Hi,

Welcome to our latest update.

All three Affluence funds delivered positive returns in October. Global and Australian stock markets also bounced back during the month. There did not appear to be any fundamental reason for the increases. A slightly lower than expected inflation number in the US in November has helped markets continue the positive momentum.

This may well turn out to be a bear market rally before investors turn cautious again. Central banks increased interest rates in Australia, the USA and England in November, and in our opinion markets continue to underestimate the potential impact on 2023 earnings. We’re excited by many of the investments in each of our funds. But we continue to be cautious about markets in general, and are holding more cash than usual.

As an example of the value on offer in our Funds at the moment, here’s some highlights for the Affluence LIC Fund portfolio as at mid November:

- 19% of the portfolio is in debt LITs and convertible notes, with an average estimated discount to NTA of 13%. A few of the debt LITs are trading on a yield to maturity on underlying assets of 10-13%.

- 28% in Australian equity LICs with a bias towards small caps and an average estimated discount to NTA of 19%.

- 33% in Global equity LICs, with an average estimated NTA discount of 21%. Many of these have an identifiable catalyst for closing the discount.

- 20% in cash awaiting further opportunities. If the market corrects further, we’ll be ready to take advantage.

Monthly applications for the Affluence Investment Fund and Affluence Small Company Fund close on Friday 25 November. Applications for the Affluence LIC Fund close Wednesday 30 November. If you want to apply online or download application or withdrawal forms for any of our funds, go to our website and click “Invest Now”.

If you have any questions or want to give us some feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund increased 2.2% in October. Since commencing in 2014, returns have averaged 7.7% per annum, including monthly distributions of 6.5% per annum.

At month end, 59% of the portfolio was invested in unlisted funds, 15% in the Affluence LIC Fund, 17% in listed investments, 1% in portfolio hedges and 8% in cash.

The cut-off for monthly applications and withdrawals is Friday 25 November.

Affluence LIC Fund

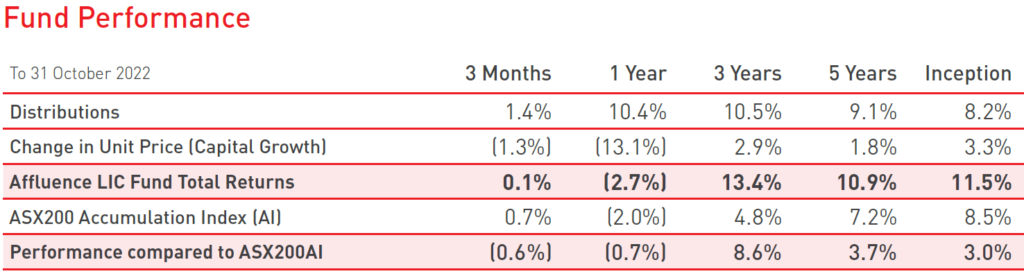

The Affluence LIC Fund increased 1.5% in October. Since commencing in 2016, returns have averaged 11.5% per annum, including quarterly distributions of 8.2% per annum.

The average discount to NTA for the portfolio at the end of the month was 19%. The Fund held investments in 28 LICs (78% of the Fund), 3% in portfolio hedges and 19% in cash.

The cut-off for monthly applications and withdrawals is Wednesday 30 November.

Affluence Small Company Fund

The Affluence Small Company Fund increased by 3.7% in October. The Fund holds a range of value investments focused on smaller companies. Since commencing in 2016, returns have averaged 8.7% per annum.

The Fund held 8 unlisted funds (56% of the portfolio), 8 LICs (16%) and 8 ASX listed Small Companies (22%). The balance 5% was cash and hedges.

Available to wholesale investors only. The cut-off for monthly applications and withdrawals is Friday 25 November.

Affluence LIC Fund

A unique strategy with an exceptional track record

The Affluence LIC Fund Fund seeks to invest with some of the best LIC managers, while simultaneously taking advantage of unusually large discounts and short term trading opportunities via our unique discount capture strategy.

The Fund has outperformed the ASX200 by 3% per annum since inception. We’ve recently reopened the fund to new investors. At the end of October, the Fund held 28 LICs, plus significant cash to take advantage of opportunities. The average NTA discount for the LIC portfolio at the end of the month was approximately 19%.

With quarterly distributions and a performance based fee structure, the Affluence LIC Fund may be a useful diversifier for your investment portfolio.

Things we found interesting

Chart of the month.

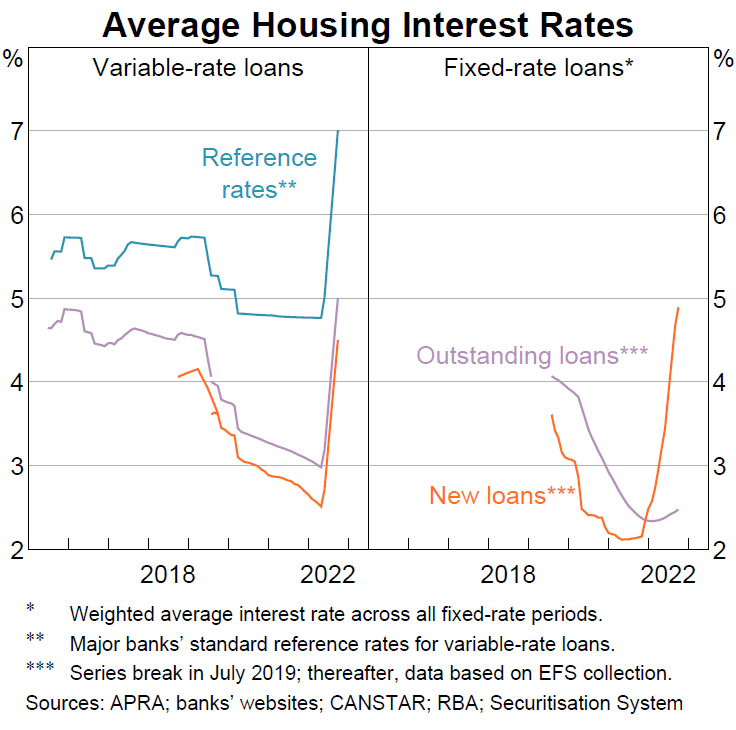

This chart goes some way to explaining why Australia’s economy is still going along fantastically well, despite the RBA increasing the cash rate from 0.10% to 2.85% so far this year.

Historically, 85-90% of borrowers were on variable rates. But when the cash rate fell to 0.10% a couple of years ago, and the RBA promised to leave it there for three years, banks started offering 2 and 3 year fixed loans at 2-3% interest rates. Predictably, many borrowers signed up for that deal. This has meant the share of fixed rate mortgages has ballooned to around 40% of total outstanding loans.

As you would expect, the graph above shows that the interest rate on those outstanding fixed loans has barely moved, at around 2.5%. A big proportion of those fixed rates expire in 2023. And more than half expire during the first half of the year. Based on the average current variable rate of around 4.5%, those borrowers can expect a big increase in their mortgage payments. The average mortgage in Australia is approximately $600,000. And a 2% increase in interest rates means an extra $12,000 a year has to be found. That’s $1,000 a month or $230 a week. For the average family, that’s a lot. And of course, interest rates are predicted to rise further, although not as quickly.

But what about the 60% of variable mortgages that have already taken the pain? Why has that not had a big impact on our economy already? We think there are two reasons. Firstly, it’s most likely that the borrowers who fixed are the ones that are most sensitive to interest rate rises. Those who stayed on variable rates were perhaps more able to afford the higher rates, and so are impacted less.

The second reason has to do with how banks fund their mortgages, and another trend change that has been going on for many years. Approximately 60% of bank balance sheets are now funded by customer deposits, up from 40-50% in the early 2000’s. Those customers with savings and term deposit accounts are earning much higher rates of interest than they were. In many cases, particularly for term deposits, the increase in interest rates has actually been greater than the increase on variable mortgages. That’s a lot of extra income for retirees, businesses and other savers.

So, its quite possible that up to this point, the extra interest paid by borrowers has been offset by the extra interest earned by savers. And that’s why we haven’t seen any slowdown in consumer spending and employment yet. We believe that the impact of what the RBA has been doing will not be felt until well after Christmas, continuing to get worse during the second quarter of next year.

Chart of the month 2.

Warren Buffett and Charlie Munger are investing geniuses. Of that there is no doubt. But, surprisingly, here is the performance of Berkshire Hathaway vs the S&P 500 index over the past 20 years.

Berkshire has underperformed, although they have caught up a lot recently. And the difference, despite appearances, is not that great. Berkshire has delivered 8.3%pa, while the S&P200 has done 8.6%pa. The lesson that we can learn from this? Well, Berkshire Hathaway has a market cap of $680 billion. Perhaps, no matter how good an investor you are, having too much money will drag you back to the average.

Quote of the month.

“The problem as a contrarian investor is that when you are right, you are perceived to be lucky. When you are wrong, people think you are an idiot.

“Rob Arnott, Founder and Chairman of Research Affiliates, explaining why investors should not be afraid of bear markets as there will be great investment opportunities.

This month in (financial) history.

In November 1960, Tom Monaghan and his brother, James, took over the operation of a small pizza restaurant chain in the US state of Michigan called DomiNick’s. Until then, the chain was owned by founder Dominick DeVarti. The deal was secured by a $500 down payment. The brothers then borrowed $900 to pay for the store. By 1965, Tom purchased two additional pizzerias. He wanted the stores to share the same branding as the original, but the original owner forbade him from using the DomiNick’s name. An employee suggested the name “Domino’s”, and so the iconic Pizza chain was born.

The three dots we see today on the logo and the pizza box represent those three stores owned in 1965. Tom Monaghan originally planned to add a new dot for every new store. But Domino’s opened its first franchise in 1967 and by 1978, the company had over 200 stores. So they kept just the three dots.

Tom and James originally planned to split the work hours evenly, but James didn’t want to quit his job as a full-time postman. In 1961, James traded his half of the business to Tom in exchange for the Volkswagen Beetle they used for pizza deliveries. That proved to be an expensive mistake for James. In 1998, after 38 years of ownership, Tom Monaghan announced his retirement. He sold 93 percent of the company to Bain Capital for about $1 billion, and ceased being involved in day-to-day operations of the company.

The ASX listed Domino’s Pizza Enterprises is separate from the US head office. Domino’s Australia own the rights to operate and franchise branches of the chain in Australia, New Zealand, Belgium, France, The Netherlands, Japan, Germany, Luxembourg, Denmark and Taiwan.

Vaguely interesting facts.

- Baby porcupines are known as porcupettes.

- Chinese checkers was invented in Germany.

- There is one member of ZZ Top without a beard. It’s the drummer. His name? Frank Beard. *

- When Disneyland was opened in 1955, “Tomorrowland” was designed to look like a year in the distant future: 1986.

- Staff members of the Slovak and Slovenian embassies meet once a month to exchange incorrectly addressed mail.

Source: mentalfloss.com, wikipedia.com.

* Though Frank does not sport a beard, he has variously been spotted with a moustache, a goatee and a mullet.

And finally…don’t be like Larry

Crypto exchange FTX unravelled very quickly earlier this month. We won’t know the full story for a while, but it seems they used customer deposits to prop up an associated hedge fund manager and it went spectacularly wrong. A lot of people have been caught up in the collapse. It’s reported more than 30,000 Australian crypto investors have been impacted, with the Australian subsidiary entering administration on 11 November.

So far as we can tell, the only good thing to ever come out of FTX was this January 2022 Superbowl ad for the company, featuring comedic genius Larry David. Given what’s transpired this month, the ending has perhaps a different meaning to what was originally intended by FTX.

If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.