Invest differently

Hi,

All our funds delivered positive returns in November. You can access the latest reports from the links below. After three months of falls, equity markets bounced back strongly last month, and this has continued into December so far. Investors have taken relief from an increasing belief that a perfect ‘soft landing’ is in sight, whereby economies slow enough to reduce inflation but not enough to cause a recession.

As 2023 draws to a close, we find ourselves in an interesting investment environment. Consensus is now that a recession will be avoided, and that interest rates will start to come down in the next 6 months. Despite this general positivity, a good proportion of our portfolios are being valued like a recession is in full swing. Small caps, REITs, LICs, resource companies and a wide range of individual holdings are trading at prices normally only seen once a cycle. We’re incredibly positive about the opportunities out there as we finish off 2023.

Should you wish to invest with us this month, applications for the Affluence Investment Fund and Affluence Small Company Fund close this Friday, 22 December. Applications for the Affluence LIC Fund close Friday 29 December. Go to our website and click “Invest Now” to apply online or access application and other forms for any of our funds.

As always, thanks for reading and for your continued interest in what we do. We wish you all the best for the holiday season and a Happy New Year.

If you have any questions or feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund returned 1.4% in November. Since commencing in November 2014, the Fund has returned 7.6% per annum, including monthly distributions of 6.4% per annum.

The cut-off for monthly applications and withdrawals is Friday 22 December.

Affluence LIC Fund

The Affluence LIC Fund rose by 1.5% in November. Since the Fund commenced, returns have averaged 10.7% per annum, compared to 8.4% per annum for the ASX 200 Index.

The cut-off for monthly applications and withdrawals is Friday 29 December.

Affluence Small Company Fund

The Affluence Small Company Fund returned 3.5% in November. Since commencing, returns have averaged 8.5% per annum vs 5.6% per annum for the ASX Small Ords Index.

The cut-off for monthly applications and withdrawals is Friday 22 November.

Performance

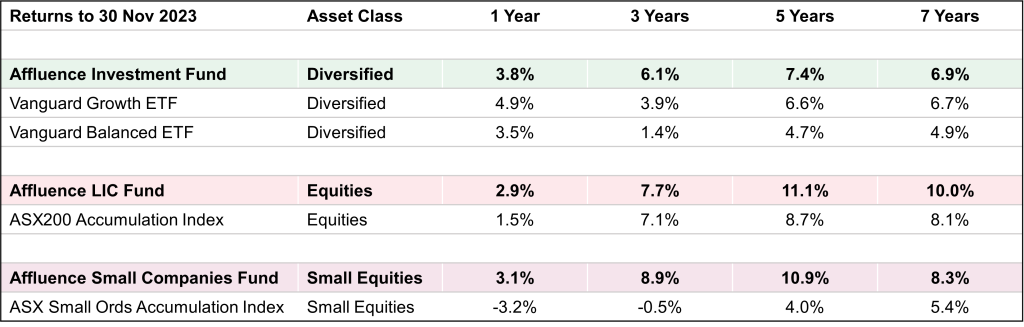

Our goal is to provide you with a better than average investment outcome, while smoothing out market ups and downs.

All of our Funds have substantially outperformed their index or passive equivalents over the suggested minimum investment period of 3 years and longer, with substantially less volatility.

We continue to be excited by the value on offer in all of our fund portfolios.

Performance data is calculated assuming the reinvestment of distributions and is expressed net of fees and costs, excluding the buy-sell spread. Performance includes distributions and changes in unit prices, but not franking or other tax credits. Returns for periods over 1 year are annualised. Past performance is not indicative of future performance. Current performance data is available at https://affluencefunds.com.au.

Things we found interesting

More on the LIC opportunity

Despite our enthusiasm, there’s still not a lot of love out there for LICs. We sat down with Livewire to explain what’s going on in a bit more detail. You can read it all right here.

Video of the month: Lessons from Charlie

Charlie Munger passed away at the end of November, one month shy of his 100th birthday. In memory of this stellar investment mind, here’s a compilation of his wisdom while being interviewed for the HBO documentary, Becoming Warren Buffett.

Financial history lesson: Why the US has 30 year fixed mortgages and we don’t

In early 2022, Australia had the highest level of fixed rate mortgages in its history, with almost 40% of borrowers paying fixed rates. Since then, borrowers have been gradually switching back to variable rates, as the extremely generous fixed rate deals on offer in 2020 and 2021 expired. Right now, it’s estimated only about 20-25% of loans remain fixed. Contrast this situation with the US, where almost all mortgages are fixed for the entire 30 year life of the loan, unless you sell your house or refinance. This excellent 2 minute video from Alan Kohler explains how it works and how it all started around a century ago.

This difference in treatment, coupled with rapidly rising interest rates, has led to some strange, but differing implications for both countries. In the US, existing home sales volumes have plummeted. That’s because most mortgages continue to have fixed rates set back in the low rate era before the end of 2021. No-one wants to lose that ultra low rate, so much less people are selling houses. Here in Australia, it’s new home sales that have suffered, as building cost increases and other factors have significantly reduced new home affordability.

Vaguely interesting facts.

- A study done by the University of Glasgow found that dogs appear to prefer reggae and soft rock over other genres of music.

- Japan is home to about a dozen “cat islands”—places where cats significantly outnumber people.

- Ackwards is the term used to describe a creature lying on its back that can’t get up.

- Newborn elephants suck their trunks for comfort.

- Wisdom teeth used to be useful. *

Source: mentalfloss.com, wikipedia.com.

* Humans and apes have wisdom teeth. They were originally useful as a third set of molars. The term was probably coined because they appear so much later than the other teeth, at an age where people are “wiser” than as a child. As early humans’ brains grew bigger, and the quality of our diets improved, the jaw gradually became smaller. This reduced space in the mouth, crowding out this third set of molars. Wisdom teeth have been known to cause dental issues for millennia. The oldest known case belongs to a European woman who lived between 13,000 and 11,000 BCE.

Did you know?

When you make an online banking payment to another account, the account name you enter for the payee is never verified, or even used in the transaction. It would seem obvious that to protect against mistakes and fraud, the account name you are paying to should be checked. Finally, it looks like our banks are doing something about it. This month, the Australian Banking Association announced the following:

“All banks will soon implement new name-checking technology to confirm who you’re paying and stop customers being manipulated into paying a scammer when names on account details don’t match. Expect to be alerted when you may be paying someone you are not expecting to pay, with increased warnings highlighting your potential risks.”

The bad news is that the Australian Banking Association definition of soon is not the same as the rest of us. Buried later in the same announcement they confirmed that the work would commence in December 2023 and will be complete in 2025. Given how efficiently Banks usually deliver technology projects, we wouldn’t be surprised if it was 2026 by the time it’s available to everyone. Still, it’s a big step in the right direction.

Thanks for reading. If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.