Hi,

Our unbroken run of positive returns finally came to an end in November as the Affluence Investment Fund was flat and our other two funds fell by 0.9% and 0.4%. Mind you, the ASX200 Index fell by 0.5% for the month and many overseas markets did much worse. Links to the latest fund reports are below.

If you would like to invest with us this month, Affluence Investment Fund applications close on Christmas Eve. Investments will be effective 1 January, with confirmations emailed about a week after that. Go to our website and click “Invest Now” to apply online or download application or withdrawal forms for all our funds. If you have any questions or want to give us some feedback, reply to this email or give us a call.

Read on to discover some things we found interesting this month, including inflation (again), a great investor you’ve never heard of, dragonfly technology and how fizzy lemonade 7UP (probably) got its name.

We’re almost at the end of what has, for most, been another long year. It feels like everybody is ready for a break. We hope you get a chance to enjoy some time with friends and family over the festive season. Thanks for your continued support this year. We wish you all the best for the holidays and a Happy New Year.

Regards, and thanks for reading.

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund was flat in November. Since commencing in 2014, returns have averaged 9.1% per annum, including distributions of 6.6% per annum.

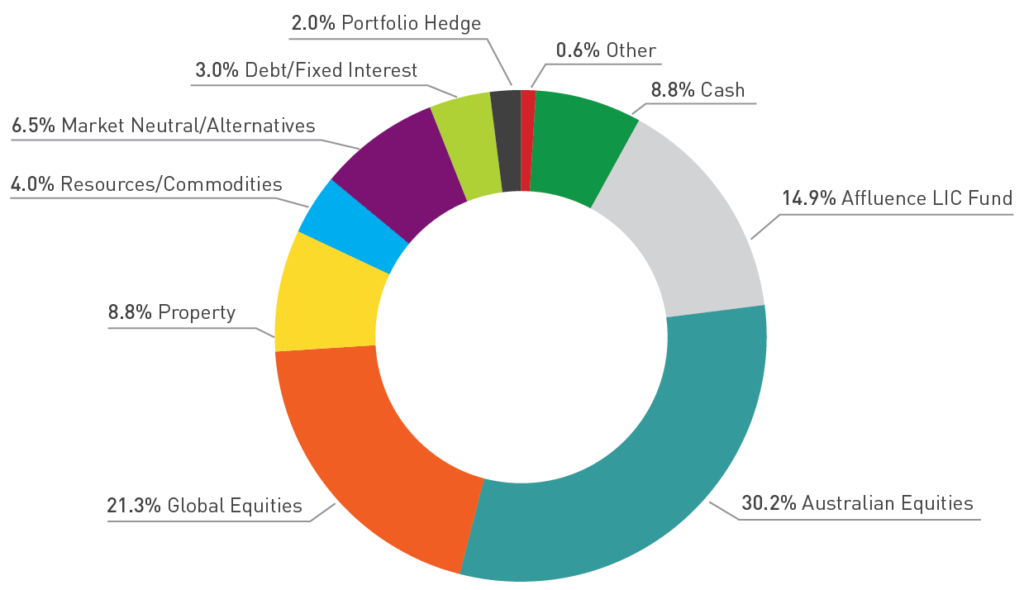

At month end, 63% of the portfolio was invested in unlisted funds, 15% in the Affluence LIC Fund, 11% in listed investments, 2% in portfolio hedges and 9% in cash.

Affluence LIC Fund

The Affluence LIC Fund returned -0.9% in November. Since commencing in 2016, returns have averaged 13.9% per annum, including quarterly distributions of 7.5% per annum.

The average discount to NTA for the portfolio at the end of the month was 14%. The Fund held investments in 28 LICs (78% of the Fund), 5% in portfolio hedges and 17% in cash.

Affluence Small Company Fund

Our contrarian Fund holds a range of small cap exposures with a distinct value focus. Since commencing in 2016, returns have averaged 10.8% per annum, including distributions of 6.7% per annum.

At the end of November, the Fund held eight unlisted funds (51% of the portfolio), six LICs (15%) and seven ASX listed Small Companies (20%). The balance 14% was cash and hedges.

Access to over 25 talented fund managers

The Affluence Investment Fund provides access to a manager set that is simply impossible to replicate. Around 39% of the portfolio is in underlying funds that are currently closed to new investors. A further 23% is allocated to funds that are only available to wholesale investors.

With monthly distributions, a focus on investing differently and fees based only on performance, the Affluence Investment Fund is probably unlike anything else in your investment portfolio.

Things we found interesting

Chart of the month.

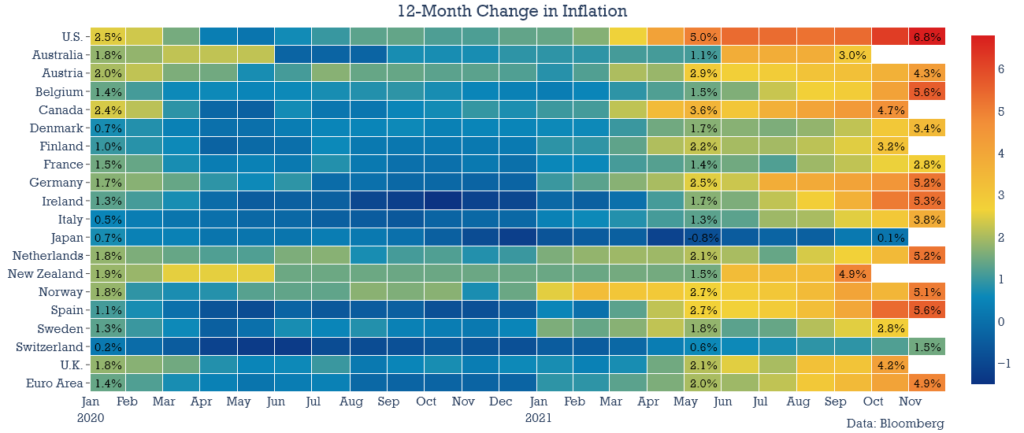

We know we keep going on about inflation, but there’s a very good reason. Changes in inflation, particularly unexpected changes, can have a big impact on interest rates. And changes in interest rates can impact the price of almost any financial asset in the world. So it pays to pay attention to inflation. The “heat map” below shows how it has changed over the past 12 months around the world (click the picture to see a larger version).

There are a couple of interesting takeaways from this. The numbers have escalated quite a lot over the past six months. In many places, including the US, inflation is at levels not seen for a generation or more. Of course, these are headline numbers, which include more volatile items. Underlying inflation numbers, which are arguably more important, are lower. Still, even underlying inflation is now well above recent averages pretty much everywhere except Japan.

What’s also obvious is that Australia is a bit of an outlier. We only announce CPI quarterly, and it takes almost a month after the end of each quarter to do the calculation. Most other developed nations have already got their November number finalised.

What is crucial for markets over the next few months is what happens next. It’s probable that headline inflation numbers will start to trend back down. But it’s also likely (at least in our view) that underlying inflation will stay stubbornly high, and that’s what really matters. Depending on how markets react to that, it could make 2022 a very interesting and potentially volatile year.

Chart of the month 2.

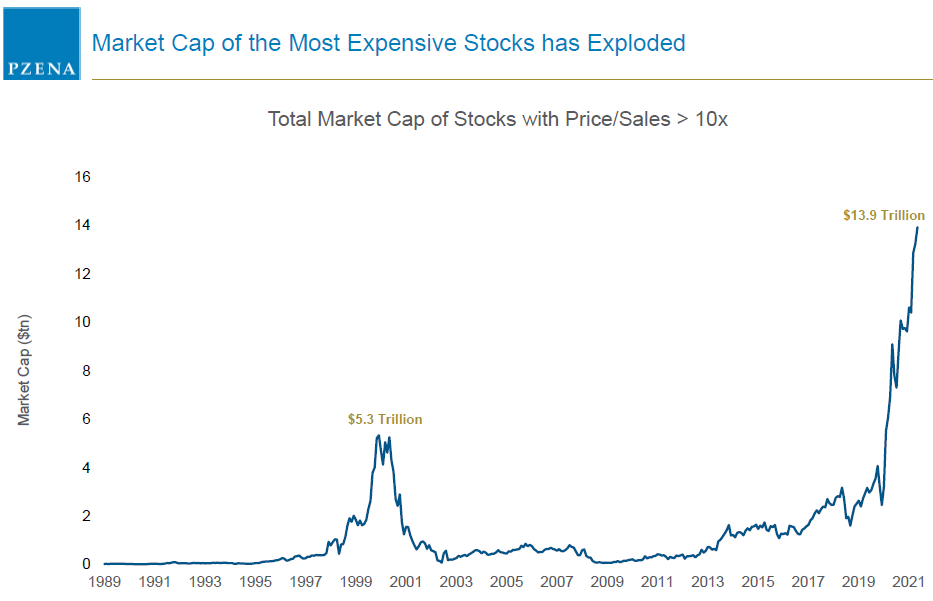

From value manager Pzena comes this chart of the combined value of stocks with a price to sales ratio of at least ten times. Most of them make no profit. Almost all require the achievement of some fairly heroic growth assumptions for the current prices to make any sense. We’re skeptical…

Quote of the month.

“Skill is just recognising when you’ve gotten lucky.”

Wilmot Kidd said that, in response to a question from journalist Jason Zweig about whether he attributes his investment success to luck, or skill.

Despite his stunning track record as a professional investor for over 50 years, you’ve probably never heard of Wilmot Kidd. He has no LinkedIn page. Few photos of him can be found online. And he has given less than five interviews in his career. He’s about to retire, at age 80, as the chief executive of US listed fund, Central Securities Corp.

Since March 1974, when Wilmot took over Central Securities, it has returned 14.5% per annum. An initial investment of $10,000 in 1974 would be worth $6.4 million by now. “We’ve always said: We’re in business to make money for the stockholders, not off the stockholders,” he says. How has he done it? Mostly through patience, concentration, deep research and courage.

Here’s a few of the key takeaways from a recent interview with the Wall Street Journal.

- Over the past 15 years, Central has held its investments for nearly a decade on average. That’s about six times longer than the average fund, according to Morningstar. “We want to own growing companies during as much of their period of growth as we can,” says Mr. Kidd. “That enables compounding to work its magic.”

- The fund holds a reasonably concentrated portfolio. Central has 33 positions, with 57% of its money in its top ten. “We’ve always felt you had to concentrate,” Kidd says. “You’ve got to have a few big positions, you’ve got to own a lot of what works.”

- Mr. Kidd has successfully backed secular trends. For example, in the mid-to-late 1970s, Central earned outsized returns investing in energy companies. By 1982, Mr. Kidd decided the energy boom had mostly played out. Within a few years, Central had pivoted from having a third of its assets in energy to having a third in tech stocks. He earned big gains again.

He explains his process like this, “It’s when you’ve been fortunate enough to make an investment in a great company, and suddenly you realize just how very lucky you were, and you buy more. That’s skill, I suppose. That—and holding on to what you have and not chickening out.

”Quote of the month 2.

“The market can stay irrational longer than you can stay solvent.”

John Maynard Keynes made this famous proclamation in 1920. You may have heard the quote, but not the story behind it. The famous economist was mostly a very good investor, but not on this occasion. Keynes voiced this quote after nearly getting wiped out betting heavily on currencies. His long term economic forecasts had him believe that the Deutschmark should fall against the US dollar in early 1920. But the currency rallied for 3 months instead.

Keynes’ bets were placed on 10:1 margin, and although his long term forecast was right, he did not have the capital to hold his bets.

Source: begintoinvest.com

Sign of the times.

More than 40 contestants have been disqualified from a beauty pageant in Saudi Arabia for receiving Botox injections and other cosmetic enhancements. Judges used “advanced” technology to uncover tampering on a scale not seen before. All contestants were led into a hall where their external appearance and movements were examined by specialists. Their heads, necks and torsos were then scanned with X-ray and 3D ultrasound machines, and samples were taken for genetic analysis and other tests.

Sound weird? It gets weirder. Key attributes in this competition include long droopy lips, a big nose and a shapely hump. That’s because it was a camel beauty pageant.

The competition was part of the King Abdulaziz Camel Festival, which is the largest in the world and lasts 40 days. Some 33,000 camel owners from as far away as the US, Russia and France are participating (in the festival, not the pageant). As many as 100,000 tourists are also expected daily at the festival site, near the Saudi capital of Riyadh.

Source: BBC World News

This month in (financial) history.

December 1913. Henry Ford installs the first line to assemble a complete car. The new technology would make it possible for Ford to produce a car in just 90 minutes. The technology made Ford much more efficient, and made cars available to the masses. Ford’s model T sold for $850 before the assembly line, equal to about $21,500 in today’s dollars. After it was operational, they lowered the price to just $300, or about $7,500 in today’s dollars.

December 1825. A worldwide commodity bubble pops and banks in England that had recklessly extended credit for speculation in commodities, bonds, and stocks are beginning to fail. On December 14th, 1825 a London bank fails, causing bank runs and immediately bringing down 40 other commercial banks. In the panic of 1825, stocks would fall 80%, troops would be called to control riots, and the Bank of England would nearly fail. At its low point, the Bank of England would have gold reserves of less than a million pounds, less than a 2 day supply. The Bank of England was saved on Christmas Eve 1825, as Nathan Rothschild made a gold deposit of more than 300,000 coins.

December 14, 1503. The best forecaster* ever was born.

Hamster update.

Two months ago, we told you all about Mr Goxx, the German hamster who specialised in trading Cryptocurrencies. During the month the world received the sad news that Mr Goxx had unexpectedly passed away. Despite a cracking short term investment track record, perhaps hamsters aren’t well suited to the high pressure world of Crypto trading. RIP Mr Goxx.

Amazing fact.

In the 1970s, the CIA created a laser-guided, liquid-fuelled dragonfly-sized drone.In 2017, researchers equipped a real genetically-modified dragonfly with a solar-powered backpack and steering implants to turn it into a drone.

And finally…five things to think about.

- Why is it that night falls but day breaks?

- If the #2 pencil is so popular, why is it still #2?

- How do “Do not walk on the grass” signs get there?

- How do they get the Koalas to cross at that yellow road sign?

- Why is the drink called 7UP? What happened to the first 6 “UPs”?

Not sure about the first four, but here’s some more about 7UP. The drink was invented in October 1929 by Charles Leiper Grigg. It was first known as “Bib-Label Lithiated Lemon-Lime Soda.” Predictably, that name never quite caught on. The long name was eventually changed to “7UP Lithiated Lemon Soda,” and then in a moment of marketing genius in 1936, to just “7UP”.

Unfortunately, Grigg never explained where he got the name 7UP. There are many theories. The most popular is that “7” was due to the 7 ingredients: sugar, carbonated water, essence of lemon and lime oils, citric acid, sodium citrate, and lithium citrate.

The “UP” part of the name referred to the mood lift attributed to the lithium citrate.Incidentally, lithium citrate is used as a mood stabiliser in psychiatric treatment of manic states and bipolar disorder. It is, for obvious reasons, no longer an ingredient in 7UP, having been removed in 1948.

If you enjoyed this newsletter, forward it to a friend.

* The best ever forecaster, of course, was Nostradamus.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.