Revolution Asset Management – Key Details

Profile date: April 2024

Manager: Revolution Asset Management

Fund: Revolution Wholesale Private Debt Fund II

Fund Type: Wholesale Unlisted Fund

Asset Class: Fixed Income

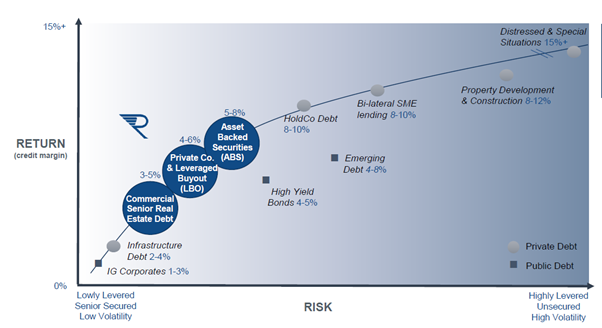

Investment Strategy: The Fund focuses on three private credit sectors: lending to corporate private equity borrowers (leveraged loans), commercial real estate debt and asset backed securities.

Affluence Exposure: The Revolution Wholesale Private Debt Fund II is an investment in the Affluence Income Trust.

What does Revolution Asset Management do?

Revolution Asset Management is a boutique private credit manager founded in 2018. The three founders, Bob Sahota, Simon Petris, and David Saija, are some of the country’s most experienced private credit operators. Revolution has an investment team of five professionals and manages more than $2 billion of assets. Its clients include super funds, institutional investors, high-net-worth investors, and other wholesale investors.

What is the Revolution Wholesale Private Debt Fund II?

The Fund provides wholesale investors with access to the Revolution Private Debt Fund II, which holds the majority of investments. The Revolution Private Debt Fund II was launched in 2019 after the success of Fund I.

The Fund focuses on three private credit sectors: leveraged loans, commercial real estate debt and asset backed securities. The Fund comprises 100% floating rate assets, so any change in the RBA cash rate flows through to the returns from the Fund.

Revolution lends in Australia and New Zealand. They have demonstrated their ability to preserve capital across multiple market cycles.

Leveraged Loans

This is secured debt issued to private equity sponsors to facilitate the acquisition of a target company. Revolution focuses on defensive industries, high-quality businesses with strong market share, stable demand drivers, and reliable cash flow generation. It avoids cyclical, highly leveraged, and smaller companies.

Commercial Real Estate Debt

When accessing Commercial Real Estate (CRE) deals, Revolution looks for the following features:

- Completed and stabilised commercial assets (office, industrial and retail) or portfolios of assets.

- Strong underlying leases and cash flow.

- A maximum loan to value ratio (LVR) of 70% against the asset value.

Unlike many other lenders in this space, they do not lend to development or construction projects, which typically reduces the overall risk.

Asset Backed Securities

The Fund predominantly lends to private warehouse facilities for residential mortgage backed security (RMBS) and asset backed security (ABS) originators. These facilities are bespoke arrangements between the loan originator and Revolution. They allow the originator to fund new loans before securitising them into public (traded) markets.

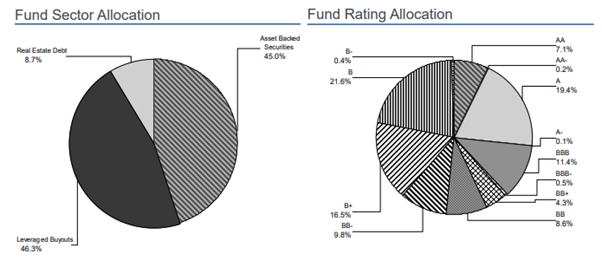

The Revolution portfolio was structured as follows at 29 February 2024:

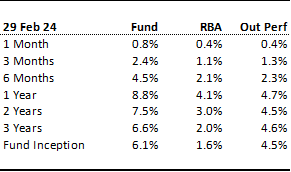

Revolution Wholesale Private Debt Fund II Performance

The Fund has produced excellent returns, with no negative months in its four-year history. It has delivered a consistent 4-5% premium over the RBA Cash Rate.

Why we like the Fund

The Revolution investment team includes some of the most experienced private credit operators in Australia. Sectors such as private warehouses for loan originators are very complex investments that require specialist knowledge to structure correctly.

The Fund returns have been consistent and impressive, and Revolution’s approach to risk management is comprehensive.

Conclusion

The Revolution Wholesale Private Debt Fund II has an impressive track record of returns well above the RBA Cash Rate. The Fund is diversified by sector and can increase or decrease its weighting to a sector depending on their assessment of the risks and returns. On a risk adjusted basis and given the current level of the RBA Cash Rate, overall returns are attractive.

We hope that was helpful.

If you enjoyed this Fund Manager Profile, you can view our March 2024 profile here

If you would like to read more about Opportunities in Fixed Income, you can read it here

Disclaimer

Affluence Funds Management Limited (Affluence) has prepared this fund profile. It was prepared to assist investors in various Affluence funds in understanding the investments of the relevant Affluence fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any product advice or service.

This Fund Profile does not take into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser before making any decision to invest.