Here’s our Affluence Sharesight Review. We occasionally publish reviews of products we think you might find useful in your investing journey. We have no relationship with the product provider other than as a paying customer.

Setup and Features

Sharesight is an online investment portfolio management tool designed to make measuring investment performance and keeping your tax records a breeze.

With Sharesight you can record and manage investments in ASX-listed stocks, plus those in many overseas markets. You can also track investments in most Managed Funds in Australia and New Zealand.

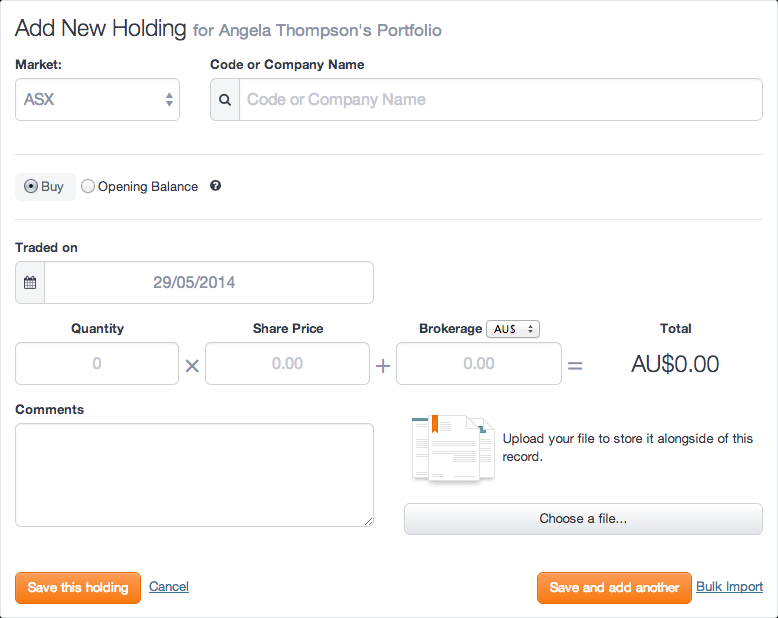

Setup is easy. Your initial portfolio can be entered manually or there are facilities to import holdings via an excel spreadsheet. Depending on your broker, you may also be able to import historical transactions. Once the initial setup is complete, future share transactions can be recorded by emailing a copy of the contract note to a personalised Sharesight email address. Usually this can be arranged directly with your broker, meaning all share trades are automatically entered into Sharesight. You will receive a confirmation email as each contract is uploaded.

Values for listed stocks are updated daily from ASX data. Dividends and distributions from listed investments are automatically created based on your holdings and ASX data. You can then confirm the payment and amend if necessary. Corporate actions such a share splits, cancellations and buybacks can all be catered for.

Managed Fund transactions must be set up manually. Once recorded, unit prices and values are updated periodically using Morningstar data. Again, managed fund distribution records are created for you based on Morningstar data. They can then be quickly verified in most cases.

The tax features include recording of all investment transactions and brokerage, as well as franking credits and differing tax components for managed fund distributions. Each parcel is recorded separately. When sales occur there are many options to help you get the best capital gains tax outcome.

Reporting

Sharesight provides a range of reports for both your investment portfolio and tax position.

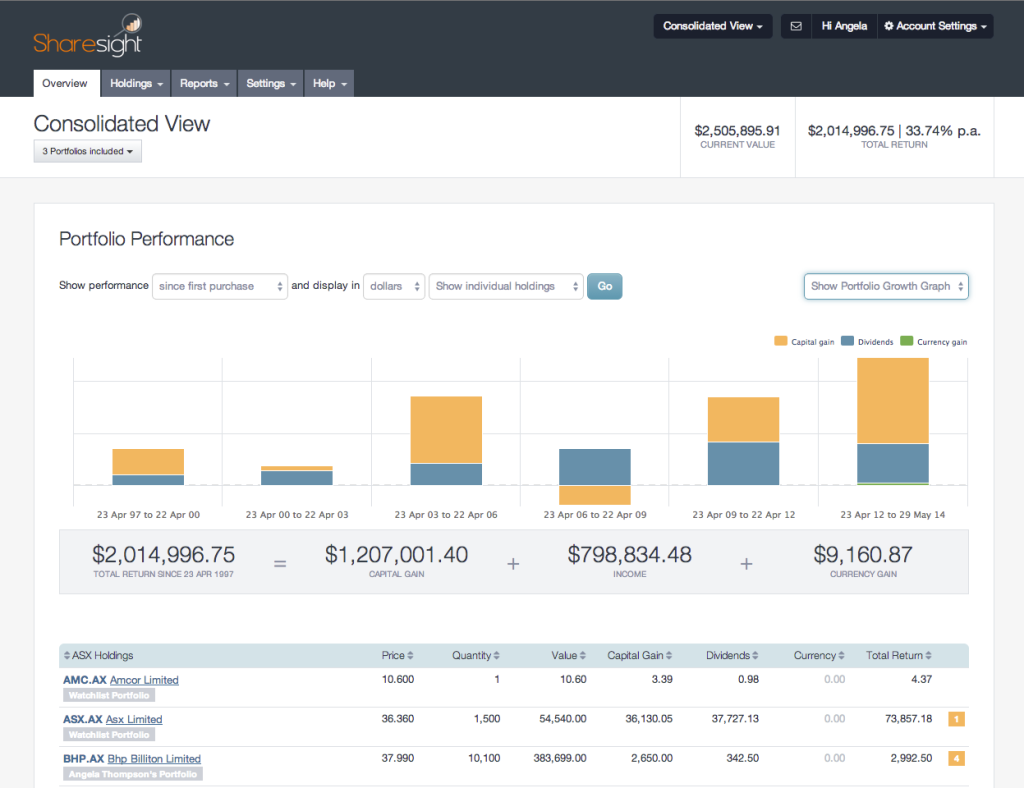

Portfolio reports include an investment portfolio snapshot, performance report (income and changes in value) and diversification report. The consolidation feature is excellent and allows you to combine more than one portfolio (for example your SMSF and personal holdings) to get a combined view of your family wealth.

Tax reporting includes full details of share sales, realised and unrealised capital gains, taxable income and historical cost reporting. Reports can be easily saved as a pdf or exported to excel.

Sharing and permission features allow you to provide view only or full editing access to advisors, accountants or anyone else you wish, at no extra charge.

Improvements

The Sharesight team seem to have a good attitude towards continual improvement of the product, which we believe is a key benefit. User surveys and other opportunities to provide feedback are common. A monthly newsletter and regular information on current and expected enhancements provide extra comfort.

Limitations

Sharesight does have its limitations.

There is currently no way to efficiently record bank accounts and cash transactions directly within Sharesight. There is an option to add integration with Xero accounting software for around $15 per month. We have trialled this in the past, but we’re not fans of the Xero application. It would be good if more accounting packages (such as MYOB) or a simple cashbook alternative were included in future.

Assets such as property, collectibles and offshore managed funds can be recorded, but functionality is limited.

Suitability

Although Sharesight has many of the same features as a full-service investment platform at a fraction of the cost, it’s not a full service model and users must be happy to do a lot of the work themselves. Support is limited and it helps to have an understanding of how tax works. If you are already doing a lot of the administration work for your own SMSF or investments and perhaps using excel to record transactions, Sharesight could be a big help.

If you have less than 10 investments, you can access Sharesight for free. Otherwise, you can manage up to 3 portfolios and an unlimited number of investments for around $25 per month. This seems like good value, especially if you have multiple investment entities and can take advantage of the consolidated reporting features.

For active investors with a basic knowledge of tax and are happy to do a lot of the legwork, Sharesight can be well worth the money. If you’re a beginner or more passive investor and your accountant or advisor does the administration work for you – Sharesight may not be for you.

Learn more

If you’re interested in learning more, visit http://www.sharesight.com/. You can also access the introductory video here: https://vimeo.com/57338416.

Have you used Sharesight? Have you come across other investing websites, apps or services you would like us to review? Feel free to add your feedback in the comments section below.

If you’d like to know more about Affluence and how we find the best fund managers available in Australia, go here.

Want more of our insights and investment ideas? Plus, access to profiles of some of the best fund managers in Australia? Go here to register as an Affluence Member. It’s completely free and you can unsubscribe at any time. Take charge of your financial future!