Invest differently

Hi,

Share markets fell for the third month in a row in October, though as we write, much of this has been recovered already in November. The debate over a soft landing versus a recession rages on, with data available to support both arguments. In October, it looked like recession was more likely. More recently, slightly worse economic data and a 0.1% lower than expected US inflation figure have produced a strong market rally.

You can access the latest reports for all Affluence funds from the links below.

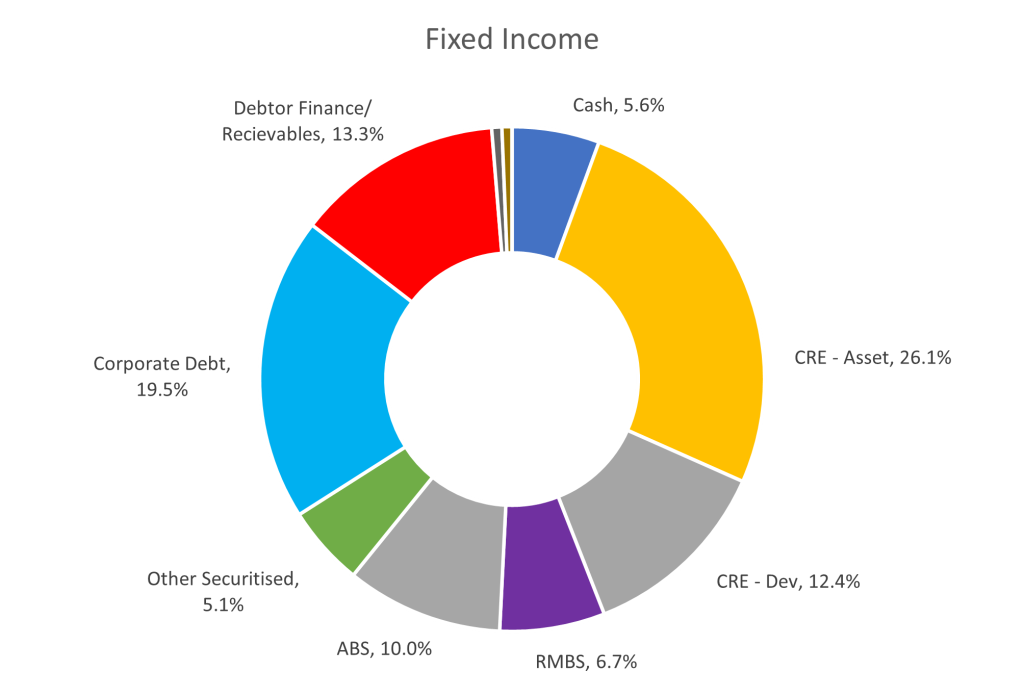

Last month we shared a quote from Howard Marks explaining why the fixed income sector offers extremely attractive returns at the moment from what is in most cases a relatively low risk asset class. This month, Greg has expanded more on the topic, including taking a look at the types of fixed income investments we hold in the Affluence Investment Fund. You can read the article here or via the story link below. The Reserve Bank increased interest rates by another 0.25% on Melbourne Cup day, making the sector even more attractive. We’re working on an opportunity for investors to be able to take advantage of the attractive returns available in this asset class, so stay tuned.

Should you wish to invest with us this month, applications for the Affluence Investment Fund and Affluence Small Company Fund close on Friday 24 November. Applications for the Affluence LIC Fund close Wednesday 30 November. Go to our website and click “Invest Now” to apply online or access application and other forms for any of our funds.

If you have any questions or feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund returned -1.0% in October. Since commencing over eight years ago in November 2014, the Fund has returned 7.5% per annum, including monthly distributions of 6.4% per annum.

The cut-off for monthly applications and withdrawals is Friday 24 November.

Affluence LIC Fund

The Affluence LIC Fund fell by 1.9% in October, as the ASX 200 Index decreased by 3.8%. Since the Fund commenced, returns have averaged 10.6% per annum, compared to 7.7% per annum for the ASX 200 Index.

The cut-off for monthly applications and withdrawals is Thursday 30 November.

Affluence Small Company Fund

The Affluence Small Company Fund returned -3.6% in October, outperforming the ASX Small Ords Index which fell 5.5%. Since commencing, returns have averaged 8.1% per annum vs 4.7% per annum for the ASX Small Ords Index.

The cut-off for monthly applications and withdrawals is Friday 24 November.

The Opportunity In Fixed Income

Using the current Affluence Investment Fund fixed income investments as an example, Greg takes a look at how it’s possible to achieve a return of 7.5% or more from a diversified fixed income portfolio. Click the button below.

The Opportunity in Fixed Income

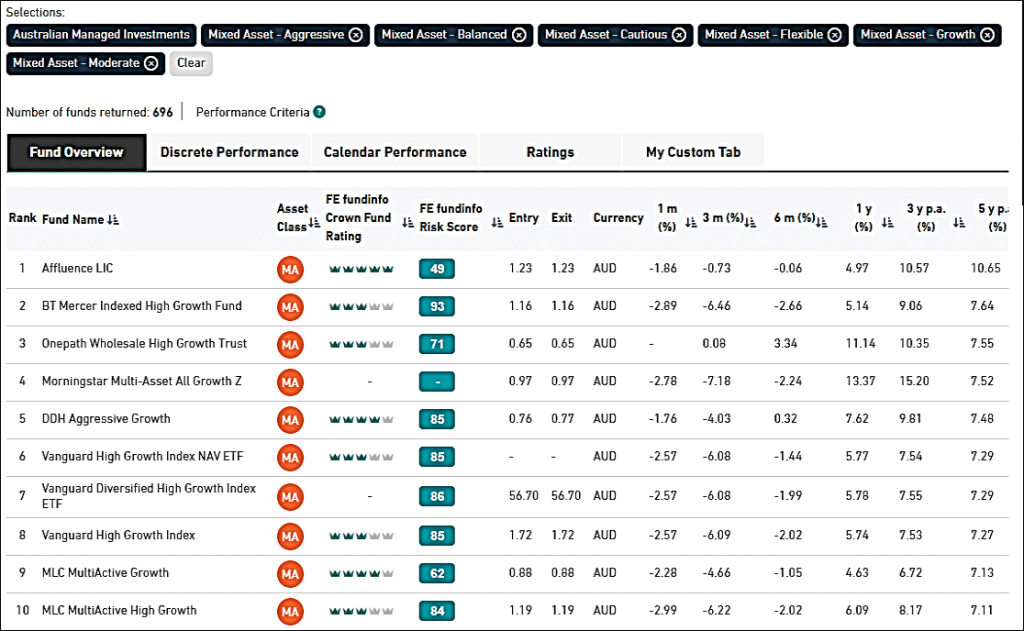

Performance

FE Fundinfo publishes performance data for almost 4,000 Australian investment Funds. According to FE, there were 696 multi asset funds in Australia at 31 October. Over the last 5 years, our Affluence LIC Fund is ranked #1 out of those 696 funds. Pleasingly, this performance has been delivered with a much lower risk score than the balance of the top 10, which are mostly volatile high growth funds.

If you would like to know more about the Affluence LIC Fund, you can access the Fund page on our website by clicking the button below.

Performance data is calculated assuming the reinvestment of distributions and is expressed net of fees and costs, excluding the buy-sell spread. Performance includes distributions and changes in unit prices, but not franking or other tax credits. Returns for periods over 1 year are annualised. Past performance is not indicative of future performance. Current performance data is available at https://affluencefunds.com.au.

Things we found interesting

The annual LIC Form Guide

November is Melbourne Cup month, and you know what that means. Once again, we’ve rummaged through the LIC bargain bin, and we are proud to present our seventh annual form guide for the Affluence LIC Cup, including three of our favourites for the year ahead. You can read it all right here.

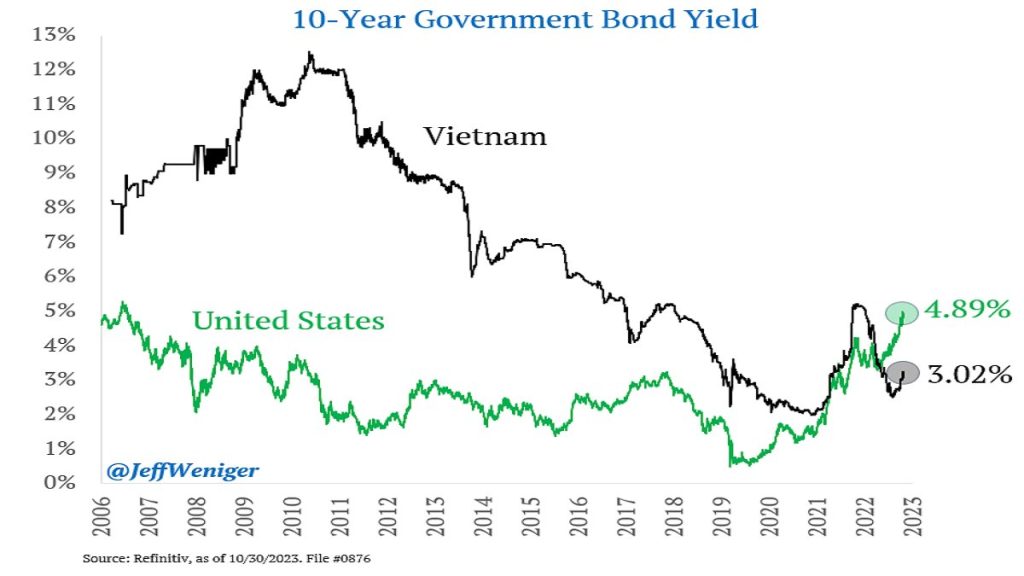

Chart of the month: Is US debt becoming an issue?

In October this year, US 10 year bonds briefly hit 5% yields, the highest since 2006. Vietnamese 10 year bonds are apparently now less risky than their US counterparts.

While US bond yields have fallen in November, the impact of these higher rates on US government finances, coupled with the sheer volume of US bonds to be issued in coming years, may well cause issues.

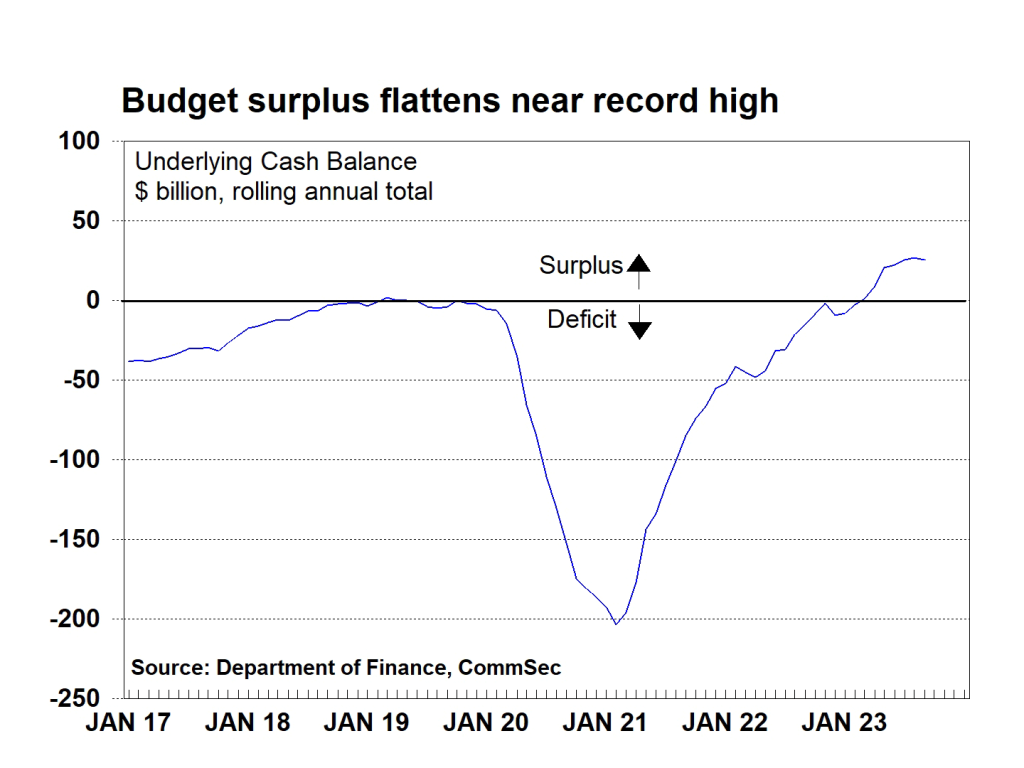

Chart of the month 2: Australia is much better positioned

In the 12 months to September the rolling Australian Government budget surplus stood at $25.5 billion.

Total receipts were $6.0bn higher than the 2023-24 budget forecast. In a world of deficits as far as the eye can see, it’s a welcome development.

Brain teaser.

What has 4 letters, sometimes 9 letters and never 5 letters.Scroll right down the bottom for the answer.

This month in financial history.

On 15 November 1996, Vimpel Communications became the first Russian company to list its shares on the New York Stock Exchange. In 2010 it delisted after being acquired by Dutch based VEON. It is currently in the process of being sold, after VEON announced in November 2022 that they would divest their Russian operations.

On 15 November 1994, the US Federal Reserve raised interest rates by three-quarters of a percentage point, one of its biggest hikes ever, and the sixth increase so far that year. Already bearish bond analysts turn downright dismal, forecasting that interest rates will soon go above 8%. Instead, rates fall in 1995 and long-term Treasury bonds have their best year since 1982, returning 31.7%.

In November 1971, the microprocessor was officially born as Intel introduced its new 4004 computer chip. Approximately 3mm by 1.5mm, it held over 2,000 transistors and had almost as much computational power as the 30 ton ENIAC computer of 1946. The chip was designed for Japanese client Busicom, who used it for their calculators. Busicom got into some financial difficulty and would have likely failed if Intel didn’t agree to reduce the price of the chip. Intel agreed to lower the price and pay $60,000 to Busicom, in exchange for releasing Intel from its exclusivity agreement. This allowed Intel to market the chip to other clients, and it became the first commercial microprocessor available for general use.

Sources: jasonzweig.com, wikipedia.com.

Vaguely interesting facts.

- At the Gettysburg reunion of American Civil War veterans in 1913, two men purchased a hatchet, walked to the site where their regiments had fought and buried it.

- In the 18th century, wealthy British landowners hired ornamental hermits to live in their gardens.

- Trained pigeons can differentiate between the paintings of Pablo Picasso and Claude Monet.

- In his will, William Shakespeare left his wife Anne Hathaway “my second best bed.”

- Boring (in the US) and Dull (in Scotland) have been sister cities since 2012. *

Source: mentalfloss.com, wikipedia.com.

* In 2017, they added Bland Shire, Australia to their “League of Extraordinary Communities”, which now comprises Dull, Boring and Bland. Bland Shire is near the Riverina district of NSW and by all accounts, is not bland at all. The scenery is fantastic, and the area is home to such iconic events as the West Wyalong Rodeo, the Mirrool Silo Kick (look it up) and the West Wyalong Christmas Markets.

Word of the month.

Procaffeination: The tendency not to start something until you’ve had a cup of coffee.

Brain teaser answer.

The sentence was a statement, not a question. WHAT = 4 letters SOMETIMES = 9 letters NEVER = 5 letters

Thanks for reading. If you enjoyed this newsletter, forward it to a friend. If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.