We first started investing in LICs back in 2015. We didn’t start out specifically targeting them. But we realised there were some features in the LIC market that made them an attractive investment opportunity.

The biggest positive from our point of view is the potential for LICs to trade at prices below the value of their net tangible assets. In other words, you can buy a dollar of investment value at a discount. Over time, that discount can move higher or lower, or even turn into a premium (where an LIC trades at a price above its NTA). That can be viewed as both a positive and a negative. We feel it provides an important opportunity to add value and it’s a feature unique to LICs. It’s not shared by ETFs and unlisted funds, which by design usually always trade at prices very close to their NTA.

Right now, the average level of LIC discounts is very high, much higher than usual. It’s also unusual that the discount has appeared at a time when the ASX has been going very well. History would suggest that LICs are more likely to trade at a discount when times are tough. That situation is presenting a good opportunity to reallocate some equities exposure away from areas that have done very well, and towards LICs.

Why are discounts so large right now?

While average discounts as at June 2019 are the largest since about 2012, getting to this point has taken a while. A big factor was the attempt by the Federal opposition to alter the franking credit regime as part of their election campaign. From late 2018, this led to both a reduction in buyers for LICs, combined with selling from holders concerned about the potential impact on them from a loss in franking credits.

At the same time, investors fell in love with debt-based LITs (listed investment trusts). We’ve seen over $2 billion raised for this sector in the last 12 months. These debt LITs are currently trading at premiums, despite in many cases only targeting and achieving relatively low yields. It seems investors have been very much attracted to “certain yield” and are prepared to pay a very big premium for it compared to traditional LICs investing in equities.

Following the Coalition victory in the May election, it looked like interest in LICs might return. However, the combination of tax loss selling and significant underperformance by many active managers in a strongly rising market, saw NTA discounts continue to widen all the way to 30 June.

What’s next?

Since the end of the financial year, we’ve seen some tentative signs that interest in LICs was returning. We expect debt based LITs will continue to be in high demand. But market buyers for traditional LICs are also returning in July. We think that will continue, as NTA discounts had increased to levels where activist investors have started to take meaningful stakes. We expect that if discounts stay where they are, these activist investors will continue to get more involved.

At the same time, underperformers are starting to come under more pressure from shareholders. We’ve seen two LIC’s run by Watermark delist recently and convert to unlisted funds, thereby offering investors the opportunity to exit at NTA. This represents around a 20% uplift from the levels of discount they were trading at prior to announcement of those transactions. We’re currently seeing another LIC (8EC) looking to wind up and return investor capital, having performed poorly and also traded at a 20%+ discount prior to the announcement.

We expect there are a range of LICs that will be under pressure to perform over the next short while, or significantly close the discount to NTA. If that doesn’t occur, they are likely to come under significantly more pressure to delist or wind up.

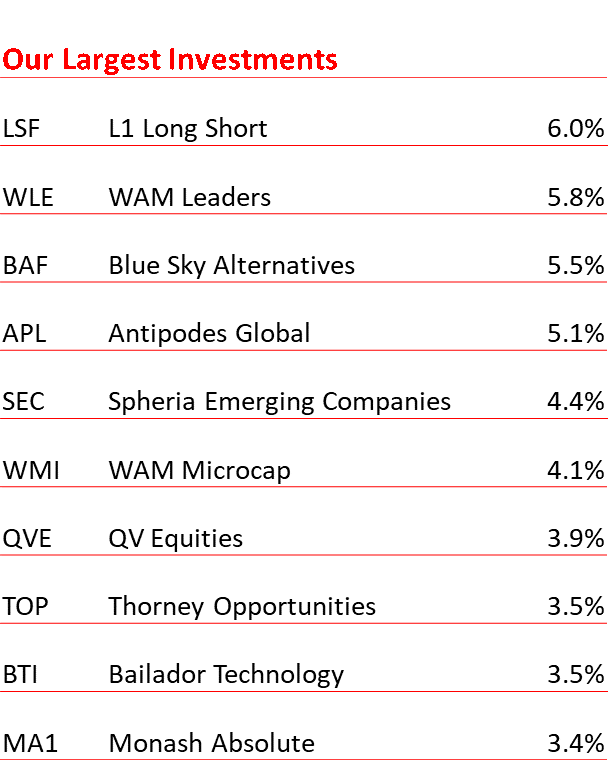

Our current top 10

As at 30 June, the average discount to NTA was 16%. That represents a significant head-start compared to longer term market averages. We see some opportunity in buying LICs which might be subject to corporate actions or investor dissent. But our top ten holdings at 30 June (shown below) are predominantly run by managers with exceptional track records, trading at discounts much higher than average.

Summing up

The major reason the LIC market is attractive to us, is that they can trade at prices that are quite different to the value of their assets, otherwise known as their NTA. It’s the major difference between LICs and many other types of investment funds. Right now, the discounts available are much greater than average, which represents a compelling opportunity.

Take care and all the best with your investing.

We hope that was helpful. If so, here are some other resources you might like.

Find out more about the Affluence LIC Fund.

See more of our articles.

Find out all about us.

Subscribe to our free monthly Affluence newsletter.

Become anAffluence Memberand access profiles of some of Australia’s best fund managers and full details of our Affluence investment portfolios.