Hi,

The last 6 weeks have seen a continuation of the market roller coaster we seem to have been on all year. In early October, markets rose very strongly, then corrected during the last week, giving back the majority of the gains. Then, in early November as the result of the US election became more certain (sort of), markets again rallied.

And then came the big one. Early this week, on what has been termed Vaccine Monday in financial markets (even though it was Tuesday in Australia), we had news that one of the leading vaccine candidates had better than expected trial results. This led to a huge one day rotation out of recent winners, and into the market laggards who stand to gain the most from a quicker return to normality.

It is being hailed by many as the beginning of the long overdue return of value stocks. We’re not sure that’s right, but if it is, our portfolios stand to benefit from this trend. What is certain, is that investors have finally turned their minds to whether at least some of the valuation difference between the growth darlings and the value dags is overdone. That can only be a good thing.

Next week, we’re holding our first ever live webinar. If you’re interested, we’d love you to join us. We’ll be talking about our funds, profiling some of our key holdings, explaining how we are positioned in what continues to be a very tricky investment environment and of course, answering all your questions. See below for the link to register.

If you’d like to invest with us this month, you’ve got until Wednesday 25 November to apply for the Affluence Investment Fund or Affluence Small Company Fund. Affluence LIC Fund applications must be completed by 30 November. As always, go to our website and click the “Invest Now” button to apply online or download application/withdrawal forms.

If you have any questions, simply reply to this email or give us a call at any time. In the meantime, read on for our monthly fund reports, our key LIC picks for the next 12 months, and other stuff we found interesting.

Daryl and the Affluence Team

Affluence Fund Reports & News

Affluence Investment Fund Report

The Fund returned 1.2% in October. Since commencing in 2014, returns of 7.4% per annum have exceeded the ASX200. Distributions have averaged 6.7% per

annum, paid monthly. See the report for more detail including our top holdings.

Affluence LIC Fund Report

The Fund returned 2.7% in October. Since commencing in 2016, returns of 10.6% per annum have exceeded the ASX200. Distributions have averaged 7.3% per

annum, paid quarterly. See the report for more detail including our top holdings.

Affluence Small Company Fund Report

The Fund returned 2.4% in October and has outperformed the ASX Small Ordinaries index by 14.3% over the past year. If you’re a wholesale investor looking for out of favour small cap value, you’re going to find this fund very interesting.

Top Listed Investment Company picks

Last week was the Melbourne Cup and you know what that means. Once again we’ve rummaged through the LIC bargain bin to come up with our best picks for the year ahead. Most have already increased significantly since we wrote this.

Register for our live Webinar

Next week, we’re holding our first ever live webinar. We’ll be discussing:

- How each of our funds are currently positioned.

- Some of our top fund and LIC holdings.

- Where we’re seeing opportunities in this market.

It will take no more than an hour and you will of course have the chance to ask questions.

If you would like to register, the link is below. Do it now! Register Now

Other Interesting Stuff

Chart of the month.

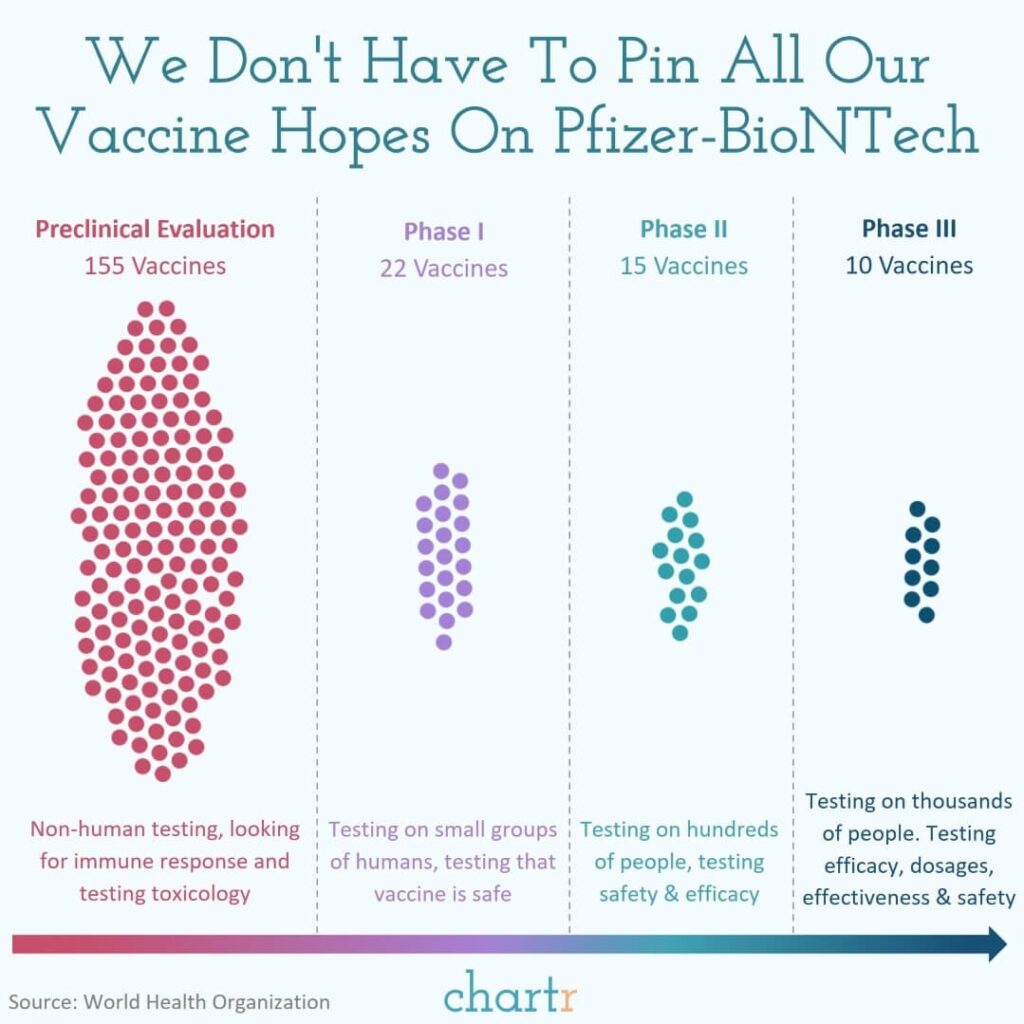

Following on from the good news this week, there are many more vaccines in the pipeline. Results for several promising phase 3 studies will be released in coming weeks/months. That, more than anything else, might determine the market direction in the short term.

This week in (financial) history:

For much of the abbreviated three-hour trading day on 11 November, 1929, investors breathed a sigh of relief, as the market’s recent panic seemed to lift. Until the last hour, volume was light and stocks held steady. Then a tidal wave of selling crashed onto the floor of the New York Stock Exchange. General Electric and New York Central Railroad hit new lows for the year. The Dow Jones Industrial Average finished with one of its worst days ever, losing 6.8% and bringing losses from the year’s high to over 40%.

It was to get worse. A lot worse. Despite a strong recovery into early 1930, the index lost over 80% from the 1929 peak, to the trough in 1932. Ouch!

Source: https://jasonzweig.com/

Brain teaser

A girl meets a bull and a bear in the forest. The bull lies every Monday, Tuesday, and Wednesday, and the other days he speaks the truth. The bear lies on Thursdays, Fridays, and Saturdays, and the other days of the week she speaks the truth.

“Yesterday I was lying,” the bull told the girl. “So was I,” said the bear. What day is it?

See below for the answer.

Quote of the month:

“Investors, faced with having to do due diligence remotely, have been sending the lion’s share of any new money to the large diversified asset managers that they already know. But it’s the smaller hedge fund managers that are providing the best returns, according to new research. Hedge fund managers with less assets on average generated returns of 10.6 percent year to date through August. Managers on the opposite side of the spectrum, those with the largest amount of assets, returned 1.3 percent year to date.”

From an Institutional Investor article, quoting recent research by hedge fund allocator PivotalPath. It turns out when it comes to investment management,

that smaller is better.

Video of the month:

Baby Shark, the insanely repetitive kids song, has now notched up over 7 billion views on YouTube and recently became the most-viewed video on the site, marginally ahead of the music video for another classic (not!), Despacito.

This time lapse shows how the 15 most viewed videos on YouTube have changed between 2011 and now. It appears to confirm that YouTube is mostly frequented by a younger audience.

How fit are you really?:

Physical fitness is key to a long life and good health. You can estimate your fitness level by answering a few questions on this website.

It’s a global initiative, backed by the Norwegian University of Science & Technology. And finally:2020, thank goodness it’s almost over…

Brain teaser answer:

Thursday. But please don’t ask us to explain why.

Media and Presentations

We recently spoke with Jonathan Shapiro at the AFR about out top LIC picks.

Here’s the full article.

We regularly present to investment groups on various topics including our Affluence Funds, how we choose great fund managers, LICs and the investment environment.If you would like to meet with us or have us speak with your investment group, get in touch.

Are you an Affluence Member?

We’ve spent hundreds of hours looking for Australia’s best Fund Managers and LICs.

Click below to register as an Affluence Member and see the results of all our hard work! Access our Affluence Fund portfolios and profiles of managers we invest with.

Thinking about Investing with us?

If you would like to learn more about our Funds, or invest with us, the buttons below will take you to the right places.

If you have a question, you can email or call using the details below. Alternatively, click on the ‘contact us’ button, fill out the contact form on our website and we will be in touch with you as soon as we can.

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete and it does not take into account your investment objectives, financial situation or needs. Prospective investors in any Affluence Fund should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contain important notices and disclaimers and important information about the relevant offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions.

Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. The value of your investment will go up and down over time, returns from each fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that there is always the chance that you could lose money on an investment. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM is not a recommendation by Affluence or any of its officers, employees, agents or advisers and potential investors are encouraged to obtain independent expert advice before any investment decision.

The Morningstar Rating™ is an assessment of a fund’s past performance – based on both return and risk – which shows how similar investments compare with their competitors. A high rating alone is insufficient basis for an investment decision. © 2019 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘class service’ have been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. Refer to our Financial Services Guide (FSG) for more information at www.morningstar.com.au/s/fsg.pdf.

You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a professional financial adviser.