Tea Tree Opportunity Trust

Key Details

Profile date: October 2024

Manager: Scentre Group/Barrenjoey

Fund: Tea Tree Opportunity Trust

Fund Type: Single asset property syndicate

Asset Class: Commercial Real Estate

Investment Strategy: The syndicate will own Tea Tree Plaza for an initial period of 5 years.

Affluence Holdings: The Tea Tree Opportunity Trust is an investment in the Affluence Investment Fund with a position size of approximately 1.5%.

The Asset Class

The Affluence Investment Fund has had some exposure to unlisted property funds for most periods since inception. However, in recent years we have largely avoided the sector, as valuations during the period of ultra-low interest rates were well above what was sustainable in the long term.

As interest rates in Australia and globally have normalised, there has been a meaningful fall in commercial property values. We have researched a number of potential property syndicates recently, as potential returns are now much more attractive based on current values.

In July 2024, we made our first new unlisted property investment for some time, the Tea Tree Opportunity Trust. Below we explain what attracted us to this particular opportunity.

What is the Tea Tree Opportunity Trust?

The Tea Tree Opportunity Trust is the first syndicate launched by a joint venture between Scentre Group (ASX: SCG) and Barrenjoey investment bank. Scentre Group is the owner and manager of 42 Westfield Shopping Centres in Australia and New Zealand. Barrenjoey is an investment bank established in 2020. The syndicate will own Tea Tree Plaza for an initial period of 5 years. The trust was established to purchase a 50% stake in Westfield Tea Tree Plaza, in Adelaide.

Westfield Tea Tree Plaza

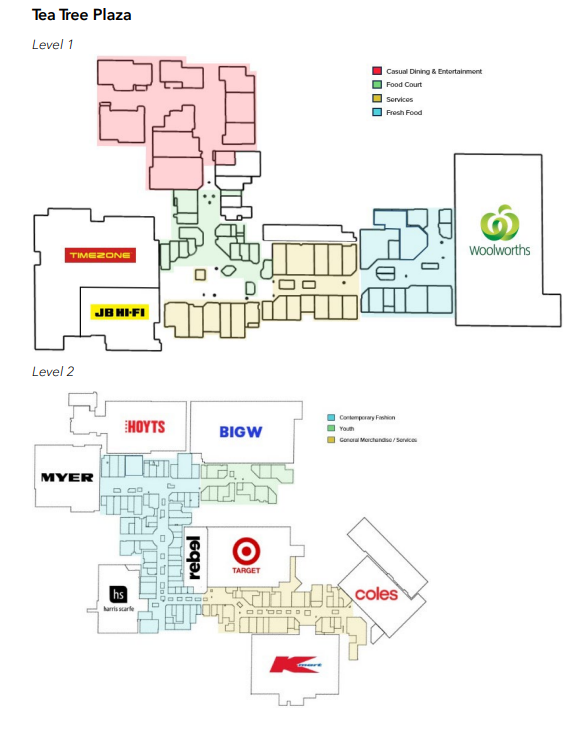

Westfield Tea Tree Plaza is the second largest shopping centre in South Australia, and the only regional shopping centre in its primary trade area. It comprises 101,584 square metres of lettable area.

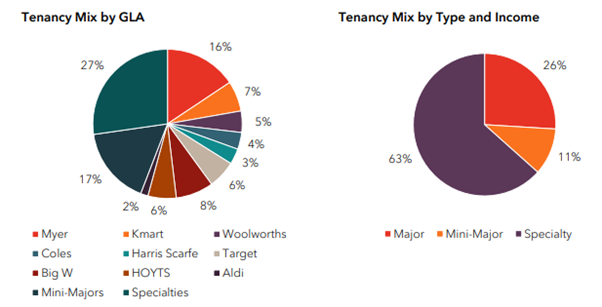

Major tenants include Aldi, Big W, Coles, Harris Scarfe, Hoyts, Kmart, Myer, Target and Woolworths. There are approximately 230 other retailers.

The Tea Tree Opportunity Trust has purchased its 50% stake from a Dexus managed fund for $298 million. The manager has reported that this purchase price equates to a market capitalisation rate (yield) of 8.0%, which we believe is exceptionally attractive for this type of asset. The other 50% of the centre is owned by Scentre Group itself. As at 30 June 2024 Scentre Group have valued their share of the asset at $342.5 million, based on a 6.75% cap rate. At its peak in December 2018, Scentre Group valued their 50% stake in Tea Tree Plaza at $410 million, based on a 5.38% cap rate.

The trust was able to purchase the 50% interest below market value due to Dexus being somewhat of a forced seller of the asset, due to client redemption requests. We believe this is a temporary period of softness in the retail market for larger opportunities.

The property will continue to be managed by Scentre Group. We believe this is crucial, as there are only a few groups we would trust to have the full set of asset management skills to operate a 100,000 square metre plus retail asset. These are not the type of assets that most smaller boutique property companies can manage efficiently.

Another advantage for this asset is that unlike the other states in Australia, there is no stamp duty payable in South Australia. Therefore when comparing valuations to other states, this results is around a 5% saving for this opportunity.

Tea Tree Plaza Opportunity Trust

The 50% interest in Tea Tree Plaza is being purchased with a combination of equity and bank debt. The initial loan to value ratio will be approximately 50% of the purchase price, with a covenant of 60%. Given the other 50% of this asset is currently valued at over $340 million, we are very comfortable with these gearing metrics.

The units in the trust were issued at $1.00. Based on the purchase price, the NTA at commencement is $0.95 per unit. This is much higher than most property syndicates as there was no stamp duty paid. Based on the Scentre Group carrying value of $342.5 million, the NTA is $1.21 per unit.

We are carrying the investment at the purchase price of $1.00 per unit, however we do feel very confident that the asset was purchased at a very attractive price.

The manager is targeting to pay investors a 9.25% distribution yield, partly tax deferred. They have also given financial information targeting a 15% IRR for the investment. We are always wary of forecasts given they involve unknown future assumptions. However, given the attractive price paid for the asset, we believe this appears reasonable.

Conclusion

This is our first foray back into Australian unlisted property in quite a few years. While we have reviewed quite a number of opportunities recently, we were not specifically targeting an investment in this sector. However, we believe that the asset was purchased below market value, and we expect to generate attractive returns from the investment over time.

We hope that was helpful.

Learn more about the Affluence Investment Fund.

If you enjoyed this Fund Manager Profile, you could view our September Fund Manager profile MA Financial Group – Fund Manager Profile – Affluence Funds Management

Want to learn more about Managed Funds?

You can download our Guide toManaged Funds

Disclaimer

This Fund Profile was prepared by Affluence Funds Management Limited (Affluence). It was prepared to assist investors in various Affluence funds in understanding the investments of the relevant Affluence fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any product advice or service.

This Fund Profile does not take into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser before making any decision to invest.