Hi,

Markets bounced back hard in January, as investors started the year with a strong dose of optimism. All our funds delivered positive returns for the month. As always, detailed fund reports can be accessed below.

We are a little more cautious on markets as central banks continue to increase interest rates to try and tame sticky inflation, and the previous interest rate increases are yet to be reflected in the real economy. The positive from this is that lower risk alternatives such as cash and high quality debt are now offering reasonable returns after being anchored near zero for the last few years.

Should you wish to invest this month, applications for the Affluence Investment Fund and Affluence Small Company Fund close on Friday 24 February. Applications for the Affluence LIC Fund close Tuesday 28 February. Go to our website and click “Invest Now” to apply online or access application and other forms for any of our funds.

Keep reading to learn about some other things we found interesting this month, including starting early, gold production, the holey dollar and gecko feet.

If you have any questions or want to give us some feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund increased by 1.3% in January. Since commencing over eight years ago in November 2014, the Fund has returned 8.0% per annum, including monthly distributions of 6.5% per annum.

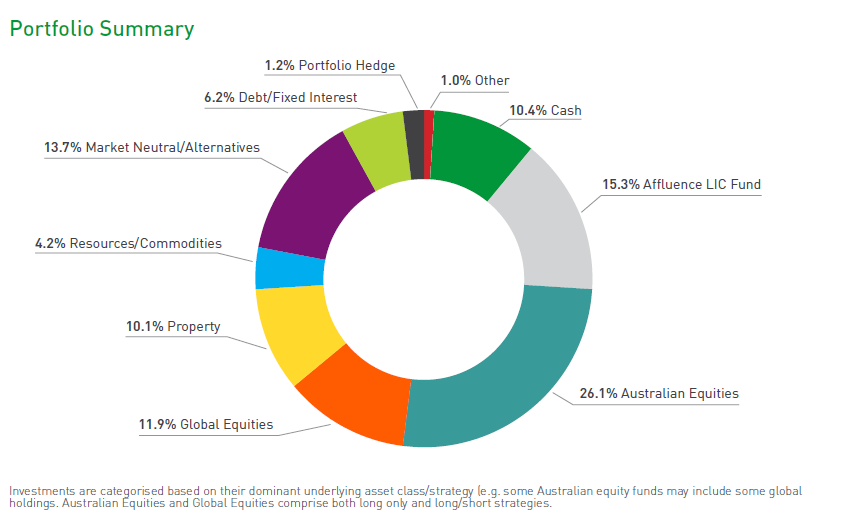

At month end, 60% of the portfolio was invested in unlisted funds, 15% in the Affluence LIC Fund, 13% in listed investments, 1% in portfolio hedges and 10% in cash.

The cut-off for monthly applications and withdrawals is Friday 24 February.

Affluence LIC Fund

The Affluence LIC Fund increased by 1.3% in January. Since the fund commenced over 6 years ago, returns have averaged 11.8% per annum, including quarterly distributions of 8.1% per annum.

The average discount to NTA for the portfolio at the end of the month was approximately 17.5%. The Fund held investments in 30 LICs (73% of the Fund), 3% in portfolio hedges and 24% in cash.

The cut-off for monthly applications and withdrawals is Tuesday 28 February.

Affluence Small Company Fund

The Affluence Small Company Fund increase 2.4% in January. Since commencing in 2016, returns have averaged 9.4% per annum.

The Fund held 8 unlisted funds (58% of the portfolio), 8 LICs (15%) and 7 ASX listed Small Companies (23%). The balance 4% was cash and hedges.

Available to wholesale investors only. The cut-off for monthly applications and withdrawals is Friday 24 February.

Invest Differently

The Affluence Investment Fund provides you with access to a wide range of different investment strategies, combining our portfolio construction expertise, with access to over 30 talented boutique investment managers. A significant number of funds in the portfolio can only be accessed directly by wholesale investors, or existing clients of the manager.

We aim for the Affluence Investment Fund portfolio to have an all weather focus – prepared for whatever markets may do. We also tend to skew the portfolio towards the asset classes that we feel are cheapest, and to the themes we think are most likely to impact markets over the next few years. Returns since the Fund commenced have been similar to the Australian share market, with more consistency and significantly better outcomes in falling markets.

With monthly distributions and a performance based fee structure, the Affluence Investment Fund may be a useful diversifier for your investment portfolio.

Things we found interesting

Chart of the month.

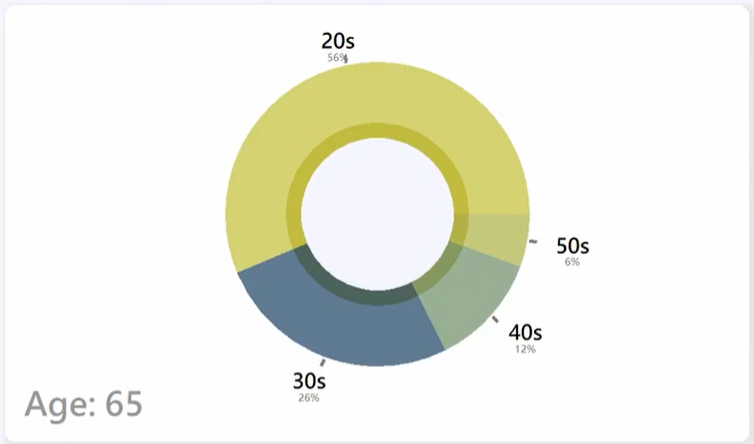

If you invested $200 per month from age 20 until age 60, and achieved a return of 8% per annum, you would have just over $1 million by age 65. This chart shows how much of your investment nest egg comes from the amounts you invested in each decade.

A whopping 56% of your final amount at age 65 (over half a million dollars), would be attributable to the amounts you had invested in your 20’s. So, waiting just 10 years to start would cut your end balance in half. Waiting until your 40’s to start would cut your ending balance by over 75%. The lesson? Start early. If you’re already over 20 (and there’s a good chance you are), then this is the single most important investment lesson you can pass on to your children or grandchildren.

Chart of the month 2.

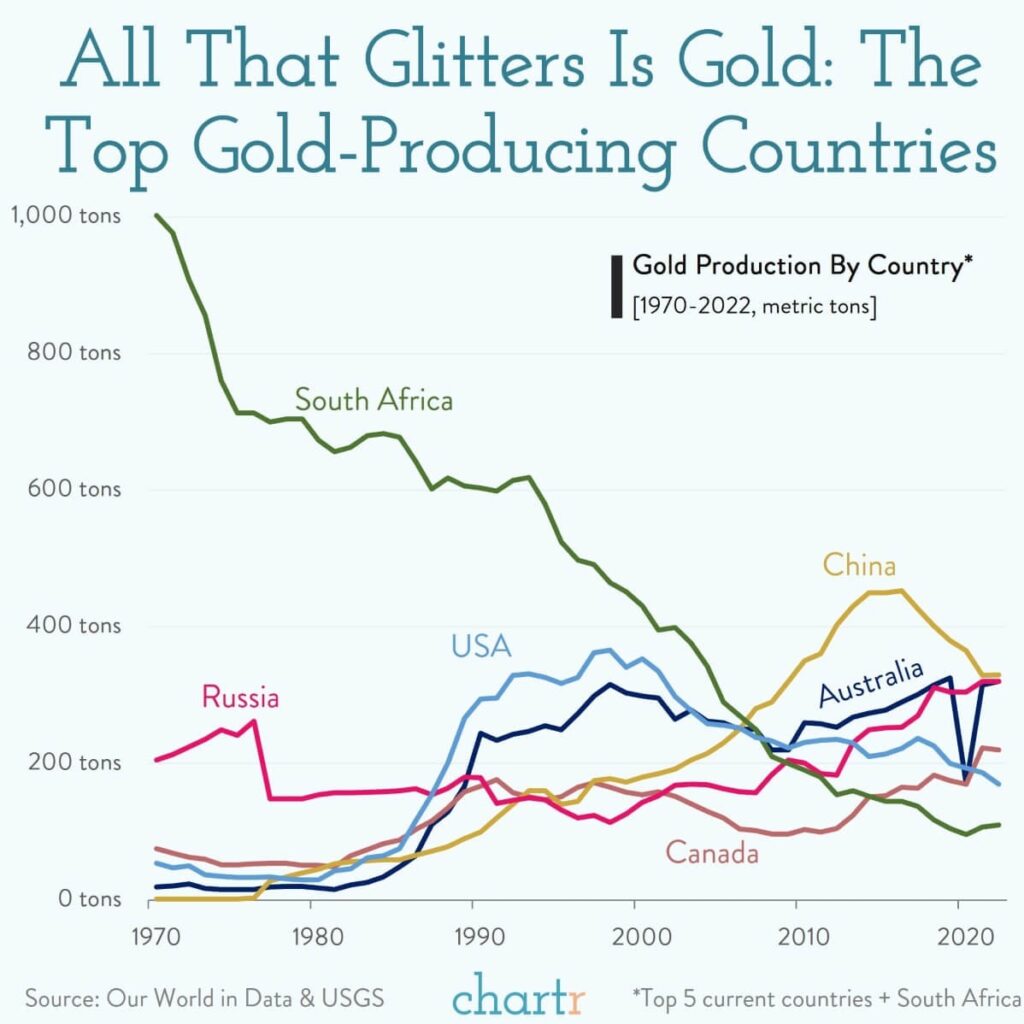

In 1970, South Africa was by far the top producer of gold, mining more than 70% of the world’s total. Ever since then, South African gold production has been in decline. In 2007, China moved to top of the pile.

These days, Australia is one of the top three gold-producing nations on Earth, thanks in part to some extremely low-cost long life mines. Like many other commodities, gold is proving increasingly hard to find. Of the 341 major deposits discovered since 1990, only 8% were found in the past decade. It’s one of the reasons we remain excited about the medium term prospects for resources stocks, particularly smaller to medium producers, who might increasingly become targets for larger players looking to secure future capacity.

This month in history.

In February 1814, Australia’s first currency was introduced. Known as the ‘holey dollar’, the coins were minted from imported Spanish ‘pieces of eight’. NSW Governor Lachlan Macquarie imported 40,000 Spanish reals and had convicted forger William Henshall cut the centre out of each, to double the number of available coins. The coins were then counterstamped so they could not be re-exported.

The outer ring became known as the holey dollar, with the centre named the dump. Governor Macquarie set the value of the holey dollar at five shillings, with 15 pence for the dump. Henshall left Australia for England in 1817. It is not known what became of him.Prior to the holey dollar, foreign coins were common in the early years of the New South Wales colony. Foreign coins circulated included British coins, Dutch guilders and ducats, Indian mohurs and rupees and Portuguese johannas.These days, it is estimated there are only around 300 holey dollars and just over 1000 dumps remaining in existence. Today, a dump might sell for between $5,000 and $40,000, depending on quality. A holey dollar is likely to be worth $50,000 to $500,000.

Vaguely interesting facts.

Those short ads for new movies are called trailers because they used to run in cinemas after the main movie, not before it. Then someone worked out that no-one stays after a movie, but everyone is there at the start.

Despite the country’s staunchly anti-nuclear policy, New Zealand high schools and universities are allowed to keep up to one pound of uranium on premises for educational purposes.

Geckos can turn the stickiness of their feet on and off at will. They do this by controlling the adhesiveness of bunches of hair on their toes.

Women in traditional Rwandan societies avoid eating goat meat as it is believed that it will cause them to grow a beard.

In the sport of wife carrying, the male must carry the female through a special obstacle track in the fastest time. *

Source: mentalfloss.com, wikipedia.com.

* We just know you want to learn more about the fascinating activity of wife carrying, and we’re here to help. The sport was invented in Finland and is also popular in Sweden, Estonia and Latvia. Competitions have been held in Australia. Carrying methods include the classic piggyback, the fireman’s carry (over the shoulder), and Estonian-style (wife upside-down on his back with her legs over the neck and shoulders). The prize for winning the annual Finnish wife carrying championships is the wife’s weight in beer.

And finally…

No matter how bad it looks out there in financial markets, there’s always a bull market somewhere.

If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.