Key Details

Profile date: February 2026

Manager: Metrics Credit Partners

Fund: Metrics Real Estate Multi-Strategy Fund (ASX: MRE)

Fund Type: Listed Investment Trust (LIT)

Investment Strategy: MRE provides exposure to the full real estate capital structure, from senior secured debt facilities to co-investments in real estate development projects.

Affluence Allocation: MRE is currently held by the Affluence LIC Fund, and it comprises approximately 3.9% of the portfolio.

What does Metrics Real Estate Multi-Strategy Fund (ASX: MRE) do?

MRE provides exposure to the full real estate capital structure, from senior secured debt facilities to co-investments in real estate development projects. The Trust’s investment manager is Metrics Credit Partners. Metrics is one of Australia’s largest private credit managers, with total assets under management in excess of $30 billion.

The trust was launched via IPO in October 2024 and currently has a market capitalisation of approximately $300 million. MRE is one of three LITs managed by Metrics. The others are:

- Metrics Income Opportunities Trust (ASX: MXT) with a market cap over $600 million.

- Metrics Master Income Fund (ASX: MXT) with a market cap of $2.4 billion

What does Metrics Real Estate Multi-Strategy Fund (ASX: MRE) invest in?

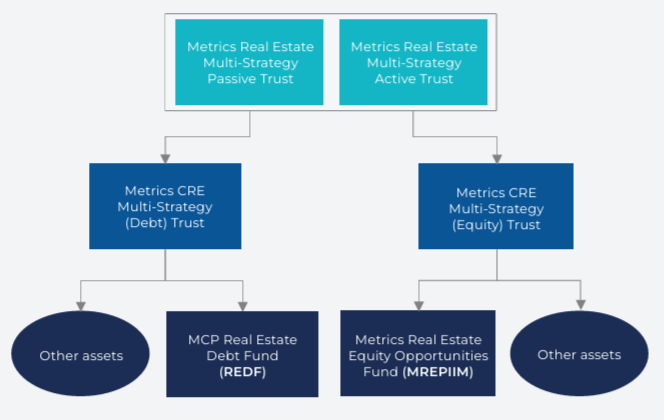

When MRE was launched, it was structured for half the assets to be invested in real estate debt and the other half in equity investments in real estate development projects. Both of these asset classes are relatively illiquid, therefore providing this multi-strategy investment through a listed structure allows investors a more streamlined investment alternative while ensuring underlying assets don’t have to be sold at inopportune times.

The strategy targets total returns of 10-12% per annum through the economic cycle:

- The debt exposure provides consistent monthly income that can be distributed to unitholders.

- The equity exposure provides higher upside potential over time.

The debt exposure is provided via the MCP Real Estate Debt Fund. This is one of Metrics core capabilities, with inception of this fund in October 2017. The fund lends to Australian real estate borrowers and projects including office, retail, industrial, residential development and specialised real estate assets (hotels, healthcare, etc). The fund targets returns of cash plus 5% per annum. Actual returns have generally been in excess of this target. The vast majority of the loans are senior secured, with very limited exposure to subordinated positions.

The property development equity exposure is provided via the Metrics Real Estate Equity Opportunities Fund. This fund currently has investments in 16 real estate developments across residential, industrial and mixed use projects. The fund invests alongside the developer of the project, who generally manage and undertake the development with Metrics contributing to the equity requirements.

Metrics Real Estate Multi-Strategy Fund (ASX: MRE) Performance

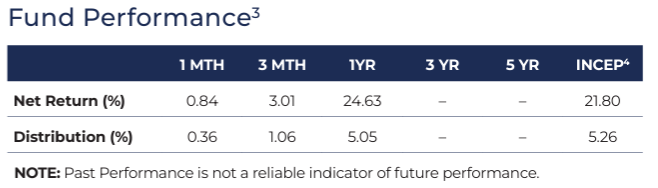

The Fund has outperformed its target returns of 10-12% per annum, with the majority coming by way of capital growth. However, MRE has only been operating over a relatively short period of 16 months.

MRE has paid out distributions in excess of 5% per annum since inception, and the net tangible assets (NTA) per unit has increased from $2.00 at IPO to $2.42 at 31 January 2026. In approximate terms, the distributions have come from the $1.00 originally invested in the MCP Real Estate Debt Fund, and the $1.00 originally invested in the Metrics Real Estate Equity Opportunities Fund has increased to $1.42.

Metrics Real Estate Multi-Strategy Fund (ASX: MRE) Share Price and NTA

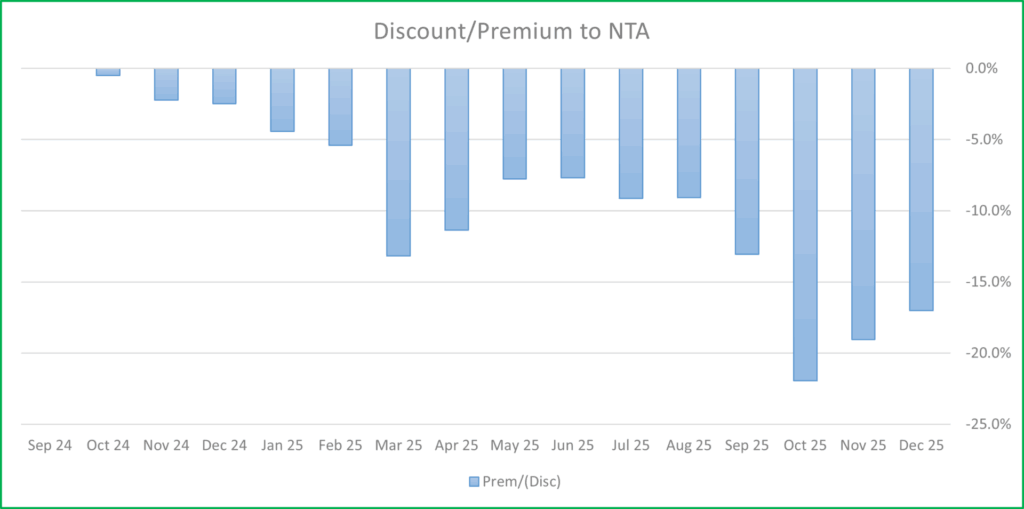

MRE’s trading performance since listing has been disappointing compared to Metrics other LITs, in particular MXT, which has generally traded around NTA. While MRE has traded at around its IPO price of $2.00 a number of times, the share price has not kept pace with the increase in NTA. The graph below shows the discount to NTA since inception in October 2024.

It is not unusual for a discount to develop 12-18 months after listing of a new LIT or LIC. In the case of MRE, we believe the discount has developed for two reasons.

The first is that some investors didn’t understand the multi-strategy aspect when they participated in the IPO. Metrics is most well known for their private credit investments that pay relatively high levels of monthly income. For example, MXT currently distributes approximately 8% per annum and MOT targets an even higher level of income. MRE is structured as approximately half private credit which pays a similar (or higher) distribution rate to MXT, and the other half as an equity investment that grows over time. Any distributions relating to the property equity investments will not be paid out until individual projects are completed, which has not yet occurred given the reasonably short period since listing. The result is that MRE has paid a distribution yield of just over 5% over the past year. Some investors held the unrealistic expectation that the total 10-12% target returns would be delivered as smooth monthly distributions. When they discovered this was not the case, they sold MRE, pushing down the price.

The other aspect we believe has contributed to the discount is Metrics has not made it easy to understand the underlying portfolio or return performance attribution. Their monthly reports are fairly limited in the portfolio data that is available. There has been some improvement recently in the quarterly reports and more regular investor communications. However, given MRE is unlike anything else in the LIT or REIT market, we believe that additional reporting would help more investors understand the strategy and its benefits.

What are the risks?

With most investments, there are a range of risks that can negatively impact returns. MRE is no different. We see three key risks that are worth understanding.

Clearly, property development activity carries with it significant risks. If things don’t go to plan in a number of areas, including obtaining or varying development approvals, construction of the finished product, or sales rates, this can quickly and substantially impact returns from an individual project. A market wide downturn in property prices can impact multiple or even all projects. There’s no question that property development can be a very risky business. Metrics experience over a long period, astute selection of development partners and the range and diversification of projects underway and at different stages of completion can all help to mitigate development risk. But we are always alert for early signs of any trouble.

The real estate debt investments can also suffer losses, though these would be expected to be less pronounced than development risks, and would likely be partly or fully offset by interest income unless we saw a significant economic or property downturn.

Finally, the NTA discount can widen, especially after periods of substandard or negative returns, leading to a lower share price. Buying at an attractive discount in the first place (as we did), and being prepared to be patient, lowers this risk.

Why we like MRE

We like the philosophy of MRE, whereby investors can access the entire capital stack from debt to equity within a single vehicle. Metrics are one of the leading private credit managers in Australia, and their real estate lending capabilities have provided excellent returns for investors over a long period.

They are in a unique position to invest equity in individual development projects, as they have been lending to property developers since their inception in 2013. This provides Metrics with invaluable experience and data to select the best developers and projects for equity investment.

As at 31 January 2026, the NAV was $2.42 per unit and the unit price was $1.99, reflecting a discount of 18%. When assessing the attractiveness of the discount, we have given consideration to the different risk profiles of the two strategies. The private debt portfolio has a substantially lower risk profile, compared to the higher returning, but much higher risk development equity investments. If the overall discount to NAV is 18%, and we allocate a 5% discount to the debt portion of the portfolio, then this translates to a 26% discount on the equity component. We believe these are attractive discounts and provide us with a decent margin of safety.

The vehicle is relatively young at just over one year. As the manager continues to prove their capability on the equity development investments, and they achieve or exceed the target returns, than we believe this will lead to a narrowing of the discount over time. This may be expedited if distributions were to be made as property development profits crystallise, and if Metrics continue to improve their portfolio and monthly reporting so more investors can understand the portfolio and its benefits.

We hope that was helpful.

Learn more about the Affluence LIC Fund

Want to learn more about LICs?

You can download our Guide to LICs

Enjoyed this Investment Profile?

Read more of our Affluence Insights Investment Markets Archives – Affluence Funds Management

Disclaimer:

This Fund Profile was prepared by Affluence Funds Management Limited (Affluence). It was prepared to assist investors in Affluence funds in understanding the investments of the relevant Affluence fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any product advice or service.

This Fund Profile does not consider your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser before making any decision to invest.