It’s a bumper holiday edition of the Affluence eNews this month.

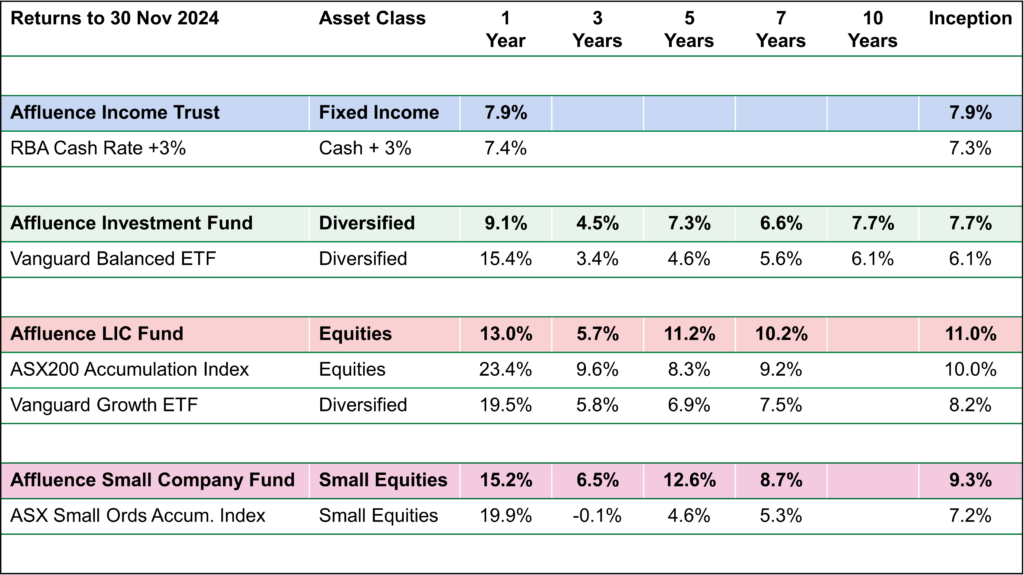

The Affluence Investment Fund had its 10 year anniversary in November. Returns have been solid, especially considering the hostile environment the strategy has faced most of the time. Here are some highlights:

- The Fund has outperformed every other Fund in its Morningstar category, ranking #1 over its 10 year history.

- It has the highest possible 5 star rating from Morningstar (star ratings are assigned based on an assessment of both returns and risk).

- The Fund has also outperformed its passive alternative, the Vanguard Balanced Index Fund, by 1.6% per annum over ten years, debunking the argument that active funds can’t outperform low fee passive alternatives.

- Distributions have averaged of 6.4% per annum for 10 years, paid monthly. This is significantly ahead of our 5% per annum target.

- We’ve also managed market corrections exceptionally well, with the Fund generally falling way less than equity markets, and recovering the losses faster.

We’re determined to do even better in the next ten years.

In other news, the US election result caused Trump Mania in markets in November. Equity markets were largely driven by the same large cap stocks that have been powering indices for the last 12 months. In what is becoming a familiar pattern, small cap equities missed the rally entirely. Many large cap stocks are at nosebleed valuations (such as CBA at more than 25 times falling earnings), while many small and microcap stocks are very cheap. Over the last three years, total returns for the ASX200 Index were +29.5%. Meanwhile, the ASX Small Ords delivered -0.3%, and the ASX Emerging Companies Index -8.0%. We believe this is an incredible opportunity for patient investors, but for us, it has been a very frustrating period as we await commonsense to make a comeback. All our fund reports for November can be accessed below.

Also below, Greg takes a look at the opportunity in the LIC market, we profile a recent addition to the Affluence LIC Fund portfolio and link to a webinar and presentation which provide a detailed update on the Fund. We’ve also added some extra holiday reading.

Should you wish to invest this month, head to our invest page to apply online and access printable paper forms. Applications received by the cut-off dates will be effective from 1 January. Over the next few weeks, our service provider Registry Direct will be rolling out a number of changes and updates to the online application process to make it even easier to apply online.

As always, thanks for reading and for your continued interest in what we do. We wish you all the best for the holiday season and a Happy New Year.

If you have any questions or feedback, reply to this email or give us a call.

Regards, Daryl, Greg and the Affluence Team.

Affluence Fund Returns

Affluence Income Trust

The Affluence Income Trust returned 0.6% in November and has delivered 7.9%per annum since commencing. The Fund pays monthly distributions, and the current distribution rate is 7.5% per annum.

The cut-off for monthly applications and withdrawals is Tuesday 24 December.

Affluence Investment Fund

The Affluence Investment Fund returned -0.7% in November. This diversified fund brings together our best ideas across all asset classes. Since commencing, the Fund has returned 7.7% per annum.

The cut-off for monthly applications and withdrawals is Tuesday 24 December.

Affluence LIC Fund

The Affluence LIC Fund returned -2.4% in November and has delivered 11.0% per annum since commencement. At the end of the month, the average portfolio NTA discount reached another new high at 26%.

The cut-off for monthly applications and withdrawals is Tuesday 31 December.

In the following webinar we provide an update on the portfolio, explain how we add value through discount capture and why the Fund might be an attractive alternative to investing in LICs directly.

Affluence Small Company Fund

The Affluence Small Company Fund returned 0.6% in November. The largest positive contributor was ASX listed Midway (MWY) which received a takeover offer, more than offsetting a poor month for small caps.

The cut-off for monthly applications and withdrawals is Tuesday 24 December.

Investment Profile

This month, we’ve taken a look at a recent addition to our Affluence LIC Fund Portfolio.

WAM Leaders Limited (ASX: WLE) is a listed investment company. WLE is currently trading at an attractive discount and provides a differentiated exposure to the ASX200, which has the potential to significantly outperform the index in 2025. Click below to find out more.

A once in a cycle investing opportunity for LICs?

Have we reached peak madness for LICs? Greg explores this, in the Affluence Funds LIC Wrap Up for 2024.

Read the Article

Affluence LIC Fund webinar and presentation

In November, we also recorded a short 30 minute webinar taking a closer look at the LIC market, and providing an update on the portfolio for the Affluence LIC Fund. You can access them both below.

Things we found interesting

Here’s a selection of articles we’ve come across recently that might get you thinking. We’re not suggesting they are correct, but it always helps to explore contrary points of view.

- Canadian market strategist David Rosenberg has been bearish on the US economy for years. In this piece, he finally throws in the towel (even though he denies doing so). He admits that the market may be exuberant but may not be rational and suggests he will be buying the next 5-10% correction. You know what they say when the last bear turns bullish…

- In this article, noted market historian Russell Napier outlines a future in which governments mandate where investors should deploy their capital. That’s not as crazy as it sounds. He thinks that will be bad for bonds and the S&P 500. His thoughts on what you should own might be surprising.

- What if the artificial intelligence boom is unsustainable, destined for mediocre progress and will ultimately achieve not very much at all. Tech industry veteran Ed Zitron believes this will be the case, and in this very long article, explains why. Warning…the article does contain swearing.

In this day and age, the case can be made that we live in an era of too much. Too much information, too much stuff, too many choices, and too many distractions. Ted Lamade makes the case here that the path to happier lives, and yes, better investment portfolio performance, might start by taking things away.

Financial word of the month.

Technical Analysis.

A method of predicting the future prices of a financial asset by looking at its past prices, which is about as reliable as attempting to forecast tomorrow’s weather by studying yesterday’s. There is some evidence that technical analysis may have a weak ability to predict momentary fluctuations in price for some assets, particularly commodities and currencies. But it is unclear whether technical analysis can work over longer investing horizons. After all, the future prices of stocks and other securities are determined by the flows of cash generated by the underlying assets, not by the past prices of the securities themselves – just as the future records of sports teams are determined by how well the players perform, not by the scores of the games they played in the past.

Because the prices of securities move in an almost infinite range of patterns, no endeavor in the financial world is more encrusted with arcane jargon than technical analysis, including the Hindenburg Omen, Fibonacci retracements, Ichimoku clouds, vortex indicators, stochastic oscillators, triple exponential moving averages, guppy multiple moving averages, SAUCERS, stick sandwiches, double tops, triple bottoms, tweezer bottoms, Head and Shoulders, the long-legged Doji, bearish catapults, bullish abandoned babies, the death cross, and the “upside gap two crows” pattern.

It is a good general rule on Wall Street that the more impenetrable the jargon is, the less likely the thing described by it is to be profitable.

Source: “The Devil’s Financial Dictionary” by Jason Zweig.

Tips to protect yourself from scams.

According to Macquarie Bank, Gen Z and Millennials are more likely to be victims of an online scam compared to other generations. This could be due to a range of factors, including being more comfortable but less careful in an online environment and being time poor (skipping the fine print). Macquarie has released this excellent summary of methods scammers use and some great tips to protect yourself this holiday season.

Vaguely interesting facts.

Astound your friends with these morsels of knowledge:

- Staff at the Slovakian and Slovenian embassies meet once a month to exchange incorrectly addressed mail.

- The Vatican’s bank is the only one in existence that allows ATM users to perform transactions in Latin.

- In medieval times, “a moment” was defined as 1/40th of an hour. That’s 1.5 minutes.

- Each year, 40,000 tons of space dust falls down and settles on Earth.

- Giraffes are 30 times more likely than humans, to get hit by lightning.

- Rudolph the Red Nosed Reindeer has a son named Robbie. *

* The famous song about Rudolf, which we’ve all heard so many times, was actually based on a book written ten years earlier. Author Robert L. May created Rudolph in 1939 as an assignment for US department store Montgomery Ward. The retailer had been buying and giving away colouring books for Christmas every year, and it was decided that creating their own book would save money. May considered naming the reindeer Rollo or Reginald before deciding upon using the name Rudolph. In that first year, Montgomery Ward gave away 2.4 million copies of Rudolph’s story.

May’s brother-in-law, Johnny Marks, adapted the story of Rudolph into the famous song. Gene Autry’s recording of the song hit No. 1 on the US Billboard pop singles chart the week of Christmas 1949.

Source: mentalfloss

And finally…

Thanks for reading. If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

Catch up on earlier versions of our monthly newsletter.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.