Key Details

Profile date: July 2016

Manager: Watermark Funds Management

Fund: Watermark Market Neutral Trust and two LIC’s

Fund Type: Retail Unlisted Fund and LIC’s

Investments: ASX listed stocks

Key People: Justin Braitling

Strategy: Market neutral fund manager that looks to generate positive returns regardless of the direction of the underlying market.

Risk profile: Medium. Being a market neutral fund it has a reasonable level of gearing, however the hedged nature of the strategy has resulted in volatility being quite low.

Affluence Weighting: As at June 2016, the Watermark Market Neutral Trust makes up around 3% of the Affluence Fund’s portfolio.

Why we like it

Watermark Funds Management is a boutique specialist market neutral fund manager based in Sydney. This manager runs one of three market neutral funds we are currently invested in.

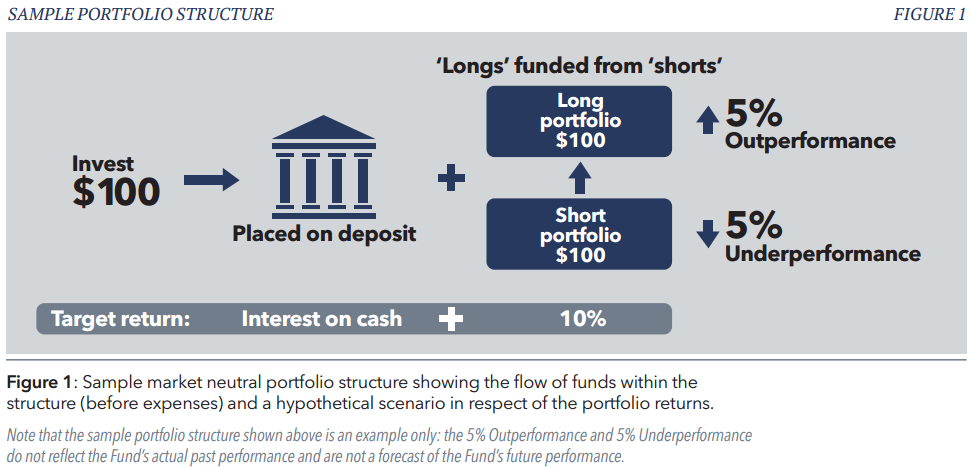

A market neutral fund aims to profit from the relative performance of two very different portfolios of shares of equal value. Firstly, in much the same way as most investors, the manager buys a portfolio of shares they like, with the expectation this portfolio will deliver better than average returns over time. At the same time, they sell (or short) a portfolio of shares they don’t like. The manager expects this second portfolio to deliver much worse results than the market over time. The combination of these portfolios provides a market neutral structure. In simple terms, by holding equal value of long and short positions, exposure to the underlying sharemarket movements is significantly reduced.

Shorting a stock is complicated. Stock must be borrowed from another investor that owns it – usually at a cost – and must be returned in certain circumstances. Thus not all stocks can be shorted and sometimes can only be shorted in limited amounts. It requires a specialist team who have a lot of experience in the field. The team at Watermark have these skills and have honed them over many years.

Source: Watermark Funds Management

Investors in the fund profit to the extent the long portfolio outperforms the short portfolio. Therefore, returns from the fund reflect the manager’s ability in selecting shares to buy and sell (short).

The reason we like market neutral funds is that they can make money regardless of the performance of the underlying market. This is the case even in a falling market. For example, if the ASX 200 falls by 5%, a market neutral fund can still make money if the shares the bought long perform better than the shares they sold short. In fact, in many cases market neutral funds tend to perform best in falling markets, because the performance gap between the long and the short parts of the portfolio is wider.

For outstanding managers (such as Watermark) this can result in strong returns, with a low correlation to the general market and low volatility, a combination that we love.

What the Manager does

Watermark Funds Management currently manages one retail unlisted fund and two LIC’s. They all have similar strategies, except for the amount of flexibility around the net long or net short exposure.

The key manager is Justin Braitling who has significant experience in financial analysis and investing over many years.

Watermark run their investments as two separate portfolios, long and short. The long portfolio aims to invest in shares of strong, well-managed business than can be purchased for cheaper than their intrinsic value. These companies generally display the following characteristics:

- A history of superior returns through the economic cycle;

- Management with a track record of creating and distributing value to security holders; and

- The capacity to grow.

The short portfolio looks to borrow and sell (short) shares in companies with the opposite characteristics to the above, those with weak fundamentals that can be sold for more than the intrinsic value.

As at 31 May 2016, the unlisted fund (Watermark Market Neutral Trust) owned shares with a value of 93% of net assets. They had short sold shares to the value of -98% of net assets. This provides a total gross exposure of 191% of net assets (93% plus 98%) and net exposure of -5%. The gross exposure is calculated as the sum of the long and short portfolios, while the net exposure is the difference between the two. In practical terms, this means for every $10,000 an investor has in the Fund, the Fund has used $9,300 of the cash to purchases shares. They have also sold $9,800 borrowed shares and hold the proceeds of these sales in cash also. This means a total of $10,500 is held in cash for each $10,000 invested in the Fund.

Performance History

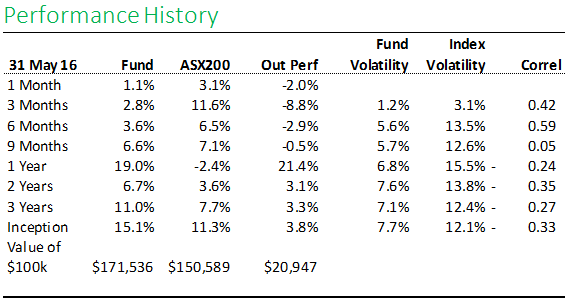

Since inception in August 2012 to May 2016 the fund has delivered an average annual compound return of 15.1%. Over the same period the ASX 200 Accumulation Index has returned 11.3%, resulting in outperformance of 3.8% per annum. This was achieved with volatility of roughly half the ASX 200 Accumulation Index, and a negative correlation to the general market.

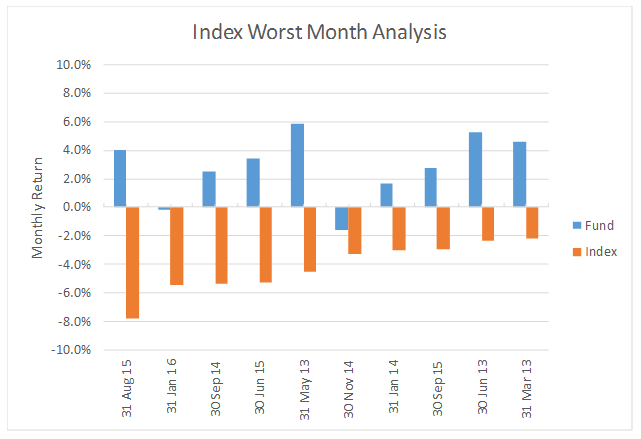

The following graph demonstrates why we hold this fund. It shows the 10 worst performing months for the ASX 200 since inception of the fund, and the performance of the fund for those months. What it shows is that the fund has outperformed significantly when the market has fallen. This is a great attribute to our portfolio as it helps to reduce overall volatility, provides some protection in falling markets, and still produces strong positive returns.

Potential risks

We spend a significant amount of time thinking about what could go wrong for each investment we make. Outside of normal equity market risks, here are our top risks for this Fund:

1. Fund Strategy

One of the things that we love about this fund, is also the source of one of its highest risks. Given that it is by default market neutral, just because the underlying share market increases over time, does not mean that the fund will make positive returns. Positive returns are generated by the skills of the investment manager, not by the general upwards trend of the market. However, the fund manager has proven their ability to generate positive returns, and we believe they have the skill to continue to do so in the future. Nonetheless, there will be periods where the manager and the Fund underperform the market.

2. Gross Exposure

While the fund usually maintains a net exposure of around 0%, the gross exposure (long plus short positions) is often around 200% of net assets. It can be up to 400%, however this would be unusual. This structure in effect equates to a fairly high level of leverage within the portfolio. Leverage can increase both positive and negative returns, and while historically the fund has maintained volatility of less than the market, there is the potential for greater downside risks. We are mindful of this when reviewing our asset allocation and would usually limit allocations to these types of funds.

3. Short Selling

Short selling shares can be dangerous. In theory, while losses on a bought stock are limited to the amount paid for it, a stock that is sold short can rise by many times the amount it was sold for and significantly compound losses. For example, if a stock is sold for $0.25 per share and then rises to $1.00, the investor who short sold it has lost 3 times they amount they invested. Short selling requires experience and enhanced risk management. Watermark have been active in this space for some time and we believe they appropriately manage the risk in this area.

4. Key man risk

Like most boutique fund managers, the key investment manager, Justin Braitling, is considered by us to be a significant contributor to the exceptional performance. Should it be required, investments could mostly be liquidated over a period of time and capital returned.

Conclusion

Watermark Funds Management is one of the few dedicated market neutral managers in Australia. Their performance has been very strong, and the combination of positive returns, negative correlation to the market and low volatility is a combination we enjoy.

Disclaimer: This article is prepared by Affluence Funds Management Pty Ltd ABN 68 604 406 297 AFS licence no. 475940 (Affluence) to enable investors in the Affluence Investment Fund to understand the underlying investments of the Fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any financial product advice or service. The content has been prepared without taking into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser to determine whether a particular financial product meets your objectives, financial situation or needs before making any decision to invest.