or more Affluence Funds in more detail. It is not an investment recommendation and the contents of this article should not be construed as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any product advice or service.

This Investment Profile does not consider your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in an Affluence Fund or any other financial product, you should consider the relevant disclosure document for that product, which are available from the product provider. Affluence recommends you consult your professional adviser before making any decision to invest.