Key details

Fund: Phoenix Opportunities Fund

Profile date: February 2020

Fund Type: Retail Unlisted Fund

Invests In: ASX small and micro-cap stocks

Key People: Stuart Cartledge and Richard Fakhry

Investment Focus: ASX listed microcaps with a value style. Results have been very impressive. The fund has a cap of $50 million of assets.

Risk profile: Medium. Small and micro sized companies can be quite volatile. However, this fund has displayed volatility well below the ASX 200 Index.

Affluence Fund Weighting: As at February, the Phoenix Opportunities Fund has a weighting of 4.7% in the Affluence Investment Fund portfolio and 18.3% in the Affluence Small Company Fund portfolio.

What Phoenix does

Phoenix Portfolios is a Melbourne based fund manager. The manager is owned by senior management and Cromwell Property Group. Phoenix is better known as an A-REIT manager. They are regarded as one of the best investment managers in this category, with a very impressive track record.

Phoenix started the Opportunities Fund in November 2011 when they noticed there were limited opportunities for investors to get exposure to microcap value stocks. The Affluence team were working at Cromwell at that time. We worked closely with Phoenix in the creation of the Phoenix Opportunity Fund and its investment philosophy.

The Fund aims to take advantage of microcaps typically having little analyst coverage. This occurs because institutions are unable to deploy meaningful amounts of capital and therefore cannot justify investing in research. Many companies outside the main ASX indices are therefore under-researched and relatively undiscovered. This can give rise to situations where companies trade well below their potential value.

Phoenix seek to identify pricing discrepancies in these ‘under-researched’ stocks. They aim to hold a portfolio of investments that offers the highest risk adjusted after-tax expected return. The Fund typically holds between 15 and 40 investments.

Phoenix uses a number of quantitative screens to reduce the potential number of investments for research from a universe of around 1,300 stocks, down to around 150.

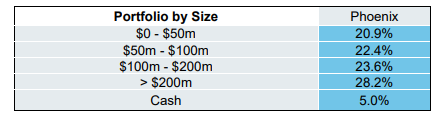

The following table shows the exposure by market capitalisation. The Fund access to genuine microcaps. Most are far too small for most institutional investors or analysts to bother with, giving Phoenix a significant and genuine edge.

The key managers are Stuart Cartledge and Richard Fakhry, ably supported by analyst Jordan Lipson.

Phoenix Fund performance

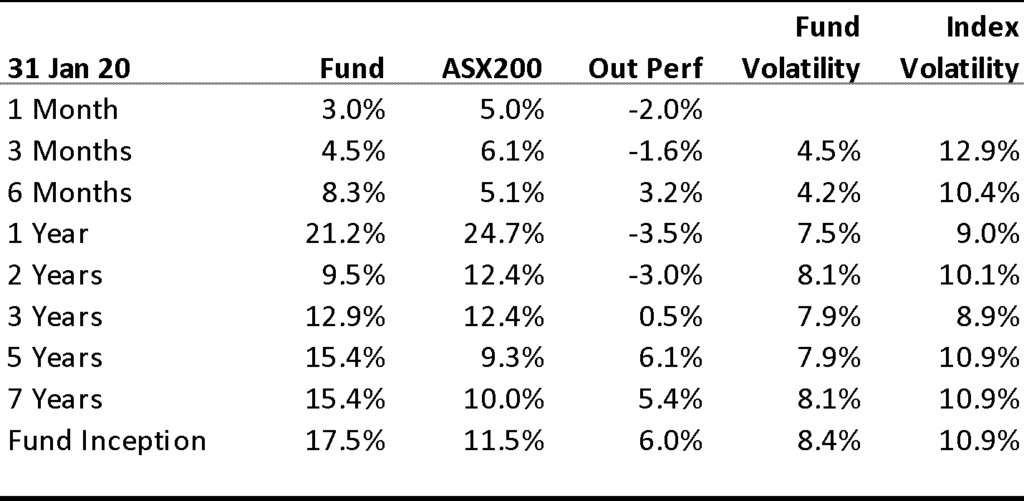

From inception in November 2011 to January 2020 the fund has delivered an average annual compound return of 17.5%. Over the same period, the ASX 200 Accumulation Index has returned 11.5%, resulting in outperformance of 6.0% per annum.

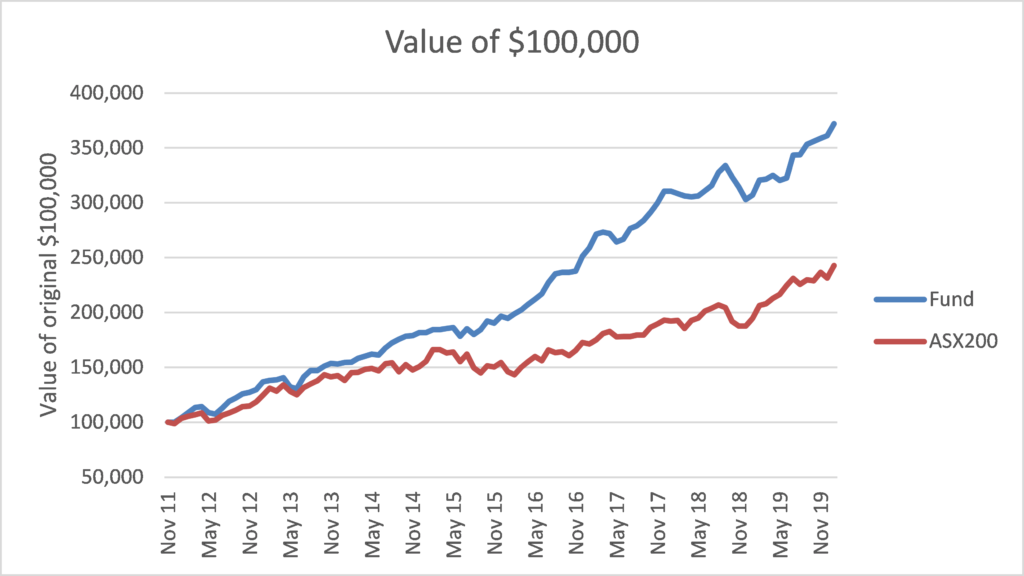

A $100,000 investment in the Fund in November 2011 would now be worth $372,000. The same amount invested in the index would be worth $243,000. This represents a 53% difference over the Funds more than 8 year history.

How the performance is delivered can be just as important as the performance itself. In the case of the Phoenix Fund:

- Volatility (or variability of returns) has been 8.4% for the Fund since inception. This is significantly less than the ASX 200 index. It shows that investing in small and micro caps does not necessarily mean higher volatility.

- The correlation (how similar the returns are) between the Fund and the index is just 0.6, and the beta is only 0.5 since inception. This shows that the Fund does not rely just on the market going up to make money.

- During periods when the index has had the most significant losses, the Fund has usually outperformed the index.

These factors differentiate this fund from many peers, which tend to be more volatile and more correlated to the index.

Why we like the Phoenix Fund

Investing in small and micro caps gives a manager a much higher chance of discovering inefficiencies than large and mid-caps. However, while many managers claim to invest in small caps and exclude the ASX 100, the Phoenix team delve down into stocks with a market cap of less than $10 million, allowing them to expose the fund to a greater number of opportunities.

Their strategy seeks to identify distinct value opportunities. This differentiates them from most small cap managers who are looking for growth stocks as the “next big thing”.

The Phoenix Opportunity Fund returns over the past eight years have been very impressive. The Phoenix team also has a significant personal investment in this fund, ensuring an alignment of interests with investors.

Phoenix has hard closed this strategy (they accept no new money into the Fund) at just $50 million. Maintaining this relatively low level of funds provides the best opportunity to continue to outperform. There are very few managers who would implement a cap at such a low level.

Like Affluence, Phoenix does not charge any base management fee for the Fund. Instead, investors pay a performance fee of 20% of Fund returns. This further aligns the manager with investors. If the fund is very successful, as it has been to date, investors will pay much higher fees than usual. Conversely, if the fund were to return zero, investors would pay no fees.

Potential risks

We spend a significant amount of time thinking about what could go wrong for each investment we make. Outside of normal equity market risks, here are our top risks for this Fund:

Small and microcap stocks

The Fund holds positions in stocks with small market capitalisations. While overall fund performance to date has been exceptional, if the market swings to embracing larger stocks, the bigger end of the market could outperform the smaller stocks. This has been the case for much of the past few years. The biggest stocks have dominated returns, and smaller stocks have tended to underperform.

This Fund has also not been tested by a major market correction. During the 2008-09 period, many small cap managers experienced significantly higher volatility than larger cap funds.

Also, smaller stocks are less liquid than larger stocks. This can mean it can take much longer to buy and sell these stocks. In market corrections, there tend to be fewer buyers, and significant gaps between buyer and seller prices can occur.

Style Risk

Phoenix Portfolios are value investors who look to purchase shares in a company below its intrinsic value. There are periods when this style of investing underperforms other methods such as growth investing.

Key man risk

Stuart and Richard are, in our view, the key reason for the exceptional performance. Should either or both no longer manage the Fund, future returns would be much less assured. In that case, the investment could be redeemed within a relatively short time.

Conclusion

Phoenix Portfolios is one of our most trusted managers. The Phoenix Opportunities Fund has been one of Affluence’s longest held investments. Our current allocation to this fund is one of the highest in our portfolios. They run a differentiated strategy in a sector of the market that allows them to outperform significantly, and we are very confident to continue holding this fund in the future.

We hope that was helpful. If so, here are some other things you might like.

Learn more about this manager.

See more of our articles.

Visit the Affluence Members page to see more Fund Manager Profiles.

Find out about our Affluence Investment Fund.

View the Affluence Investment Fund Portfolio.

Disclaimer

This article is prepared by Affluence Funds Management Pty Ltd ABN 68 604 406 297 AFS licence no. 475940 (Affluence) to enable investors in the Affluence Investment Fund to understand the underlying investments of the Fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any financial product advice or service.

The content has been prepared without taking into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser to determine whether a particular financial product meets your objectives, financial situation or needs before making any decision to invest.