Key Details

Profile date: April 2020

Manager: Packer & Co Limited

Fund: Packer & Co Investigator Trust

Fund Type: Retail Unlisted Fund

Invests In: Wide mandate. Currently, global equities, cash and bonds.

Key People: Willy Packer

Investment Focus: The Fund can invest in Australian and global shares, derivatives, bonds, cash or unit trusts, with very few investment limits. The objective for the Fund is to grow wealth over the medium to long term by more than the ASX All Ordinaries Accumulation Index.

Risk profile: Medium/High. The Fund mostly invests in Global and Australian equities and could be subject to sharp declines. Historically the Fund has had reasonably low volatility and has only returned two negative calendar years since 1997.

Affluence Fund Weighting: As at April 2020, the Packer & Co Investigator Trust has a weighting of 2.1% of the Affluence Investment Fund portfolio.

What Packer & Co does

Packer & Co are a boutique investment manager with one retail Fund, the Packer & Co Investigator Trust. The manager was founded in 1993 by Willy Packer and is based in Perth. The Fund commenced in 1996, and currently has $2.5 billion of assets.

The manager has an open mandate to allocate funds to a broad spectrum of asset classes. The Fund can invest in Australia and global shares, derivatives, bonds, cash or unit trusts, with very few investment limits. The objective for the Fund is to grow wealth over the medium to long term by more than the ASX All Ordinaries Accumulation Index.

Given the managers’ location in Perth and their broad investment mandate, there are virtually no institutional investors in this Fund. Most investors appear to be retail and high net worth Western Australian investors, who are no doubt happy to keep backing Willy Packer and his two other investment team members.

Over the past 20 years, the managers’ asset allocation has changed dramatically, from being fully invested in Australian equities, to almost entirely bonds and cash, and recently in global equities. The most impressive part of the historical performance for this manager is their ability to identify inflection points. Both the 2000 tech wreck and 2008/2009 GFC decimated equity markets across the globe. However, leading into both meltdowns, Packer sold the vast majority of his equity holdings and moved into cash and bonds. He didn’t just reduce the market falls. He ended each of those calendar years with positive returns.

Sidestepping the latest market crisis

We have been invested in this Fund since late 2015 and have enjoyed excellent returns. For all this time, they have been fully invested in global equities. The Packer & Co Investigator Trust has not held a significant cash holding since 2009. In early February 2020, we received a brief update from the manager advising that as at the end of January 2020 they had sold a significant portion of their equities and were now sitting on 39% cash. They identified the potential risk from the coronavirus as the major reason for the selldown. In mid-February, we received another update that they had moved to 48% cash. When we received the February report, it revealed that the portfolio was by then comprised of 56% cash and US government bonds, with the balance retained in global stocks.

It hasn’t gone their way entirely, as the parts of the portfolio they maintained were biased towards oil and energy, which took a bit hit in March as the oil price plummeted. By the end of March 2020, the Packer Investigator Trust was down 6.5% for the first three months of 2020, while sitting on a portfolio of exceptionally cheap energy stocks and 56% in firepower.

As someone who believes trying to predict the future is hopeless, we have no idea how the Packer team has achieved their enviable track record of being well positioned for the past three major market corrections. Our working hypothesis involves time travel and a Tardis, but this is so far unproven…

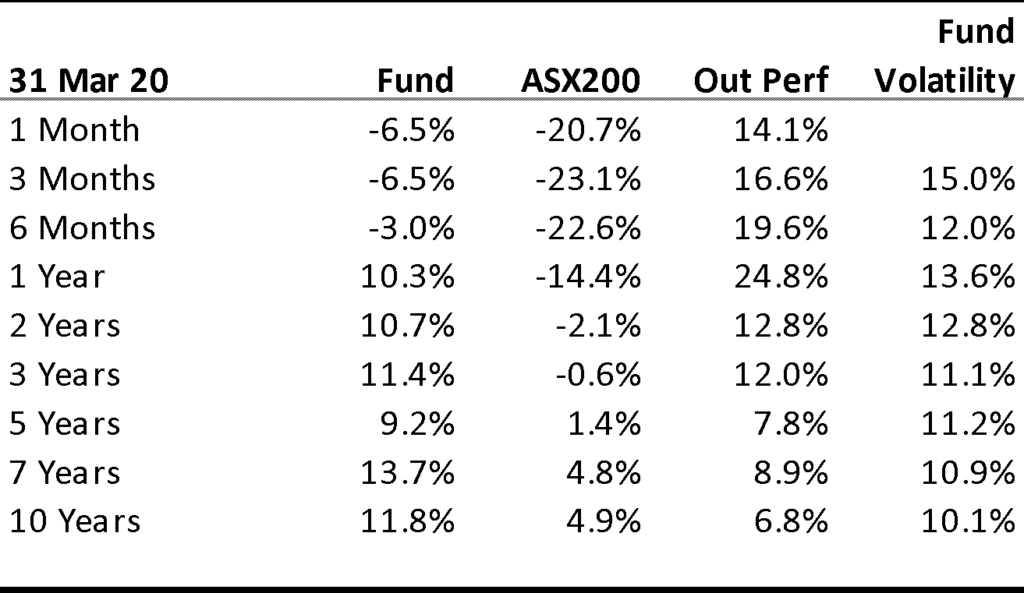

Packer & Co Investigator Trust Performance

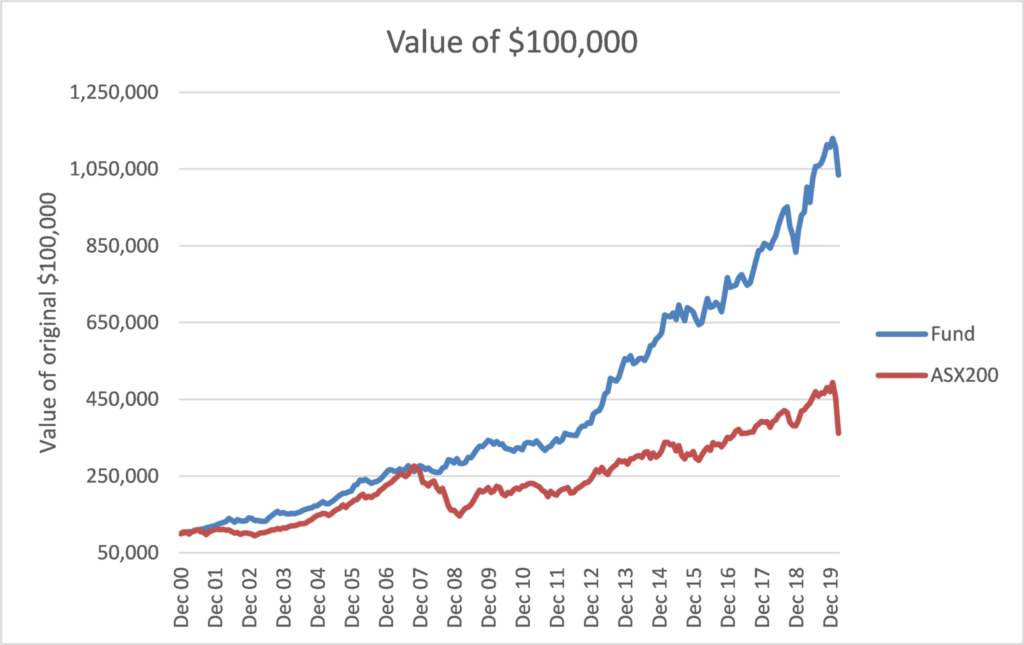

The following shows the performance of the Fund since 1 January 2001.

If you had invested in this Fund at the start of 2001, by the end of March 2020, you would have roughly ten times your initial investment. This is almost tripled what your investment gains would have been, compared to investing in the ASX 200. What’s more, this return was delivered with significantly less volatility than the index.

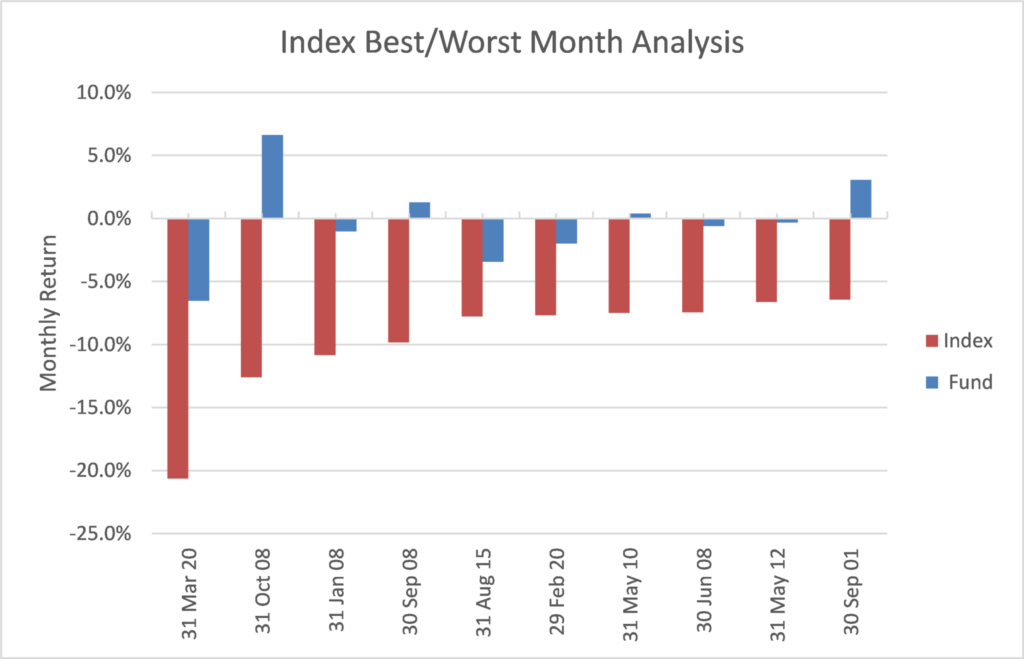

One of the other factors we focus a lot on is the Fund’s performance during months when the index had the largest negative returns.

Not surprisingly, the Fund has a reasonably low beta to the ASX200 Index of only 0.2 since 2001. This is another reason it fits well into the Affluence Investment Fund, as we like investments to contribute at different times.

Why we like the Packer & Co Investigator Trust

It would be difficult to find a superior track record to this, on a risk adjusted basis. We are aware of other funds that have achieved higher returns over this period. But they generally use substantial amounts of gearing and also involve substantially greater drawdowns. We are not aware of any Australian based fund that has achieved this level of return, combined with a reasonable level of volatility and the ability to largely protect capital in a crisis.

A fund that has had only two small negative years in 20 is pretty special. The manager has proven more than once that they recognise when assets are fully valued and have moved into more defensive assets when this occurs.

Potential risks

We spend a significant amount of time thinking about what could go wrong for each investment we make. Outside of normal equity market risks, here are our top risks for this Fund:

1. Global Equities

As with all global funds, an investment in this Fund introduces the potential for global markets performing worse than Australian markets. The Fund is also subject to adverse moves in currency rates, but this can work in our favour as well.

2. Wide Mandate

While we understand that managers generally prefer broad investment mandates to allow them to execute their best ideas properly, this Fund does allow a lot of freedom for the manager to determine where to invest. Despite the exceptional track record to date, this does bring with it the potential for a range of returns. To date, the manager has added a lot of value through their asset allocation. However, nobody is perfect, and there is a risk that they will not always call significant market changes correctly.

3. Key man risk

Willy Packer is the portfolio manager and the primary reason for the exceptional performance. Should he no longer manage the Fund, investments could be sold over a short period, and capital returned to investors.

Conclusion

The Packer & Co Investigator Trust provides the Affluence Investment Fund with access to an exceptional investment mind. There are very few funds in Australia that can boast such impressive performance over such a long period.

We hope that was helpful. If so, here are some other things you might like.

Learn more about this manager.

See more of our articles.

Visit the Affluence Members page to see more Fund Manager Profiles.

Find out about our Affluence Investment Fund.

View the Affluence Investment Fund Portfolio.

Disclaimer

This article is prepared by Affluence Funds Management Pty Ltd ABN 68 604 406 297 AFS licence no. 475940 (Affluence) to enable investors in the Affluence Investment Fund to understand the underlying investments of the Fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any financial product advice or service.

The content has been prepared without taking into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser to determine whether a particular financial product meets your objectives, financial situation or needs before making any decision to invest.