Merricks Capital – Key Details

Profile date: March 2024

Manager: Merricks Capital

Fund: Merricks Capital Partners Fund

Fund Type: Wholesale Unlisted Fund

Asset Class: Fixed Income

Investment Strategy: Commercial real estate debt. The Fund lends to highly qualified borrowers and real estate transactions for the purpose of real estate investment and development.

Affluence Exposure: The Merricks Capital Partners Fund is a core investment in the Affluence Income Trust and has been a long term holding in the Affluence Investment Fund.

What Does Merricks Capital Do?

Merricks Capital is a Melbourne based investment house. It was founded in 2007 by Adrian Redlich. Adrian is responsible for investment strategy, investors, and portfolio across all Merricks Capital products. Over the last 17 years, Merricks have pivoted to a number of different multi-strategy offerings. They invest in strategies where they believe they can exploit market dislocations, and are not afraid to close down funds and strategies when they believe the opportunity has closed. The majority of their capital comes from large institutional clients, and they generally don’t offer investments to retail investors.

What is the Merricks Capital Partners Fund

The Merricks Capital Partners Fund is a commercial real estate (CRE) debt fund. The Fund commenced in January 2017 when the manager saw the opportunity to exploit the dislocation in lending markets resulting from changes in bank lending practices. They believed that as the major banks were accounting for a lower proportion of the CRE lending market, there was an opportunity to deliver outsized risk adjusted returns.

Today, the Fund has over $1 billion of assets. In addition, a number of institutional investor mandates invest alongside the fund. The manager lends across the CRE sector to borrowers in Australia and New Zealand, including:

- Investment Loans – Lending against existing assets such as office buildings, retail shopping centres and industrial sheds.

- Development/Construction Loans – Lending to builders and developers to produce land estates, apartment projects, hotels and office buildings.

- Residual Stock Loans – Loans to developers who have completed a project and have not sold all of the units. The loan is secured against the remaining units, giving the developer time to sell down the stock.

- Agriculture – The Fund is quite unique in that the manager has the skills and ability to lend to farmers and agricultural businesses. These are generally not small family run farms, but large corporate congolomerates in the sector.

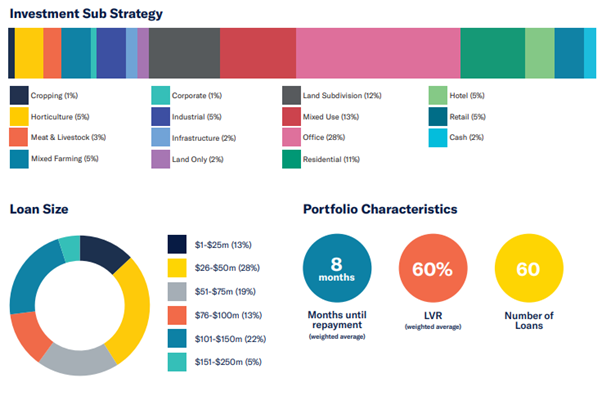

There are currently 60 loans in the Fund across these sectors, making it very diverse by borrower, sector and geography.

The following summarises the portfolio as at 31 January 2024:

Apart from the agricultural sector exposure, the other unique feature of the Fund is that the manager runs a form of hedging across the portfolio. They hedge against a decline in prices of publicly traded debt through credit default swaps (CDS) and other similar instruments. This has a small cost in most months, but can provide extra returns when markets become volatile and credit spreads expand.

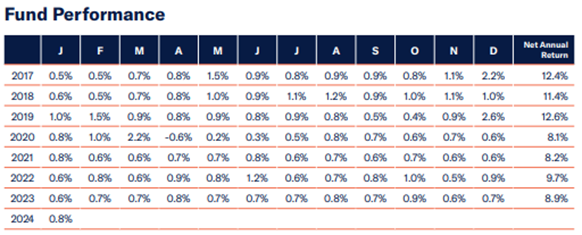

Merricks Capital Partners Fund Performance

Even before the interest rate increases over the past couple of years, the Fund was producing excellent risk adjusted returns.

The best month was March 2020, as the hedging created value during the initial Covid crisis. The only negative month was April 2020, as governments and central banks flooded the market with liquidity. This unwound the hedging gains from the previous month.

While like any CRE debt strategy there have been borrower defaults, project delays and other problems. The manager has proven they have the ability to work through these issues, take control of the asset if necessary, and not lose any capital for their investors.

Why we like the Fund

The consistency and level of returns has been impressive. While we like the CRE sector, the quality of manages varies widely. Merricks Capital have a very refined risk management process, and the appropriate expertise to assess what could go wrong with a project and how they would rectify it.

The agriculture exposure is also a point of difference. Merricks have considerable experience in this sector and have leveraged it for the benefit of the fund. The risks for an agricultural enterprise a very different to a residential development or office building. We believe the agricultural loans play an important part in diversifying the overall risks of the fund.

Lastly the hedging strategy is a relatively unique feature. This is mostly undertaken to protect the portfolio from systematic risk. While it is a small drag on performance, it can provide additional downside protection in times of trouble.

Conclusion

The Merricks Capital Partners Fund has a long track record of strong returns. Given the consistent returns of 8% plus, we believe that on a risk adjusted basis, investing in this Fund is a superior alternative to investing in most types of direct property assets.

Disclaimer

This Fund Profile was prepared by Affluence Funds Management Limited (Affluence). It was prepared to assist investors in various Affluence funds in understanding the investments of the relevant Affluence fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any product advice or service.

This Fund Profile does not take into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser before making any decision to invest.