Hi,

All our funds recorded positive returns in July. You can access July Fund reports from the links below. Australian and global equity markets rallied to start the new financial year. Economic data continues to present a case for both bulls and bears, however investors were in an optimistic mood in July and continued to push prices up. Our cautious outlook continues into the new financial year.

The distribution rate for the Affluence Investment Fund was increased from July (paid 10 August). The new rate represents a distribution yield of approximately 5.5% on the current unit price.

Year-end tax and investor statements are being prepared. Affluence LIC Fund statements have already been sent out, with other funds expected to be finalised in the coming fortnight. You can keep up to date with our progress here.

In other news this month, we wrote here about why we’re getting excited about LICs again.

We also talked to the AFR this month about the opportunities in LICs here and here. If you can’t access the links and are interested in reading the articles please let us know and we can send you a copy.

Should you wish to invest with us this month, applications for the Affluence Investment Fund and Affluence Small Company Fund close on Friday 25 August. Applications for the Affluence LIC Fund close Thursday 31 August. Go to our website and click “Invest Now” to apply online or access application and other forms for any of our funds.

If you have any questions or feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund returned 1.4% in July. Since commencing over eight years ago in November 2014, the Fund has returned 7.8% per annum, including monthly distributions of 6.4% per annum.

The cut-off for monthly applications and withdrawals is Friday 25 August.

Affluence LIC Fund

The Affluence LIC Fund returned 2.1% in July. Since the Fund commenced over seven years ago, returns have averaged 11.1% per annum, including quarterly distributions of 7.9% per annum.

The cut-off for monthly applications and withdrawals is Thursday 31 August.

Affluence Small Company Fund

The Affluence Small Company Fund returned 0.5% in July. Since commencing in 2016, returns have averaged 9.1% per annum. including quarterly distributions of 6.9% per annum.

Available to wholesale investors only. The cut-off for monthly applications and withdrawals is Friday 25 August.

Invest Differently

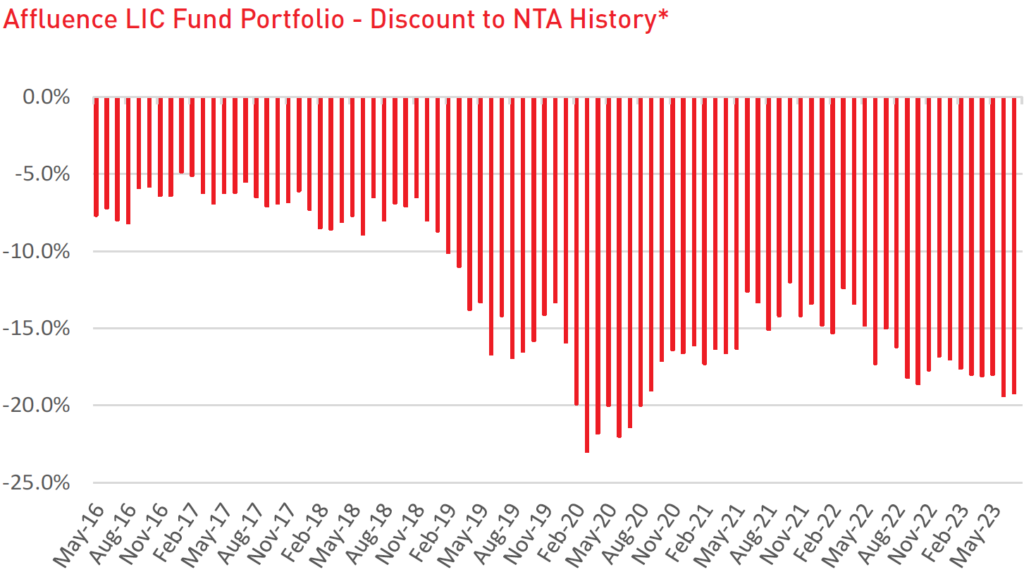

The current portfolio of the Affluence LIC Fund has an average discount to net asset value of 19%. The only time it has been higher since the Fund commenced in 2016 was during the COVID crunch of 2020.

*Discounts estimated by Affluence. The Affluence LIC Fund portfolio varies from month to month.

The Affluence LIC Fund seeks to invest with some of the best LIC managers while simultaneously taking advantage of unusually large discounts and short term trading opportunities via our unique discount capture strategy.

With quarterly distributions and access to a wide range of quality LICs, the Affluence LIC Fund may be a useful addition to your investment portfolio. Learn More About the Fund

Things we found interesting

Chart of the month: Mind the gap

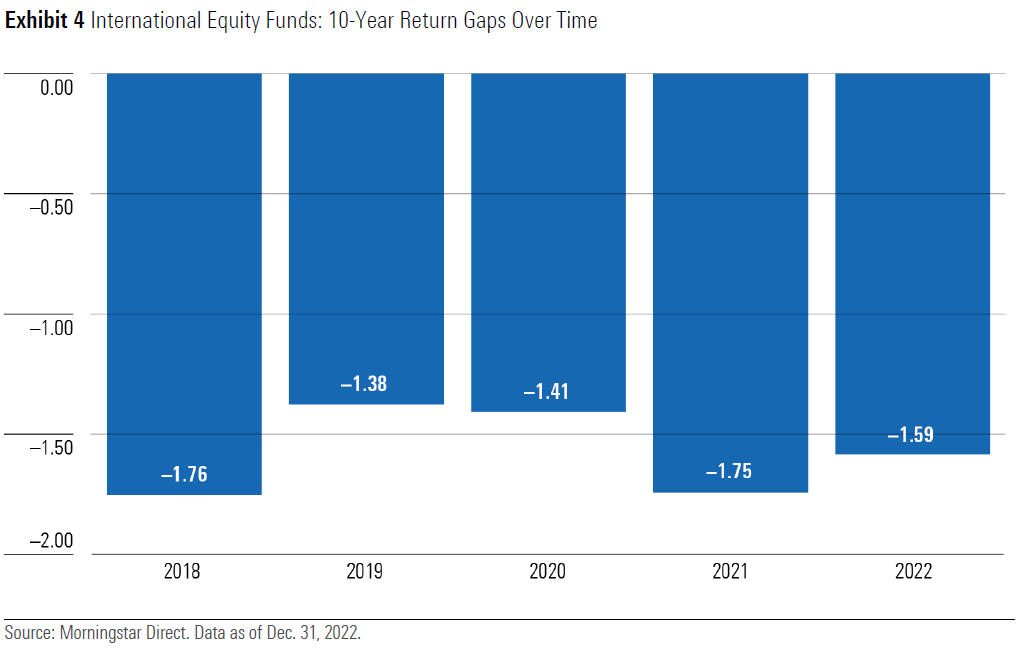

Morningstar undertakes an annual “mind the gap” study, which measures the difference in returns between what the average managed fund achieves, and what the investor in those funds receives. The data is from the US, but these types of studies usually show similar results when conducted using Australian data.

Below, we can see the results for US based international equity funds. Over the 10 years to December 2022, the average investor received a return that was 1.59% per annum worse than the Fund itself achieved. Across all seven categories Morningstar measured, the average investor did 1.68% per annum worse. To quote Morningstar, “This shortfall, or gap, stems from poorly timed purchases and sales of fund shares, which cost investors roughly one fifth the return they would have earned if they had simply bought and held.”

Over the years, this data and other similar studies have shown that there is a consistent discrepancy between investor returns and underlying fund/market returns. This suggests that investors, as a whole, get their timing decisions wrong. This tends to stem from two key mistakes. First, succumbing to the temptation to buy during the late stages of bull markets, and to sell during market corrections. And secondly, but related to that same theme, is the tendency to buy stocks/sectors and asset classes that have recently shown very high returns. Quite often, one or two years of very high returns are followed by a poor year.

The study also throws up four other very important lessons for investors trying to avoid such mistakes.

- Hold fewer, more widely diversified funds and invest more regularly. Investors in diversified funds (such as our Affluence Investment Fund) tend to capture a greater share of the Fund total returns. This is because they are designed to span multiple asset classes and rebalance on a regular basis, sparing investors from having to do as much maintenance.

- Be careful with highly volatile funds. Investors have struggled to successfully use narrowly focused or highly volatile funds. These types of funds saw some of the largest return gaps. This makes sense. The more a fund rises and falls, the more tempting it is to make the wrong decision. It’s why for all of our funds, we aim to make them less volatile than the markets they invest in.

- Keep it simple. The evidence suggests that investors enjoyed greater success when they favored simpler solutions. Interestingly, Morningstar found larger gaps in areas and styles which are usually used to better diversify portfolios (for example emerging markets). Again, the added volatility these strategies entail has ended up offsetting any excess return investors might have earned, and then some.

- Finally, and perhaps most surprisingly, the negative return gap was larger for passive/indexed investments vs active funds. Not only did index funds have lower investor returns in all seven category groups, but for six of those categories, the investors in active funds received a better average return than the passive alternatives.

This month in financial history.

On August 23rd, 1976, the first index fund available for retail investors was launched. It was called the First Investment Trust, and was sponsored by a upstart Vanguard, which had only been incorporated the year prior. Management of the fund was based on the simple principle that a low cost, passively managed investment fund will outperform the majority of actively managed funds over time. Vanguard’s fund charged a 0.20% expense ratio. This is still low today, but at the time was unheard of – average funds charged around 1.5%.

The First Investment Trust launched with $11 million in assets. Today it still exists. It is now known as the Vanguard 500 index fund, and currently manages over $300 billion in assets, making it one of the largest funds in the world.

Quote of the month:

“If there’s going to be the kind of dip in earnings that I expect, the market will not look through that…If I don’t see the earnings damage in the third quarter, I’m wrong.”

Morgan Stanley strategist Mike Wilson (no relation!) is sticking to his guns.

Vaguely interesting facts.

A 1907 ad for Kellogg’s cornflakes offered a free sample to any customer who winked at their grocer. So far as we know, the offer is still valid. Why don’t you try it next time you’re at the supermarket.

The number of annual shark bites around the world is only one tenth of the annual number of people in New York bitten by other people.

The logo for the famous Chupa Chups lollipop was designed by surrealist artist Salvador Dali.

A black cat crossing your path (from right to left) is considered good luck in Germany.

The longest ever case of hiccups lasted 68 years. *

Source: mentalfloss.com, wikipedia.com.

* American Charles Osborne had the hiccups from 1922 to 1990. It all started after an accident at work, as Charlie fell down while lifting a heavy object. “I felt nothing, but the doctor said later that I busted a blood vessel the size of a pin in my brain,” Charlie recalled. Osborne traveled long distances to visit a bunch of doctors. But none could find a cure that was tolerable, so Charlie settled for learning a breathing technique that minimised the hiccup sound. He led a relatively normal life in which he had two wives and fathered eight children. He continued hiccuping until one morning in February 1990, when they mysteriously stopped. A year later, Charlie passed away due to natural causes. It is estimated that Osborne experienced around 430 million hiccups during his life.

There were various theories as to the cause of Charles’s problem. His original doctor believed that Osborne’s fall destroyed a small area in the brain stem that inhibits the hiccup response. A neurosurgeon specialising in treating hiccups theorised that he sustained a minor injury to the ribs during his 1922 accident, causing damage to his diaphragm. Another possibility is that Osborne hit his head and had a stroke. If Charles was alive these days, he could perhaps have fixed the problem with a HiccAway. The device was invented by a neurosurgeon in 2020, and apparently relieves hiccups for chronic sufferers.

Thanks for reading. If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.