Ryder Investment Management – Key Details

Profile date: July 2024

Manager: Ryder Investment Management

Fund: Ryder Capital Limited (ASX: RYD)

Fund Type: Listed Investment Company

Asset Class: Small cap Australian equities.

Investment Strategy: Ryder Capital Limited (ASX: RYD) is a listed investment company focused on Australian small cap stocks.

Affluence Holdings: The Affluence LIC Fund currently holds RYD, and it comprises approximately 6% of the portfolio.

Important Note: All figures are as at June 2024 and can change significantly over time.

What does Ryder do?

Ryder Investment Management are a Sydney based boutique investment manager. They specialise in small cap Australian equities. Strategies include the LIC (RYD), a special situations fund and private equity and venture capital funds.

The portfolio managers are Peter Constable and David Bottomley, who are also the largest shareholders of RYD and owners of the management company. This creates excellent alignment between stakeholders.

What is RYD?

Ryder Capital Limited (RYD) is a listed investment company. RYD listed on the ASX in 2015. Ryder Capital pursue a value based investment strategy focusing on ASX small cap equities. They have an absolute return target of the RBA cash rate plus 4.25% over the medium to long term.

RYD has a current market capitalisation of approximately $90 million. The net asset value (NAV) is approximately $110 million, making it one of the smaller LICs.

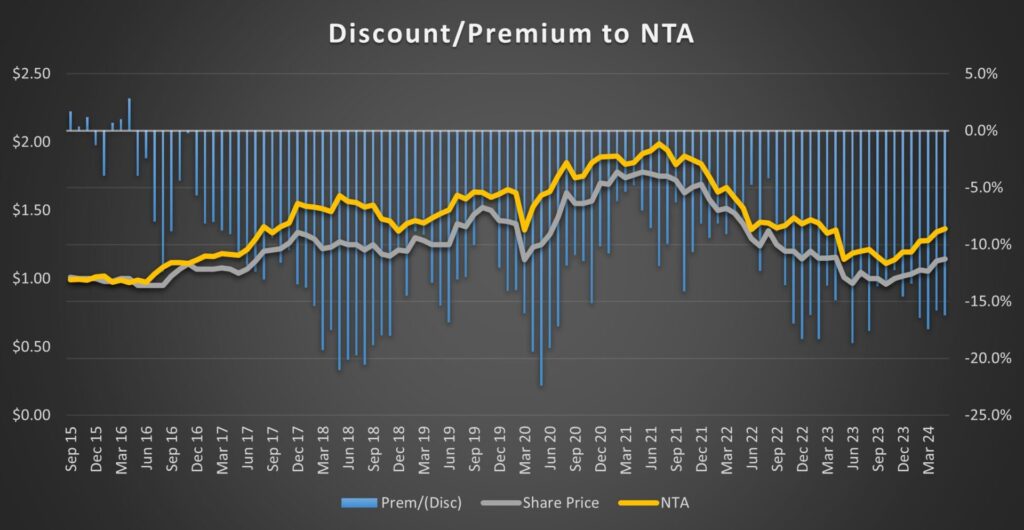

The following graph shows the share price discount to NTA since inception. As at late June 2024 RYD was trading at a little over a 15% discount to NTA, which is towards the top end of the historical average.

RYD Performance

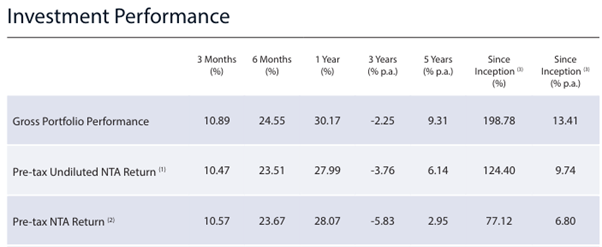

The following performance numbers are from the May 2024 RYD monthly report:

Performance was excellent up until mid 2021. Then, some missteps from the manager and the market wide underperformance of small caps versus large caps combined to deliver two years of very poor returns. Over the past 12 months, performance has recovered significantly. We retain a very positive rating on the managers ability.

Why we like the Fund

We are very comfortable with the current RYD investment portfolio. Over time, we expect small cap equities to recover their underperformance compared to larger stocks. If this happens, the portfolio returns have the potential to be very strong.

In addition to the portfolio potential, we also have some prospect of the manager taking action to deal with the persistent discount. In the AGM Presentation in November 2023, the Chairman made the following statement:

“The Board are increasingly concerned by the ongoing poor liquidity and large and consistent discount to NTA that Ryder shares trade at. This situation presents a problem for Shareholders wishing to realise their investment in Ryder. The Board has recently commenced a review of a range of alternatives to best solve for these dual problems of poor liquidity and the discount to NTA and anticipates being in a position to report to Shareholders no later than February 2024 the outcomes and proposed course of action from this review.”

And then, in the half year results in February 2024, the company made the following statement:

“During the 2023 Annual General Meeting (AGM) Ryder informed shareholders of its initiative to enhance liquidity and address the persistent discount to NTA associated with trading in its shares. This effort aims to ensure that any solution benefits all shareholders regardless of their investment horizon. The Board is currently evaluating various restructuring options and has engaged Pitcher Partners to assist with preliminary tax advice. Each restructuring option has its advantages but must be weighed against the costs, associated risks and tax implications. Importantly, the Board is very cautious not to compromise potential future returns particularly given the cyclically low trading multiples for the majority of its core Portfolio positions. The ongoing strategic review is anticipated to be completed by the release of the Company’s full-year results in August 2024, however at this stage, there can be no assurance of an acceptable solution.”

There is no certainty that any restructuring will occur. However, the board has made it fairly clear that allowing investors to exit their investment at or close to NTA is a very important matter to them. We agree. If the Board were to announce a restructure at the August full year results, that could allow investors to exit over time at close to NTA. This has the potential to provide investors with a “free” 10-15% head start on the market as the discount closes.

Conclusion

Even without the potential for a one-off return from any restructuring, there is much to like about RYD:

- A reasonably attractive discount to NTA, compared to history.

- A quality investment team.

- The portfolio managers are the largest shareholders in RYD, thus very aligned with other shareholders.

- We believe their small cap focused strategy can outperform the ASX 200 Index from here, over the medium to long term.

At June 2024, RYD is one of the largest holdings in the Affluence LIC Fund.

We hope that was helpful.

To learn more about the Affluence LIC Fund you can visit the Fund Page here

If you enjoyed this Fund Manager Profile, you can view our June 2024 profile here

Want to learn more about LIC’s?

You can download our Guide to LICs

Read our article Finding the best LICs

If you would like to read a recent article Affluence has written on LICs, you can find one here

Disclaimer

This Fund Profile was prepared by Affluence Funds Management Limited (Affluence). It was prepared to assist investors in Affluence funds in understanding the investments of the relevant Affluence fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any product advice or service.

This Fund Profile does not consider your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser before making any decision to invest.