Hi,

Returns were close to zero across many markets in January. Prices climbed through most of the month, only to have those gains largely eroded in the last week. Likewise, it was a fairly uneventful month for the Affluence funds, with returns between 0.4% and -0.1%. Monthly reports are below.

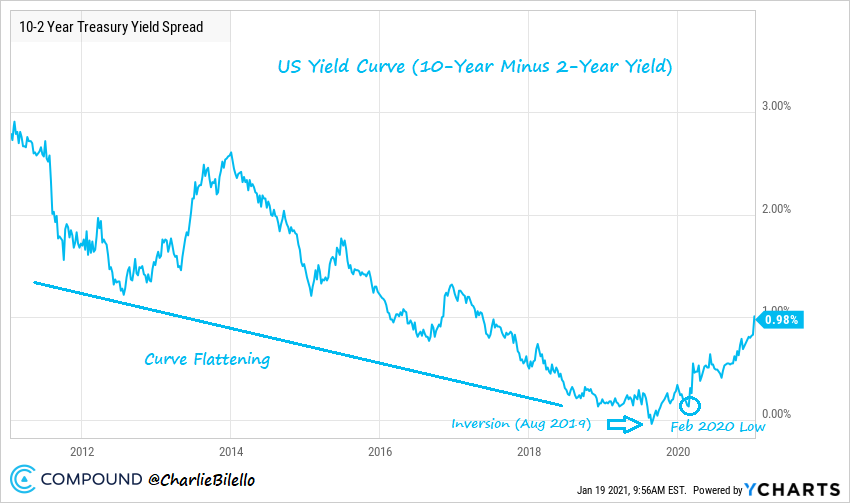

Some of the most significant investing trends over the last 10 years can be summarised as follows:

- Large Caps over Small Caps.

- US over International.

- Growth over Value.

- Tech over Everything.

- Long Duration over Short Duration.

- Stocks over Commodities.

This might, finally, be changing. Below is a link to a piece from advisor Charlie Bilello with a series of graphs showing potential turning points in all those trends. If that’s the case, it will be good for all of our funds, but in particular for our Affluence Small Company Fund.

If you’d like to invest with us this month, applications for the Affluence Investment Fund and Affluence Small Company Fund close on Thursday 25 February. Affluence LIC Fund applications must be completed by Friday 26 February. As always, go to our website and click the “Invest Now” button to apply online or download application/withdrawal forms. If you have any questions, simply reply to this email or give us a call at any time.

Read on for our monthly Fund reports and other interesting stuff.

Daryl, Greg and the Affluence Team

Affluence Fund Reports & News

Affluence Investment Fund Report

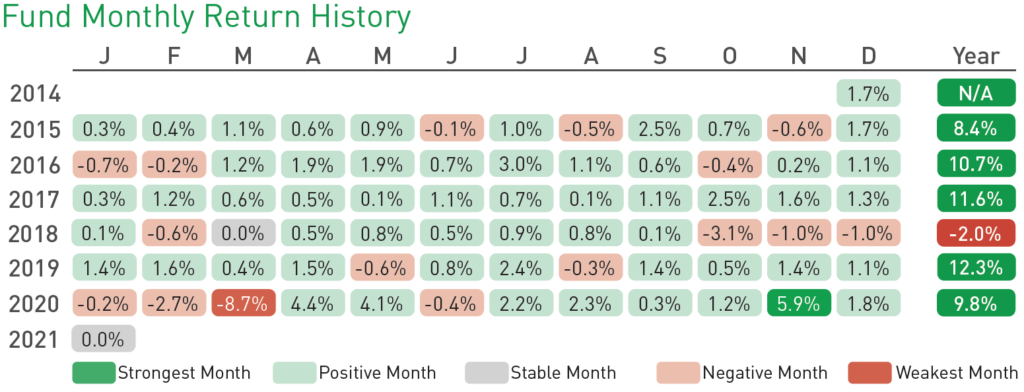

The Fund was flat in January. Since commencing in 2014, returns have averaged 8.4% per annum, including monthly distributions of 6.7% per annum. See the report for more detail including detailed performance and top holdings.

Affluence LIC Fund Report

The Fund returned 0.4% in January. Since commencing in 2016, returns have averaged 12.7% per annum, including quarterly distributions of 7.4% per annum. See the report for more detail including detailed performance and top holdings.

Affluence Small Company Fund Report

The Fund returned -0.1% in January. Since commencing in 2016, returns have averaged 8.5% per annum, including quarterly distributions of 5.9% per annum. See the report for more detail including detailed performance and top holdings.

Trend reversal imminent?

“When secular trends reverse, no bell is rung, and no one can believe that a shift has actually occurred.”This article, from Charlie Bilello expands on this, and looks at a few long term trend reversals that just might be underway.

All Weather Fund, Monthly Distributions

The Affluence Investment Fund gives you access to a portfolio of vastly diversified assets and investment styles through a range of exceptional fund managers chosen by us. The result is an all-weather portfolio that can deliver in differing market conditions. Many of the managers in the Affluence Investment Fund are closed to new investors, only available to wholesale clients or have high minimum investment amounts.

The Affluence Investment Fund targets a minimum distribution rate of 5% per annum. Over the life of the Fund, cash distributions have averaged 6.7% per annum. Distributions are paid 10 days after the end of each month, or you can reinvest and receive additional units.

Returns shown above exclude franking credits received from investments and passed through in full at the end of each tax year. These have typically averaged 0.4% to 0.5% per annum.

Other Interesting Stuff

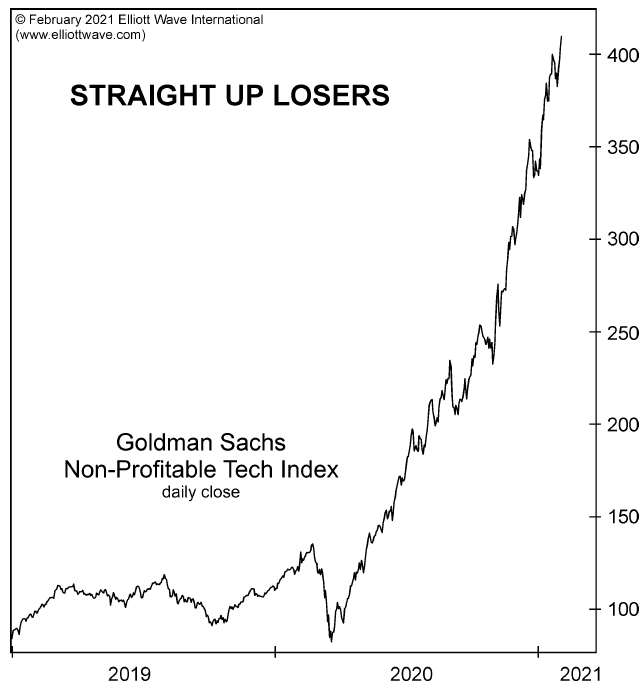

Chart of the month.

This month, it’s the Goldman Sachs Non Profitable Tech Index (which is exactly what it sounds like – listed tech companies that make no money). It has rallied over 400% since March 2020.

Wall Street vs the Internet:

The big story of January was GameStop. You could not make this stuff up! A couple of million David’s (individual investors, mostly under 35) vs a few Goliaths (evil hedge funds). This fascinating episode of investor rebellion has played out in three distinct stages. This story from Chartr, succinctly summarises parts 1 and 2. Part 3 is currently in it’s final stages.

Here’s the lowdown.

Part 1: The setup

For the last few years US listed company GameStop has been a business in decline as a predominantly brick-and-mortar computer gaming retailer and its share price reflected that. GameStop had long been the target of short sellers and by mid 2020, it was among the most shorted stocks in the entire market. A range of hedge funds had effectively bet that the company’s share price would keep falling, perhaps all the way to zero.

As the shares really began to scrape the barrel (at around the $4 – $5 mark), a few investors began to see an opportunity. Among the more notable believers was Michael Burry, which is a name you might recognise from 2015 film The Big Short. Less notable investors included a Reddit user who we will call DFV (because his actual Reddit name is unprintable) who bought a bunch of call options back in the middle of 2019.

Throughout 2020, a few other investors jumped on the bandwagon, including subscribers to subreddit WallStreetBets. By late last year GameStop’s share price rice had risen to the mid-teens, closing out 2020 at just under $19.

Part 2: The sting

The uptick in fortunes in late 2020 resolved more hedge funds to bet against GameStop, anticipating it would eventually resume its downward trajectory. What the hedge funds shorting the stock didn’t bank on was just how determined and reckless a group of hundreds of thousands of mostly amateur investors could be. Meanwhile, as the price rose, DFV’s regular updates via WallStreetBets on his GameStop options revealed greater and greater paper profits – and reached a greater and greater audience.

Inspired traders jumped on the WallStreetBets train, and in January and early February this grew into an enormous movement with two goals. The first was to make money. The second was to screw over the Wall Street elite betting against GameStop.

Many of the small investors/speculators buying the stock were motivated solely by their experiences (or those of their parents) after the 2009 financial crisis. The quote below, from one WallStreetBets subscriber typifies the depth of feeling towards those perceived to have profited before and during the GFC at the expense of ordinary people:

“If I lose $600 and they lose $6 billion I’m good with that. I know what I’m risking.

Edit:Because I’m getting people actually telling me I’m being stupid with my money let me make it more clear. I would light $600 on fire if it meant one hedge fund took meaningful loss and was forced to realize why it happened.”

As these traders bought call options (betting the price will go up), the mechanics of the option market meant that it caused the price to move much higher. The hedge funds holding short positions began to show huge losses. As they ran out of courage, or money, they had to start unwinding that short exposure by buying shares or otherwise limiting their exposures. That sent the share price even higher in a vicious feedback loop known as a short squeeze.

One hedge fund, Melvin Capital, reportedly lost over 50% of its entire investment capital in January and had to have $3 billion injected into it to shore up its finances. In late January, GameStop shares reached a high of over $450. Remember, this is a company that is probably worth, at best, $15 a share. It was trading at 30+ times that value. It was Wall Street vs the Internet and the internet was winning big.

Part 3: Reality bites

Unfortunately for the little guys, when something trades at an unsustainable price, it’s unsustainable. WallStreetBets traders trying to make money were expecting an ever bigger price spike, driven by the belief that short sellers still had a massive exposure to the stock. Many pledged to never sell, just so long as they could inflict major damage on Wall Street.

Due to the opaque rules and timing delays around short selling disclosures in the US, we will probably never know exactly when or exactly how the hedge funds negated their exposure to the stock. But on 29 January 2021, GameStop started falling and kept going. At the time of writing it is back to around $50 per share. Before this is over it will probably be a $10 stock again. It looks like the GameStop squeeze of 2021 is done.

It is likely, when the analysis is complete, that the biggest winners were the value investors and others who bought before mid 2020. Of course, they also probably sold well before the top. The losers will probably include many hedge funds who shorted the stock. But unfortunately, it will also include most of the young WallStreetBets crowd who brought shares at between $50 and $450 and will probably lose almost all of it.

Quote of the month:

“Above all else…the stock market is people. It is people trying to read the future. And it is this intensely human quality that makes the stock market so dramatic an arena in which men and women pit their conflicting judgements, their hopes and fears, strengths and weaknesses, greeds and ideals.”

Bernard Baruch.

Bernard Baruch was born to a Jewish family in 1870 in South Carolina, USA. He was the second of four sons, including brothers Herman, Sailing Wolfe and Hartwig. In 1881 the family moved to New York City, where Bernard attended local schools. He graduated from college in New York and became a stock broker.

With his earnings and commissions, he bought a seat on the New York Stock Exchange. There he amassed a fortune before the age of 30 by profiting from the sugar and rubber markets. By 1903 Baruch had his own brokerage firm and gained the reputation of “the lone wolf of wall street” because of his refusal to join any financial house. By 1910, he had become one of Wall Street’s best-known financiers.

Bernard Baruch then made millions in the 1920’s US bull market in stocks. Showing an uncanny ability, he started anticipating a Wall Street crash as early as 1927 and sold stocks short periodically in 1927 and 1928. In September 1929, after the 1929 peak of the Dow, Baruch refused to join a bull pool of financiers to support the declining market.

Bernard was as prolific a source of quotes as Churchill (with whom he was reportedly friends). Here are some more classic Barnard quotes:

On investing:

“Most of the successful people I’ve known are the ones who do more listening than talking.”

“Never follow the crowd.”

“The investing public was wary, as it always is when things are cheap.”

“The main purpose of the stock market is to make fools of as many men as possible.”

“I made my money by selling too soon.”

“Something that everyone knows isn’t worth anything.”

“During my eighty-seven years I have witnessed a whole succession of technological revolutions. But none of them has done away with the need for character in the individual or the ability to think.”

“Don’t try to be a jack of all investments. Stick to the field you know best.”

“I get the facts, I study them patiently, I apply imagination.”

“Approach each new problem not with a view of finding what you hope will be there, but to get the truth.”

“I think economists as a rule…take for granted that they know a lot of things. If they really knew so much, they would have all the money and we would have none.”

On life in general:

“Those who matter don’t mind, and those who mind don’t matter.” This was actually in response to question about how he handled the seating arrangements for all those who attended his dinner parties.

“There are no such things as incurable, there are only things for which man has not found a cure.”

“To me, old age is always fifteen years older than I am”

“I have always done some physical exercising, which undoubtedly has helped me stay in good health.” Bernard Baruch passed away just before his 95th birthday.

A statisticians dream:

If you like financial charts then you’ll love this free resource. The JP Morgan quarterly guide to the markets highlights long term economic trends in Australia, the world and key economies.

Video of the month:

Video of the month: Last week, it was time once again for the most watched global TV event of the year. The Superbowl. And you know what that means. Superbowl ads. Here’s this year’s top 10.

Did you know:

When bar codes were patented in 1952, they were round.

The rule of 72 is a way to estimate how long it will take for something to double in value. Just divide 72 by the expected return. So, if an investment returns 5% per annum, it will take roughly 14 years (72 divided by 5) to double, assuming you reinvest all returns.

Humans have a stereo sense of smell. Our two nostrils work like two ears to subconsciously help us move towards the source of an odour.

And finally:

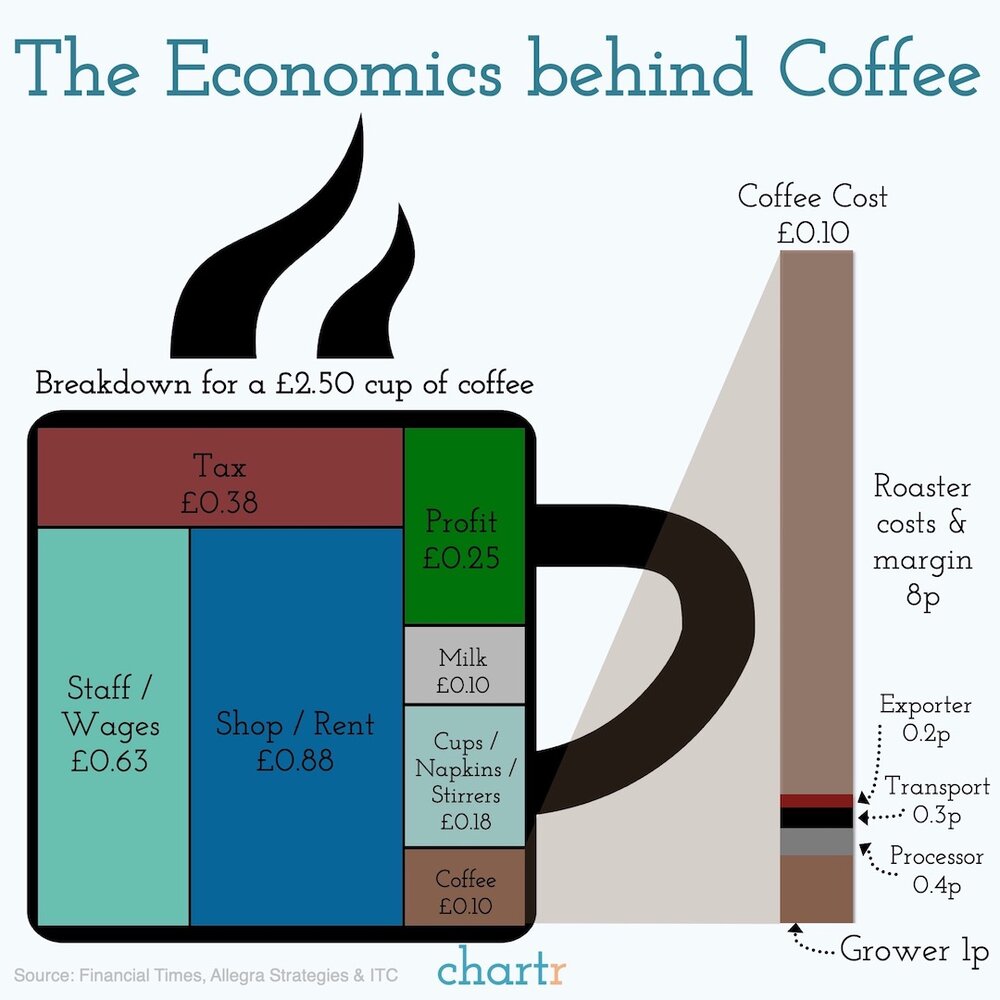

Ever wonder how much the grower of the coffee beans in your morning cup gets paid? Wonder no more. Sadly, it’s about 2 cents. Here’s the rest of the breakdown. Unfortunately, it’s all in UK money. But just double the figures and change the pounds and pence to dollars and cents and you’ll be close.

Media and Presentations

We regularly present to investment groups on various topics including our Affluence Funds, how we choose great fund managers, LICs and the investment environment.If you would like to meet with us or have us speak with your investment group, get in touch.

Are you an Affluence Member?

We’ve spent hundreds of hours looking for Australia’s best Fund Managers and LICs.Click below to register as an Affluence Member and see the results of all our hard work! Access our Affluence Fund portfolios and profiles of managers we invest with.

Thinking about Investing with us?

If you would like to learn more about our Funds, or invest with us, the buttons below will take you to the right places.

If you have a question, you can email or call using the details below. Alternatively, click on the ‘contact us’ button, fill out the contact form on our website and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete and it does not take into account your investment objectives, financial situation or needs. Prospective investors in any Affluence Fund should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contain important notices and disclaimers and important information about the relevant offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. The value of your investment will go up and down over time, returns from each fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that there is always the chance that you could lose money on an investment. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM is not a recommendation by Affluence or any of its officers, employees, agents or advisers and potential investors are encouraged to obtain independent expert advice before any investment decision.

The Morningstar Rating™ is an assessment of a fund’s past performance – based on both return and risk – which shows how similar investments compare with their competitors. A high rating alone is insufficient basis for an investment decision. © 2019 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘class service’ have been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. Refer to our Financial Services Guide (FSG) for more information at www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a professional financial adviser.