Salter Brothers – Key Details

Profile date: June 2024

Manager: Salter Brothers

Fund: Salter Brothers Emerging Companies Limited (ASX: SB2)

Fund Type: Listed Investment Company

Asset Class: Small and microcap Australian equities.

Investment Strategy: Salter Brothers Emerging Companies Ltd (ASX: SB2) is a listed investment company focused on emerging companies. These are predominantly Australian listed and unlisted securities with market capitalisations under $500 million at the time of the initial investment.

Affluence Holdings: The Affluence LIC Fund currently holds SB2, and it comprises approximately 5% of the portfolio.

Important Note: All figures are as at June 2024 and can change significantly over time.

What does Salter Brothers do?

Salter Brothers describe themselves as an alternative investment manager, focusing on specialist property, equities and credit. The group has assets under management of more than $3 billion. Most products are focused towards wholesale and institutional investors.

What is SB2?

Salter Brothers Emerging Companies Limited (SB2) is a listed investment company on the ASX. SB2 listed in June 2021 through a combination of an existing Salter Brothers Fund and capital raising to the public.

The Salter Brothers Fund, which formed the majority of the investor base, was set up to comply with the Significant Investor Visa (SIV) Regime. Under the SIV Regime, certain conditions are attached to a Significant Investor Visa, including that the visa holder must hold a certain amount of complying significant investments for a period. Part of those significant investments can be held in a complying emerging company investment.

SB2 continues to aim to comply with the SIV Regime, as investors continue to rely on the LIC to meet their visa requirements. This does make the investor register for SB2 quite different from the majority of LICs.

- SB2’s investment strategy is to own 25-30 listed and unlisted securities with market capitalisations under $500 million at the time of the initial investment. This sector of the market has materially underperformed larger stocks since 2022. We believe that, at current pricing, there is significantly more potential in the smaller end of the market.

- SB2 is one of the smaller LICs. It has a market capitalisation of approximately $55 million and net assets of approximately $84 million. SB2 trades at a circa 35% discount to NTA. It has also not yet paid any dividends to shareholders.

- SB2’s investment team has changed since the vehicle was listed in 2021. The two original portfolio managers resigned in November 2021 before the current team took over in April 2022. There was a period of investment portfolio turnover as the new team implemented their slightly amended process.

SB2 Major Shareholders

There are two substantial investors in SB2.

The first is the fund managed by Salter Brothers as part of the SIV Regime. It holds a little less than 40% of SB2. This shareholding is expected to continue to fall over the next 2-3 years, as these investors will no longer be required to hold SB2 as part of their visa requirements, though they may still choose to do so. This is likely to continue to result in more sellers than purchasers.

The other substantial shareholder is WAM Strategic Value (ASX: WAR). WAR is Geoff Wilson’s discount capture strategy. This shareholding creates an interesting opportunity in SB2. Wilson Asset Management, the manager of WAR, has been in this situation many times before. They take a position in a smaller LIC trading at a discount and eventually negotiate to merge it with one of their existing LICs. We believe WAM Microcap (ASX: WMI), which currently trades at a small premium to NTA, would be the most likely merger partner.

SB2 Performance

SB2 has had a rocky ride since listing. The combination of small and microcap underperformance, rising interest rates, and a change in the investment team has weighed on performance.

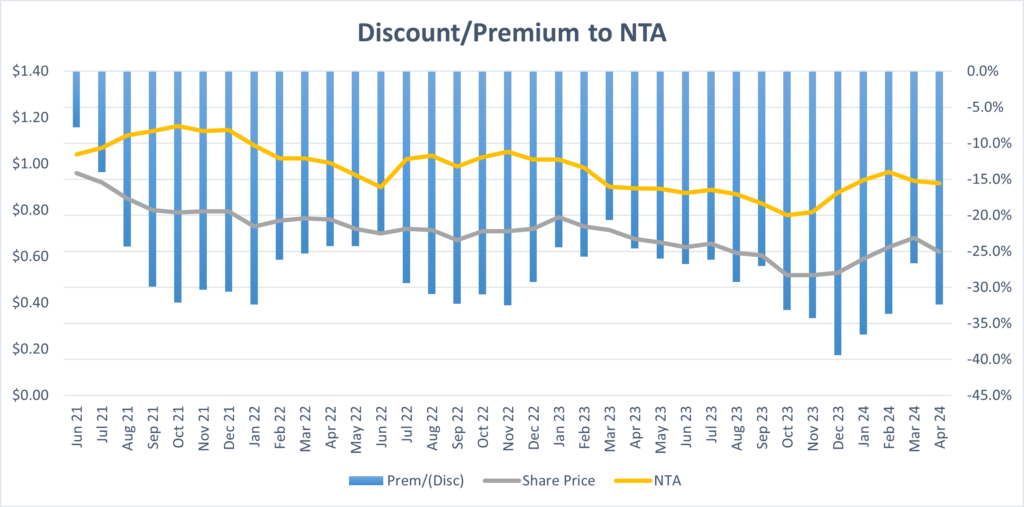

Over the almost three years since listing, the portfolio performance (change in NTA plus dividends) has been -4% per annum. The share price performance (change in share price plus dividends) has been -14% per annum.

The significant difference between the two measures is due to SB2 trading at a substantial discount to NTA. The following graph shows the discount to NTA since inception.

Why we like the Fund

With a combination of mediocre performance, a large discount to NTA, no dividends, and an unusual investor register, it is not surprising that SB2 has not been popular with investors. However, we assess returns based on future prospects. All of these negatives have the potential to be rectified and provide strong tailwinds in the future.

There are two main ways to make profits from an LIC:

- Strong underlying portfolio performance, usually heavily influenced by market returns.

- Discount capture by buying at a large discount to NTA and selling when it reduces.

We believe that with SB2 there is an opportunity for a patient investor to achieve profits from both.

The small and microcap equity market has significantly lagged the ASX200 Index since early 2022. The smaller the stocks, the more they have underperformed and been ignored by the market. While we cannot predict the timing or catalyst, we strongly believe in reversion to the mean. We therefore expect that there will be a catchup in performance for these smaller stocks at some point in the future.

The current portfolio manager, Gregg Taylor, is very experienced in small and microcap investing and is excited about the potential of the underlying portfolio. Over a 3 to 5 year period, we would expect the portfolio to outperform the ASX200 Index.

We believe that for most LICs, a discount to NTA above 20% is not sustainable in the long run. The current discount is around 35%. From here, there are two likely scenarios for SB2. The first is that the portfolio performs strongly. New investors will then be attracted to the strong returns, which would likely drive a rerating of the discount to something more reasonable. The second scenario is that if performance is weak or the discount doesn’t reduce, then WAR and/or other activist investors are likely to agitate for a merger or windup.

Conclusion

SB2 is one of the larger holdings in the Affluence LIC Fund. It is one of several LICs in the portfolio that have the combination of three factors:

- A focus on small and microcap stocks.

- Trading at a larger discount to NTA than is justified.

- A strong chance of activist investors pushing for change if things do not improve.

We hope that was helpful.

To learn more about the Affluence LIC Fund you can visit the Fund Page here

If you enjoyed this Fund Manager Profile, you can view our May 2024 profile here

What is a LIC?

Want to learn more about LIC’s? You can download our Guide to LICs

If you would like to read a recent article Affluence has written on LICs, you can find one here

Disclaimer

Affluence Funds Management Limited (Affluence) has prepared this fund profile. It was prepared to assist investors in various Affluence funds in understanding the investments of the relevant Affluence fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any product advice or service.

This Fund Profile does not take into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product, which are available from the product provider. Affluence recommends you consult your professional adviser before making any decision to invest.